Daily Notes 12-12-2023

Developments

Solana Whale Sells $5M in LST

A Solana whale sold $5 million of Marinade Finance’s LST, mSOL, causing it to drop by as much as 18% before it retraced its “peg”.

Mastercard on Latin American Crypto Usage

According to Mastercard, “over 51% of Latin American consumers have made a purchase with digital currency and one-third have used a stablecoin for everyday purchases.”

AVAX High Influences Trader Joe's Fees

As AVAX reached a high of nearly $43, Trader Joe's fees earned reached $145,000 - the protocol’s second highest day in 2023.

Binance Opens BRC-20 SATS Trading

Binance opened trading for BRC-20 SATS today. The token has done $439 million in volume and sits at a $1.09 billion market cap.

Upbit Lists CreditCoin

Upbit will be listing CreditCoin. Creditcoin is a Multichain Credit Protocol Powering Real-World Assets.

Coinbase Announces Project Diamond

Coinbase announced Project Diamond - “a smart contract-powered platform for institutions to create, buy, and sell digitally native assets”. The platform uses Coinbase’s technology stack and Base chain “to deliver secure, compliant, capital market activity” for institutional adoption.

Over $1 Billion INJ Staked on Injective

The amount of INJ staked on Injective has exceeded $1 billion.

My Neighbor Alice Migrates to Chromia

Metaverse game My Neighbor Alice has migrated from BNB chain to “relational blockchain” Chromia as their new season 4 commences. Chromia’s native token, CHR, is up 16% which may be attributed to the announcement.

Do Kwon's Detention Extended in Montenegro

Do Kwon’s detention in Montenegro has been extended by two months to Feb 15th at the request of the US and South Korea.

SEC Discusses BTC ETF with Franklin Templeton

The SEC met with Franklin Templeton to discuss their spot BTC ETF application.

SSV Launches Permissionless Mainnet

Distributed validator technology project SSV launched their permissionless mainnet. SSV’s founder has also stated that Lido’s adoption of SSV‘s decentralized technology is expected in the first quarter of 2024.

S&P Global Ratings on Stablecoins

S&P Global Ratings finds USDC, USDP and GUSD to be strong stablecoins, USDT, DAI and FDUSD as “constrained” and FRAX and TUSD as weak. The analysis mainly focused on the quality of assets backing the stablecoin and associated risks with custody and more.

Polygon Adds Celestia for Layer 2 Developers

Polygon will start offering Celestia as a data availability layer for layer 2 developers using Polygon’s Chain Development Kit.

Polygon Launches Public Beta for Polygon Portal

Polygon launches the public beta for “Polygon Portal” - a unified UX for bridging to and from Polygon PoS chain, Polygon zkevm and ETH powered by Socket bridge. It also features a refuel gas feature to easily purchase MATIC and ETH to simplify the Polygon onboarding process.

Kucoin Settles New York Lawsuit

Kucoin has agreed to pay $22 million in a lawsuit brought by the US state of New York. Additionally, they will now be blocking New York users from the exchange.

OKX Opens Support for Aptos Inscriptions

OKX’s NFT Market opens support for Aptos inscriptions.

Aave DAO Votes to Onboard sfrxETH

Aave’s DAO has voted to pass a proposal to onboard staked frxETH (sfrxETH) to the Aave V3 Ethereum market. It will launch with a supply cap of 40,000, loan limit of 4,000 and Loan To Value ratio (LTV) of 71%.

