Daily Notes: 17-07-2023

Developments

Celsius Start to Sell Alts

Celsius have started sending altcoins to their FalconX deposit address and their OKX deposit address, presumably to convert to the majors, ETH & BTC.

Notably, 4.45 million 1inch tokens ($2.5mil) were sent to FalconX and the price fell 20% not longer after.

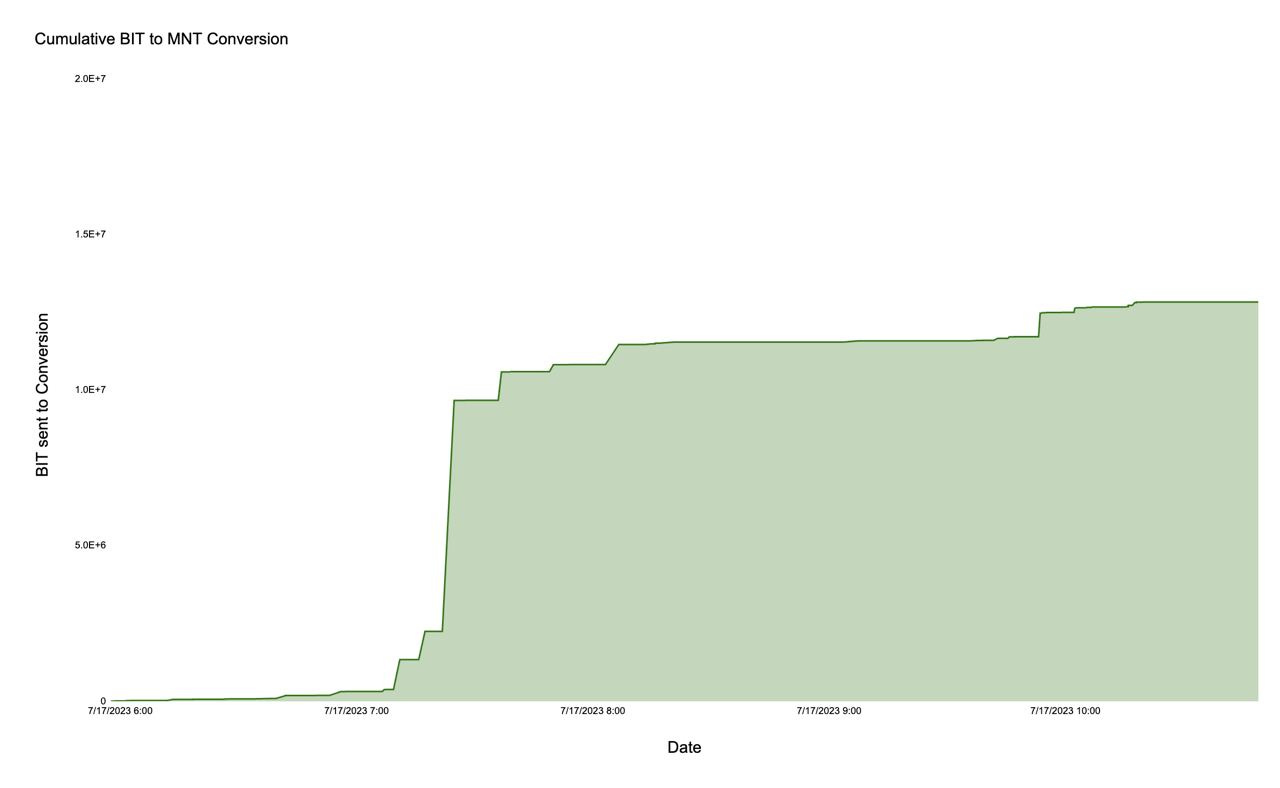

Mantle Network Launches

Mantle network launched their new L2 token, $MNT. Users are able to convert their BIT to MNT at a 1:1 ratio through Bybit or via a smart contract. So far, a cumulative 19.5 million BIT ($9.75 Mil) have been converted to MNT via the contract.

The contract: 0xfFb94c81D9A283aB4373ab4Ba3534DC4FB8d1295

Ethena Finance, a stablecoin and RWA protocol on Ethereum, raised $6M for its seed round led by Dragon Fly Capital.

