Daily Notes 18-08-2023

Developments

Market Downturn

Yesterday was the largest day of total liquidations since FTX, with more than $1B USD being liquidated. Taking a look at BTC liquidations we can see that OKX made up the bulk of them with $175 mil liquidated.

Open interest on BTC alone dropped by 27% ($2B USD). This large unwinding of leverage led to significant market dislocations with perpetual futures contracts trading at deep discounts to spot as traders positions were liquidated. On some markets BTC touched as low as $24,132.

Paradigm Invest In Friend Tech

Post the news that @paradigm invested in @friendtech, we have started to see an uptick in volume on the social platform. A total of 9042 ETH in volume has been traded, earning the friend tech treasury 452 ETH.

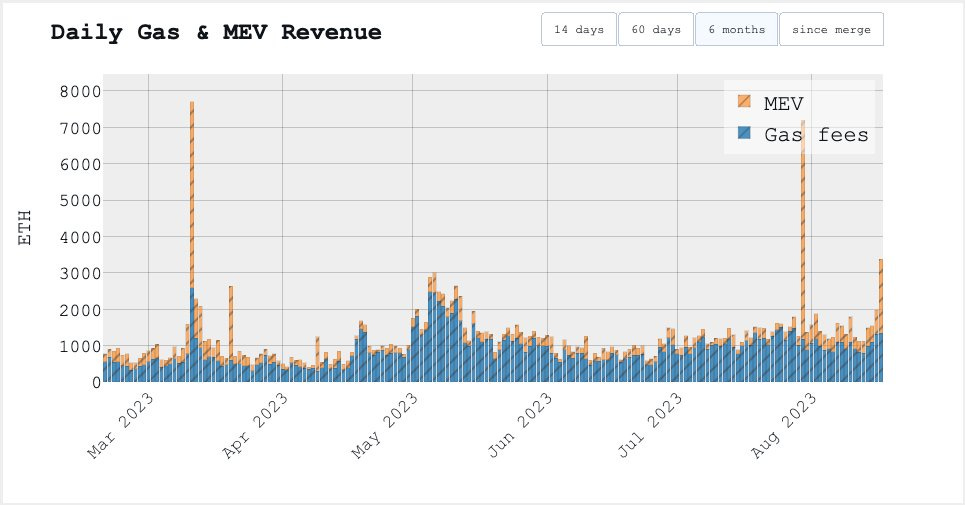

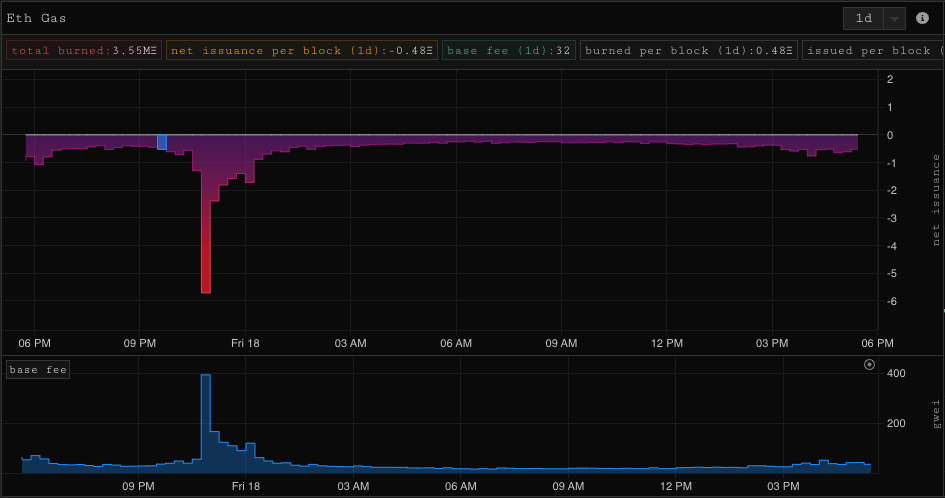

MEV Revenue & Gas

There was a total of 2040 ETH in MEV fees paid during the chaos yesterday and Ethereum base fees spiked up to 400 Gwei for a short period of time.