Trending Assets

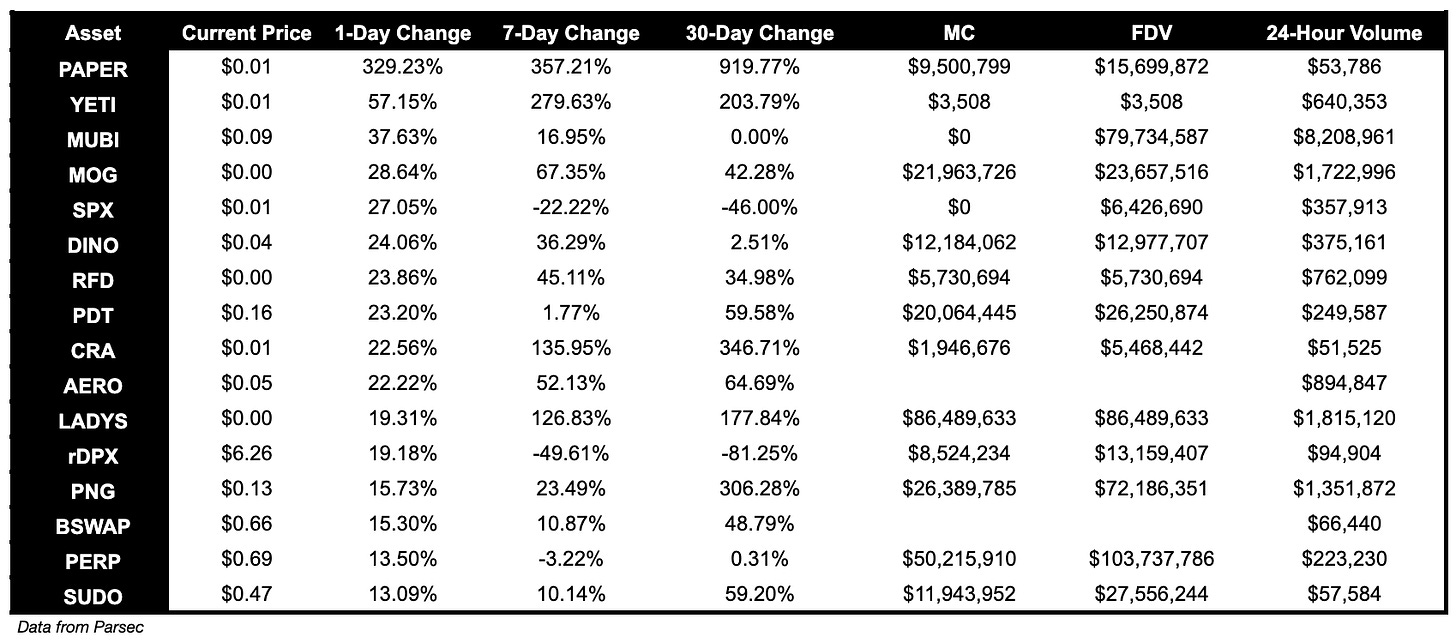

Below $100M MC by performance, on chain

MUBI is up 37.63%, MOG is up 28% and SPX is up 27%.

