Daily Notes 13-12-2023

Developments

Yearn Finance Loses $1.4 Million

On the 11th, Yearn Finance lost $1.4 million (2%) of their treasury after mistakenly transferring all 3.8 million lp-yCRVv2 of protocol-owned liquidity to a faulty multisig script that then exchanged it for 779,958 yvDAI instead of the appropriate 2.18 million yvDAI. The price of yCRV dropped ~36% before being arbed back to its original price. The incident occurred due to the contract's lack of sufficient output checks as it typically only receives smaller fee portions. No user funds were lost.

Redacted Launches Dinero Mainnet

Redacted launched their Dinero Mainnet. Users can also mint pxETH (Pirex ETH) and apxETH. The REDACTED token is up 18% in the last 24 hours. pxETH is “for those willing to forgo staking yield for liquidity” and other opportunities through the DeFi space. apxETH is an LST “for users focused on maximizing their staking yields.” Dinero is a protocol designed to bring together ETH staking, block creation, an RPC, and other features into one.

OKX Suffers $2.7 Million Exploit

OKX lost $2.7 million in an exploit after the private key of a proxy admin owner was leaked following a contract upgrade.

Axelar and Squid Router Integrate into Vertex

Interoperability protocols Axelar and Squid router have been integrated into Vertex, a dex, to allow users to “bridge & deposit seamlessly from 8 different chains”.

Eclipse Launches Fastest Ethereum L2 Testnet

Eclipse, “Ethereum’s fastest L2, powered by the SVM [Solana Virtual Machine]” and posting to Celestia’s data availability layer, has launched their testnet. The next steps will be the developer mainnet beta which is expected to launch “around the end of 2023” according to their documentation.

Swarm Introduces Open dOTC Platform

Swarm launched Open dOTC - a permissionless trading platform for tokenized real-world assets.

Record High Bitcoin Ordinals Trading Volume

Trading volumes of Bitcoin Ordinals hit a record high of $36 million yesterday coinciding with Binance’s listing of BRC-20 SATS.

Coinbase to List Bitcoin and Ether Pairs

Coinbase’s international exchange will be listing Bitcoin and Ether pairs tomorrow (14th) as it aims to expand globally.

Cosmos Foundation's $26M Ecosystem Funding

The Cosmos Interchain Foundation allocates $26 million for ecosystem development funding in 2024. Comparatively, Cosmos allocated $40 million in ecosystem development for 2023.

Early Release for Su Zhu Anticipated

According to Bloomberg, Su Zhu is set to be released this month due to good behavior. This is at least 1 month earlier than his expected late January 2024 release.

Coti to Build Ethereum Layer 2 Focused on Privacy

Coti announces plans to build an Ethereum Layer 2 focused on user privacy. The move will upgrade Coti’s DAG-based protocol to an EVM-compatible layer 2 that inherits the security of Ethereum.

Federal Reserve Maintains Current Rates

The Federal Reserve leaves rates unchanged. Most Fed officials see rate cuts occurring in 2024.

Trending Assets

Below $100M MC by performance, on chain

USH (unshETH’s governance token) went up 114%, REKT (Telegram casino game and trading bot) is up 65%.

Above $100M MC by performance, on chain

Gaming ecosystem GuildFi is up 20%, reclaiming 100 million MC after over a year. Autonomous services platform OLAS is up 23%.

Above $1B MC by performance, on chain

BEAM (formerly Merit Circle) is up 20%. AVAX is up 5% and OKB reclaims all time high of $60 (+5% increase in last 24 hours).

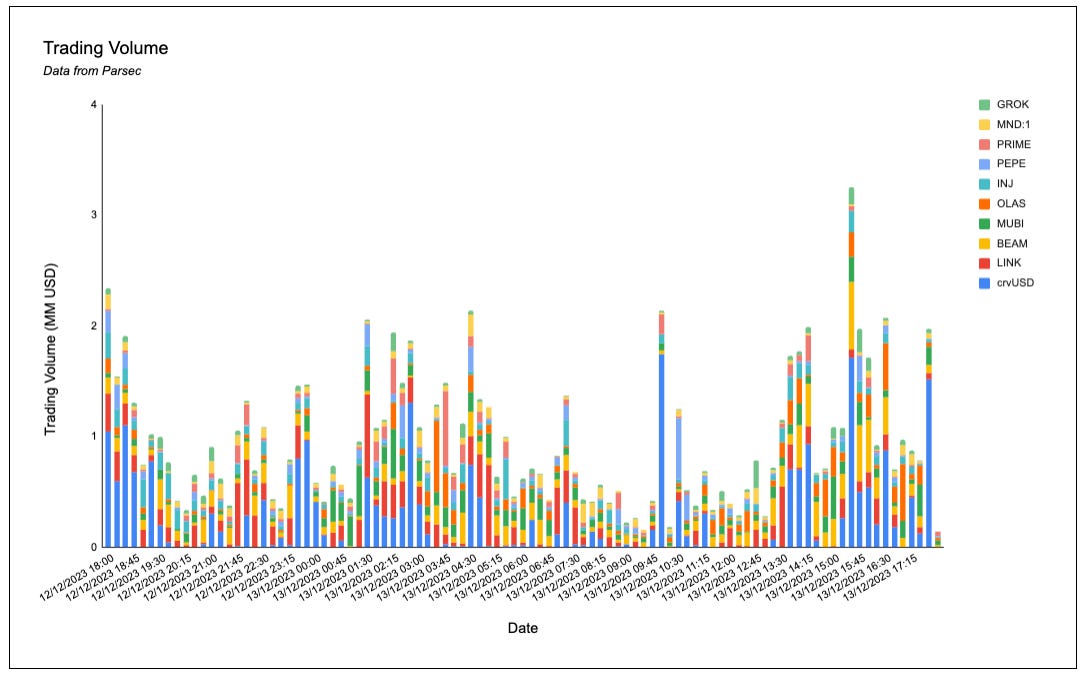

Trading Volumes

crvUSD, LINK, BEAM and MUBI dominated on-chain volumes.

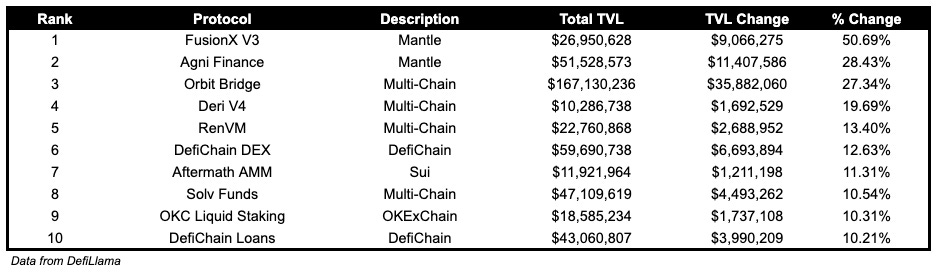

TVL

TVL Above $10M

Over the past day:

FusionX V3, DEX on Mantle, TVL grew by 50.69%.

Agni Finance, DEX on Mantle, TVL grew by 28.43%.

Orbit Bridge, multichain bridge, TVL grew by 27.34%.

Fees

Bitcoin and Ethereum fees are on the climb again. Aave v2 fees up 12%. GMX fees down 51%.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.