Daily Notes 17-08-2023

Developments

Alameda Migrate BIT Tokens & Mantle Pause Their Migrator Contract

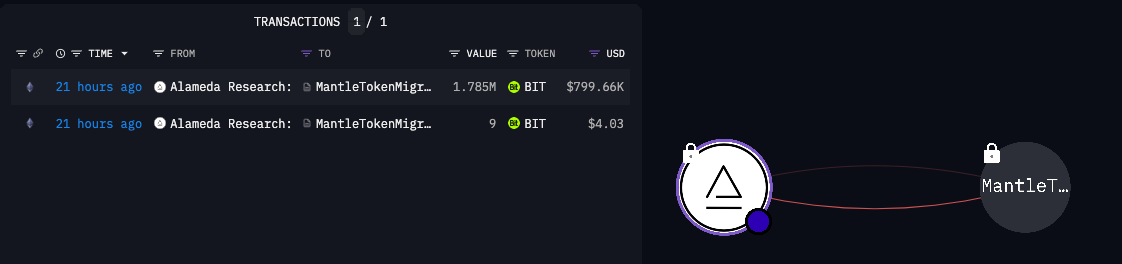

On August 16th, Alameda Research migrated some of their BIT tokens to MNT via the tokenmigrator contract. Alameda research migrated 1.8 million BitDAO ($BIT) tokens 1 for 1 to $MNT tokens. This migration accounts for 1.77% of Alameda’s BitDAO/Mantle holdings, which amounts to 100,555,999 tokens, currently valued at $45 million.

In early November 2021, BitDAO and Alameda partook in a token swap, exchanging 1% of $BIT supply for 1% of $FTT ( FTX’s token), with a public commitment not to sell each other's tokens for 3 years (until November 2nd 2024).

During FTX’s collapse, there was concern amongst the BitDAO community, due to movement of the 100 million $BIT tokens from Alameda’s wallets to FTX, which happened to coincide with a 20% decrease in the tokens price.

It was unclear where the sell pressure originated from but later that day the 100M $BIT was accumulated into a wallet from several different sources, with 92 million tokens coming back from FTX, showing Alameda did not in fact sell their tokens [or that they bought them back].

