Daily Notes: 16-06-2023

Developments

Binance Stepping Back in Europe

Binance have closed up operations in the Netherlands after being unable to secure a virtual asset service provider (VASP) license from the Dutch regulator. Further, Binance's French division is currently being investigated by local authorities for allegedly engaging in the "unlawful" offering of digital asset services and committing "acts of aggravated money laundering".

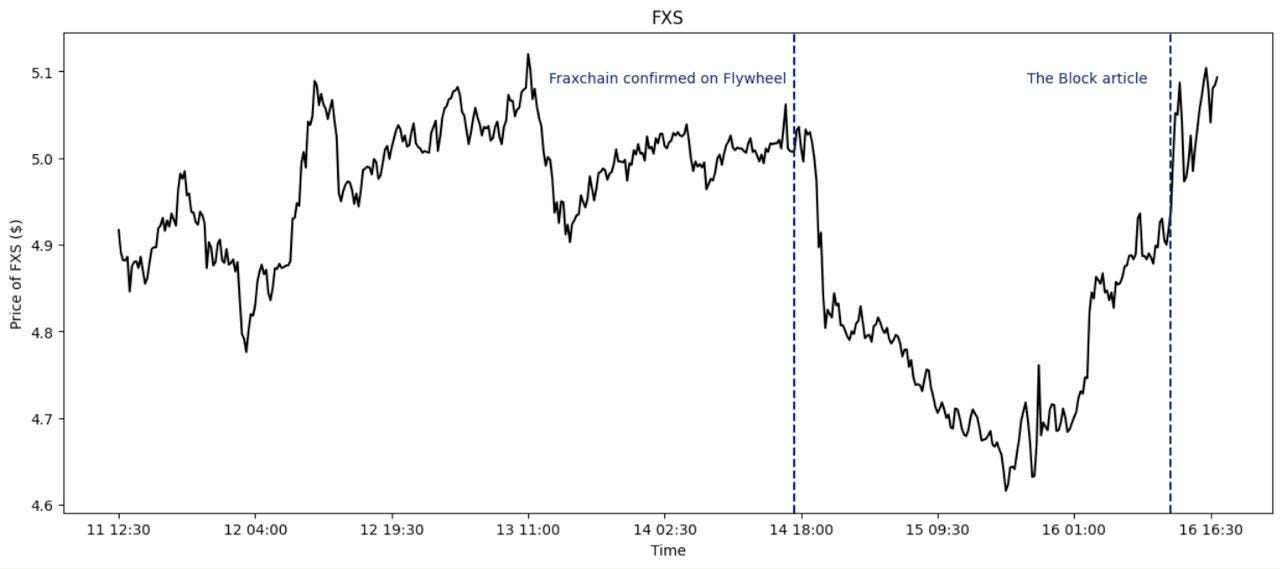

Fraxchain

Fraxchain, a DeFi focused Ethereum based optimistic rollup, will be ready before year end.

frxETH and FRAX will be used as gas tokens, and unlike other Layer 2’s, it will have decentralized sequencers.

Fees generated by the rollup could be partly burned or redirected back mainnet to be distributed among stakers of FXS.

Through new proposals (Prop 530, 531, 532, 534 and 535), Osmosis has proposed to:

Decrease OSMO emissions by 67%

Launch concentrated liquidity pools

Potentially introduce a fee switch (0.15% taker fee)

