Daily Notes: 14-06-2023

Developments

Trouble with Delio Global and Haru

The largest Korean BTC lending service Delio Global and Korea's largest yield service Haru halts withdrawals. Delio offers lending services and typically offers lower yields for crypto. Haru on the other hand offers his yield across the board for lockups (>10% for majors and stables). There are some reports of mismanaged & co-mingled user funds.

Interestingly, Delio reports a total value utilized of (TVU):

41,740 BTC ($1.08B)

118,044 ETH ($205M)

Altcoins ($6M)

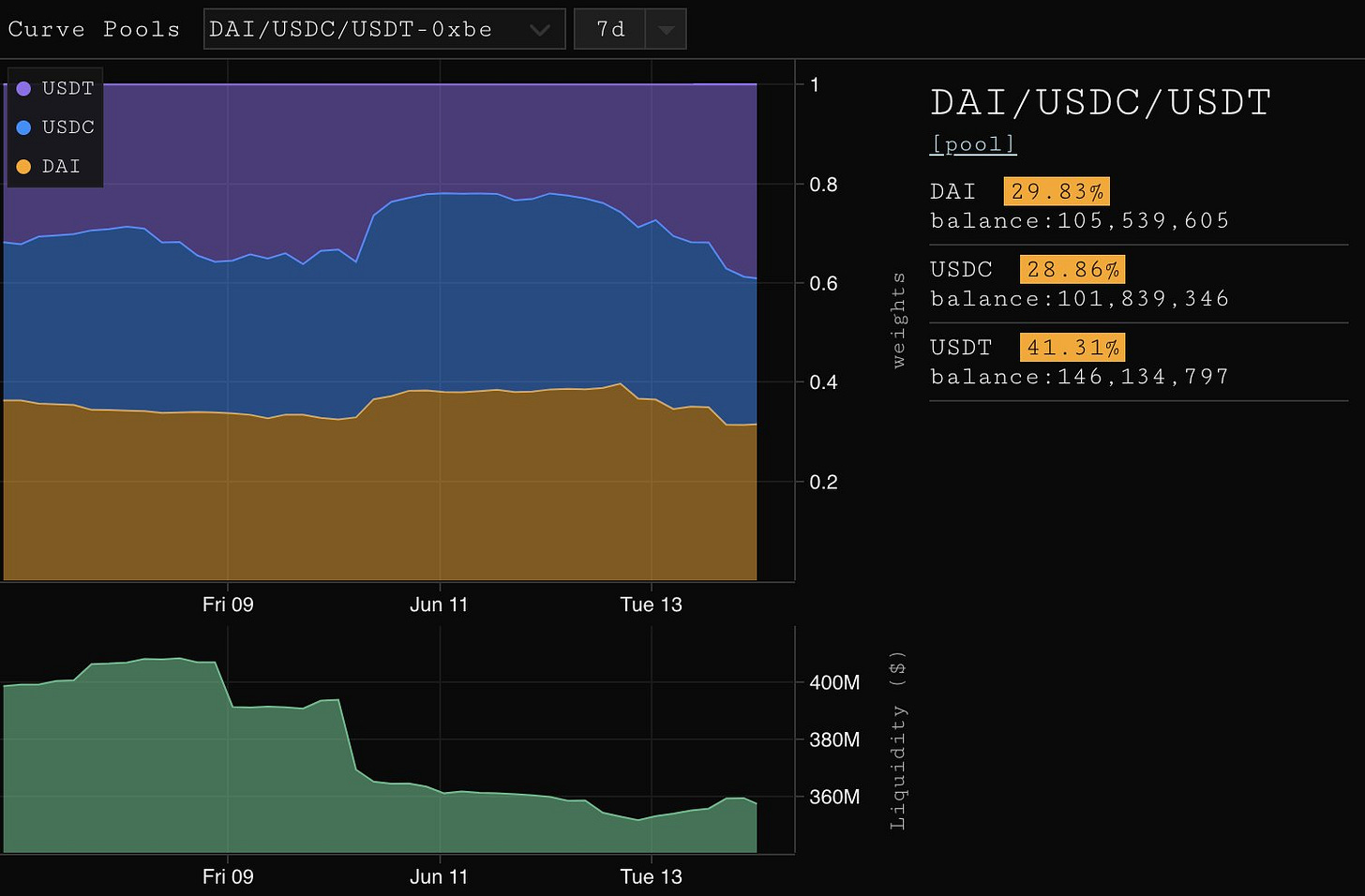

USDT weighting increasing in Curve 3Pool

USDT in the 3pool has increased from a 22% weighting to a 41.31% weighting in the last ~30 hours. There has not been any news about USDT yet but this one way flow is slightly alarming - could this be informed flow front-running a news headline?

Right now its too early to tell and the 3pool has at times become unbalanced before reverting to normal. We continue to monitor for developments.

frxETH Deposits & Burns

1750 frxETH were deposited into the sfrxETH contract last night. This comes just after 12,000 frxETH were burned in order to maintain the frxETH/ETH peg on the 11th of June.

Here’s what happened & how the frxETH AMO works:

The frxETH AMO mints frxETH tokens & pairs these tokens with ETH in the curve pool to deepen liquidity.

When frxETH/ETH strays away from 1:1, like during the market panic last week, the AMO will withdraw this LP position and collect the underlying tokens (frxETH & ETH).

The ETH recovered from the LP is then used to buy frxETH

