Daily Notes 11-09-2023

Developments

On September 13th, courts will decide whether FTX can commence liquidation of select crypto assets. The FTX estate then needs to give 10 days notice before they start executing sales / hedges. Initially they will have a $50M per week sales limit, going to $100M per week in the second week after approval.

SOL is a large holding of the FTX estate and has been the centre of sustained selling pressure and OI increases as market participants short the token ahead of the decision in a couple days. It's important to note a lot of this $1.16B SOL position is locked, linearly unlocking until 2028.

In addition to the FTX estate’s top 10 Crypto assets shown below, they also own 38 properties that have been appraised at between $185 - $214 million cumulatively and have successfully secured ~ $2.6 billion in cash since FTX’s initial bankruptcy.

As of current, 36,075 customers have filed claims across FTX.com and FTX US for a total $16 billion in funds.

Mountain Protocol has announced the official launch of its protocol and $USDM, a short-term US treasuries backed stablecoin, which provides users daily rewards in the form of rebasing that reflects the rate on US treasuries(currently above 5%).

$USDM is pegged to $1 and seeks to collapse the walls that prevent people from outside of the US from accessing the high yield that treasury bills offer. It also has the potential for other protocols to use it as a foundation for liquidity in other protocols (ie. borrowing/lending).

Note that USDM is not available to US customers.

Mountain Protocol also announced a funding round led by Castke Uskabd Ventures which sees the participation of other notable VC’s like Coinbase Ventures, New Form Capital, Daedalus Angels among others.

A proposal has been posted for voting to Arbitrum’s snapshot to decide on the amount of Arbitrum ($ARB) to be granted to eligible protocols.

The proposal provides several amounts:

Up to 75 million $ARB (5.88% of current $ARB circulating supply)

Up to 50 million $ARB

Up to 25 million $ARB

0 (A vote against the proposal)

The proposal has been live for ~14 hours and currently stands at 59.43% of votes so far in favour of Up to 50 million $ARB, 30.31% for up to 25 million $ARB and 9.25% for up to 75 million $ARB of grants with the last 1.1% voting against.

The criteria for a protocol to receive a (corresponding) grant is as follows:

Sushi has announced the launch of its decentralized exchange on the Aptos network. This will be the first non-EVM compatible chain that Sushi has launched on. It will also bring the total chains that SushiSwap is deployed on up to 30.

Remilio Corporation has sued three individuals identified to have been involved with the diversion (theft) of $1 million in fees generated from the Bonkler NFT and the compromising of 3 Twitter accounts.

One developer who worked on the Bonkler NFT diverted the $1 million and also coordinated with two other team members to successfully seize codebases and also compromise three social media accounts which they attempted to ransom for a share of Remillas (which remains intact).

Remilla Corp and its leader Charlotte Fang are now suing these individuals for an amount to be determined at court.

Synapse Launches Testnets of SIN and Synapse Chain

Synapse launched testnets of the Synapse Interchain Network (SIN) and Synapse Chain.

Synapse Interchain Network is a optimistic PoS interchain network for trustless communication and settlement between chains. Synapse Chain is an optimistic rollup that serves as data availability for the Interchain Network, where network agents stake tokens, confirm transactions and submit fraud proofs.

Trending Assets

Below $100M MC by performance, on chain

MULTI, up 17.51%, LINQ, up 13.01% and VSTA, up 9.40%, were tokens below $100M MC which outperformed over the past day.

Above $100M MC by performance, on chain

ENJ, up 2.79%, outperformed today, for coins above $100M MC on chain.

Above $1B MC by performance, on chain

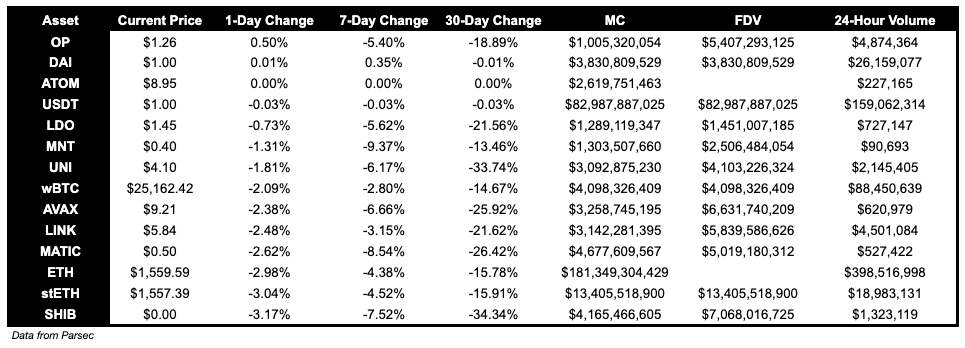

OP, up 0.50%, held up well over the past day.

TVL

TVL Above $10M

Over the past day:

KyperSwap Elastic, multichain DEX, TVL increased by 12.18%.

Liquid Collective, LSD on Ethereum, TVL up 12.04%.

BaseSwap V2, DEX on Base, TVL up 10.68%.

Fees

friendtech was the third highest fee earner over the past day. Notably, Uniswap V3 fees earned are up 89.13%.

Governance Proposals

AIP #28 - DWF Labs SPELL Token Loan and Purchase Plans

DWF requests a 4.62B SPELL (1.8m USD) token loan and a 1m USD worth of token purchase at a 15% discount, locked for 24 months coming from future SPELL emissions budget.

[FIP - 285] sFRAX Governance Proposal

Proposal regarding Staked FRAX (sFRAX), which allows users to deposit FRAX stablecoins into a smart contract (Standard ERC-4626) and earn interest (denominated in FRAX stablecoins) on their holdings.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.