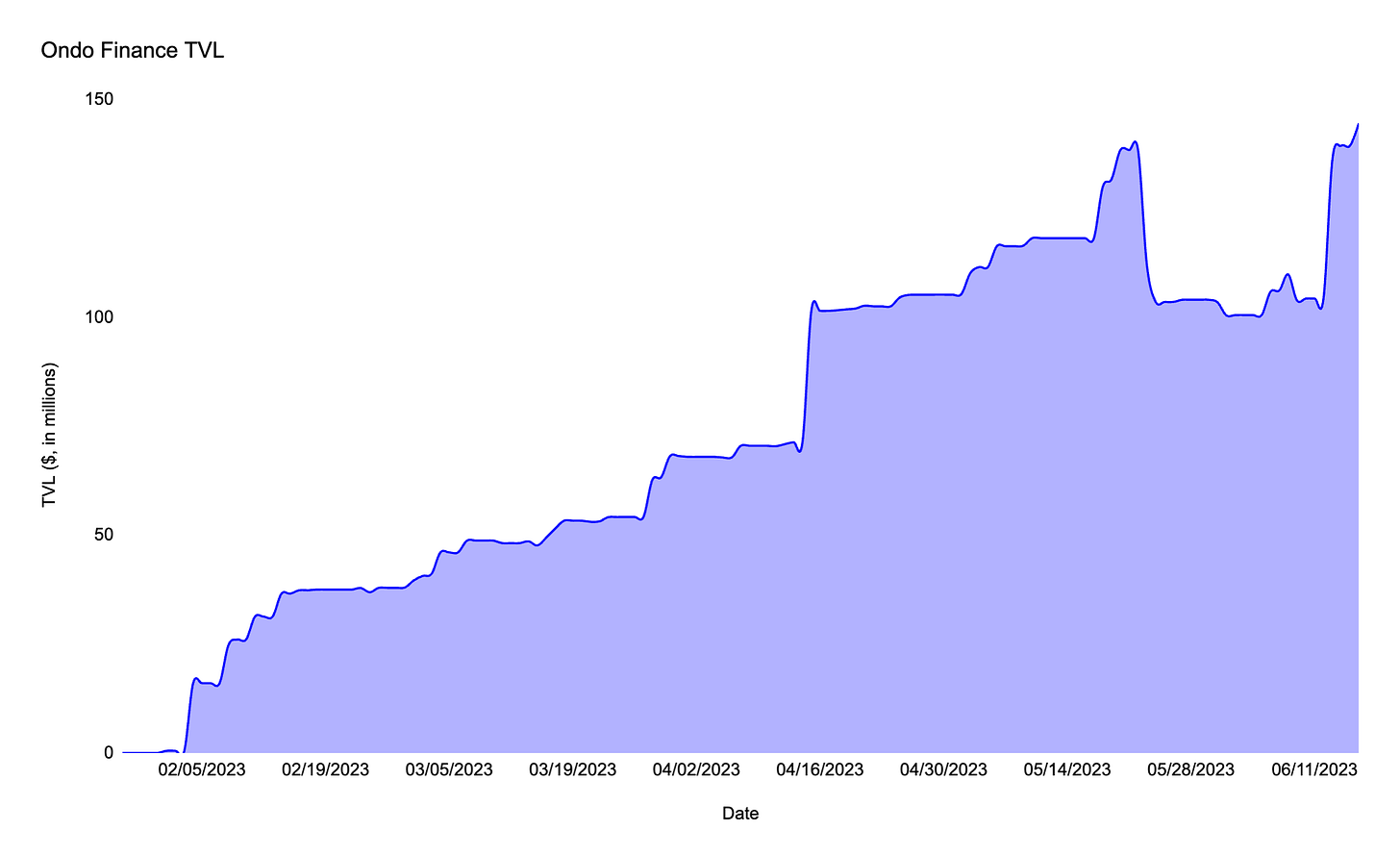

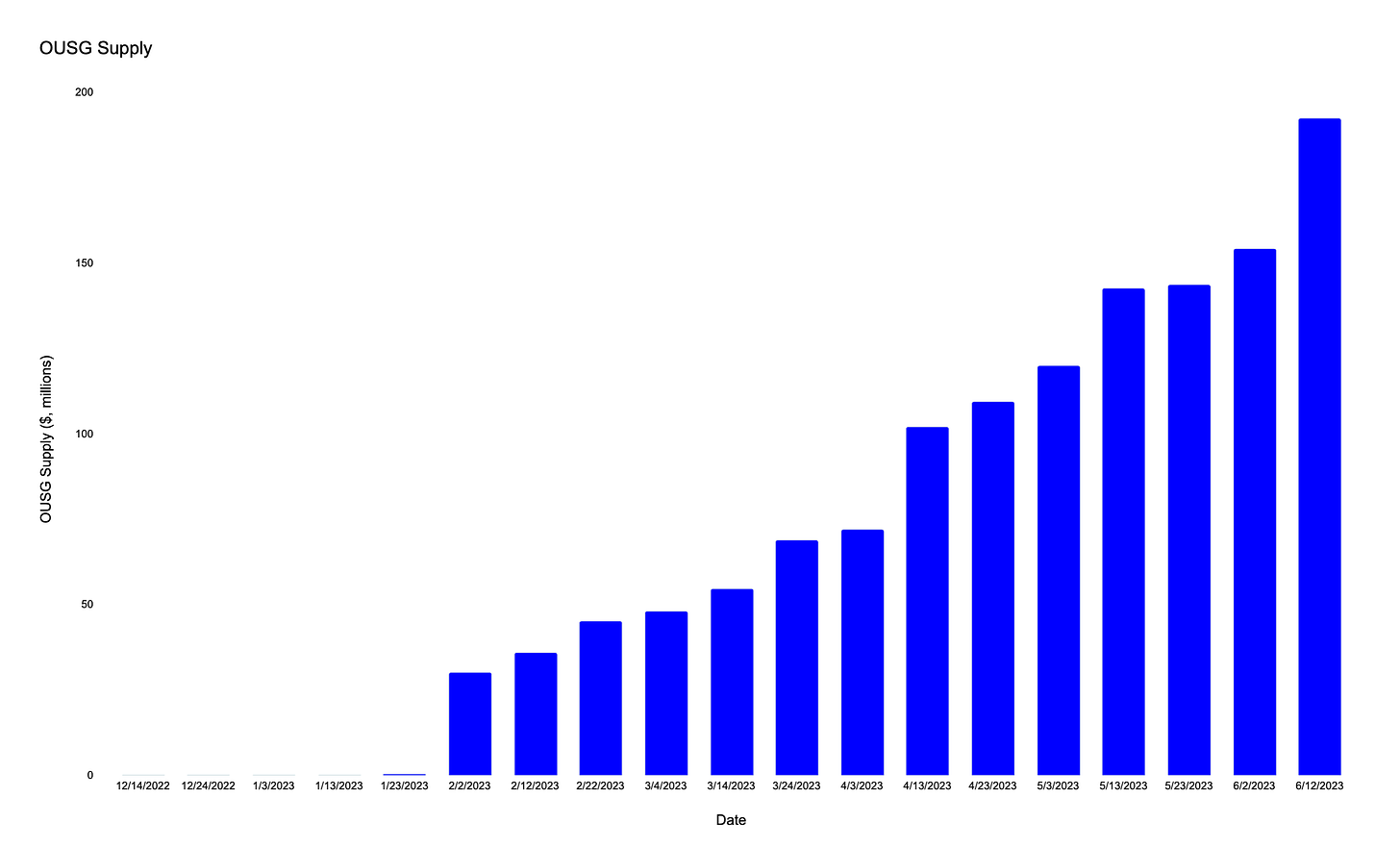

On-Chain T-Bills

Ondo Finance, a startup specializing in security tokens, is introducing a stablecoin alternative that offers interest payments to its holders through a tokenized money market fund. The company, in its blog post, states that the OMMF token will be pegged to the value of US$1 and supported by money market funds traded on established exchanges. Investors will have the ability to create and redeem OMMF tokens on weekdays, while earning daily interest in the form of additional OMMF tokens.

OUSG grew 40% since 8th June, growing $40mil

Looking on-chain, this multisig wallet 0x1A8c53147E7b61C015159723408762fc60A34D17 added $47 mil in OUSG in the past 7 days.

Notably the account is one of the top holders of the NXM token and seems to be a fund.

