Daily Notes: 13-07-2023

Developments

Ripple SEC Case

Ripple wins verdict that states XRP is not a security, but institutional sales of XRP constituted as investment contracts. Off the back of this, XRP rallied 90% making it the 3rd largest crypto asset (ex-stablecoins). This move added >$35 billion in FDV to XRP’s marketcap

NOT SECURITIES: Programmatic sales via digital asset exchanges were not classified as investment contracts as buyers did not know to whom or what it was paying its money to.

SECURITIES: Institutional buyers knowingly purchasing XRP directly from Ripple pursuant to a contract.

This should have wide implications across the industry when it comes to future token launches and sales

Less likely that protocols decide to launch via launchpads and investment rounds

More likely for tokens to have majority of offerings carried out on programmatic exchanges (DEX, CLOBs etc)

Celsius CEO, Alex Mashinsky, Arrested and Celsius Fined

The SEC has sued Celsius CEO, Alex Mashinsky. The FTC has banned Celsius network from trading, and fined them $4.7B.

Celsius also moved 2.867M LINK, 95.608K AAVE, 2.832M SNX to their OTC wallet today.

Polygon Rebrand Token to POL

Polygon launches whitepaper for the conversion of $MATIC into $POL, a token which will govern and validate all the Polygon chains.

Utility

Validator Staking

Validators can validate multiple Polygon ecosystem chains (zkEVM, supernets, Polygon PoS)

Validator Rewards

Governance

Tokenomics

Initial Supply: 10B POL

Entirety of initial supply dedicated to MATIC <> POL migration

MATIC will be exchanged for POL at a 1:1 ratio

Emissions

Yearly rate of 2% emission

1% to Community Treasury

1% to Validator Rewards

Emissions will be fixed and immutable for the first 10 years

After 10 years governance can vote to alter emissions

FTX Group, led by Sam Bankman-Fried, reportedly paid around $323.5 million for the acquisition of Swiss company DAAG, later rebranded as FTX Europe. However, FTX's lawyers have recently filed a court request in the US bankruptcy court in Delaware seeking to recover the aforementioned amount from FTX Europe's leadership.

ZKM Launch Optimistic & ZK Rollup Technology

The MetisDAO Foundation has recently announced the emergence of Zero-Knowledge rollup ZKM from its incubation program, with the ambition of transforming Ethereum into a "universal settlement layer" for both blockchain and non-blockchain applications.

ZKM is in the process of creating a hybrid rollup solution that integrates the features of both Optimistic rollups and Zero-Knowledge rollups.

Trending Assets

Coingecko Top 300 Performers

XLM and XRP are top performers of the day, XLM is up 70.82% and XRP is up 70.09%.

Coingecko Top 300 Losers

JOE, ORDI and AKT are some relevant coins that have underperformed over the past day.

Above $100M MC by performance, on chain

OX, up 18.12%, CFG, up 12.95%, and LQTY, up 12.11%, have outperformed over the past day.

Above $1B MC by performance, on chain

MATIC is up 11.24% over the past day, possibly due to the launch of their revamped tokenomics.

