Daily Notes 08-11-2023

Developments

USDC’s Circle is considering going public via an initial public offering (IPO) in early 2024 as reported by Bloomberg.

In response, a representative of Circle stated that “Becoming a U.S.-listed public company has long been part of Circle’s strategic aspirations. We don’t comment on rumors.”

Previously, Circle was valued at $9 billion when it attempted to go public via a blank check merger deal with Concord Acquisition Corp in 2021, which was ultimately terminated in December 2022 due to the transaction timing out. After the failed merger in 2022, Jeremy Allaire, co-founder of Circle, expressed disappointment and said that “becoming a public company remains part of Circle's core strategy to enhance trust and transparency,” which reinforces today's news.

Illuvium

Illuvium, a game built on Immutable X, was listed on the Epic Games Store today. In response, the project's token, ILV, has surged by 22% in the last 24 hours.

Previously, Illuvium raised $15 million in seed funding and another 4,018 ETH and 239,388 sILV2 (valued at $72 million in June 2022 and $26 million today if unconverted) in an NFT land sale in June of 2022. The game is set to be available to the public for download on November 28th as "Early Access."

The Illuvium universe will initially contain three different games: "Illuvium: Overworld," "Illuvium: Arena," and "Illuvium: Zero."

"Illuvium: Overworld" is a third-person open-world adventure where players explore an alien planet and capture powerful creatures known as Illuvials. These range in rarity and strength from Tier 0 to Tier 5 and are received in NFT form.

Note that the free-to-play experience of Illuvium will restrict players to only collecting Tier 0 creatures, which will always be obtainable. Players can then use ETH, the primary currency for playing Illuvium, to unlock the upper tiers and rarer creatures.

"Illuvium: Arena" is an auto-battler strategy game that lets players use their collected Illuvials to compete.

"Illuvium: Zero" is a game for mobile and desktop where players can develop and manage their own digital industrial complex.

The project's token, ILV, is a governance token that also rewards players for in-game achievements. It will be bought back by the team with all in-game purchases and fees revenue generated through the Illuvium universe.

The ILV bought back will then be directed to the Illuvium "Vault," where staked ILV holders and holders of Sushiswap’s ILV/ETH pool can claim ILV. The pools will receive ILV bought back in a 20:80 ratio, respectively. Users will claim ILV proportional to their personal "token weight."

Additionally, users who stake ILV can opt to receive sILV2 (synthetic ILV, 1:1), which can be used as in-game currency for travel and shard curing (activities that don't involve another player).

The SEC could approve spot BTC ETF’s as a minimum 8 day temporary window opens up starting tomorrow.

OpenSea’s valuation has been reduced by 90% from $13.3 billion to $1.4 billion or less by Coatue, an asset management company that co-led a $300 million round for OpenSea in 2022. Coatue also marked down its stake in MoonPay by 90%.

HSBC Partner With Ripple Owned Company

HSBC has partnered with Metaco, which is a Ripple owned company. Metaco provides infrastructure for financial and non-financial institutions to securely build their digital asset operations including tokenized securities custody service for institutional clients. The service aims to go live in 2024.

The FTX estate moved an additional $38.5 million of assets to exchanges today, $31.2 million of which was SOL. This brings the total assets moved to exchanges at $350 million so far.

Robinhood Expands Crypto Services To EU

Robinhood to expand its Crypto services into the EU. It will also be establishing a UK brokerage in the next few weeks.

Near Partner With Polygon On zkWASM

The Near Foundation and Polygon Labs have partnered to develop a zero knowledge prover for WebAssembly (WASM) blockchains available via Polygon CDK. Success will mean a more interoperable Web3 ecosystem that will allow WASM chains to tap into Ethereum liquidity.

Grayscale’s Chainlink Trust is trading at $44 which is a 297% premium on spot LINK prices. Note that todays volume was $880,000 and the 30 day daily volume of the Trust is $132,000.

Trending Assets

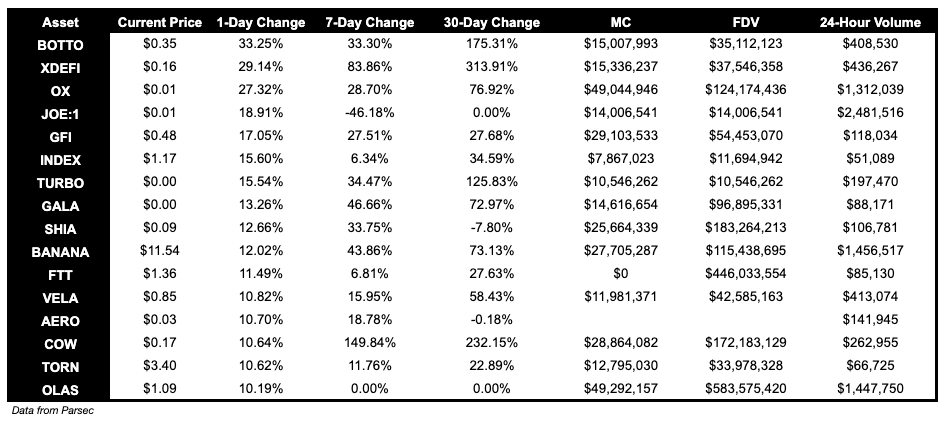

Below $100M MC by performance, on chain

BOTTO, up 33.25%, and OX, up 27.32%, are some notable tokens below $100M MC that performed well over the past day.