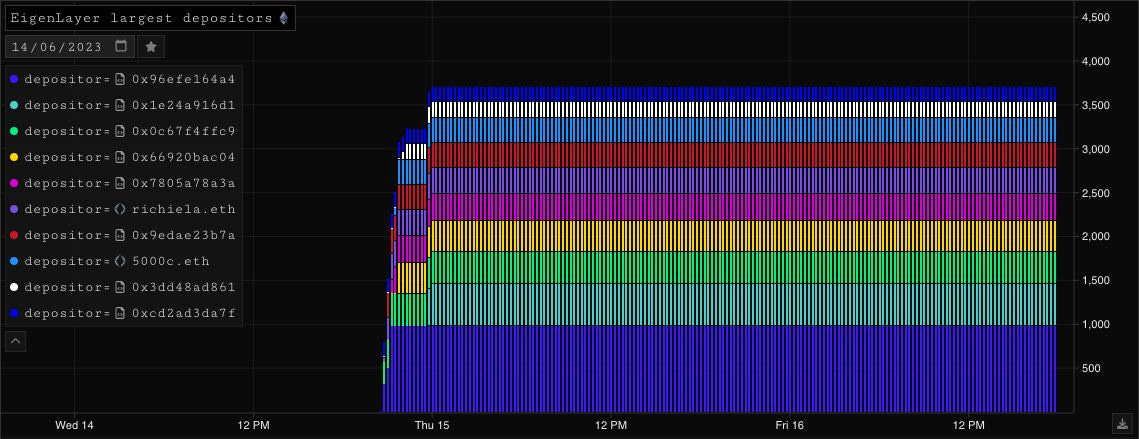

Eigenlayer top depositors

The top 5 depositors into Eigenlayer:

0x96efe164a4d243c98bbb25ba93ba06705c4777f9

Received 480 cbETH and 507 stETH from Coinbase 2 days ago & deposited it all into Eigenlayer

0x1e24a916d16e86351e9c94fabad6c8ee87d41bcd

Received 1000 ETH from Binance 4 months ago and swapped it into LSTs before depositing 15 clips of 32 cbETH into Eigenlayer.

0x0c67f4ffc902140c972ecab356c9993e6ce8caf3

Liquid staking whale with large swETH & stETH positions deposited 360 stETH into a strategy.

0x66920bac0431efbcedfe838efa662aecea79b18f

353 stETH depsoited

0x7805a78a3ad50d460efabf32562d1884c3d0259a

LSD-Fi whale ($5mil AUM) deposited 305 stETH into Eigenlayer. The wallet has substantial positions in Raft, Lido & is farming R/stETH on Balancer.

Coinbase have started offering a 4% yield on USDC held with the exchange.

DAI Overtaking BUSD

With BUSD’s wind down, we are starting to see DAI overtake it in total supply. This could be in part due to Maker raising the DAI savings rate to 3.49% recently.

