Daily Notes: 15-06-2023

Developments

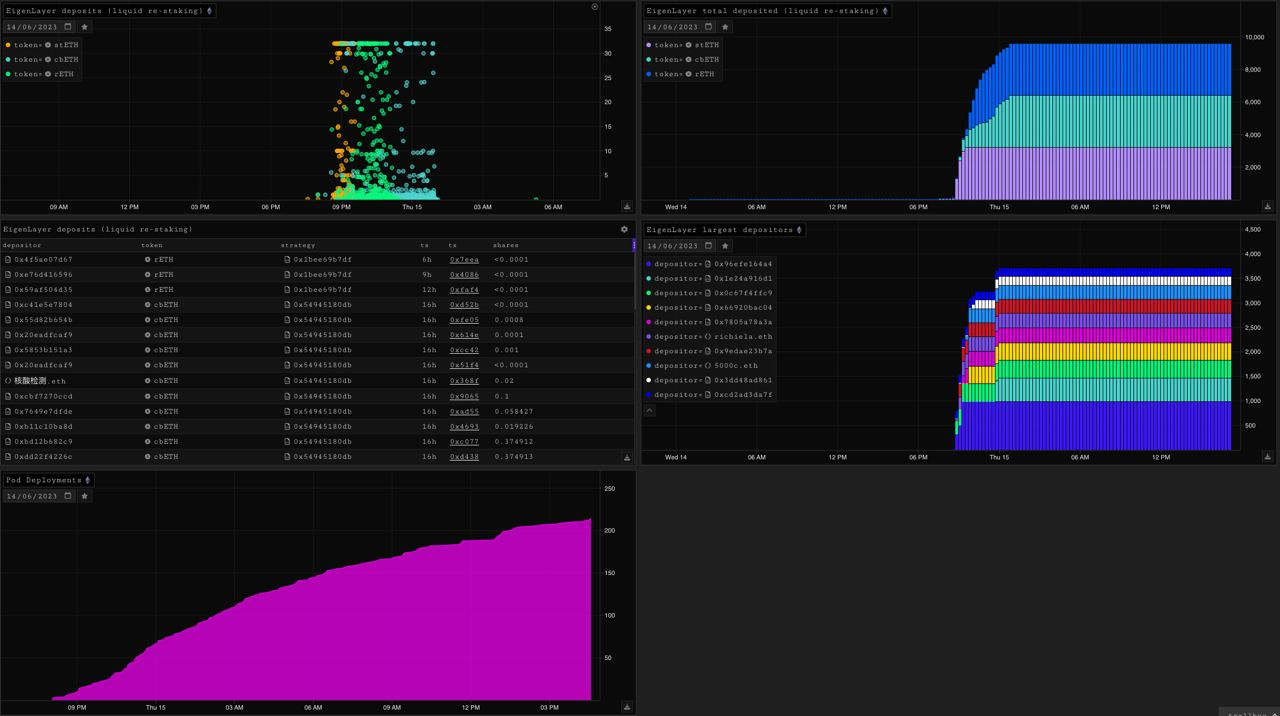

EigenLayer Stage-1 Deployment on Ethereum Mainnet

EigenLayer is a restaking protocol which enables the reuse of ETH on the consensus layer.

Ethereum stakers can restake LSTs into EigenLayer.

Currently supports: stETH, rETH and cbETH.

Current limits and specifications are:

Limit for liquid restaking: Max 3.2k tokens per asset

Deposit limit: 32 tokens per transaction

Additional EigenPod creation pauses at 9.6k ETH w/ no limits on pointing validators to an EigenPod

For enhanced asset safety there is a 7-day withdrawal delay

The guarded launch filled in 4 hours - 3200 stETH, 3200 rETH, 3200 cbETH, 392.63 Beacon chain ETH now sit in the protocol.

Celsius Network Selling Altcoins

Celsius will be converting alt coins from customers (with exception of custody and withhold accounts) to BTC and ETH from July 1st onwards.

This would lead to total sell pressure of $218.2M for the alts and $218.2M buy pressure for BTC & ETH.

Tether

As we noted yesterday, there has been an uptick in users selling USDT into the 3pool. USDT weighting in 3pool is currently sitting at a 64.78%, reaching a high of 73% in the early hours of June 15th.

+$161 mil USDT into 3pool in last 4 days.

This move started 3 days ago and market participants were speculating as to why the pool was becoming imbalanced. It seems we now have our answer - the New York Attorney General (NYAG) audited Tether’s books back in 2021 and today Coindesk have been allowed access to the results of these audits.

Tether, who found out today that Coindesk were being allowed access posted this blog.

USDT/USDC dipped outside of the uniV3 range, causing USDT to trade at 0.9 in this uniswap pool.

The summary of the Tether blog post is as follows:

“NYAG asked for reporting about Tether’s reserves each quarter for two years. Tether fully honored that obligation, and there has been no suggestion that the disclosures were incomplete or that the reserves were ever inadequate.