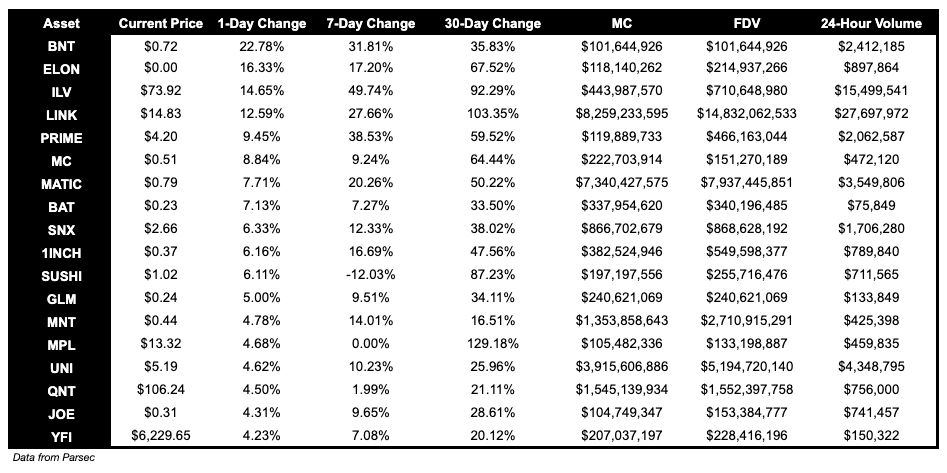

Above $100M MC by performance, on chain

BNT is up 22.78% over the past day. ILV has had a great week, and is up 49.74% over the past 7 days.

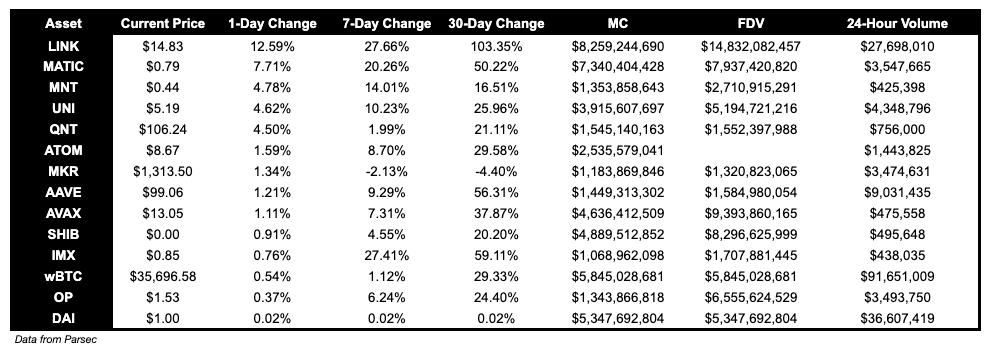

Above $1B MC by performance, on chain

LINK is up 12.59% today. MATIC continues to show strength and is up 7.71%.

