Daily Notes 15-11-2023

Developments

FRAX governance Proposal to make sFRAX bridgeable to multiple new chains

With the sFrax tokenized vaults only currently available on Ethereum, 5 proposals have been posted to make sFrax bridgeable via FraxFerry to 5 new chains: Arbitrum, Optimism, Polygon zkEVM, BSC (Binance smart chain) and Avalanche.

Posted earlier today, the proposals all have 91 thousand votes in favour but still need to each reach a 7 million vote quorum. The votes will conclude in 5 days on Nov 18th.

Another proposal is also in progress that would adopt “Axelar network’s representation of Frax Finance tokens” on chains where a dedicated Frax Ferry is unavailable allowing for bridging to Osmosis, Mantle, Linea, Kujira, Manta and Scroll.

Circle Ventures invests in Sei and announces upcoming integration of USDC

The venture arm of USDC stablecoin issuer Circle, has invested into the Layer 1 trading-focused chain, Sei.

This comes in tandem with Sei’s announcement stating the upcoming integration of native USDC which will bolster liquidity and unlock a more accessible means for cross-border transactions on the chain.

The TVL of Sei is $3.16 million and the MC of the SEI token is $284 million.

Circle Introduces USDC Minting For Entities In Singapore

Circle has announced the availability of ‘Circle Mint’ in Singapore after receiving a Major Payments Institution (MPI) licence. This means Singapore-registered entities can mint USDC with zero fees and instant availability.

Cosmos Governance Votes On If To Reduce Max Inflation Parameter From 20% to 10%

A proposal has been posted for voting on Cosmos governance to set Cosmos’ max_inflation parameter for ATOM (the staking token that secures the Cosmos Hub) from 20% to 10%. The current inflation of ATOM is 14%. If successful, this proposal would also bring the ATOM staking APR from 19% to 13.4%.

One of the main points is that lesser inflation of ATOM’s supply would position the token to be utilised as collateral and as a liquidity gateway onto the network thereby increasing its value proposition.

Four days in, 41.3% of voters have rejected the proposal, 36.0% have voted in favour, 1.5% have voted no with veto (a strong rejection of said proposal) and the rest have abstained. There are 10 days left until the vote concludes.

Ex-CEO of Compound Finance Raises $14 million For new on-chain RWA Tokenisation venture

The founder and ex-CEO of Compound Finance, Robert Leshner, has raised $14 million for his new venture - “Superstate” - an asset management firm that will offer tokenized real world asset investment products that benefit from the “speed, programmability, and compliance advantages of blockchain tokenization”.

The Series A round was co-led by Coinfund and Distributed Global.

Binance Labs Invests in Arkham’s token

Binance Labs announced its investment in the Arkham platform’s native token, ARKM,. The investment aims to support the at-scale on-chain insights Arkham offers as an AI-powered blockchain intelligence and data platform.

SEC DELAYS Hashdex BTC ETF and Grayscale Ether Futures ETF

The SEC has delayed its decision from November 17th to January 1st 2024 for both Hashdex’s application to convert its Bitcoin Futures ETF into a spot Bitcoin ETFas well as Grayscales application to launch a Ether Futures ETF.

Trending Assets

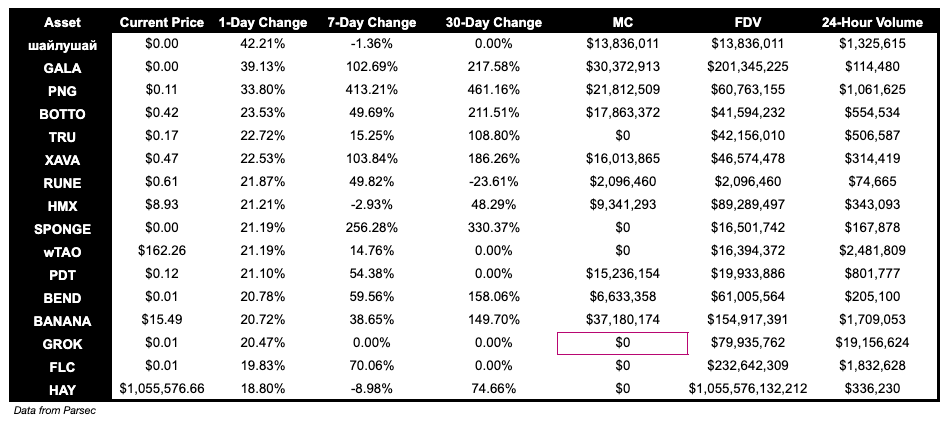

Below $100M MC by performance, on chain

SMURFCAT price increased by 42.21% over the past day. PDT is up 21.10%, following the rapid price increase of PRIME over the past few weeks.

