Daily Notes: 12-06-2023

Developments

Markets delisted from Binance international

Binance will remove and cease trading of the following spot pairs:

At 2023-06-14 03:00 (UTC): BIFI/BUSD, DASH/BNB, FIO/BUSD, GAL/BNB, ILV/BNB, KLAY/BNB

At 2023-06-14 06:00 (UTC): LIT/ETH, MC/BNB, MINA/BNB, MLN/BUSD, ONE/ETH, OXT/BUSD

At 2023-06-14 08:00 (UTC): PEOPLE/BNB, PEOPLE/ETH, QNT/BNB, WAXP/BNB, XTZ/ETH, ZEC/BNB, ZRX/ETH

Curve Finance Founder Deposits $24M in CRV to Aave, Controls 32% Circulating Supply

Wallet belonging to Curve founder Egorov deposited 38M CRV into Aave to reduce liquidation risk.

Egorov’s collateral for his Aave loan is 277 million CRV tokens — which is 32% of the total circulating supply

Decentralization: Navigating Raft Closer To The Community

Raft launches their governance forum

Governance will be minimized and limited to:

Appointment of the liquidity committee

Treasury management

Protocol fees

Managing additional collateral types

Chain deployments

Future partnerships and grants

$RAFT token will be launched as the governance token.

Raft TVL continues to grow, and has grown by approximately 18% over the last day.

We can see stETH deposits into Raft have jumped up in the last week & the supply of R is continuing to make new highs, sitting at 24.8m R now.