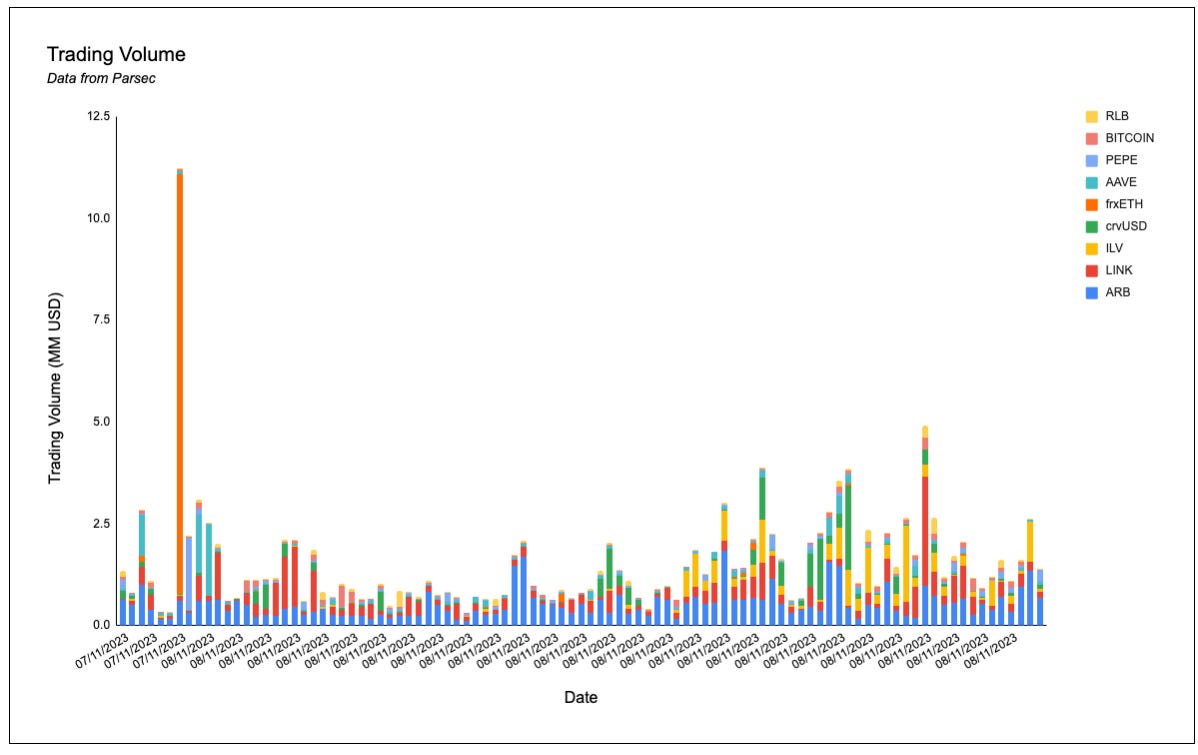

Trading Volumes

ARB, LINK and PEPE are dominating trading volumes onchain. Some other notable names are crvUSD, RLB and ILV.

TVL

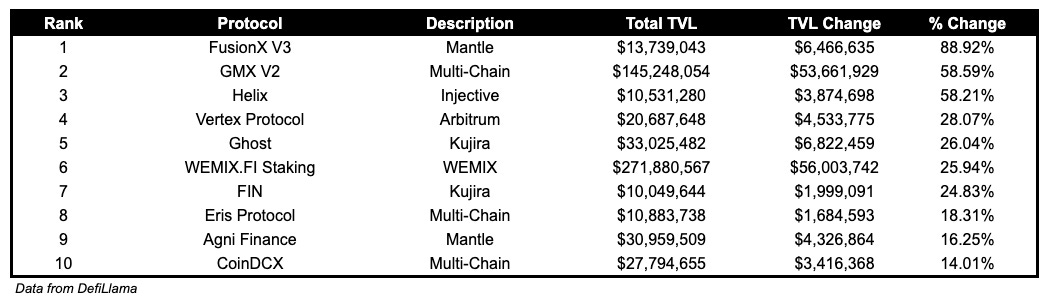

TVL Above $10M

Over the past day:

FusionX V3, DEX on Mantle, TVL grew by 88.92%.

GMX V2, perpetuals DEX on Arbitrum and Avalanche, TVL grew by 58.59%.

Helix, DEX on Injective, TVL grew by 58.21%.

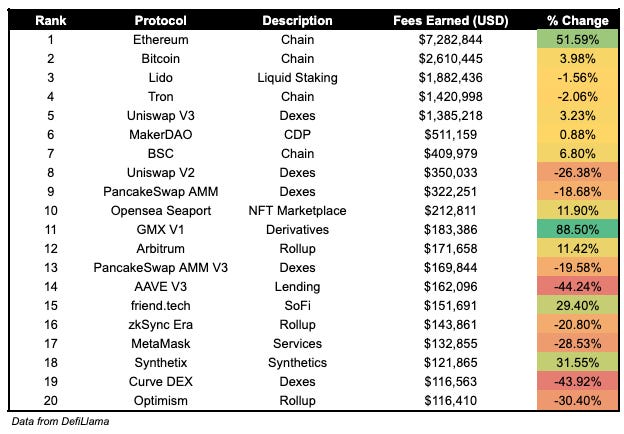

Fees

Nothing particularly notable in terms of fees earned.

Governance Proposals

[ARFC] Treasury Management - vlAURA

Aave proposal to lock the AURA holding in vlAURA via the Strategic Asset Manager and delegate managing the position to the GHO Liquidity Committee.

[ARFC] Arbitrum USDC Migration

Aave proposal regarding the parameters to migrate USDC.e to native USDC on Arbitrum.

Articles / Threads

Lido has launched wstETH on Base. The initiative was led by KyberSwap, Beefy, and Superbridge.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.