Daily Notes: 13-06-2023

Developments

Uniswap v4

Uniswap announced v4, which include features such as:

Hooks, which modules or customizations that you can make when you deploy a pool.

Architectural changes to contracts, such as Singleton and Flash Accounting, to reduce gas costs, improve efficiency and flexibility

Support for native ETH.

Full summary of Uniswap v4 proposal can be found here.

Hinman Documents

The Hinman emails were released today in the SEC’s case against Ripple. The summary of these documents in as follows:

Hinman speaks of the concept of ‘morphing’, whereby as asset can start off as a security and then transition into a non-security.

Hinman mentions that "In Howey, orange groves did not become a security, even though the sale of the future profits of those were".

Coordinated groups of people (developers, maintainers, founders, sponsors) wouldn’t necessarily rise to the level of a ‘Promoter’ if there work was non-essential.

Hinman emphasises that “The digital asset itself is simply code” and that it’s more HOW an digital asset is sold that makes it a security.

The SEC points out it is not the existence of a secondary market but the efforts of ‘promoters’ to market secondary market sale

The SEC makes the statement in 2018 “ETH as currently offered is not a security” [pre-POS]

For the SEC to now deem ETH a security they must: acknowledge the idea of asset morphing [as ETH was once labelled not a security] and prove that the ETH foundation are ‘promoters’ for secondary sales.

Overall the Hinman emails represent a net win for the crypto industry in their fight against US regulators.