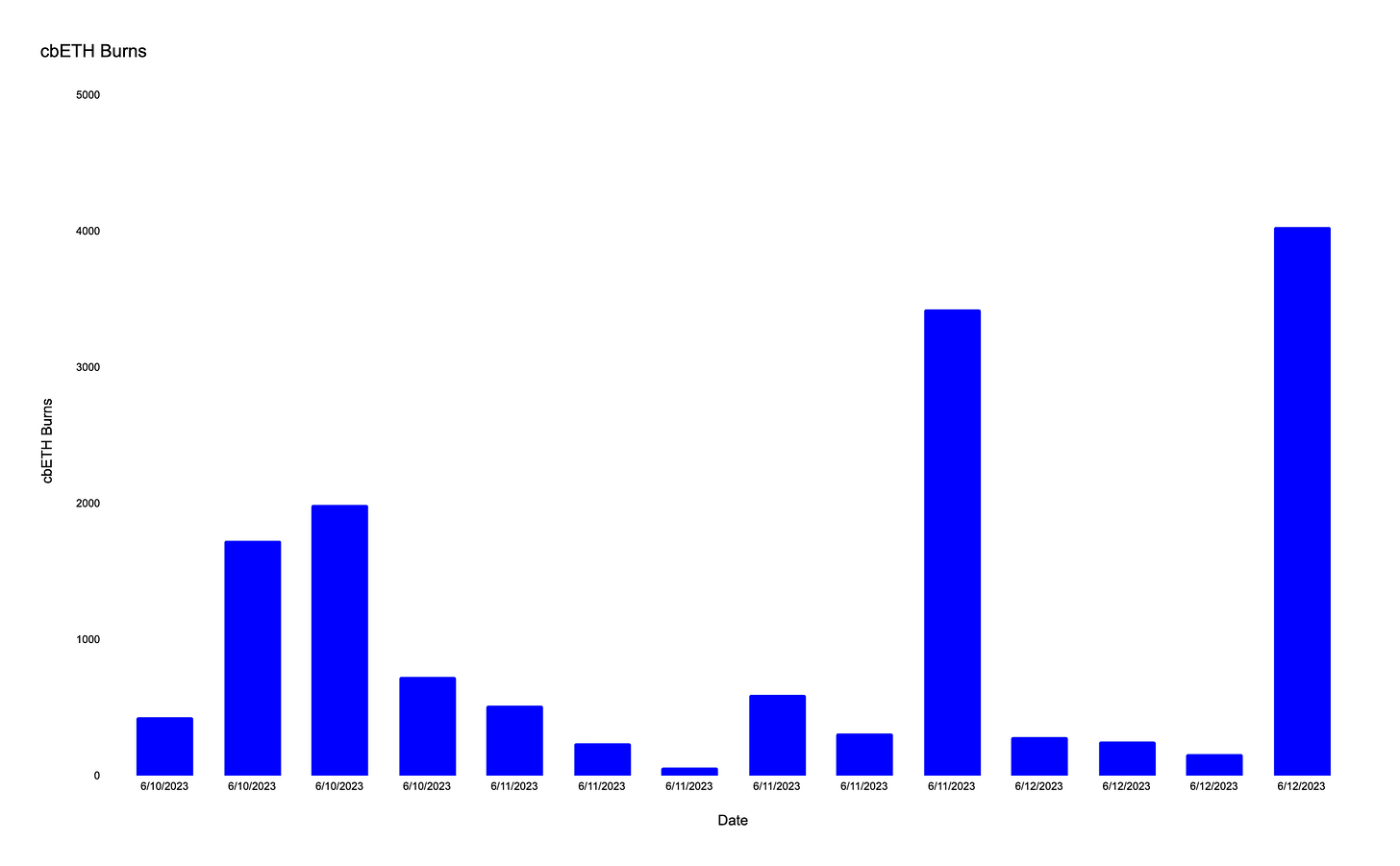

Centralised Liquid Staking

Taking a look at the centralised liquid staking landscape we can see that both cbETH and bETH (coinbase wrapped staked ETH & Binance ETH) have come under pressure this week.

cbETH saw some huge redemptions this week with all time high redemptions coming in at 24,750 cbETH on June 6th. The cbETH / ETH market exchange rate has stayed close to its ETH claim on the Beacon chain despite this pressure.

bETH however has started to trade at a discount to it’s underlying ETH claim, currently trading at a 1.37% discount currently.

h/t to etheraltog for the Parsec chart

Ripple’s Hinman Documents

on Tuesday, the Hinman documents from the SEC’s case against Ripple will be made public. These documents have been in possession of Ripple’s attorney since last year but they will now be released to the public and admissible in court for a Judge and Jury to decide. The contents of the documents are expected to be damning to the SEC case as they show SEC officers were blood thirsty and ignored protocol in suing Ripple.

The results of the SEC & Ripple case are important for the overall ecosystem since a decision here could shape policy on tokens.

A16Z moving to London

A16Z announced today they would be setting up an office in London, England because the regulatory environment in the U.K is much better for supporting innovation in the crypto space. U.K’s prime minister, Rishi Sunak, went to social media to congratulate and support this move.

21Shares intro ETP for Lido

21Shares Lido DAO ETP (LIDO) is a non-interest bearing, open-ended security. Each series of the product is linked to an index or specific underlying asset Lido DAO. The ETP offers access to LIDO, not stETH.

Binance and CZ Legal

Binance and its CEO, Changpeng Zhao (CZ), have recently bolstered their legal team by bringing on board a highly experienced criminal defense lawyer, George Canellos. With a remarkable background as the former Chief of the Major Crimes Unit in the U.S. Attorney's Office for the Southern District of New York, as well as holding prestigious roles such as the former head of the SEC's New York Office and former Co-Director of the SEC Enforcement Division.

Market participants are speculating Binance have hired this lawyer to lead the rumoured DOJ criminal case against them.