Uniswap has announced Uniswap X, a new permissionless, open source (GPL), auction-based protocol for trading across AMMs & other liquidity sources.

Uniswap X allows users to access better prices, gas-free swapping, MEV protection and no cost for failed transactions.

Chainlink announced that Chainlink CCIP is now in Mainnet Early Access for Avalanche, Ethereum, Optimism and Polygon. Additionally, CCIP has been adopted by Synthetix and Aave. Protocols will be needing LINK tokens to use CCIP.

Synthetix will be using CCIP to Synthetix to transfer tokens across chains through a burn-and-mint model. Aave protocol will use CCIP for their cross-chain governance system.

Now in Mainnet Early Access, CCIP has been adopted by DeFi leaders such as Synthetix and Aave to unlock the cross-chain economy.

CCIP allows:

Arbitrary messaging passing

Simplified token transfer

Programmable token transfers

Active Risk Management (ARM) Network

Token transfer rate limits

Smart Execution

Timelocked upgradability and more.

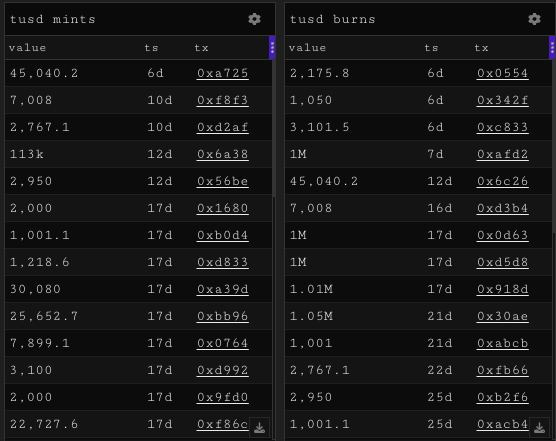

TUSD & Justin Sun Lawsuit

The founder of Archblock has initiated legal proceedings against Justin Sun, the founder of Tron amongst other things. The suit claims that Sun meticulously masked his involvement by using a series of entities and individuals to execute the acquisition of TUSD.

This comes after months of skepticism of the legitimacy of TUSD and it’s use on Binance and with the wind down of Prime trust. Taking a look at the burns and mints of TUSD we can see that none have been processed for 6 days and even before that only a few were being processed successfully. This raises questions as to the backing and financial health of the stablecoin.

Inscriptions

This weekend approximately 647,000 Ordinals were inscribed onto the Bitcoin blockchain with 386k inscriptions on Sunday alone. Sunday represents the third most active day since the inception inscriptions & there is a clear trend forming.

Trending Assets

Top 300 Performers

CELO, up 10.63%, GMT, up 10.46%, and OX, up 8.89%, are top performers over the past day. Notably, Celo proposed today to return to Ethereum ecosystem and transition to an L2.

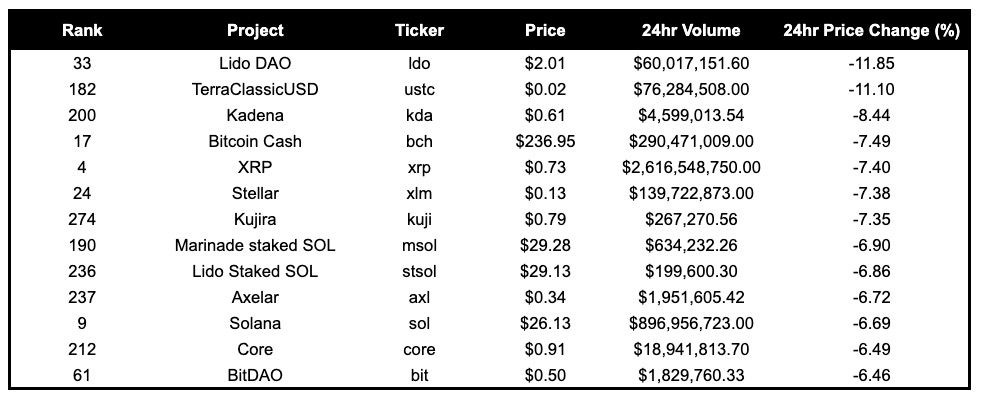

Top 300 Losers

LDO, down 11.85%, BCH, down 7.49%, XRP, down 7.40%, and XLM, down 7.38%, have underperformed today.