Trending Assets

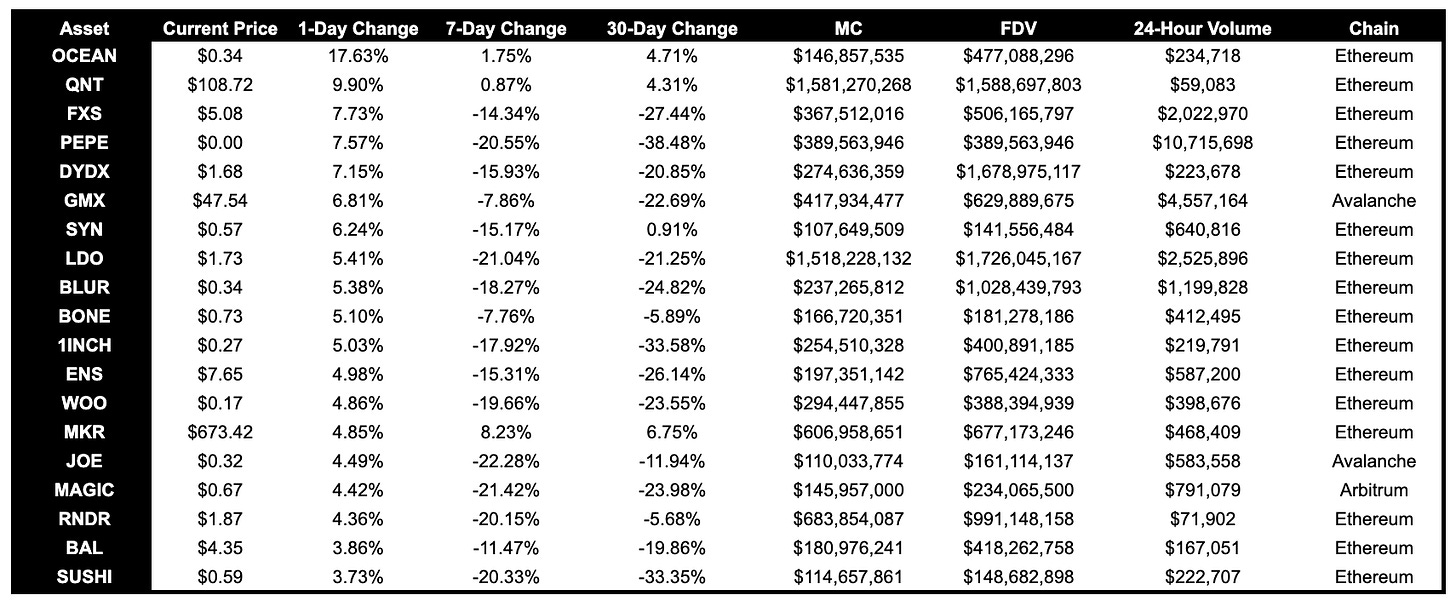

Above $100M MC by Performance

QNT, PEPE, STX, OCEAN strong performers in the rally today.

FXS performing well, possibly due to announcement of Fraxchain.

