Daily Notes 08-08-2023

Developments

EDSR Yield Cap

DAI in the DSR module has reached $860 Mil as yields have reached 8% APY with the introduction of the Enhanced DAI Savings Rate. Rune posted a proposal to cap the ESDR at 5% APY.

The move comes after a few whales have been depositing crypto collateral in Spark and borrowing DAI (& looping) to earn the EDSR, crowding out average users.

Mantle Ecosystem Partner With Lido

MIP-25 has passed, which means that the Mantle (previously BitDAO) treasury are able to allocate a combined 200,000 ETH into Lido’s LST and Mantle’s upcoming LST. There is a 40,000 ETH allocation limit to stETH & wstETH in this proposal.

Rollbit Announces Buy and Burn

Rollbit has announced their buy & burn program. They will be using 10% of revenue from their Casino, 20% of their revenue from their Sportsbook, and 30% of their revenue from their 1000x futures to buy and burn RLB on a daily basis.

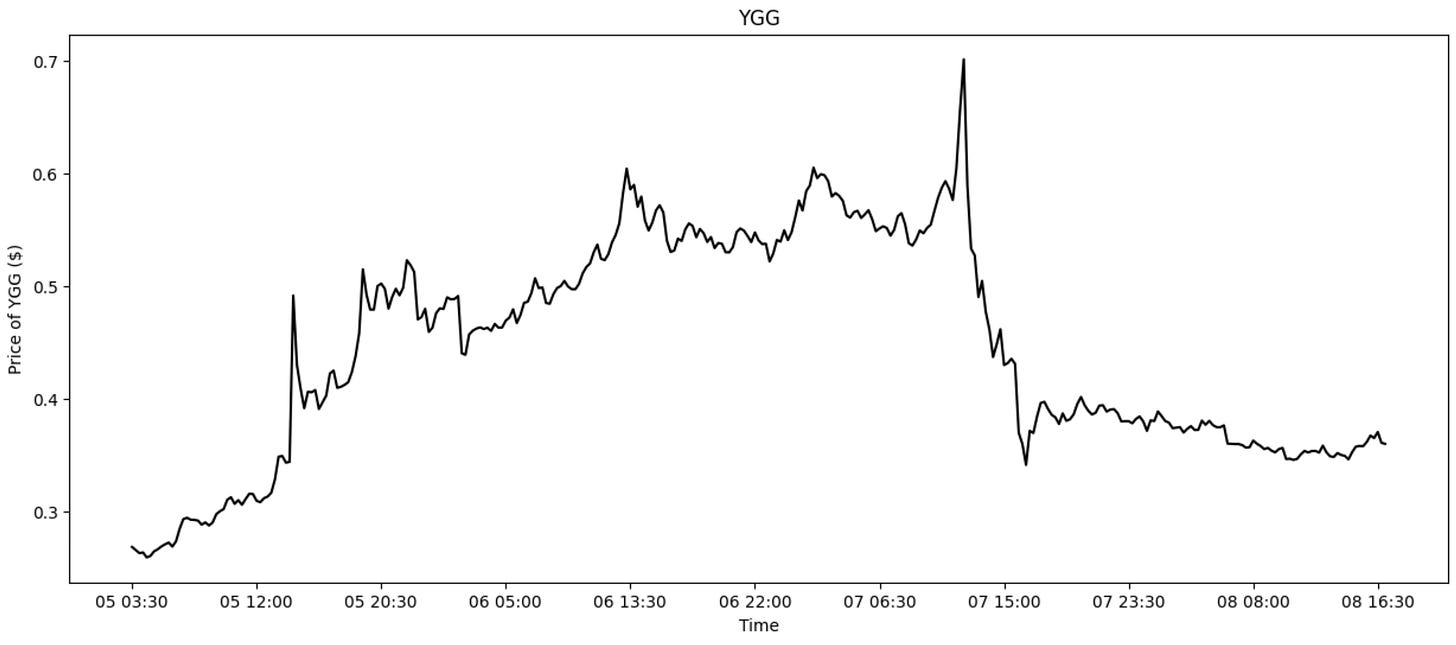

YGG

Yield Guild Games (YGG) has fallen back to $0.36 after briefly touching $1 on Binance futures. DWF labs were market making this project and have been openly talking about this coordinated pump of the token.