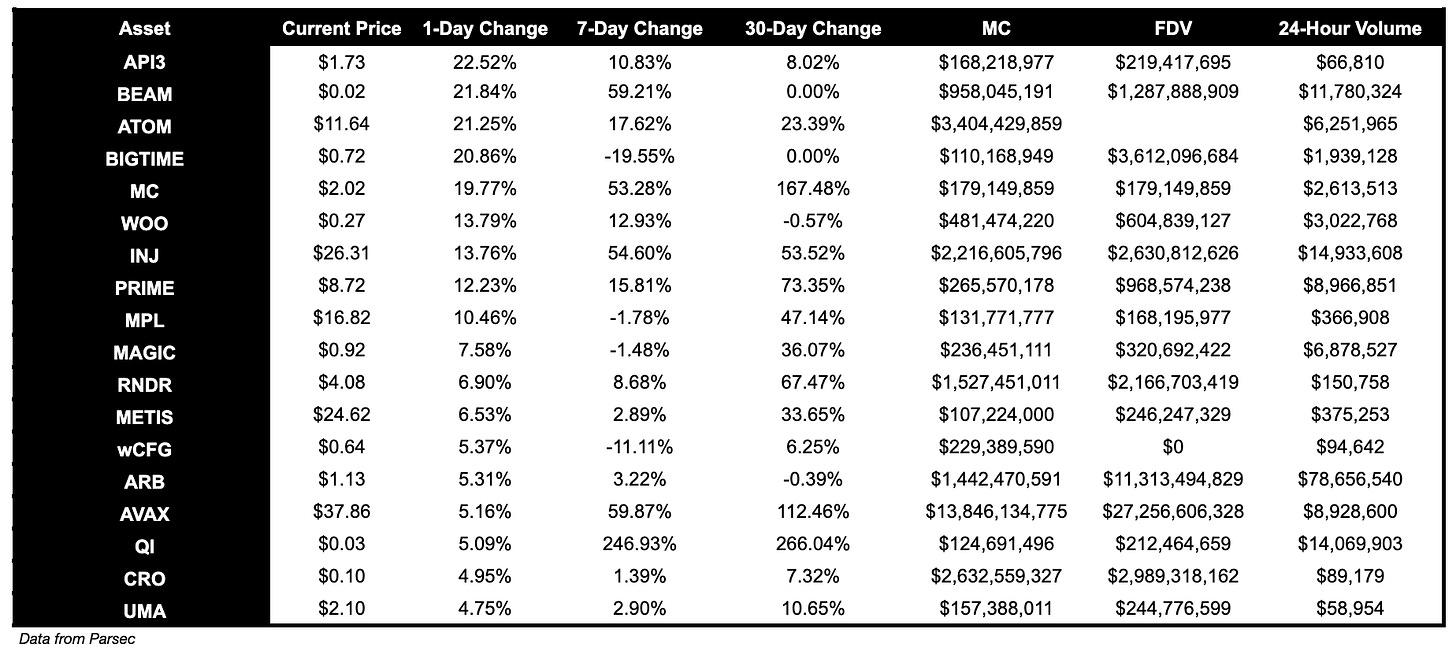

Above $100M MC by performance, on chain

API3 (a web3 focused API provider) is up 22.5%. BEAM increased 21.84% and BIGTIME 20.86%.

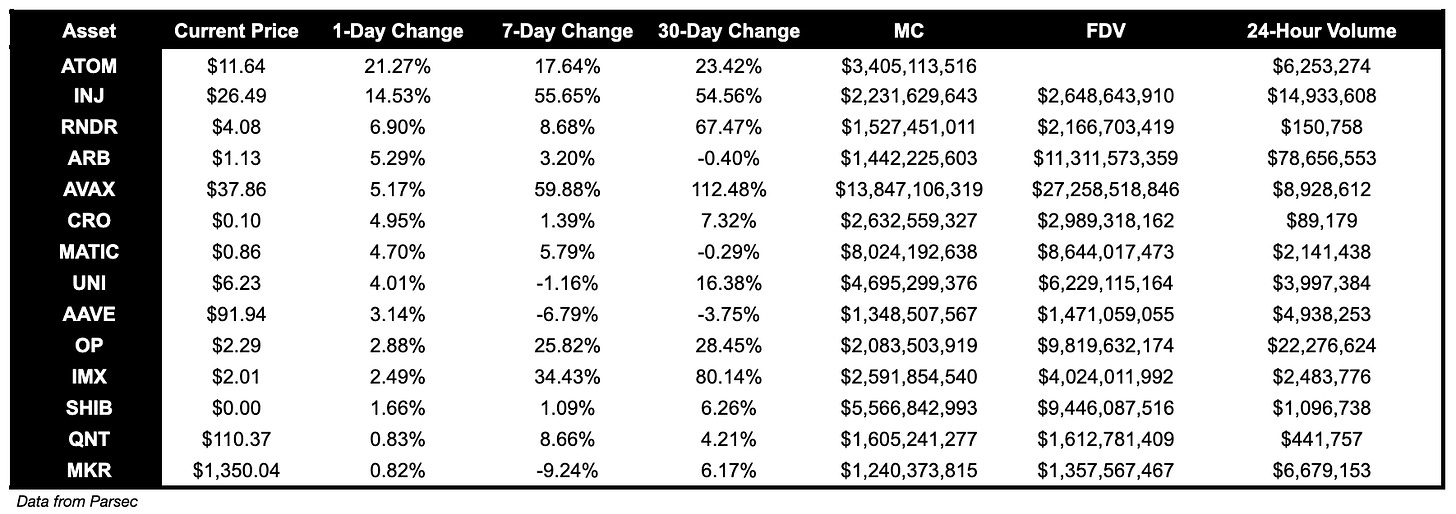

Above $1B MC by performance, on chain

ATOM is up 21.27% over the past day, and INJ is up 14.53%.

