Daily Notes 13-11-2023

Developments

A proposal to swap $3 million of $ARB tokens, from the 1inch treasury, into USDC has been published for vote via 1inch’s Snapshot.

Having been live for 9 hours and with 7.5 million votes of the 10 million 1inch token quorum reached so far, 7.2 million votes are currently in favour of approving the swap.

The 2,575,405 $ARB tokens were received by 1inch as part of Arbitrum’s airdrop in March of 2023.

ether.fi 's liquid staking token, eETH, has gone live on mainnet. Currently, only whitelisted users can mint eETH. ether.fi will continue to whitelist more users to mint over the upcoming days.

Uniswap Labs has made over $1 million in the 27 days since turning on the 0.15% fee switch for the Uniswap Protocol last month.

Users may bypass the Labs fee through using aggregators, other frontends or through directly interacting with the smart contracts themselves.

Grayscale’s Solana Trust (GSOL) is trading at a 283% premium compared to the spot SOL price.

Today, GSOL ’s volume was $1.45 million. Its 30 day average volume is 2868 shares ($456,012 at $159 a share).

Ondo Finance has partnered with Axelar to make their short-term US treasury bill backed and yield-bearing stablecoin, USDY, bridgeable across chains. Initially, bridging for the token will only be available between Ethereum and Mantle.

Ryan Wyatt, former president at Polygon Labs and previously head of gaming for 7 years at Youtube, has joined Optimism as their Chief Growth Officer. He will lead business development, marketing and partnerships strategies among other initiatives.

Crypto Fund Inflows Reach $293M

Last week, weekly Crypto Fund inflows reached $293 million. Bitcoin inflows accounted for $240 million (81%) of that sum and Ethereum took second place with $49m million of total inflows.

Cumulatively, the last seven-weeks of inflows have reached over $1 billion. The year-to-date inflows have also totalled to $1.14 billion, the third highest yearly inflows on record.

Spot crypto trading volumes rose by 57.5% in October compared to September’s volumes.

Vertex Protocol, a DEX on Arbitrum, has released the tokenomics for their upcoming native token, VRTX. Users who stake VRTX will receive rewards directed from 50% of the protocol's revenue. Users will also receive voVRTX, a non-transferable token that represents a “token score” which acts as a multiplier effect on incentives for VRTX stakers.

Via Vertex’s rewards program, users can earn VRTX by trading on Vertex. Additionally, you can earn VRTX by participating in the VRTX Liquidity Bootstrapping Auction.

ZachXBT has revealed the GROK token’s twitter account to have previously “been reused for at least one other scam”. Upon publishing his findings on Twitter, the price of GROK went down by as much as 60% within 5 minutes. It currently trades at -40% from the price at posting and -48% from all times high which were achieved early today. The token has had $70.7 million in on-chain volume over the past 24 hours.

A proposal to backfund successful Arbitrum STIP proposals is ending tomorrow Nov 14 2:00 PM UTC. Of the 110,141,000 total votes so far, 69 million have voted in favour, 41 million have voted to reject and 141,000 have abstained to vote.

If successful, an additional 21.4 million ARB will be allocated to an additional 26 protocols for a total of 56 funded projects.

A fake BlackRock iShares XRP Trust Entity filing in Delaware was published. XRP spiked +20% upon the news being spread via notable crypto news stations but has since returned to -0.20% on the daily.

Note that anyone can place a file on Delaware's Website.

Trending Assets

Below $100M MC by performance, on chain

STFX is up 46.74% today, followed by USH, up 43.57%.

Above $100M MC by performance, on chain

WLD had a good day today, and is up 27.82%. YFI is back above $10,000, as it rose 17.06% over the past day. FXS also had a good day, and is up 12.27%.

Above $1B MC by performance, on chain

MKR, up 11.75%, and OP, up 8.17%, were the top performing tokens above $1B MC.

Trading Volumes

GROK, a memecoin named after Elon Musk’s new ChatGPT competitor, has dominated volumes over the past day.

TVL

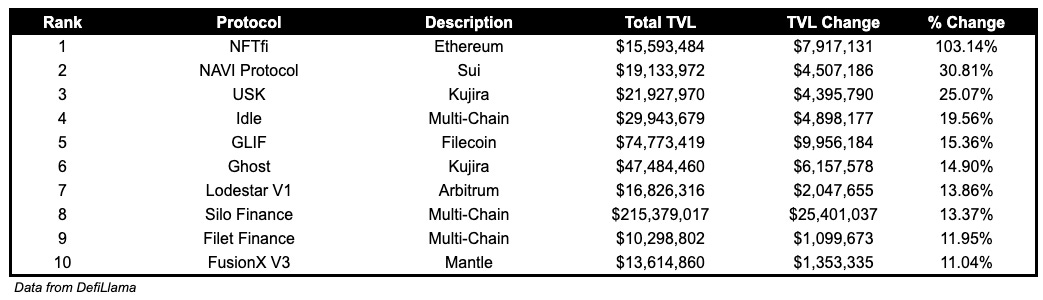

TVL Above $10M

Over the past day:

NFTFi, NFT lending on Ethereum, TVL is up 103.14%.

NAVI Protocol, lending on Sui, TVL is up 30.82%.

USK, CDP on Kujira, TVL is up 25.07%.

Fees

Prisma Finance fees earned are up 256.41% over the past day.

Governance Proposals

[ARFC] CRVUSD Onboarding on Aave V3 Ethereum Pool

Aave proposal to onboard CRVUSD onto Aave v3 on Ethereum.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.