Daily Notes 11-12-2023

Today’s newsletter is sponsored by Pendle Finance.

Pendle Finance is a DeFi protocol that allows users to tokenize and trade future yields from staked assets and real-world assets.

Pendle recently reached $250M USD in TVL and $335M USD in trading volume. They have also launched a leaderboard campaign on Arbitrum where Rank 1 for this season can win 10,000 in ARB. The campaign will last until 20 December, 23:59 UTC. The top traders will be sorted and determined by their P&L in % by the end of Season 1.

You can check out the trading competition Pendle is offering here:

Developments

According to Coinglass data, $508.66 million were liquidated in the last 24 hours as Bitcoin dropped to $40,400. Of this sum, $448.91 million were long liquidations and $59.6 million were short liquidations.

Ark Invest sold $49.2 million of Coinbase stock on Friday the 8th of December (their largest COIN sale since July). They also sold $3.7 million of GBTC (Grayscale Bitcoin Trust) on the same day.

South Korea regulators have proposed customer safety rules that if successful, will go into effect on July 19th 2024.

These rules, which do not cover NFTs, will require companies to disclose crypto holdings and exchanges to hold 80% of user deposits in cold storage as well as report suspicious behaviour to the FSC.

The act also defines digital assets and lays out the punishments and fines expected if an entity engages in “unfair trading activities”.

Solana USDC Supply Increases 27%

Solana’s USDC supply increased by 126.4 million USDC (+27%) in the last week. This brings the total supply of USDC on the chain to 729.4 million.

Cardano Introduces Identity Wallet

The Cardano Foundation introduced their new Identity wallet which lets users manage “self-sovereign identities across Cardano and other blockchain networks' ', securely manage digital assets and more.

Pixelmon CEO, confirms that there will be a token - MON. Although no date has been given, details given state that MON distribution will prioritise the Pixelmon community above all.

Trader Joe introduces a new franchise entity - “Merchant Moe” - a separate purpose built Mantle chain deployment of the DEX.

Merchant Moe will launch their own token - MOE -which will function similar to Curve as staked MOE allows users to vote for boosted rewards to their chosen gauge. Additionally, JOE holders will receive an airdrop of 2.5% of the total MOE supply on TGE and 5% vested over 12 months afterwards.

Synthetix Ends Token Inflation

Synthetix’s native token, SNX, is no longer inflationary following a successful SIP 2043 proposal which stopped the issuance of new tokens.

The rationale behind the proposal, published by Synthetix founder Kain Warwick, was that the effectiveness of inflation has diminished over time compared to the initial introduction which worked to incentivise liquidity and bootstrap the protocol. Additionally, the recently proposed buyback and burn experiments would be counter-intuitive if inflation continued.

Coinbase has listed SEAM - their first listing of a token native to the Base network.

Trading went live at 6 pm UTC.

The token is currently trading at $8.26 with a market cap of $144 million and a FDV of $826 million according to CoinMarketCap.

Polymer Labs announced last week that they are building an Ethereum Layer 2 for interoperability similar to Cosmos’ IBC.

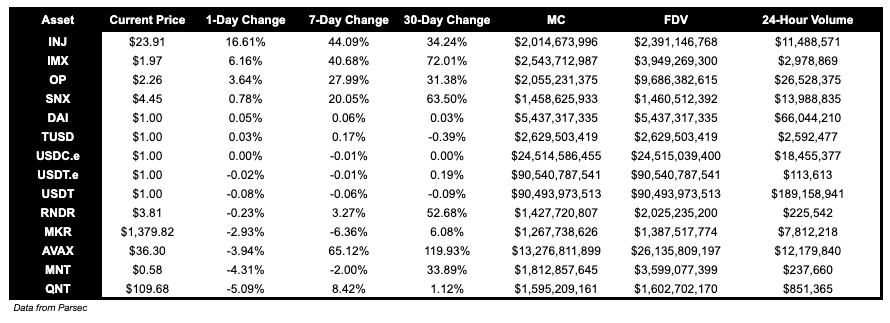

Trending Assets

Below $100M MC by performance, on chain

GFY - “go fu*k yourself” token is up 24.46%. TURBO up 18.03%.

Above $100M MC by performance, on chain

QI, the native token of Avalanche based lending and borrowing protocol Benqi, is up 84%. AMP up 37%.

Above $1B MC by performance, on chain

INJ had a great day and is up 16.61%. IMX is up 6.16%.

Trading Volumes

crvUSD, LINK, PEPE and INJ dominated onchain volumes.

TVL

TVL Above $10M

Over the past day:

Mantle Staked ETH, LSD on Mantle, TVL grew by 38.13%.

Hawksight, liquidity manager on Solana, TVL grew by 30.23%.

ThalaSwap, AMM on Aptos, TVL grew by 27.29%.

Fees

AAVE V2 fees earned are up 8907% over the past day. Avalanche fees earned are down 57.91%.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.