YGG showed such a huge dispersion in the spot and perpetual futures markets, with the perp trading 30% higher than spot at one point.

Mantle proposal to authorize the Mantle LSD and Lido ETH staking strategies, with a combined allowance of up to 200L ETH, and Lido ETH staking strategies up to an individual allowance of 40k ETH has passed.

Paypal has launched their own stablecoin PayPal USD (PYUSD) on Ethereum Mainnet.

Chainlink price feeds have been integrated into Coinbase’s Base L2. Base is scheduled to launch for the public on the 9th of August.

SecondLane July 2023 Secondary Market Report

SecondLane released their July 2023 secondary market report, where they reported taht there was a 47% increase in volume since June. Top projects were Worldcoin, Scroll, EigenLayer, Celestia, zkSync, Fuel, Starkware, Animoca and Aelo. 60% of offers were for (Pre-)Seed and 40% Rounds A-D. 21% of offers were on L1, L2 projects and 14% on DeFi.

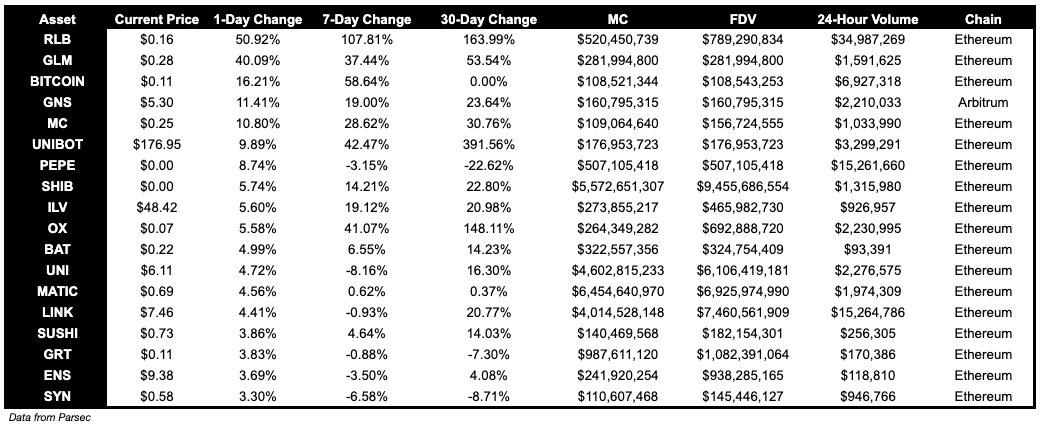

Trending Assets

Top 300 Performers

C98, up 19.61%, and UNIBOT, up 19.21%, are the top performer over the past day.

Top 300 Losers

Below $100M MC by performance, on chain

STFX, up 37.78%, and DMT, up 25.19%, are some relevant top performers below $100M MC.

Above $100M MC by performance, on chain

RLB, up 50.92%, GLM, up 40.09% and UNIBOT, up 16.21%, are the top performers over the past day for coins above $100M MC.

Above $1B MC by performance, on chain

SHIB, up 5.74%, UNI, up 4.72%, and MATIC, up 4.56%, are the top performers above $1B MC.

TVL

TVL Above $10M

Over the past day:

Spark, lending using MakerDAO on Ethereum, grew its TVL by 88.53%.

PearlFi, ve(3, 3) DEX on Polygon, grew its TVL by 60.34%.

Raydium, Dex on Solana, grew its TVL by 17.86%

Fees

Ethereum earned the highest fees today, at $3.66M, followed by Lido, $1.67M and Tron, $1.38M. Notably, Tron fees earned are up 52.3%.

Governance Proposals

Activate LUSD as Collateral on Aave V3 ETH Pool

Aave proposal to allow LUSD to be used as a collateral asset on the Aave V3 ETH pool. The risk parameters will be the same as those used for USDC.

[SIP-28] Using the Arbitrum Grant - Swap ARB for ETH

Synapse proposal to convert their 1.03M ARB airdrop to ETH and use it as liquidity on Synapse’s ETH pool on Arbitrum.

Articles / Threads

The Balancer Report: Base or Avalanche? How about both!

Balancer has launched on both Base and Avalanche.