The frxETH from the LP is burned

The AMO does this in the correct ratio to maintain peg, usually intervening at 0.998 frxETH/ETH

The mechanism worked as expected on the 11th, however, frxETH remains around 0.998 at the moment.

Abishek's Thought Experiment Regarding $SWELL and Pearls

Pearls are Swell’s pre-token rewards campaign to distribute governance to community. They will be convertible to $SWELL.

Pearls grow at a rate of ~600K pearls / week on average.

Abishek states that:

Assuming that TGE is in Sept. 2023, there'd be 12M Pearl's by then based on pearl growth rate.

If you assume a value of $5M to $10M total Swelldrop to early adopters (5% to 10% of $100M FDV), the potential value of one Pearl should be between $0.40c and $0.80c per.

Salesforce Ventures leads $6 million fundraise for NFT data platform Mnemonic

Salesforce Ventures led a $6 million seed extension round for crypto NFT data platform Mnemonic.

Aevo Launches Open Mainnet and Bitcoin Trading

Users will no longer require an Aevo $PASS to trade on Aevo

Users can now trade BTC options and perps on Aevo

Velodrome v2 Launches Tomorrow

Users can use swap functionality on Nightride to migrate v1 VELO to v2. v1 VELO will be convertible 1:1 to V2 with 0 slippage using a special pool.

LI.FI launches Fiat to Crypto Swaps through Jumper Exchange

Users can use jumper exchange (by LI.FI) to swap fiat to crypto

Trending Assets

Above $100M MC by performance

UNI outperforms on v4 announcement / mean reversion from the dump post announcement.

Above $1B MC by performance

Nothing very interesting, ARB back above $1.