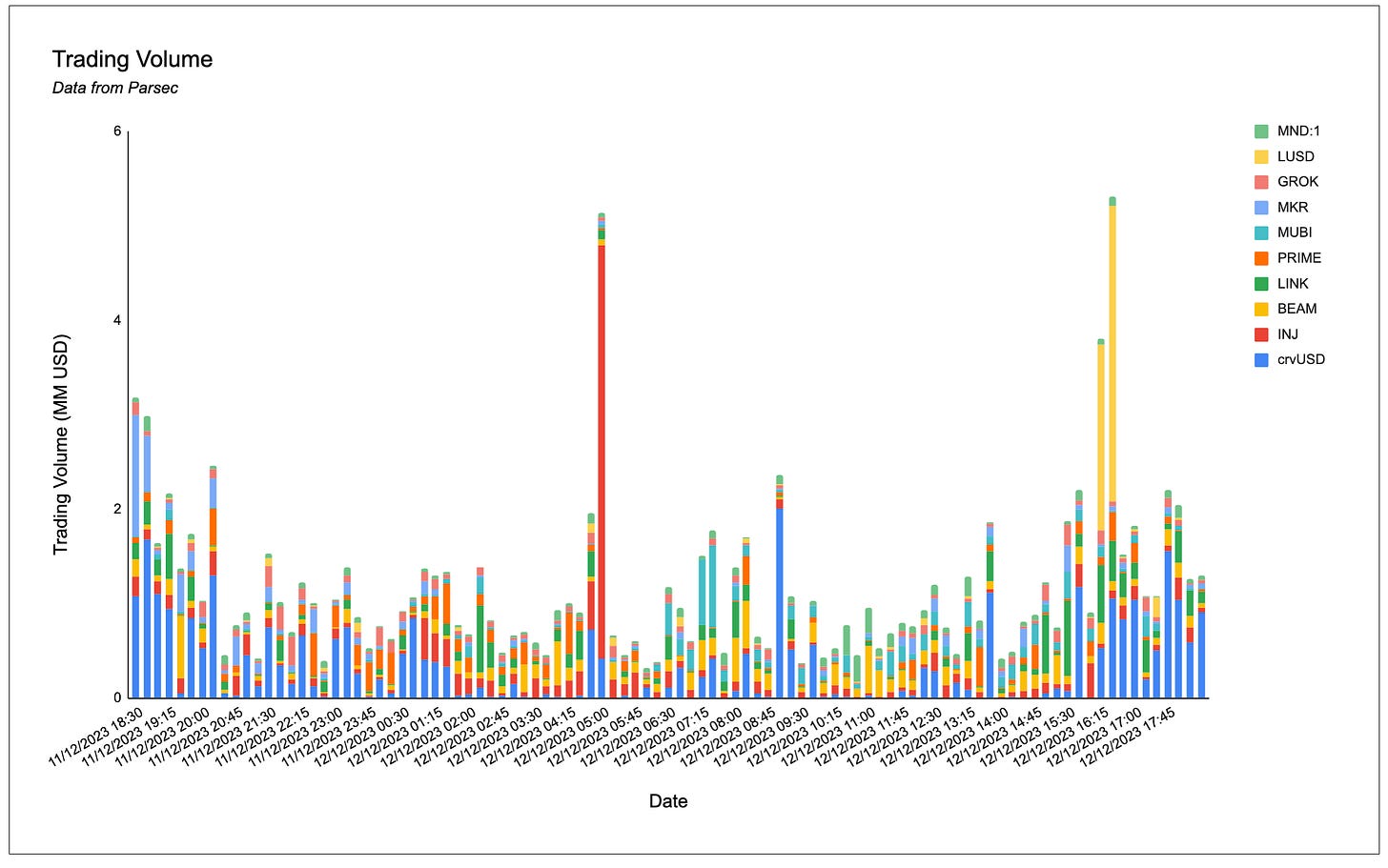

Trading Volumes

crvUSD, INJ and BEAM dominated onchain volumes.

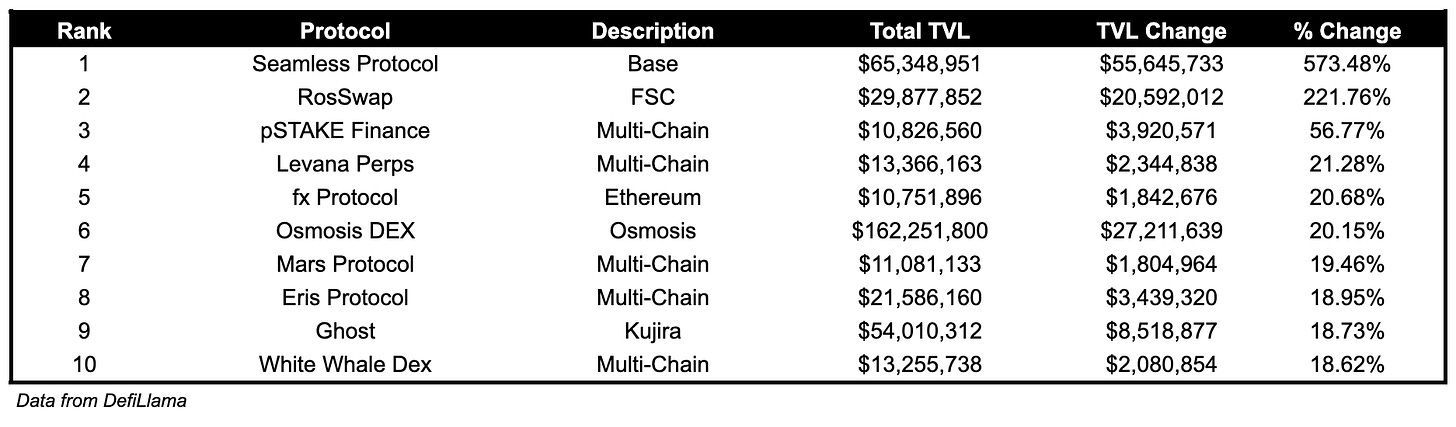

TVL

TVL Above $10

Over the past day:

Seamless Protocol, lending and borrowing on Base, TVL grew by 573.48%.