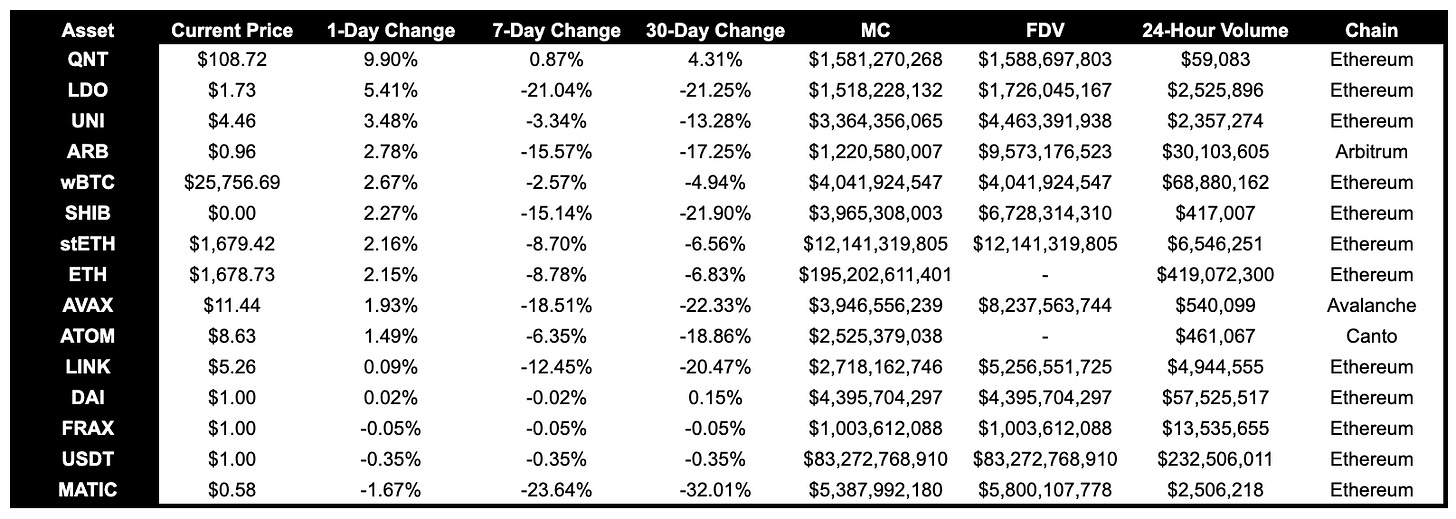

Above $1B MC by Performance

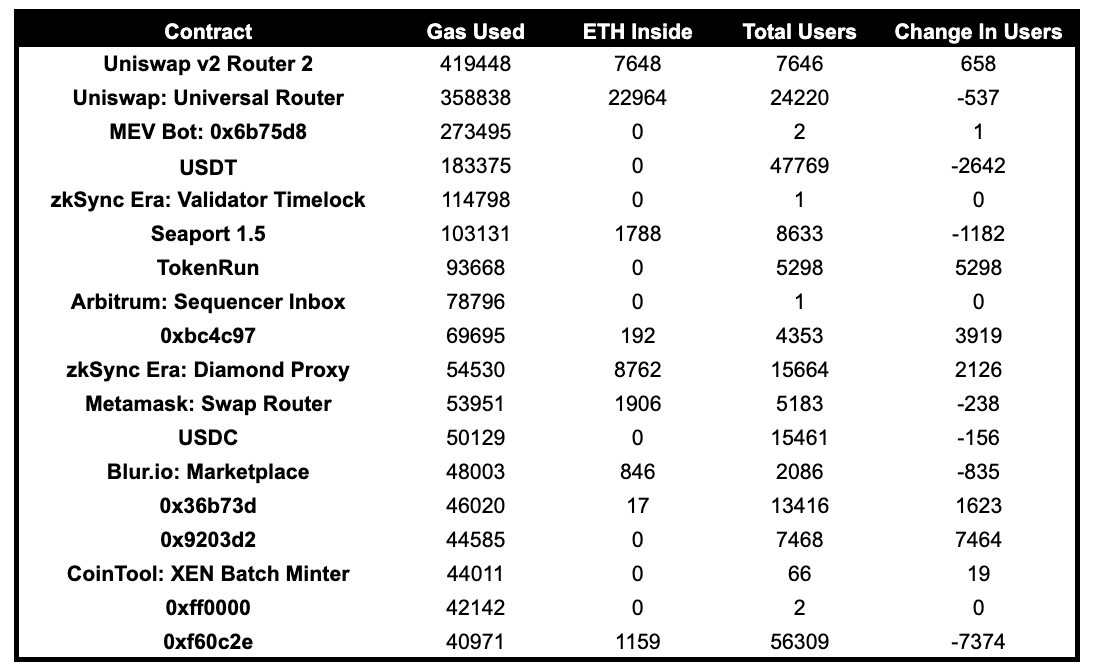

Trending Contracts

Nothing of significance, aside from TokenRun (an NFT project) being the 7th highest gas user for the day.