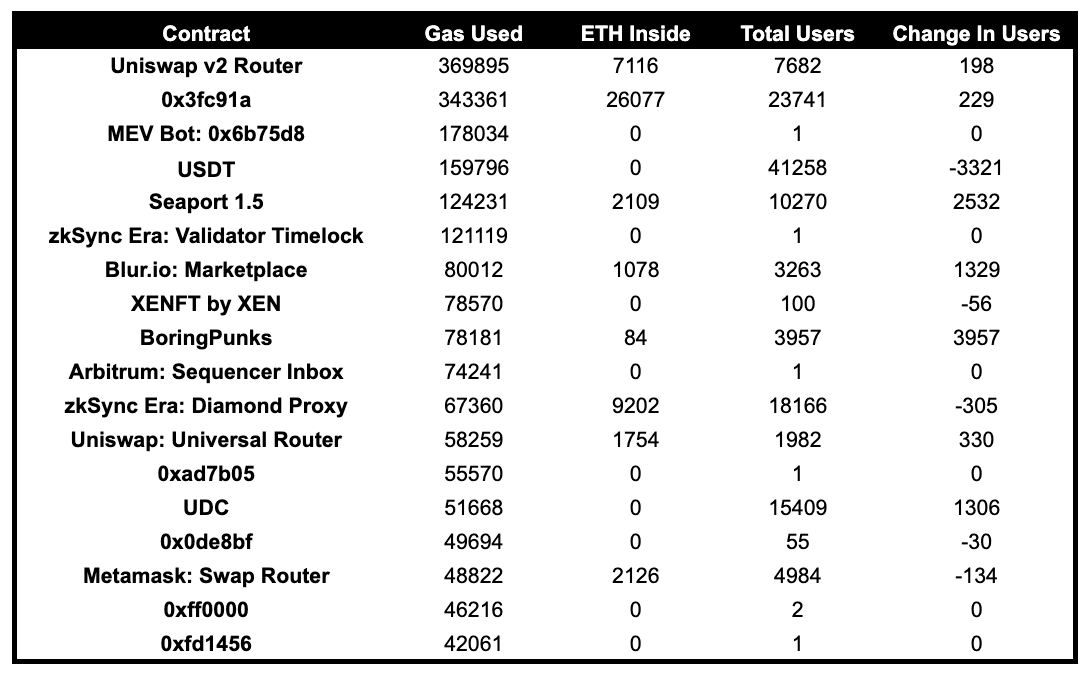

Trending Contracts

Boring Punks mint is a top 10 gas consumer for the day. Aside from this, nothing notable to mention.

Coingecko Trending Assets

trust wallet token

the open network

matic

apecoin

Pink BNB

Pepe

Sui

Stablecoin Exchange Netflows

We are seeing a moderate net stablecoin outflow from exchanges of $277 million today.

Governance Proposals

Governance:

Aave: ARFC - Add FRAX Arbitrum Aave v3

Proposal to add FRAX to the Arbitrum v3 Liquidity Pool.

Aave: TEMP CHECK - Add GMX to Arbitrum v3

Proposal to onboard GMX to the Arbitrum v3 Liquidity Pool.

Stargate: $ARB Token Allocation

Proposal regarding what to do with the $ARB allocation that was given to Stargate as part of the $ARB TGE.

Proposal offers to:

Allocated 70% for Liquidity Mining (1,171,083 $ARB), to boost liquidity on Arbitrum, which would additionally reduce emissions of STG.

Allocate remaining 30% (502,930 $ARB) for partner integrations and support of ecosystem.

ParaSwap: PIP-34 - Proposal ParaSwap Fee Collector v2.1

Proposal to:

Fully automate ParaSwap, by automating collection and conversion of fees into wrapped native token of each chain ParaSwap is on.

Improve efficiency and simplify distribution of current fee system, by switching swapping process to WETH instead of wrapped native token.

Improve bridging process by automating it across each chain.

Proposal to implement a new locking mechanism “Advanced Voting Escrowed QI” or aveQI.

If approved eQI will migrate to aveQI.

Currently QiDao runs a liquidity mining campaign where 180K QI is emitted per week (30.72% of total QI emissions)

To reduce this, and have a better model to maintain liquidity, QiDao proposes to switch to a different liquidity pool locking product.

New Protocols

Limitless Fi

Description: The Uniswap of Lending. We provide liquidation-free leverage for every asset on-chain. Completely oracleless & permissionless.

Twitter: https://twitter.com/LimitlessFi_

Website: https://limitlessfi.xyz/

Ekubo Protocol

Description: Next-generation AMM built for Starknet, coming soon!

Twitter: https://twitter.com/EkuboProtocol

Website: https://github.com/EkuboProtocol

Articles / Threads

0xGeeGee Discusses Their Research:

Depegged LSDs: crETH2 (10% discount), cDOT (16% discount), bDOT(11% discount)

New stableyen $GYEN: fiat-backed, redeemable through KYC, more liquid than competition

Aurus Official (on Polygon) launches new tokens:$tXAU, $tXAG and $tXPT for gold, silver and palladium.

Drift Protocol's MayanSwap is a simple and efficient alternative to Wormhole