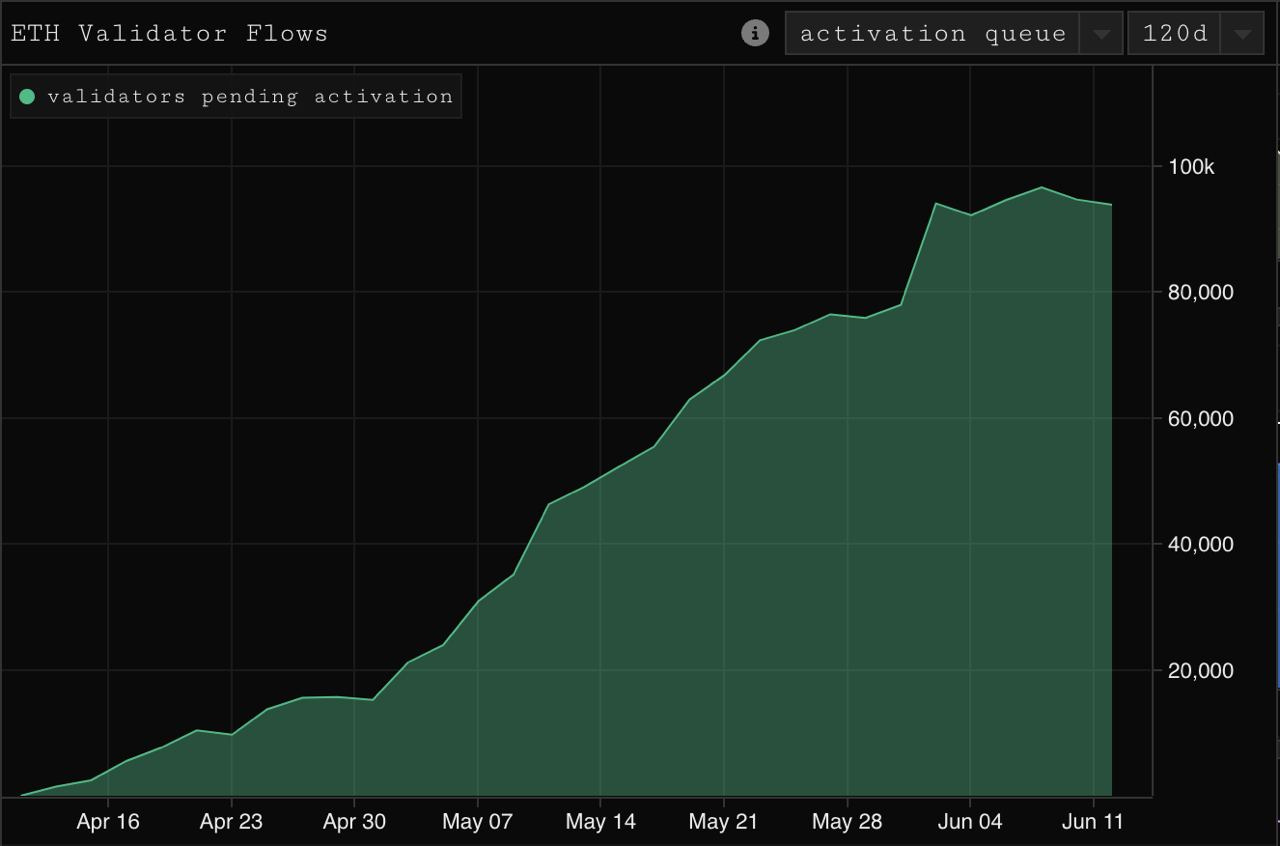

Validator Activation Queue

The activation queue to stake Ethereum has reached 93,932 validators awaiting entry, representing 3,005,824 ETH. The queue to enter ETH staking is now at 47 days.

Maverick Protocol Binance Launchpad

Maverick Protocol (MAV), a composable DEX that enables liquidity providers to achieve high capital efficiency with their desired Liquidity Providing (LP) strategy is launching on Binance launchpad.

Users can stake BNB or TUSD into separate pools to farm MAV tokens over 25 days, with farming starting from 2023-06-14 00:00 (UTC).

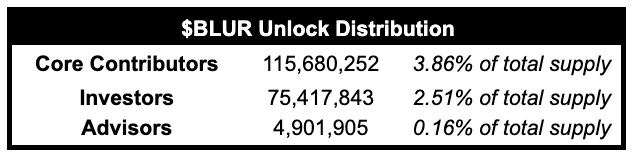

Blur Unlock

As we spoke about last week, tomorrow Blur is set to unlock 196 million Blur tokens (6.53% of total supply) on the 14th of June at 19:00 UTC.

As a reminder, here is the breakdown of the unlock:

The total circulating supply for Blur will increase 40.66% from 508.7 million Blur to 715.6 million Blur. Currently, the entire circulating supply is from the ‘Community treasury’ & this will be the first time contributors, investors and advisors will be liquid. The breakdown of this unlock is as follows:

CPI Data

U.S. CPI: +4% YEAR-OVER-YEAR (EST. +4.1%)

U.S. CORE CPI: +5.3% YEAR-OVER-YEAR (EST. +5.3%)

U.S. CPI: +0.1% MONTH-OVER-MONTH (EST. +0.2%)

U.S. CORE CPI: +0.4% MONTH-OVER-MONTH (EST. +0.4%)

China Stimulus

In a surprising move, China reduced a crucial interest rate on Tuesday and introduced tax incentives for businesses, in response to declining credit expansion, which indicates a slowdown in the recovery of the world's second-largest economy following the Covid-19 pandemic.

Trending Assets

Above $100M MC by performance

Seeing GMX, dYdX and INJ performing well today, maybe related to the harsh regulatory news around centralised exchanges

Mainly assets chopping around post CPI

Above $1B MC by performance

Not much to say here, LINK and AVAX are doing well.

UNI is performing strongly relative to the market with the announcement of Uniswap v4.

