Daily Notes 09-11-2023

Developments

BlackRock is working on launching a spot ETH ETF called the iShares Ethereum.

EU Parliament Approves Data Act With Smart-Contract Kill Switch Provision

The European Parliament approved an act that would require smart contracts to have a kill switch. The next steps towards the act being implemented would be approval from the European Council.

Circle Releases v2.2 For USDC and EURC

Circle has released v2.2 for their stablecoins - USDC and EURC. The update decreases gas costs, increases the security of transactions involving them on EVM chains, and provides improved support for account abstraction which enables developers to build products where users can pay gas in USDC or EURC.

Ark Invest and 21Shares are getting ready to launch 5 new ETF‘s that will give investors exposure to digital assets, including Bitcoin and Ethereum futures contracts.

Riot Platforms, a Bitcoin mining firm, has released their 2023 Q3 report which shows increased revenues by 11.2% from $46.3 million to $51.9 million compared to their Q3 2022 reports. Additionally, they mined 1,106 BTC compared to 1,042 BTC in Q3 2022.

Immutable Partners with Ubisoft

Immutable has partnered with Ubisoft’s Strategic Innovation Lab to “a new gaming experience to further unlock benefits for players through the power of web3”.

A New York judge approved Celsius’ plan to restart under the name “NewCo” which would see the distribution of $2 billion BTC and ETH to Celsius customers as well as NewCo Stock.

NewCo would also be seeded with up to $450 million of liquid cryptocurrencies and have its stock listed on the NASDAQ. Fahrenheit LLC, who will manage NewCo, will inject up to $50 million in exchange for an equity stake in the company. NewCo would expand on Celsius’ mining and staking operations.

Polygon has relaunched their grant program “Polygon Village” which will use 110 million MATIC ($90 million) to fund both projects both existing and being developed on the chain.

Former Flashbot’s co-founder, Stephane Gosselin, has released a Telegram bot named ‘Alfred’ which allows users to trade tokens on Ethereum while protecting against MEV.

HTX and Tron founder, His Excellency Justin Sun, has asked via his Twitter if the public would like to see Inscriptions come to Tron.

Chainlink staking v0.2 will launch to the public on December 11th 2023. The pool will have 45 million LINK in rewards. Early access will open on December 7th.

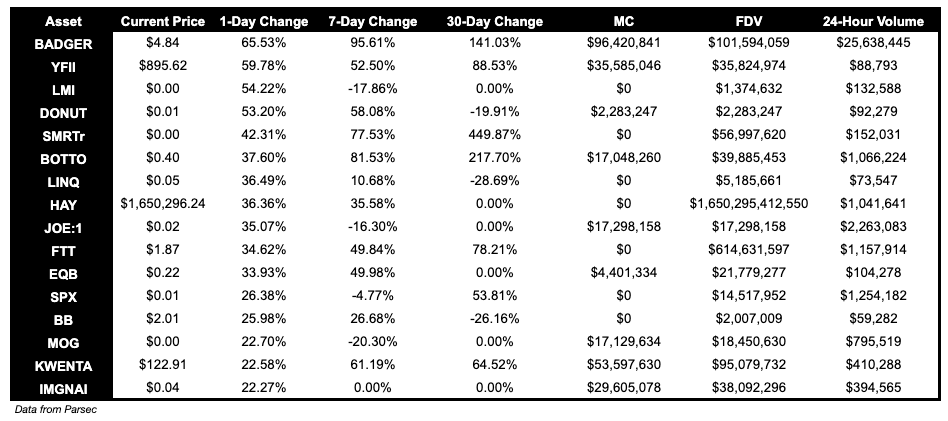

Trending Assets

Below $100M MC by performance, on chain

BADGER is up 65.53% today, and is also had one of the top 10 highest trading volumes onchain.

Above $100M MC by performance, on chain

MC, up 21.42%, HT, up 20.39%, and ELON, up 14.51%, were top performing tokens above $100M.

Above $1B MC by performance, on chain

LDO, up 7.06%, and ETH, up 6.51%, performed well today following BlackRock’s ETH ETF filing.

Trading Volumes

Nothing particularly notable in terms of top trading volumes. BADGER and LUSD are unusual names in the top 10.

TVL

TVL Above $10M

Over the past day:

HMX, multichain perpetuals DEX, TVL grew by 410.57%.

Cetus, DEX on Aptos and Sui, TVL grew by 25.56%.

Vaultka, yield on Arbitrum, TVL grew by 24.13%.

Fees

friend.tech fees earned back in the top 10, after a 54.60% increase over the past day. Bitcoin fees earned is second highest - potentially due to rising popularity of inscriptions.

Governance Proposals

[BIP-481] Claim and Lock Balancer DAO Aura allocation into vlAura

Balancer proposal to lock the vested 1.4m Aura and 600k unvested Aura into vlAura to begin earning rewards and eventually start allocating vote weight towards revenue generating pools.

Articles / Threads

Introducing $ARB Trading Incentives on Vertex

Users can earn VRTX and ARB by trading on Vertex or LPing Elixir Fusion pools.

STFX has launched spot vaults, and users can now trade every ERC-20 coin directly through the platform.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.