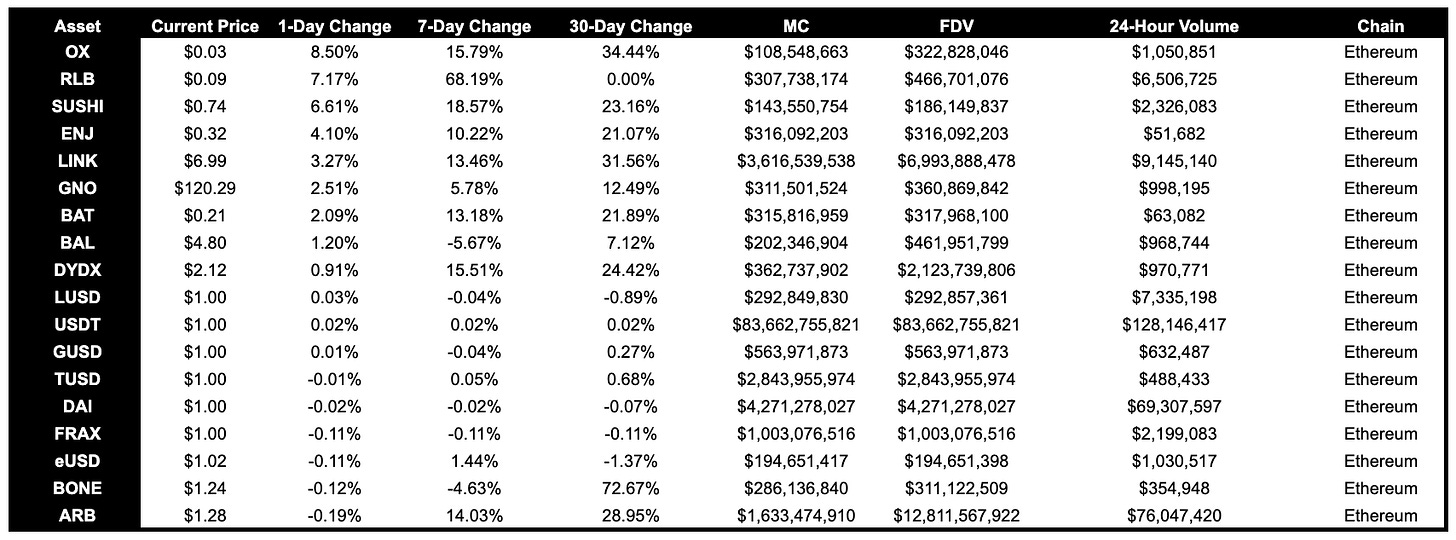

Above $100M MC by performance, on chain

On chain, OX, RLB, up 7.17%, and SUSHI, up 6.61%, have outperformed today. Notably, the top performing coins today have all been on Ethereum, with exception of ARB.

ARB continues to have high trading volume, with $76.05M over the past day.

Above $1B MC by performance, on chain

For assets above $1B MC, LINKm up 3.27%, outperformed over the past day. This comes after they announced CCIP Mainnet Early Access.

TVL

Notable protocols with high TVL growth:

Margin Fi’s (Credit, Solana), TVL has grown 27.35%.

Ajna;s (Permissionless Lending, Ethereum), TVL has grown 24.16%

Extra Finance’s (Yield, Optimism), TVL has grown 16.95%.

Fees

Ethereum has earned the highest fees over the past day, with $3.81M earned, followed by Lido and Tron.

Notably, PancakeSwap’s fees earned are up 52.24%, and Uniswap V2’s fees earned are up 54.06%.

Governance Proposals

Proposal to migrate our $BIFI token away from Multichain and to redeploy $BIFI on Ethereum. Core team will work on the capability to bridge $mooBIFI tokens via a new bridging solution managed by the DAO.

Proposal to sell Bancor 3 token surpluses for ETH

Proposal for pools on Bancor 3 that have a surplus and are disabled to have the surplus converted to ETH

Articles / Threads

Velodrome V2: Just Getting Started

Velodrome V2 is setting the groundwork for concentrated liquidity pools (clAMM) and automated voting management.

V2 has generated more weekly fees at nearly 6x the pace of V1

clAMM will improve trading execution and reduce slippage

veVELO votes control emissions