frxETH

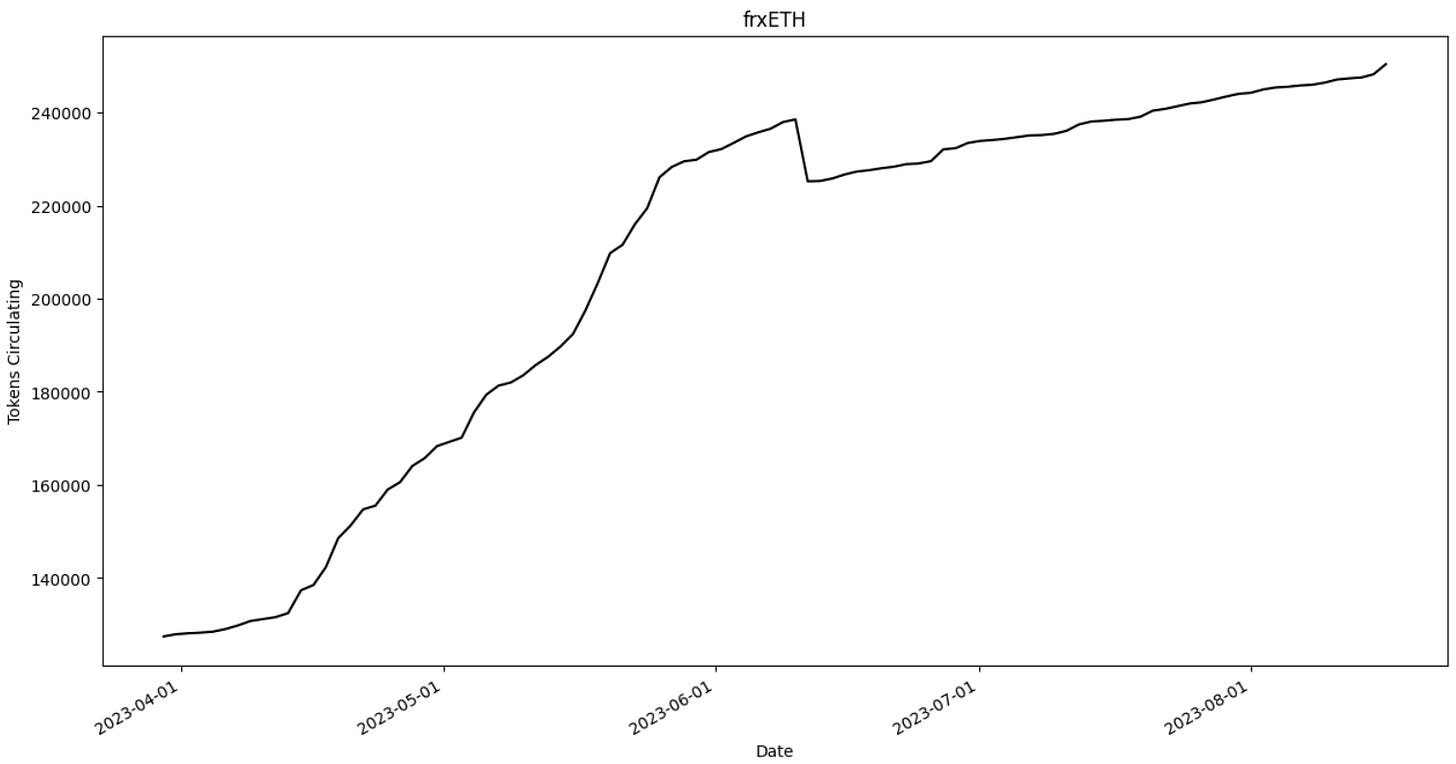

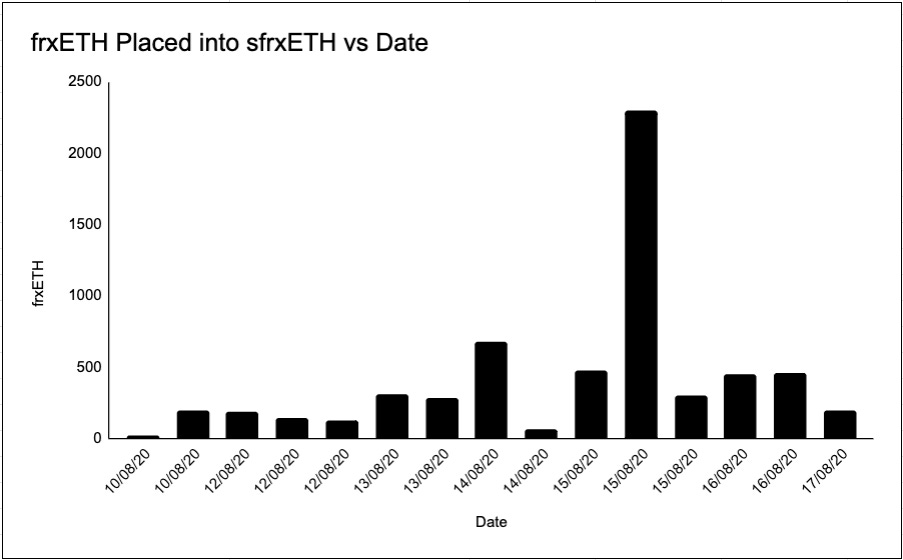

frxETH surpasses 250,000 frxETH in circulating tokens. Earlier on this week a large number of frxETH were placed into the sfrxETH token to earn staking yield.

Maker Proposal

The co-founder of MakerDAO, Rune Christensen, has proposed that Spark Protocol pay out 10% of the income it generates from the operating the borrowing and lending functionality of the protocol that is based on the Aave codebase, to Aave for a duration of 2 years.