BNB Venus Liquidator

The infamous $200mil BNB position on Venus protocol from the BNB bridge hack was partially liquidated by BNB chain yesterday. So far $30mil of the $200mil has been liquidated.

Can track here: 0x56306851238d7aee9fac8cdd6877e92f83d5924c

Bitcoin Ordinals

Bitcoin Ordinals volume has plummeted 97% from May’s high of $452 million to just $3 million so far this August.

This decline aligns with the overall trend in the NFT space as only 4% of the crypto industries total unique active wallets are participating in NFT trading according to DappRader’s report.

Exactly Protocol Exploit

The Exactly Protocol, which provides autonomous interest rate markets on Optimism, has been exploited for $7,200,000.

The TVL of the protocol has decreased by 72.28% from $40 million to $10 million and the tokens price has plummeted 36%.

Beosin, a company that specialises in Blockchain Security, has found the cause to be the ability to manipulate the market address in the protocols DebtManager contract. This allowed the malicious actor to bypass the permit check and thus steal the $USDC deposited by users.

Trending Assets

Top 300 Performers

PRIME was the top performer over the past day, up 21.49%, followed by ticker $BITCOIN, up 14.72%.

Top 300 Losers

CFX, down 16.54%, ORDI, down 15.75%, and FLOKI, down 13.38% underperformed over the past day.

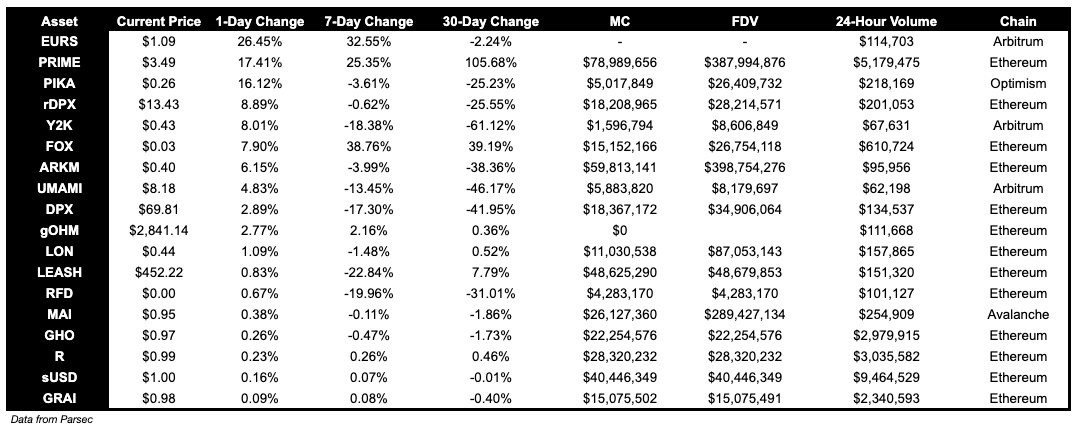

Below $100M MC by performance, on chain

PIKA, up 16.12%, rDPX, up 8.89% and Y2K, up 8.01%, were some notable performers for coins below $100M MC.

Above $100M MC by performance, on chain

WLD is up 4.53 over the past day.

Above $1B MC by performance, on chain

OP held up well today, up 1.49%, comparatively to other large cap coins.

TVL

TVL Above $10M

Over the past day:

Helix, DEX on Injective, TVL grew by 25.19%.

Liquid Collective, LSTs on Ethereum, TVL grew by 15.53%.

Morpho Aave V3, lending optimizer on Ethereum, TVL grew by 14.17%.

Fees

Notably, GMX V1 fees earned are up 269.47%, Synthetix fees earned are up 417.79% and Level Finance fees earned are up 1134.27% following the liquidations on-chain yesterday.

Articles / Threads

Silo is launching Silo Llama, a fork of the original Silo Finance Protocol that uses $crvUSD as its only bridge asset. $crvUSD lenders can lend or borrow against any token asset while remaining completely isolated from activities occurring in any other market on the protocol.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.