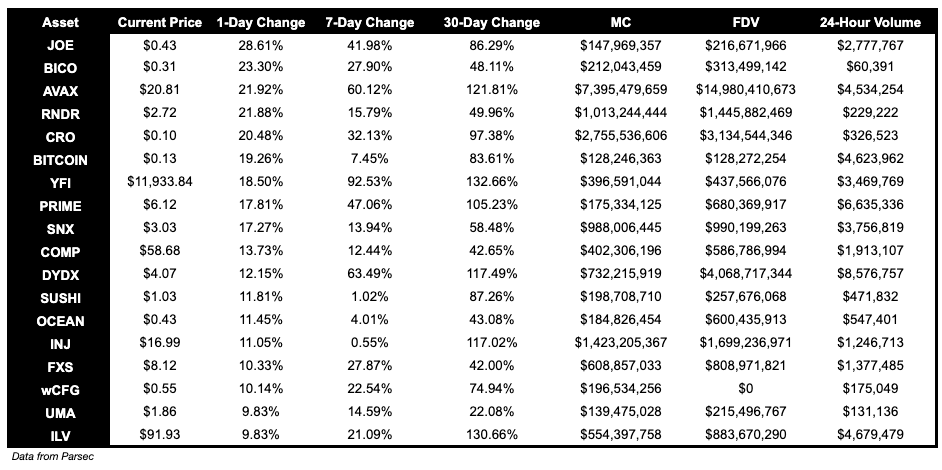

Above $100M MC by performance, on chain

JOE (Trader Joe) is up 28.61% over the past day - likely benefiting off AVAX’ strong performance. BICO is up 23.30%.

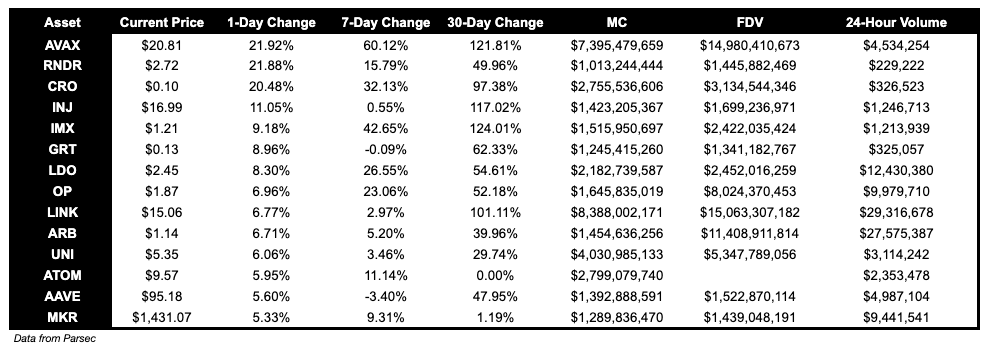

Above $1B MC by performance, on chain

AVAX, up 21.92%, RNDR, up 21.88%, and CRO, up 20.48%, performed well over the past day.