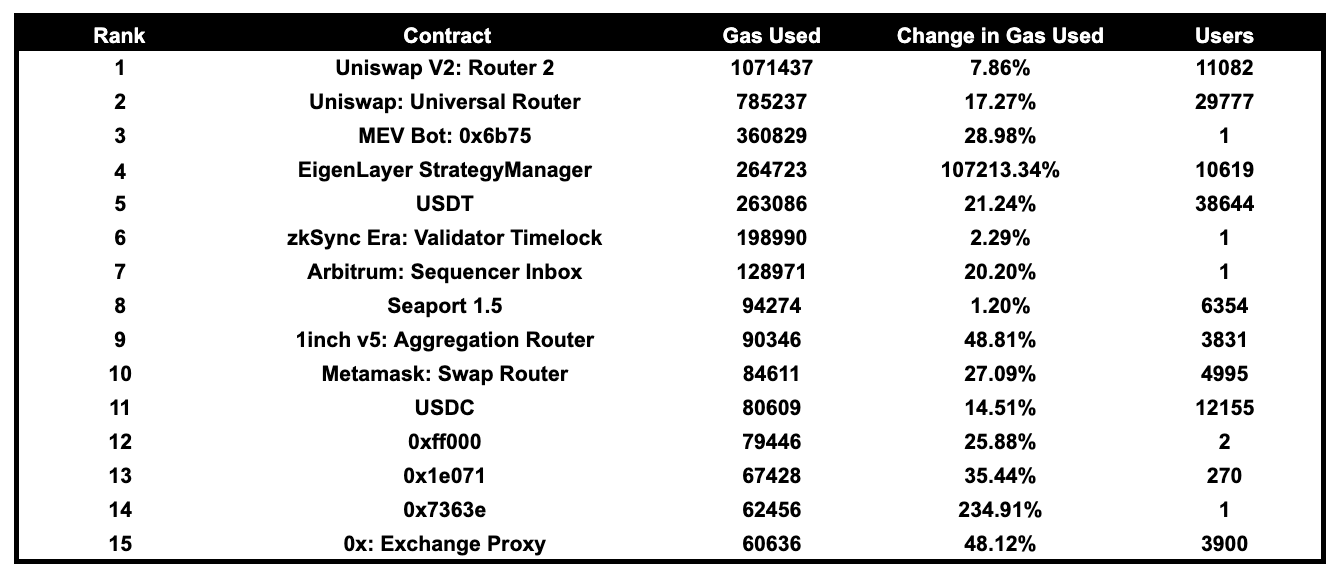

Trending Contracts

Nothing particularly interesting here.

Trading Volume by Symbol

ARB has been dominating on chain trading volume over the past few weeks, followed by PEPE and crvUSD.

TVL

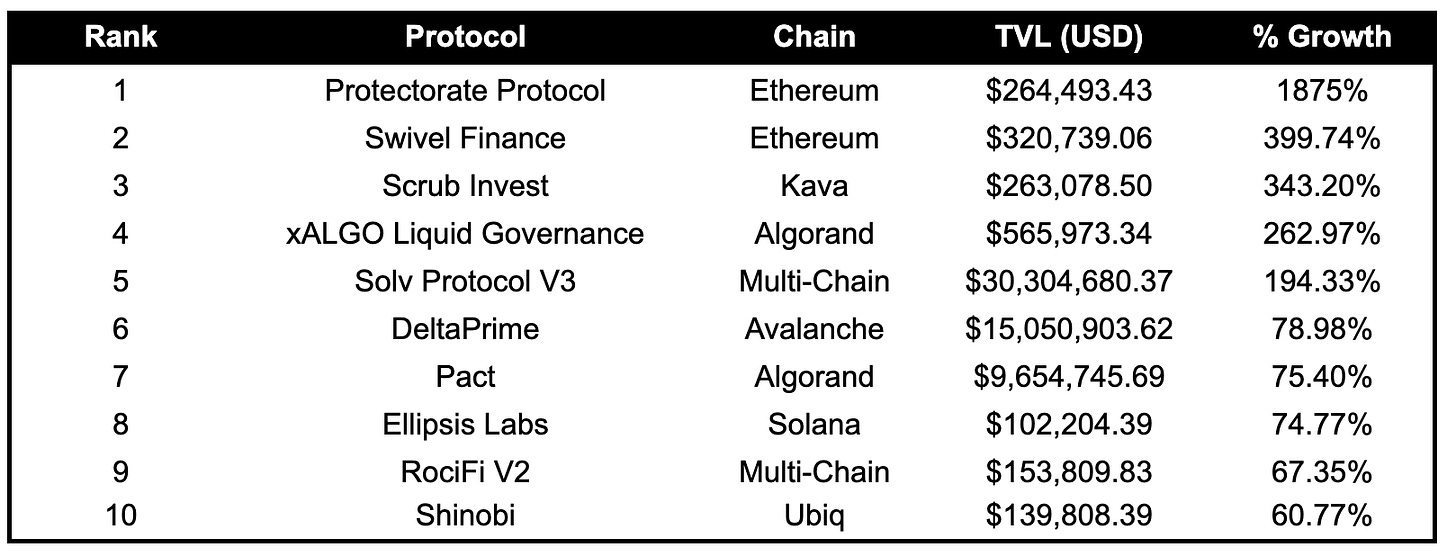

TVL Top Gainers

Protectorate Protocol (NFTFi on Ethereum) experienced the highest TVL growth over the past day, with a 1875% increase.

Fees

Fees Top Earners

Ethereum earned the highest fees over the past day, followed by Arbitrum and Lido. Notably, Arbitrum fees earned are up 47.84% over the last day, and Uniswap v3 fees earned are up 26.97%.

Governance Proposals

[ARFC] Aave V3 Deployment on BNB Chain

Proposal for the deployment of Aave V3 on the BNB Chain.

Articles / Threads

Lido stETH Synthetix Perps Trading Incentives

Synthetix and Lido announce trading rewards program specifically for stETH. 1500 OP per week will be allocated to this trading program, provided by Lido. Rewards will beging on July 18th.