This morning, the NYAG’s Office provided responsive documents to CoinDesk.

The documents disclosed are statements from Tether’s banks showing the full existence of our reserves, as demonstrated by our publicly-disclosed, independent, third party assurance attestations.

Tether, among other actions, reduced its commercial paper holdings to zero in mid-2022, and drastically reduced its secured loans portfolio, with the aim to bring it to zero in the coming months.

We find it suspicious that today’s attack on USD₮ via both DeFi and centralized exchanges occurred on the day that materials were handed over to CoinDesk. This timing raises questions”

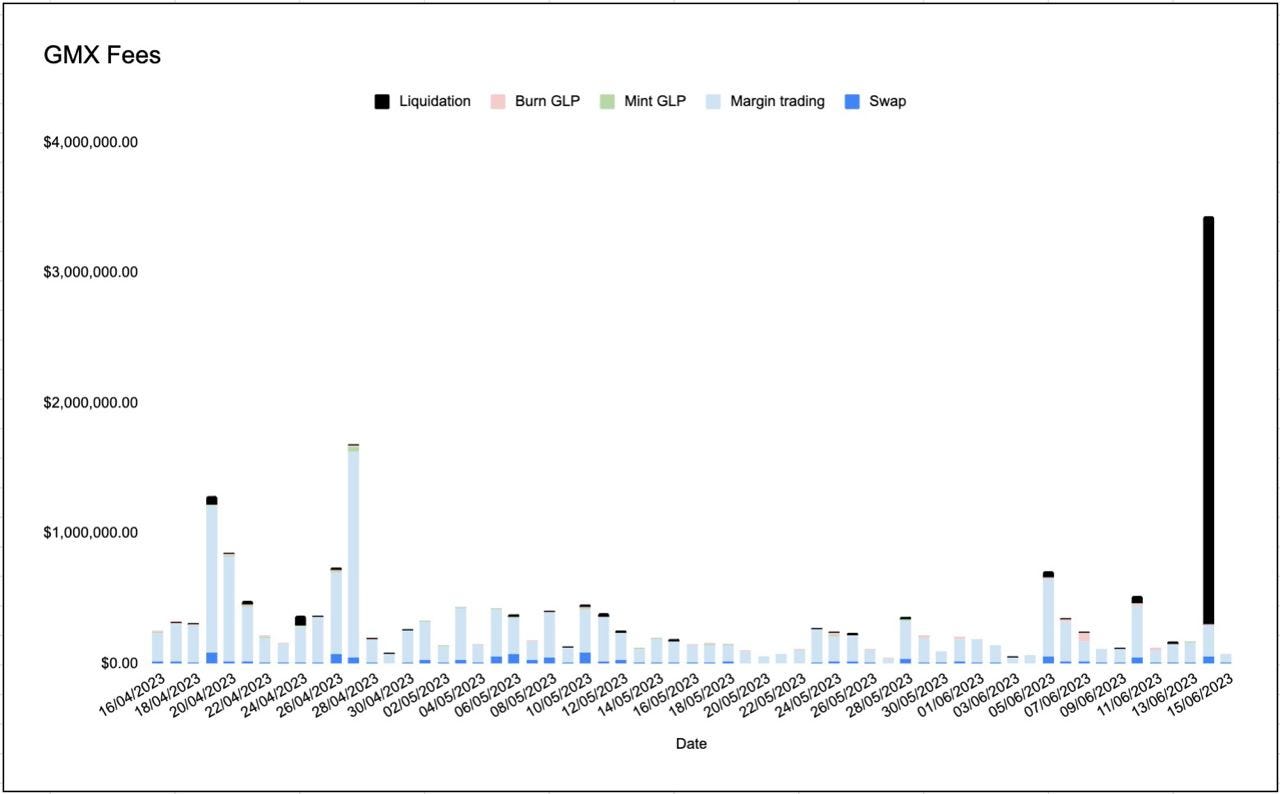

GMX Liquidations

Yesterday, GMX experienced one of its largest liquidation events ever. These liquidations resulted in ~$3.5 mil in fees for GLP/ GMX holders, bringing the cumulative fees earned in the last 2 months to ~$21 mil.

Binance mint >$1 billion Tusd

Despite Prime Trust stopping minting / redemptions, Binance minted 1,072,566,000 Tusd at 11:30:45 UTC on the Tron chain.

Transaction here.

Blackrock Bitcoin ETF

According to an individual knowledgeable about the situation, BlackRock, the largest asset manager globally, is on the verge of submitting an application for a Bitcoin Exchange Traded Fund (ETF).

The source also mentioned that BlackRock plans to utilize Coinbase Custody for the ETF and will rely on the cryptocurrency exchange's spot market data for pricing.