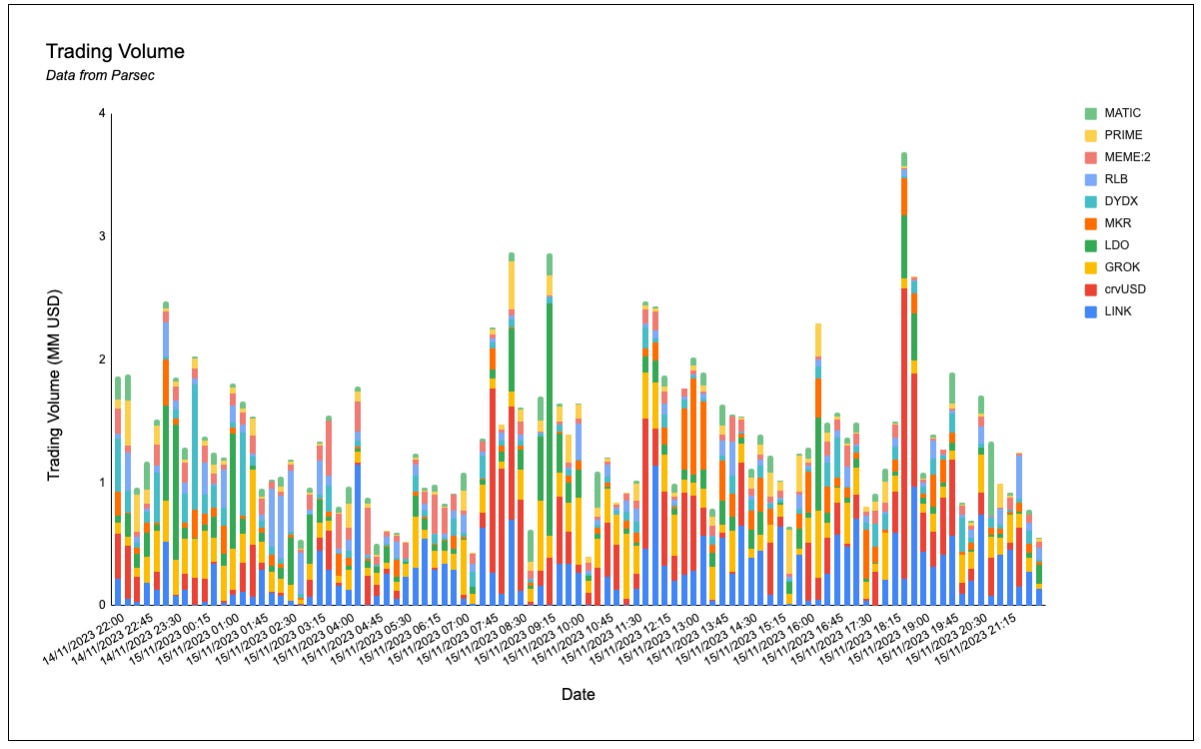

Trading Volumes

PRIME, MEME, LINK, crvUSD and RLB have the highest onchain trading volumes over the past day.

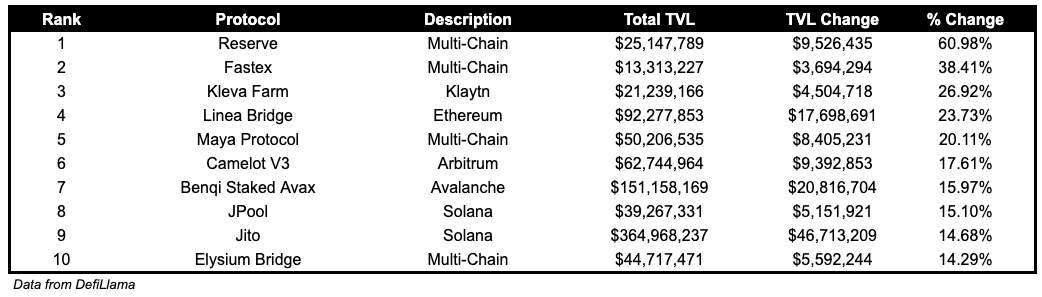

TVL

TVL Above $10M

Over the past day:

Reserve, , TVL grew by 60.98%.

Fastex, , TVL grew by 38.41%.

Kleva Farm, , TVL grew by 26.92%.

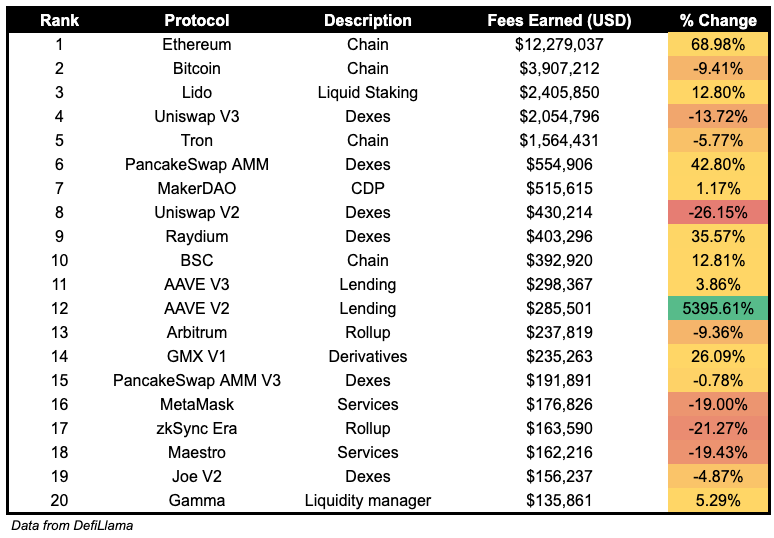

Fees

Nothing notable in terms of fees earned.

Governance Proposals

Deploy New Tokenomics for Sushi [Signal]

Sushi proposal to update SUSHI tokenomics using trading, routing and staking fees as well as partnerships.

[FIP - 300] Frax Finance and Axelar Network

Axelar proposal for Frax to use Axelar Network to bridge FRAX and other Frax assets to chains where Frax Ferry doesn’t operate to.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.