h/t @JohnReedStark

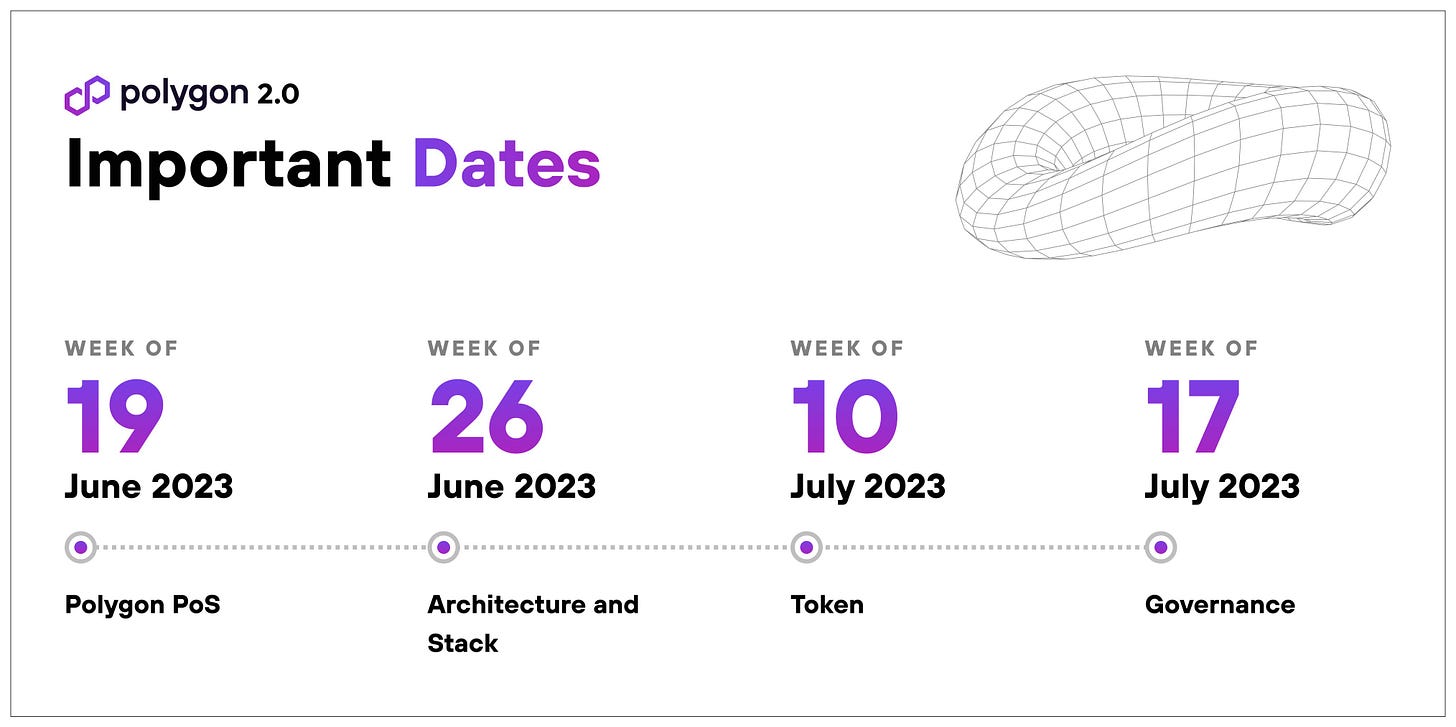

Polygon 2.0: Value Layer of the Internet

Polygon announces upcoming changes to protocol architecture, tokenomics, governance and more.

The announcement teases that Polygon will become the “Value Layer”, through enhanced scalability and liquidity using zero-knowledge tech.

The news of Polygon 2.0 tokenomics upgrades comes approximately one month after Sandeep Nailway (Polygon co-founder) teased a potential airdrop for Polygon zkEVM.

Week Ahead

Tuesday 13/06:

Motion for temporary Binance US restraining order hearing

XRP Hinman's documents release

CPI Data Release

Start of Injective Open Liquidity Program

60,000 INJ can be earned by users during each epoch for using Injective

Wednesday 14/06:

FOMC Statement

BLUR Unlock: 6.53% of total supply

196M $BLUR at 19:00 UTC

BIT Unlock: 1.95% of total supply

187.5M $BIT

Thursday 15/06:

Jobless Claims released

Retail Sales released

LOOKS Unlock: 3.75% unlock

37.5M $LOOKS

Velodrome v2 launch

Friday 16/06:

