Daily Notes: 14-07-2023

Developments

Ondo Finance and Polygon Partnership

Ondo Finance and Polygon Labs have formed a strategic partnership to promote the use of RWAs in Polygon.

Ondo is known for creating Flux Finance, an innovative lending marketplace that replicates the US Treasury repo markets on the blockchain. These platforms have quickly gained popularity and currently hold over $200 million in assets within a span of four months.

To expand its reach beyond the Ethereum network, Ondo has introduced tokenized US Treasuries called OUSG (Ondo US Government Bond Fund) on Polygon.

On Thursday, a major early investor in Shiba Inu (SHIB), holding 10% of the token's total supply, transferred approximately $30 million worth of their holdings to eight different wallets.

This particular investor is known as the largest holder of SHIB tokens, with a staggering amount of 101.47 trillion SHIB, valued at over $756 million. They initially bought $14,000 worth of SHIB tokens shortly after their issuance and have sold nearly $20 million worth in 2021.

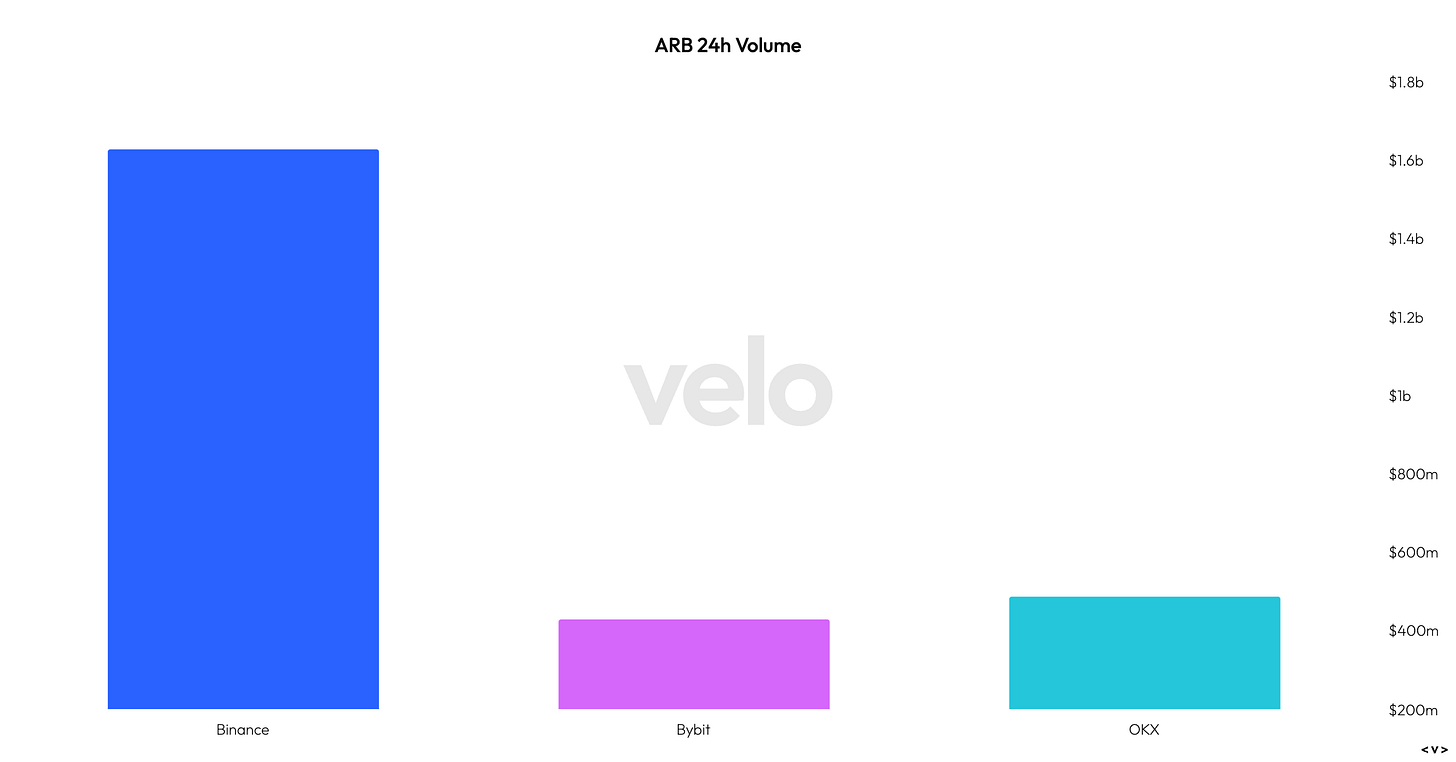

ARB has the fourth highest volume traded on chain (at $80.6M) over the past day.