Coingecko Trending Assets

Trust Wallet Token

Apecoin

Exosama Network

Ovr

Point Pay

Beldex

Arbitrum

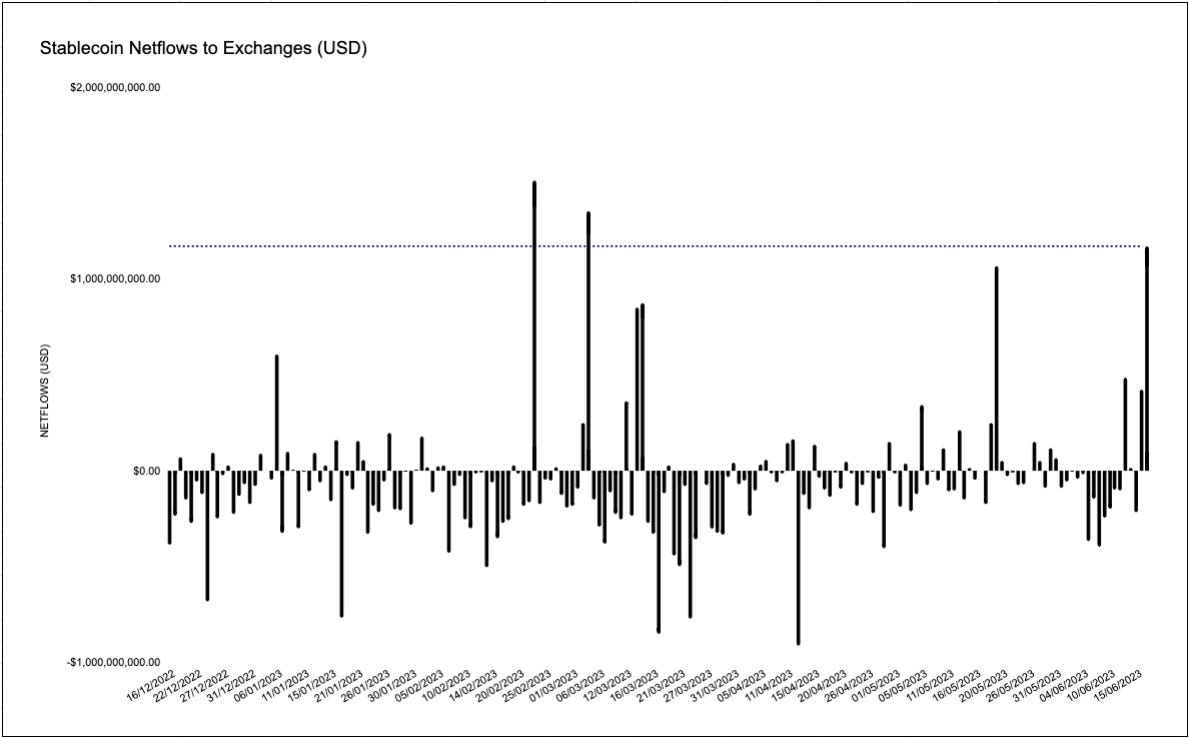

Stablecoin Netflows

We saw a huge netflow of stables to exchanges today with a netflow of $1.17 bn. This represents the 3rd largest netflow of stables to exchanges for 2023.

Governance Proposals

[FIP - 249] Axelar <> Frax: Add axlUSDC-FRAXBP Curve pool on Arbitrum to the FXS gauge controller

Proposal is to add axlUSDC-FRAXBP Curve pool on Arbitrum to the FXS gauge controller.

Proposal is for Frax to match $5k per month worth of bribes towards this pool 1:1 with Axelar Foundation voting through four voting cycles (~2 months).

Frax: Optimizing FIP-77’s TWAMM Parameters

Proposal is to optimize FIP-77s TWAMM parameters, such that it the TWAMM becomes more aggressive and increases in magnitude at lower price levels, and additionally stops buying $FXS at a higher price levels.

Articles / Threads

Kwenta has launched stETH perps on their platform.

The $stETH price will be set by push-based Chainlink oracles, as well as pull-based Pyth Oracles.

Perpetual Protocol will be launching Smart Maker as a beta feature to improve liquidity and reduce slippage.

Smart Maker uses OTC trades to deepen liquidity across 4 of the most popular markets: BTC, ETH, OP and PERP

Synthetix has launched stETH perps on their platform.

stETH price will be set by the off-chain Pyth Network oracles.

New Protocols

LogX Trade

Description: First Perps Aggregator With Cross-chain Routing.

Twitter: https://twitter.com/LogX_trade

Website: https://www.logx.trade/

Toki Finance

Description: IBC-enabled cross-chain bridge for native token swap

Twitter: https://twitter.com/tokifinance

Website: https://tokifinance.notion.site/

Hoyu

Description: Permissionless money markets.

Twitter: https://twitter.com/hoyu_io

Website: https://hoyu.io/

Well done! Keep it up!💪🏻