APE Unlock: 1.56% of total supply

15.6M $APE

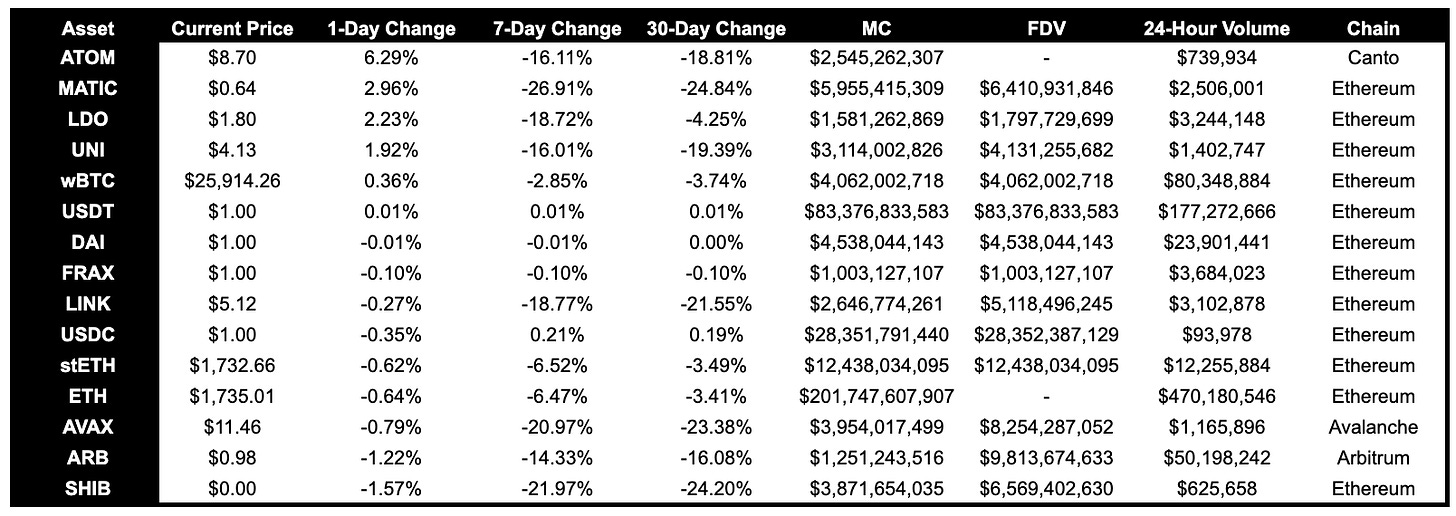

Trending Assets

Above $100M MC by performance

Atom outperforms on both above $100M mcap and above $1B mcap. Not many catalysts changes, possibly benefited from Gaia v10.

Optimism rebounding from it’s big sell off on Friday evening.

SNX recently announced spot v3 markets

Most top performers mainly mean reverting from the lows of the weekend.

Above $1B MC by performance

MATIC has perform badly over the last 30 days, likely due to the Robinhood and SEC news, but has performed relatively well today, possibly due to frontrunning of the new Polygon announcement.

LDO performing well today.

Trending Contracts

Nothing particularly notable with regard to trending contracts. The only unique contract is related to Pixel Platypi, an NFT collection.

Coingecko Trending Assets

Sui

Conic Finance - Conic Finance is an easy-to-use platform built for liquidity providers to easily diversify their exposure to multiple Curve pools

Pepe

Binancecoin [BNB]

Matic

Arbitrum

Solana

Stablecoin Exchange Netflows

We are seeing large stablecoin inflows to exchanges today, totalling $544 million.

Governance Proposals

Bancor Network: Proposal - Fastlane Gas Savings

Proposal is to redesign the Fastlane smart contract to help it function more efficiently by lowering the required gas should enable more arb opportunities

The proposed changes are to:

Support flashloans in any token

Support multiple flashloans in a single transaction

Send half the TKN to the caller and half to the Carbon vortex

As opposed to the old design of converting TKN to BNT, sending half to the caller and half to the token contract.

SIP-48: Reintroduce USDT collateral and deposit it into Camelot V2 USDT-USDC strategy

Proposal is to reintroduce USDT as a part of the USD collateral basket and to deposit it into the Camelot USDT-USDC strategy to generate yield for USD holders and SPA stakers.

April 26 Outage: Synthetix Impact And Alignment

On April 26th, Optimism experienced a significant downgrade in performance due to a large uptick in ‘eth_sendRawTransaction’ requests.

Due to this performance downgrade, losses were incurred due to liquidations caused by market volatility, leading to imbalanced market skew that couldn’t be arbitraged. This led to losses being absorbed by Synthetix stakers, who lost approximately $1M.

Articles / Threads

Extra Finance Integrates LI.FI

Extra Finance, a yield farming protocol on Optimism, is integrating LI.FI, allowing cross-chain swaps.

GMD Launchpad: Enhanced Model, GMD Incubator, & Allocation Marketplace

New adjustments will be made to the GMD launchpad model:

Instead of taking 4% of the total amount raised on the launchpad, GMD will take a reduced fee of 2.5%

Launch of GMD incubator

Introduce a Queue System where: esGMD stakers buy in first, then esGMD and xGND stakers and lastly all GMD stakers.

Allocation marketplace: will allow participants to trade their allocations in new projects before and after they go live

Balancer will be launching on Polygon’s zkEVM, Avalanche, zkSync, Base and Scroll.

[RFC] - Uniswap Foundation - Send a portion of the ARB airdrop to the Uniswap Foundation

Uniswap Foundation proposes that the DAO send 50% of the ARB airdrop to the Foundation’s multisig.

The foundation would use the ARB to fund projects that benefit both Uniswap and Arbitrum.

New Protocols

Dovish Fi

Description: Innovative DeFi on zkEVM. Swaps and perps.

Twitter: https://twitter.com/DovishFi

Website: swap.dovish.finance

Opsin Finance

Description: The omnichain modular DeFi trading terminal.

Twitter: https://twitter.com/opsinfinance

Website: https://opsin.finance/

Fluo Finance

Description: The First Omnichain Decentralized Market Making Protocol for Perp DEXs.

Twitter: https://twitter.com/FluoFinance

Website: fluofinance.com

Sorella Labs

Description: A new kind of on-chain market maker.

Twitter: https://twitter.com/SorellaLabs

Website: n/a