Seeing similarly high volumes on CEX's as well ($1.79B volume over 24h on Binance).

Aave GHO

The vote to launch Aave’s stablecoin GHO has passed. The proposal is now queued and will be activated at around 2pm UTC.

100% of interest payments will accrue to the Aave DAO

DAO will be able to change GHO’s interest rate as necessary over time through governance

GHO will be available via Aave V3 only

stkAAVE accepted as a discount token for GHO borrow rate

Initial Parameters

GMX v2 voting

The vote to decide GMX v2’s Fee Split is live, with two options available for voting

Option One - Fund GMX Treasury

An allocation of 10% of protocol fees for which GMX stakers & GM liquidity providers participate be allocated to the GMX Treasury

This will assume the continuation of a 70:30 ratio between GMX stakers and liquidity providers to create an effective allocation for the protocolFee parameter of:

10% distributed to the GMX Treasury

63% distributed to liquidity providers in each specific liquidity pool

27% distributed to a pool that goes to GMX stakers across all chains

Chainlink oracles will be funded by a sub-allocation of the 10% GMX Treasury allocation

Option Two - Maintain Existing V1 Distribution

The protocolFee parameter continues in the 70:30 from GMX v1

70% distributed to liquidity providers in each specific liquidity pool

30% distributed to a pool that goes to GMX stakers across all chains

Distribution pool for GMX stakers would be reduced by 1.2% of protocolFee towards Chainlink oracles for effective distribution of 28.8%

Votes are currently heavily in favour of Option One, which is to allocate 10% to the GMX treasury (98.07% of votes in favour)

Figment and Nexus Mutual Partnership

Figment and Nexus Mutual have partnered to offer Figment customers additional protection against validator slashing risks through the launch of "ETH Slashing Cover."

Validator slashing refers to penalties faced by validators for malicious behavior, such as signing conflicting blocks or messages.

With ETH Slashing Cover, Figment customers can potentially protect themselves against double-sign slashing events for up to 1 ETH per validator.

By combining Figment's existing coverage with this new offering, customers can achieve up to 100% coverage against slashing risks for their staked ether.

Figment manages over $3 billion in total assets staked, with nearly 5% of all staked ether on Figment validators.

DeFi cover, an alternative to traditional insurance, is a growing sector in the crypto industry and paid out $34.4 million worth of claims in 2022, according to OpenCover.

Nexus Mutual has protected over $4.4 billion in crypto assets since 2019 and paid out over $17 million in claims.

BIT token holder weighting post MIP-23 billion. 3 billion BIT tokens were sent to the burn address & will not be converted to MNT.