Proposal: link

Shibarium Launches & Bridge Fails

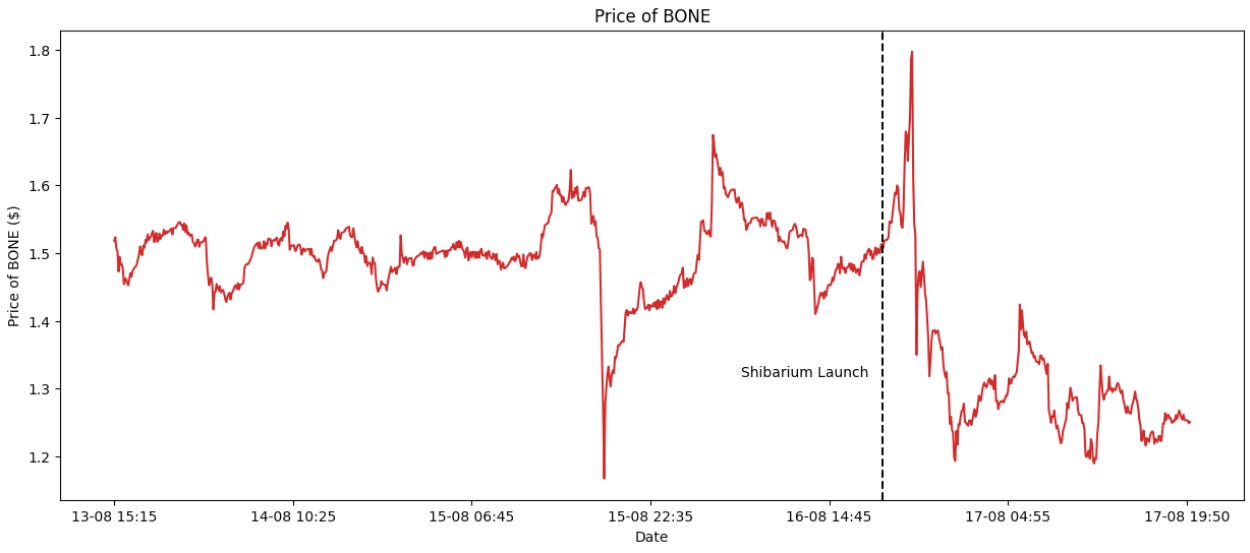

Shibarium, a Matic-fork L2 from the Shiba Inu team launched yesterday and the bridging contract was faulty resulting in $2.5 million in crypto assets being comprised [$1.73 million in ETH and $762,000 in BONE].

The team has since paused the chain with the co-founder and lead developer Shytoshi Kusama releasing a blog post denying any bridge issues and stating “any screenshot you see of me saying any issue is false” and that “your funds are safu”.

Kusama also communicated that the issue stems from the “MASSIVE influx of transactions and users that happened at the same time” while asking users to “Give us time to scale”.

As of now, there is no estimated timeline of when the chain will be back online.

Post the launch and with the bridge issues, the price of BONE pulled back significantly after touching a peak of $1.80. It’s currently trading at $1.26.

Grayscale Looking To Hire An ETF Associate

Grayscale is looking to expand their ETF team by hiring a Senior Associate to support the development of Grayscale’s Exchange Traded Fund (ETF) business.

The job will assist in “all phases of the product life cycle including product strategy, ideation, listing and post launch support”.

Connext Airdrop

Connext will be airdropping their native token, $NEXT, in 19 days on September 5th at 1 pm UTC.

The snapshot was take on August 1, 2023 at 00:00 UTC and you may see how many tokens you shall be airdropped via Connext’s website.

Pendle

Yesterday, Pendle, a permissionless yield-trading protocol, launched on Optimism. It’s TVL has fallen 6.3% in the last day and 14.61% from last months high of $153.74 Million to $132 million. Its token price ($PENDLE) is also down 33.57% in the last month to todays $0.58.

