Daily Notes 19-09-2023

Developments

Lido has proposed a new governance module called GOOSE (Guided Open Objective Setting Exercise) which sees short (1 year) to long term (3 year) goals be set in a decentralized and adaptable manner.

It is not uncommon for protocols to suffer from low governance participation. Therefore Lido’s GOOSE - and other future modules – will seek to provide an adequate replacement for the traditional managerial systems and procedures that, although efficient, do not align with Crypto’s main attribute of decentralisation and thus are unavailable.

GOOSE is the first module in a possible wider framework that allows anyone from Lido as well as the wider Ethereum community to contribute and submit goals tied to the DAO’s “mission, vision and purpose (aka vibes)”. These goals will be open to reevaluation on a yearly basis in order to allow protocol contributors to have an easily accessible and up-to-date reference point, whilst keeping sovereignty over the creation, building and contribution process.

Incentivisation of users creating proposals (and builders building projects of course!) was also touched upon in the proposal and does see a possible compensation for contributors/builders who’s proposals align with the reference maxtrix “Vibes”.

The possible benefits are that the framework would allow for faster and easier governance decisions as well the proper alignment of goals with funding to reduce the unnecessary waste of resources. In addition incentivisation also attracts better builders and contributors alike.

Spark Protocol Debt Ceiling Increase

Spark Protocol, a DAI-centric Maker SubDAO focused on lending and borrowing, has increased their debt ceiling from $200 million to $400 million. This means another additional $200 million directly injection from Maker, can be borrowed by users.

Citigroup (Citi), whose assets total $2.4 trillion, has debuted their “Citi Token Services” pilot which uses a private blockchain owned by Citi to facilitate the exchange of customer’s deposits for digital tokens that can be sent anywhere instantly.

Reportedly, Citi’s customers will also not need to set up their own digital wallets and will be able to access the service through existing systems.

Notably, Citi has also explored the use of smart contracts in trade and shipping with one of the largest ocean-cargo companies, Maersk (a.k.a A.P. Moller-Maersk A/S), to demonstrate the automatic transfer of tokenized tokens upon prerequisites and conditions being met via smart contracts. This would reduce the transaction speed from days to minutes.

Canto L2 Migration

Canto will be migrating to a zero-knowledge powered Layer 2, utilizing Polygon’s Chain Development kit to do so.

Canto’s current TVL is $42.82 million,. It’s all time high TVL was $204 million back in March of 2023.

Standard Chartered, Northern Trust and SBI partner with Zodia

Standard Chartered, Northern Trust and SBI Holding’s (combined AUM of $2.29 trillion) together with Crypto custody focused venture, Zodia Custody, have partnered with OpenEden to work on providing institutional clients yield on their tokens via real world asset opportunities. Additionally, Zodia will also be offering staking services.

As of now, Zodia offers clients secure custody of their crypto, an Ethereum Staking solution, a service called “Zodia interchange” that allows clients to “trade assets directly from a fully segregated institution-grade trading wallet” in a isolated manner as well as other services.

Eclipse has introduced the architecture of their future Ethereum SVM L2 which will be “Ethereum’s fastest Layer 2”.

The chain will execute on the Solana Virtual Machine to take advantage of the environments parallel transaction capability, settle on Ethereum (and use ETH as it’s gas token) and post its data to Celestia for scalable data availability to meet Eclipse’s large blockspace demands.

The chain will also use RISC Zero for zero knowledge proofs of fraud without Intermediate State Serialization.

Eclipse has also said that there are no plans for Eclipse Mainnet to have its own token as of now.

Optimism has airdropped a total 19 million Optimism ($OP) tokens to over 31,000 addresses to reward positive-sum governance participation. A maximum of 10,000 $OP was set per address.

Details on criteria and allocations can be found here

Phoenix Labs has proposed the activation of Spark Lend (a Spark protocol service) on the Gnosis chain. The initial collaterals to be onboarded are GNO, WETH, wstETH, and wxDAI.

These assets will have a supply cap of 200,000 GNO, 5000 wstETH, 5000 WETH and 10 million wxDAI. wxDAI will also be able to partake in the Daily Savings Rate (DSR contract).

The borrow cap will be 100 wstETH, 3000 WETH, 8 million wxDAI and not applicable for GNO

Metis launches a $5 million DeFi incentive program to support new and existing dapps on the Metis chain. The first provision has been a 100,000 $METIS token (~ $1.19 million) allocation to all Aave liquidity pools on Metis to draw in liquidity providers. The program will also look to “extend funds to regular users who contribute liquidity, engage in trading, and actively participate in our thriving ecosystem”.

Injective unveils their new Ethereum L2 coined inEVM in partnership with Caldera. It will be the first ever EVM to achieve true composability across Cosmos and Solana and will give developers access to “ultra-fast speeds due to a parallelized structure, instant transaction finality, a modular toolkit, shared liquidity, and composability across the Cosmos IBC universe and Solana”.