RosSwap, DEX on FSC, TVL grew by 221.76%.

pSTAKE Finance, multichain liquid staking, TVL grew by 56.77%.

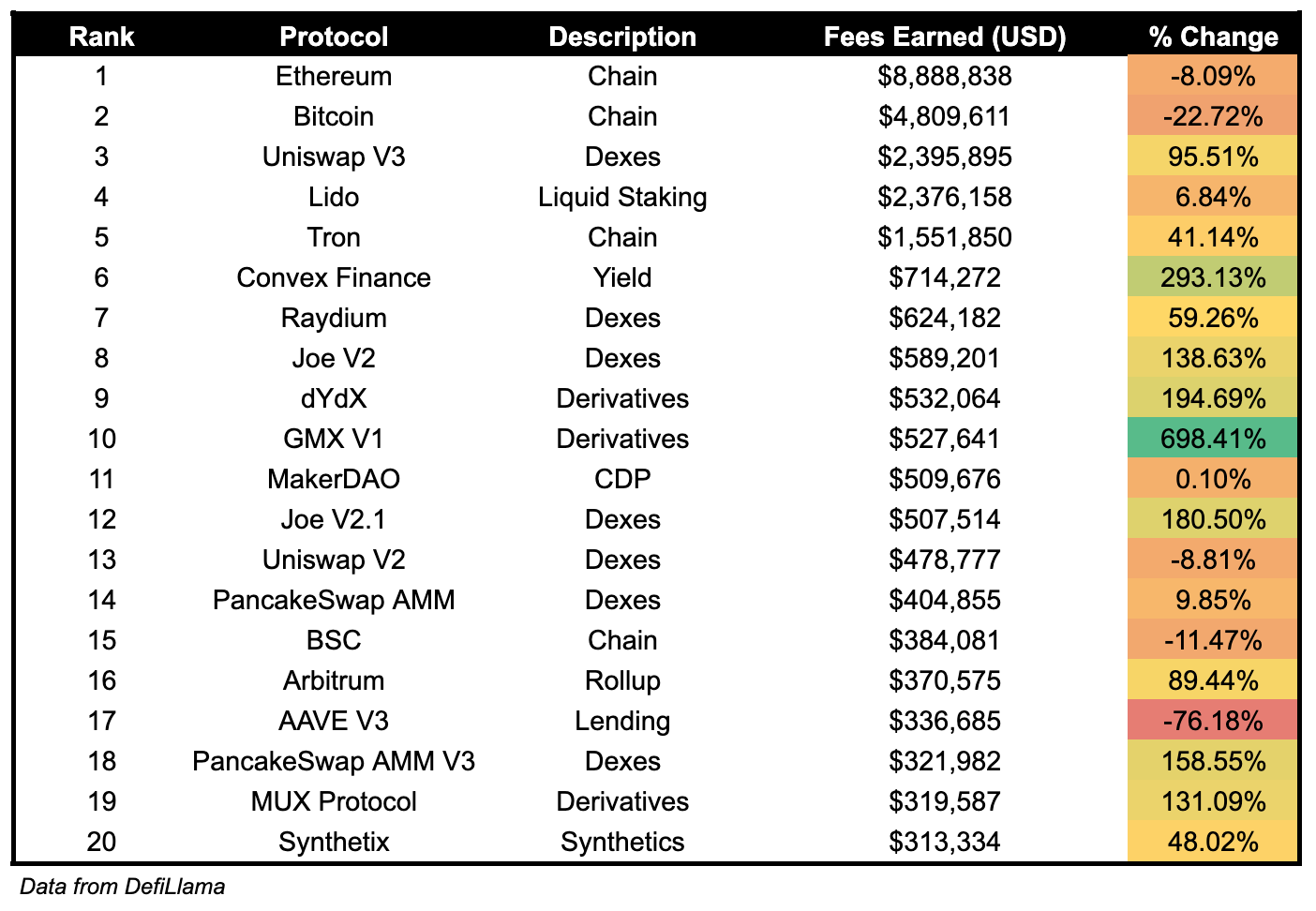

Fees

GMX v1 fees increased by 698% to $527,000 over the past day. Convex Finance, saw their fees earned increase 293% to $714,000, and Trader Joe V2 fees earned increased 138.63% over the past day.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.