Trending Assets

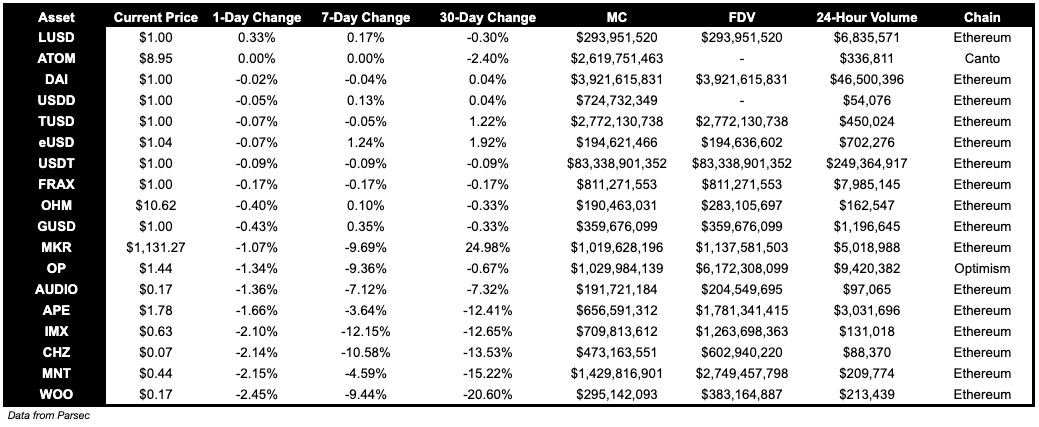

Above $100M MC by performance, on chain

Coins above $100M MC are down today. ATOM, MKR and OP have held up relatively well, compared to the broader market.

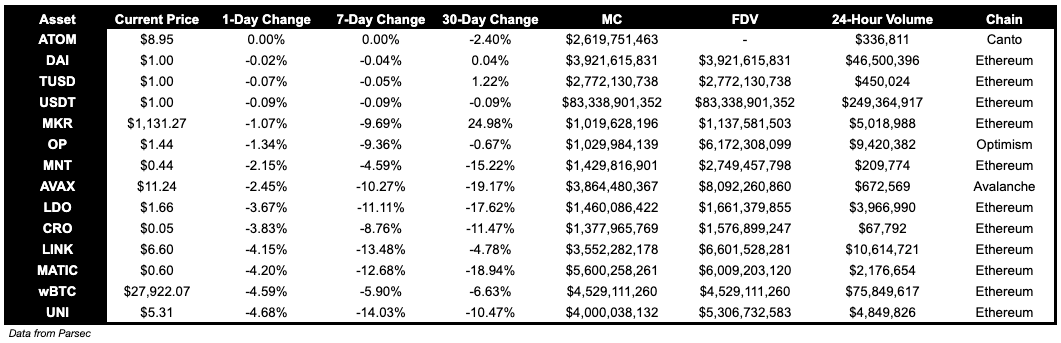

Above $1B MC by performance, on chain

TVL

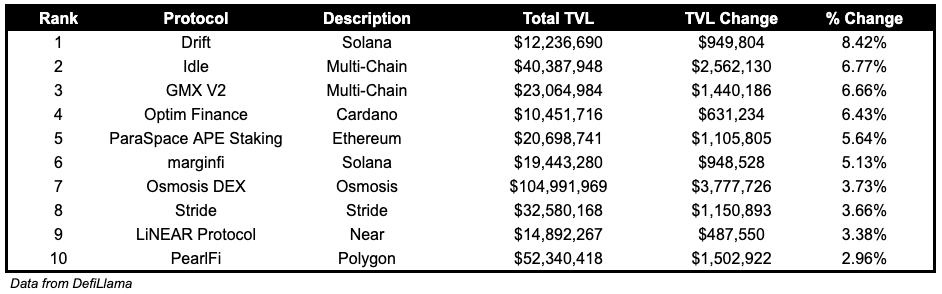

TVL Above $10M

Over the past day:

GMX V2, perpetuals on Arbitrum, TVL grew by 6.66%.

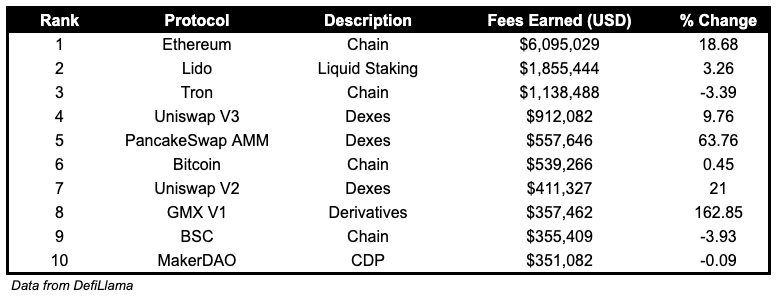

Fees

Notably, PancakeSwap fees earned are up 63.76%, at $557.6K, and GMX V1 fees earned are up 162.85%, at $357.5K.

Articles / Threads

Aevo has launched V2 of their OTC product, which will allow users to submit unwind requests to institutional market makers.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.