Gaming-focused Layer 3 Xai set to launch on Arbitrum

Xai is a Layer 3 blockchain specifically focused on gaming, will launch later this years.

Xai is built using Arbitrum Orbit. Xai will collaborate with Offchain Labs and Ex Populus for the launch.

Michael Egorov Deleveraging

As we reported yesterday, Curve’s founder has taken a large position on-chain supply CRV tokens to borrow stables. With the market downturn yesterday, Michael started repaying some of these loans to lower his liquidation price.

Trending Assets

Above $100M MC by performance

BLUR has outperformed a day after 196M BLUR unlocked.

The remaining assets that have “performed well” are stablecoins or OHM (a decentralized reserve currency) which have likely performed well due to people positioning into stablecoins or are leaving USDT for other stablecoins.

Above $1B MC by performance

Nothing to note here in particular.

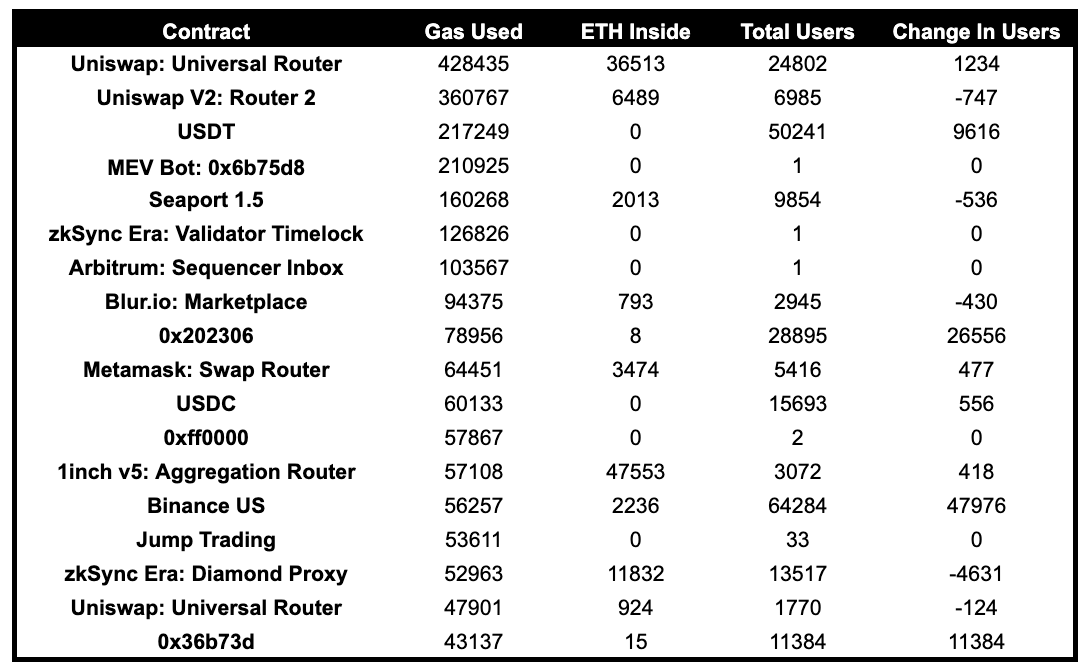

Trending Contracts

Both Binance US and Jump Trading are part of the top gas users of the day.

Coingecko Trending Assets

Matic

Bitcoin

Apecoin

Trust Wallet Token

Tether

Arbitrum

Pepe

Stablecoin Netflows to Exchanges

Stablecoin netflow to exchanges showing a decent positive day today with $272 million flowing to exchanges. This could be related to the USDT news so it may not be indicative of buying per se, more likely people are sending to CEX’s to convert to USDC as the 3pool / univ3 pools were so imbalanced / off peg.

Governance Proposals:

Aura Finance: [AIP-31] Arbitrum Deployment

Proposal to deploy Aura Finance on Arbitrum.

To bridge AURA and auraBAL tokens across chains, Aura Finance will use Layer Zero.

Aura and auraBAL tokens on L2s and sidechains will be OFTs (Omnichain Fungible Tokens - LayerZero token standard).

Balancer: [BIP-333] - Deploy Balancer on Linea

Proposal for balancer to deploy on Linea testnet & Linea mainnet.

Balancer: [BIP-332] Reallocate wstETH/wETH Protocol Fees

Proposal to bootstrap the wstETH/bb-a-wETH pool by redirecting protocol fees used for bribes from wstETH/wETH to wstETH/bb-a-wETH pool.

New Protocols

Zunami Protocol

Description: Optimize your yield with $UZD and Omnipools for the Curve Finance ecosystem

Twitter: https://twitter.com/ZunamiProtocol

Website: https://www.zunami.io/

Fluid Protocol

Description: Fluid Protocol’s $USDF is the native decentralized stablecoin for Fuel Network

Twitter: https://twitter.com/Fluid_Protocol

Website: https://fluidprotocol.xyz/