This announcement comes after there recent release of inSVM, a Solana Virtual Machine.

Trending Assets

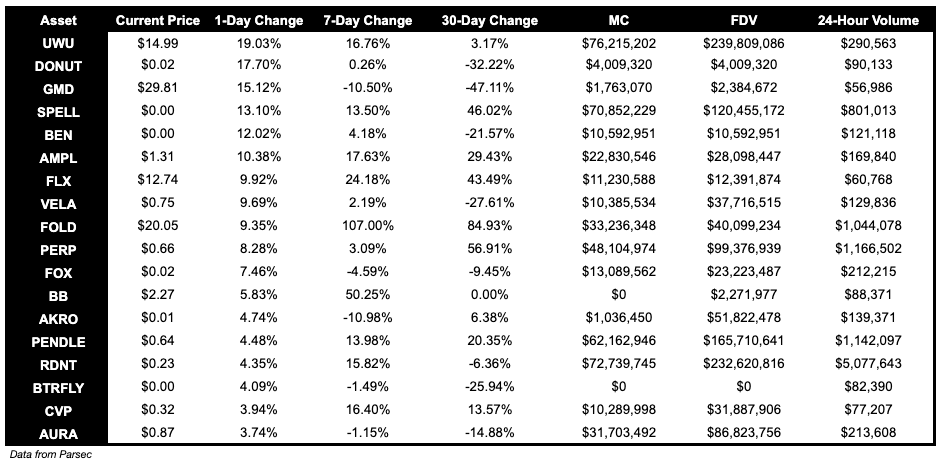

Below $100M MC by performance, on chain

GMD, up 15.12%, and SPELL, up 13.10%, performed well today.

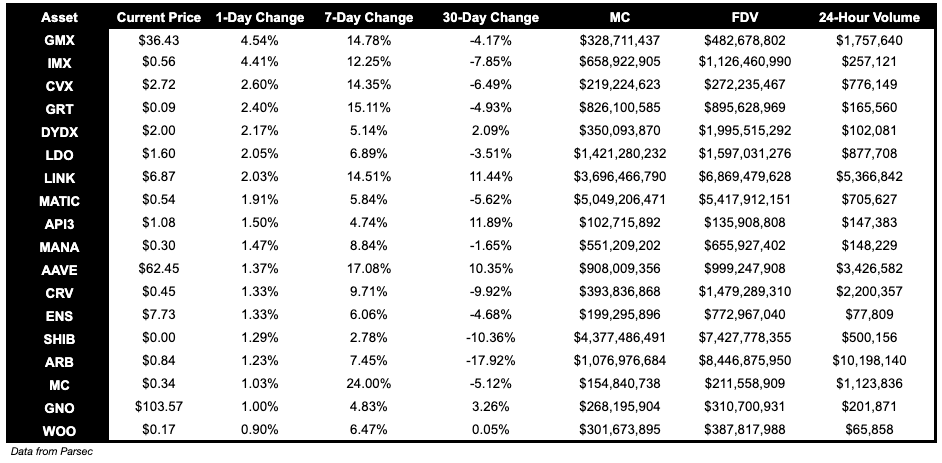

Above $100M MC by performance, on chain

GMX is up 4.54% over the past day. IMX is up 4.41%.

Above $1B MC by performance, on chain

LDO, LINK and MATIC are all up around 2% over the past day. Notably, LINK is up 14.51% over the past week.

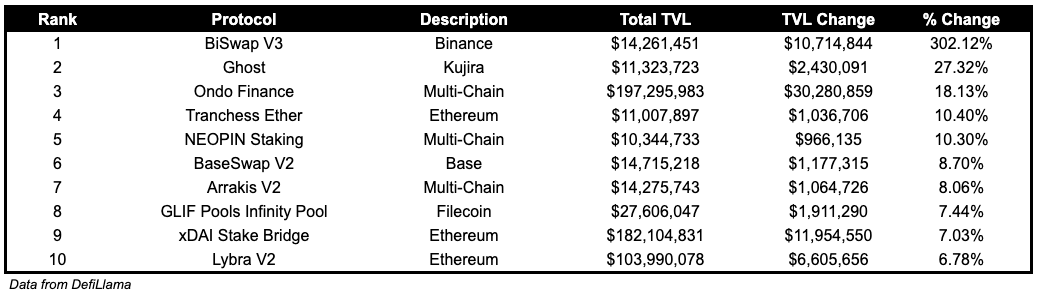

TVL

TVL Above $10M

Over the past day:

Ghost, money market on Kujira, TVL grew by 27.32%.

Ondo Finance, multichain RWA, TVL grew by 18.13%.

Tranchess Ether, LSD on Ethereum, TVL grew by 10.40%

Fees

Uniswap V3 fees earned are up 99.75% over the past day.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.