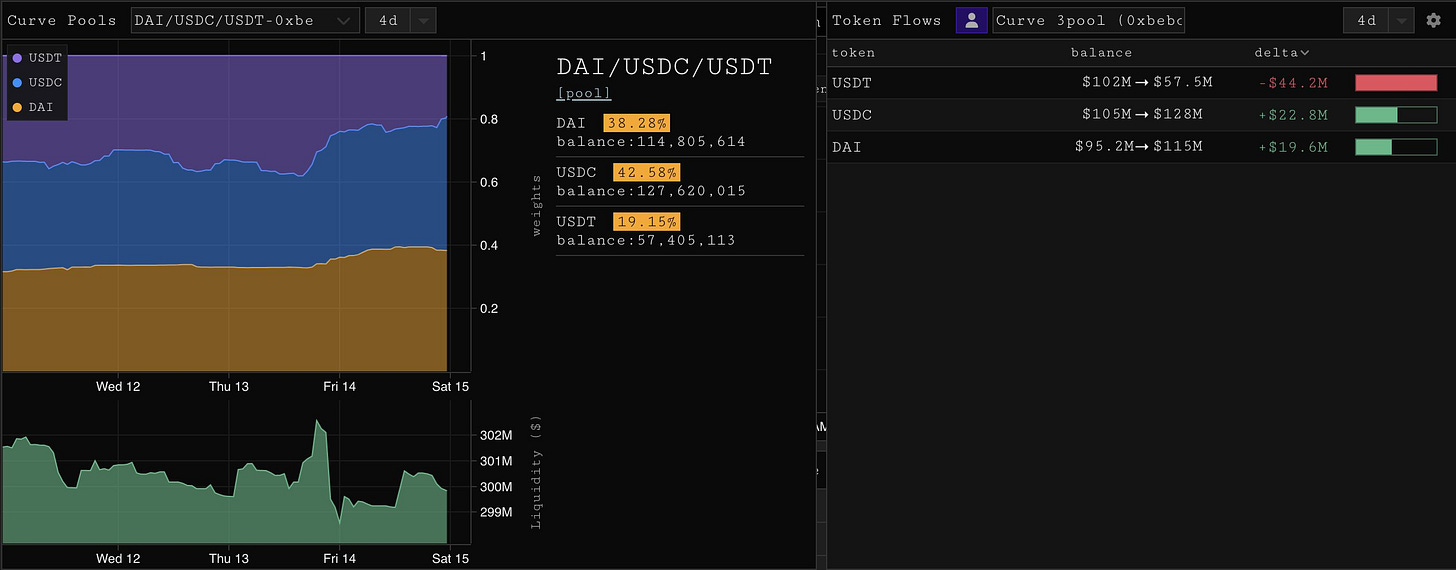

USDT underweight in the 3pool again. This move to 19% weighting started yesterday with a sharp increase in the amount of USDC & DAI in the pool.

Cumulative 4 day flows show $44mil in USDT was removed from the pool.

XRP is dominating volume on Upbit, with $1.7B traded in the past 24 hrs.

Trending Assets

Coingecko Top Losers

RLB, down 17.82%, GNS, down 8.95%, and BSV, down 6.56%, are the top relevant losers of the past 24 hours.

Above $100M MC by performance, on chain

SNX is up 33.84% over the past 24 hours, followed by INJ, up 12.36%, and SYN, up 11.66%.

Notably, LQTY is up 56.64% over the past week.

Above $1B MC by performance, on chain

Avalanche, up 8.41%, is the top performer above $1B MC by performance on chain over the past day, followed by LDO, up 7.24%, and AAVE, up 5.21%.

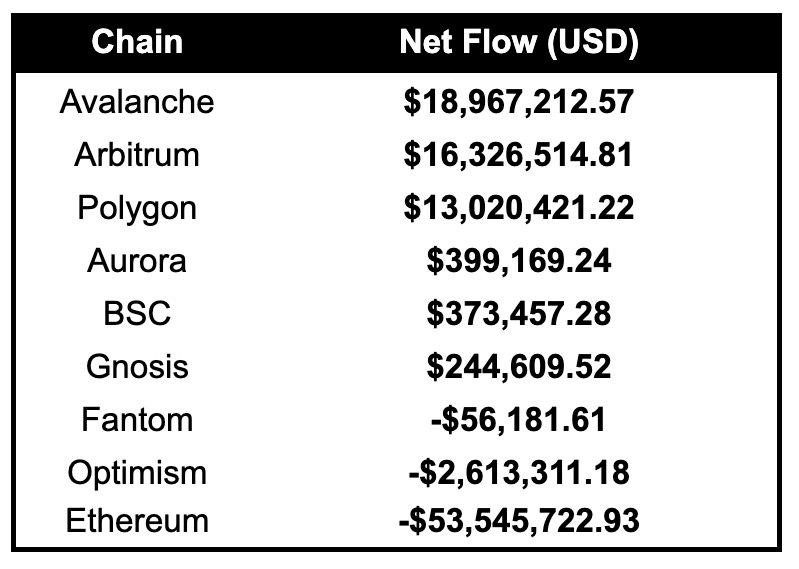

Stablecoin Netflows

Notable net inflows into Avalanche (+ $18.97M), Arbitrum (+ $16.33M) and Polygon (+ $ 13.02M). Huge net outflows out of Ethereum (- $53.54M).

Governance Proposals

Accelerating Arbitrum - leveraging Camelot as an ecosystem hub to support native builders

Proposal to 1.5M ARB per month to Camelot DAO for the next 6 months to fund liquidity incentives for Arbitrum-focused projects on Camelot.

Articles / Threads

LandX announced their new tokenomics update. LNDX token will have:

Revenue sharing

Governance rights

Requirements for validators to stake

Raft: Maximize Your Yield: One-Step Leverage Is Live

Raft introduces one-step leverage which will allow users reach up to 6x leverage in a single transaction.

Kwenta announces staking V2 with:

Escrow transferability

A 2 week unstaking cooldown period

In addition, Kwenta will be launching the following in the next few weeks:

Early Vest Fees

Automated Compounding

Upgradability