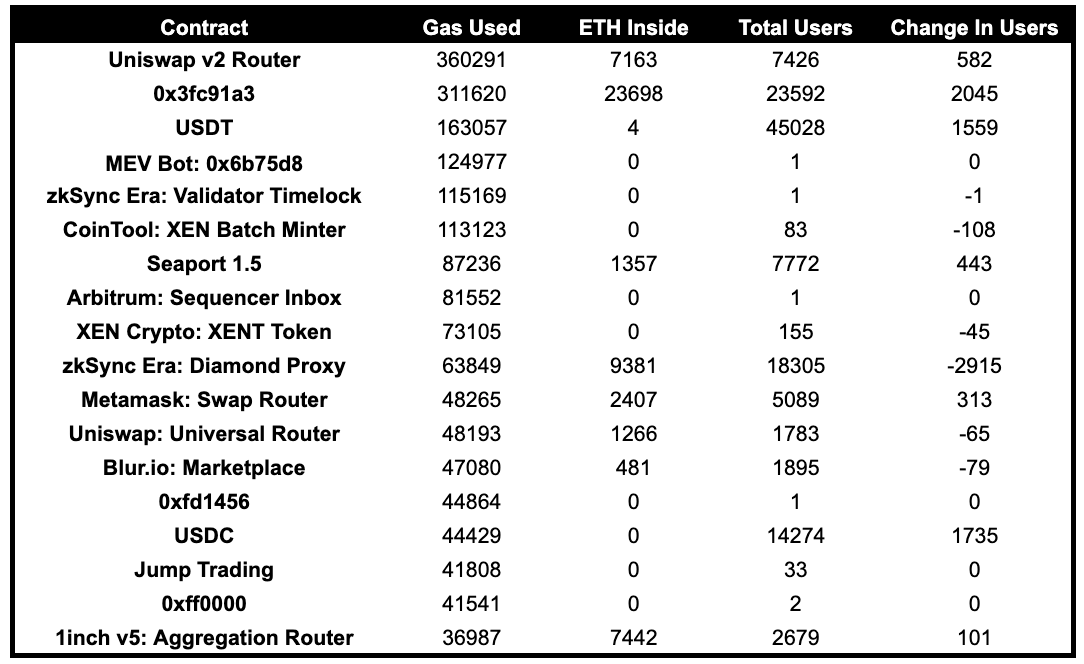

Trending Contracts

Only high gas user of note here is Jump Trading, who are one of the top gas consumers over the last day.

Coingecko Trending Assets

Matic

Trust Wallet

Ape

Arbitrum

Uniswap

Sui

XRP

Stablecoin Netflows

Stablecoin netflow to exchanges is essentially flat on the day, with just $14.7 million net stables flowing to exchanges.

Governance Proposals

Aave: Temperature Check - Aave v3 MVP deployment on Scroll mainnet

Temperature check for Aave v3 MVP deployment on Scroll mainnet

Proposal details that at deployment, three collaterals (WETH, USDC, wstETH) and one borrowable asset (USDC) will be available.

Scroll also commits 500,000 USD in $AAVE staked to the Aave Safety Module to provide additional security guarantees.

Aave: Temperature Check - Pyth to Support AAVE on Optimism as a Secondary Oracle

Proposal to use Pyth as a backup oracle for AAVE on Optimism. Integration is proposed to be a push-based one.

Uniswap: Temperature Check - Deploy Uniswap v3 on Filecoin Virtual Machine (FVM)

Proposal to deploy Uniswap on Filecoin Virtual Machine.

The FVM is a WASM-based execution environment that has the potential to enable programmable markets for storage, retrieval and compute.

Frax: FIP-247 - Add frxETH-alETH Curve Pool to FXS gauge controller

Proposal to add frxETH-alETH pool to the FXS gauge controller.

Frax: FIP-246 - Add frxETH-ankrETH Curve Pool to FXS gauge controller

Proposal to add frxETH-ankrETH pool to the FXS gauge controller.

Articles / Threads

Premia Blue: Changes to Liquidity Pools

Premia Blue will be adding concentrated liquidity, range orders, and smart liquidity management (smart range orders automatically place orders around your set range as the price fluctuates within it)

Balancer is fuelling growth on Polygon zkEVM

Balancer is deploying onto Polygon zkEVM and offer:

Balancer ecosystem launchpad

LST liquidity flywheel, through an LST hub

Balancer boosted pools and their flagship 8020 pools

Maverick Protocol Utility Token: MAV

Maverick Protocol is launch MAV, its native utility token. It is designed primarily to be used for staking, voting, and boosting.

Maverick has launched a ve contract, for vote escrowed MAV.

veMAV balance determines users' voting power.

Tokenomics are not fully released yet.