Daily Notes 09-08-2023

Developments

Base Mainnet Official Launch

Coinbase’s L2 built on top of the OP stack has officially opened for launch today. So far a cumulative $147 million tokens have been bridged to BASE.

GoldFinch Default

Goldfinch is a decentralized credit protocol that enables cryptocurrency borrowing without the need for crypto collateral. Instead, loans are fully collateralized off-chain.

Goldfinch extended a $5 million loan to The Tugende Kenya Facility, which breached the agreement by lending $1.9 million to its sister company, Tugende Uganda. This discrepancy was discovered in December 2022, and Goldfinch attempted to address it through an equity raise to cover the shortfall.

The $1.9 million loan constituted the majority of Tugende Kenya’s available liquid funds at the time. This led to a reduction in portfolio size and a decline in portfolio quality over the last nine months. As the remaining $3.1 million in Goldfinch's available assets within the business decreased in value due to repaid receivables and Tugende's lack of profitability, Goldfinch's team communicated potential losses of "up to 100% of the loan." They also acknowledged the possibility of recovering nothing if a prolonged legal process ensues.

While this setback represents around 4% of the protocol's Total Value Locked (TVL), users are concerned about the slow withdrawal pace, estimated to take approximately "7.6 years."

Blake West, Goldfinch's Co-founder and CTO, countered claims that the withdrawal process would indeed take 7.6 years. He clarified that "34% of the principal is due in 2024, 42% in 2025, and the remaining 20% in 2026."

Mantle Whale Sells MNT

Last night, the address 0x137AfecE9991a5625Ab1510cf98Eadc937f0B55f sold $4 million of the Mantle token ($MNT) over the span of 30 minutes plummeting the price by 20% to $0.38.

The price has since bounced to $0.47 at the time of writing which is -20% of it’s all time high of $0.60.

Federal Reserve Crypto Supervision Program

The Federal reserve has established the Novel Activities Supervision Program which has a strong focus on the supervision of banks that are involved in Crypto.

It lists activities such as crypto-asset custody, crypto-collateralized lending, crypto-asset trading, and the engaging in stablecoin/dollar token issuance or distribution as novel activities. In addition, Banks that provide traditional banking activities such as deposits, payments, and lending to crypto-asset-related entities and fintechs will also be supervised.

Curve Founder Opens a New Position

Michael Egorov, the founder of Curve Finance, has opened a new borrow on Cream Finance. He has deposited 13 million CRV and borrowed a combined $2.5 million USDC and USDT. This is on top of his already large Aave, Fraxlend and Inverse Finance positions.

Aptos Price Action

Media outlets reported that Aptos would be utilizing Microsoft's infrastructure to introduce innovative solutions that merge AI and blockchain. This includes the introduction of Aptos Assistant, a chatbot designed to address inquiries regarding the Aptos ecosystem. The chatbot also aids developers constructing smart contracts and decentralized apps by offering resources.

News trading bots and over-eager traders longed APT on the headline of this Microsoft ‘partnership’ but in reality it’ll be Aptos paying for Microsofts services, like any other user.

APT jumped ~8% higher immediately after the news and retraced back down as traders digested the news.

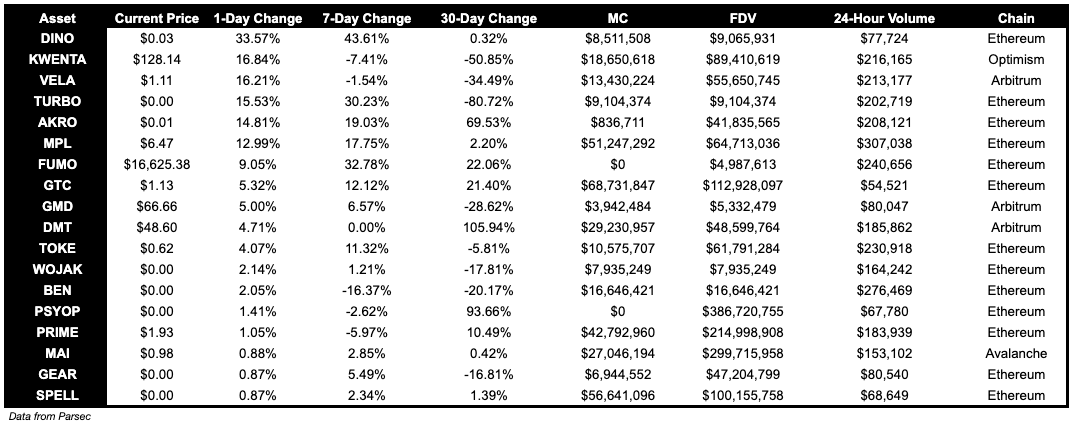

Trending Assets

Top 300 Performers

In the attention economy that is the on-chain world, the 4 tokens capturing on-chain market participant mindshare are performing well yet again. Those are 0X, Unibot, Rollbit & BITCOIN which are up double digits on the day.

Other notables moves are Akash and Aptos (as we highlighted).

Top 300 Losers

Mantle was a poor performer today, mainly due to the large whale wallet dumping into the MNT/ETH pool.

Another poor performer was Optimism, which could be related to the official launch of BASE chain today.

Below $100M MC by performance, on chain

Notably, KWENTA and VELA are up 16% on the day.

Above $100M MC by performance, on chain

OX, up 16.06% and UNIBOT, up 10.11%, are the top performers over the patst day.

Above $1B MC by performance, on chain

Nothing notable in the larger cap movers today.

TVL

TVL Above $10M

Over the past day:

Blur Lending gained 25% in TVL

Spark added $58 Mil in TVL as users are looping Crypto collateral such as ETH & wstETH to borrow DAI for the EDSR yield.

Fees

Curve had a 397% gain in fees today from yesterday.

Governance Proposals

[TEMP CHECK] Aave Treasury Proposal for RWA Allocation

Proposal for Aave to allocate a portion (initially 1M) of Aave Treasury’s stablecoin holdings to a low-risk RWA investment through Centrifuge Prime.

Articles / Threads

Kwenta and Synthetix Launch USDT Perps

Synthetix and Kwenta have listed USDT perps on their platforms.

Aevo is launching Pre-Launch Token Futures, which are perpetual futures which have no index price nor funding rate. The first market that Aevo will list is Sei Network, ahead of it’s listing on Binance next week.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.