Daily Notes 10-10-2023

Developments

Ostium Labs, a decentralised protocol that will bring perpetual swaps for commodities and real world assets like oil and gold, has raised $3.5 million in a seed round co-led by General Catalyst and Local Globe. The round also saw participation from Balaji Srinivasan among others.

Additionally, the exchange will support the trading of crypto and foreign exchange pairs for the Australian dollar, the Pound, Euro, and Yen.

Prisma Finance Integrates Stargate

Prisma Finance has integrated their liquid staking token (LST) backed stablecoin, mkUSD, into Stargate (which is powered by LayerZero) to allow for the “fluid and swift transfer of value across multiple networks”.

The Bank for International Settlements (BIS), has completed an experiment which saw the successful trading of CBDCs on-chain via automated market makers (AMMs) and bridges. The experiment was hosted under BIS and the central banks of France, Singapore, and Switzerland, using CBDCs in the form of the Euro, the Singaporean Dollar and the Swiss Franc.

Its goal was to simulate financial institutions by deploying automated market makers to enable spot FX transactions between the tokenized currencies to be priced and executed automatically and settled immediately. Bridges served to provide the utility required to seamlessly transfer CBDCs between different networks.

Bitfinex, has offered to repurchase $150 million of its shares from shareholders who received iFinex stock in 2016 in a swap arrangement through BnkToTheFuture, a fintech investment platform, as a means to reimburse customers after Bitfinex was hacked for $71 million in Bitcoin (valued at $3.3 billion today).

iFinex has stated that the buyback is due to the company’s “positive performance over the last few years”. They also stated that the buyback would also serve to alleviate demands made by shareholders and offer them a way out of the company.

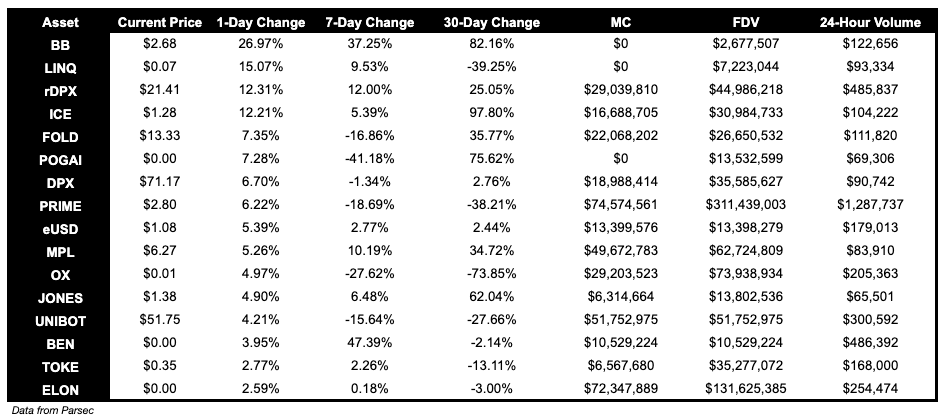

Trending Assets

Below $100M MC by performance, on chain

LINQ, up 15.07%, and rDPX, up 12.31%, performed well today.

Above $100M MC by performance, on chain

RLB and LQTY were top performers for tokens above $100M MC. Notably, LQTY is up 39.20% this week and 92.04% over the past 30 days.

Above $1B MC by performance, on chain

LDO is up 1.23%.

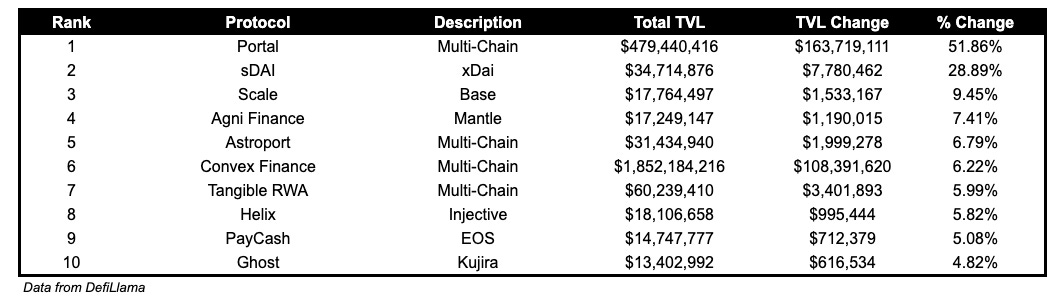

TVL

TVL Above $10M

Over the past day:

Portal, multichain bridge, TVL grew by 51.86%.

sDAI, stablecoin on xDai, TVL grew by 28.89%.

Scale, DEX on Base, TVL grew by 9.45%.

Fees

Nothing particularly notable in terms of fees. Uniswap V3 fees earned are up 52.83%, Bitcoin fees earned are down 62.82%.

Governance Proposals

Proposal for Bancor 3 to use 100% of fees for BNT market buy back and burn

Proposal for 100% of the fees from Bancor 3 to be used to buy BNT from the market. Currently 90% of fees are being used to buy from the market.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.