Daily Notes: 08-06-2023

Developments

Blur Unlocks

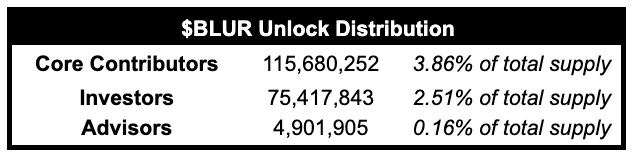

Next week blur is set to unlock 196 million Blur tokens (6.53% of total supply) on the 14th of June at 19:00 UTC.

The total circulating supply for Blur will increase 40.66% from 508.7 million Blur to 715.6 million Blur. Currently, the entire circulating supply is from the ‘Community treasury’ & this will be the first time contributors, investors and advisors will be liquid. The breakdown of this unlock is as follows:

New features include:

On-chain royalties

Custom creator settings

ERC-1155 support

Conditional orders

Fee streaming

Gas optimizations

Largest MATIC Unstaking Event

The largest MATIC unstaking to date happened over the past 2 days, as Binance US unstaked 115.27M MATIC (worth $95.71M at the time) and dispersed it across various wallets.

Polygon zkEVM Mainnet Beta received an update at 10:00 UTC

Infrastructure partners updated some of the network’s services, and the sequencer had to be restarted

Curve Finance: stETH as collateral for crvUSD

Proposal to allow for crvUSD to be minted via wstETH was passed. The borrowing rate for crvUSD will be 6%.

The wstETH market will have a debt ceiling (maximum limit) of $150M worth of cvrUSD that can be minted using wstETH as collateral. PegKeepers limits will be increased to 25M USD each.

Circle: Arbitrum USDC Now Available

USDC is now natively available on Arbitrum One as USDC, (as opposed to bridged USDC.e)

Native assets limit the risks users face from bridge exploits.

Synthetic Spot Market V3 Alpha Release

Per proposals SIP-317 and SCCP-304, a synthetic ETH spot market and the snxETH token have been deployed to Optimism.

V3 spot markets allow users to exchange the V3 protocol’s stablecoin with a synthetic asset.

Trending Assets

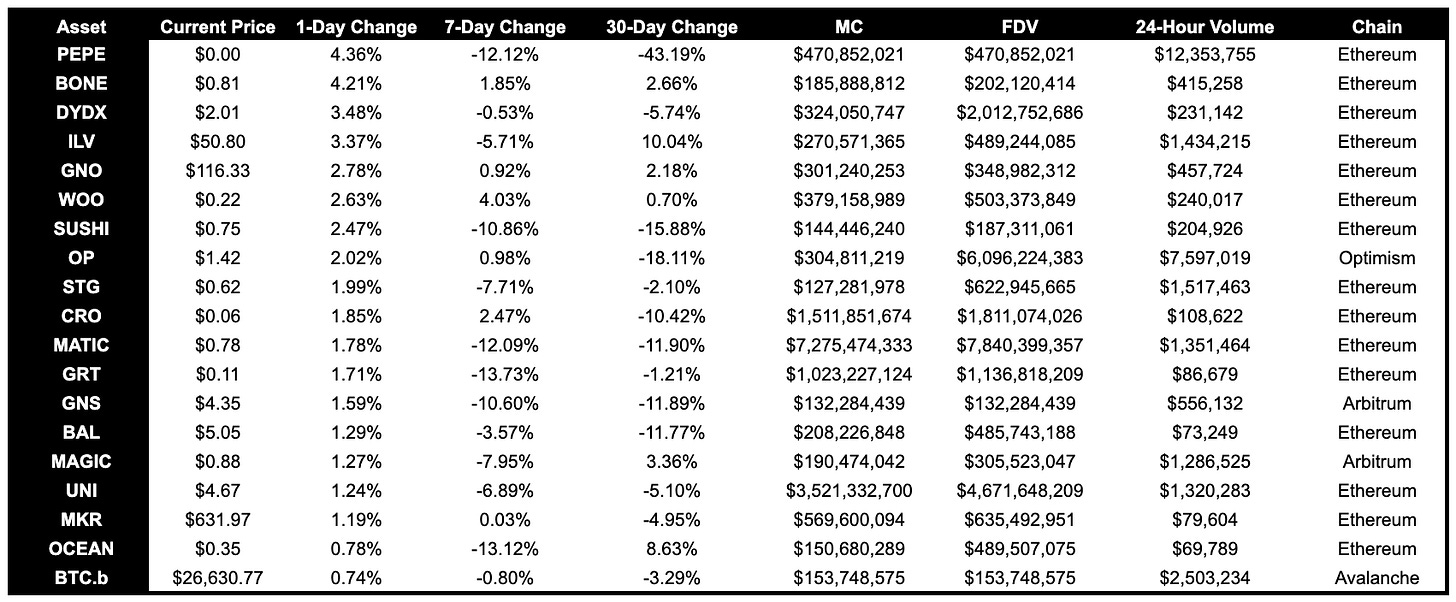

Above $100M MC by performance

PEPE and BONE are both up the most today on coins with mcap > $100mil. Both memecoins/related to memecoins.

SUSHI launching their DEX aggregator.

OP Bedrock update and post unlock has helped OP perform well relatively.

DYDX and WOO performed well, possibly due to increased CEX regulation in the US.

Above $1B MC by performance

Matic outperforms as zkEVM garners attention.

Cronos announced a partnership with Google Cloud, who will be joining Cronos Accelerator Program as a sponsor.

Trading Volume by Symbol

On-chain trading volumes are muted for the day with the top assets by volume being: ARB, PEPE, OP, OX, RDNT, LDO, LINK, CRV, VELO, frxETH.

Another standout here is, making the top 10 coins traded by volume today. A quick look and we can see there was some heavy accumulation of 0X over the past 7 days, with Sifu buying $5.2 million worth of it.

The OX token is related to Su & Kyle’s exchange OpnX.

Trending Contracts

No important changes in trending contracts

Coingecko Trending Assets

Pepe

Bitcoin

Jesus Coin

Ethereum

Hourglass

Binancecoin [BNB]

Stablecoin Netflows

Our markets continue to see a sustained net outflow of stablecoins with the current regulatory enforcement actions going on. The most recent reading we have is a $232 mn net ouflow.

Governance Proposals

Balancer/Aura: BIP-322 - Allocate Balancer’s 3M ARB

Balancer received 3M ARB from the Arbitrum token launch.

Proposal recommends that 1M ARB is allocated towards direct LP incentives, while the remaining 2M is deployed as protocol owned liquidity in combination with Aura by pairing it 33/33/33 with BAL and AURA.

BadgerDAO: BIP 100 - Allocation of Unclaimed ibBTC Rewards

BadgerDAO has $300k left in an ibBTC multi-sig from the yields generated by assets used to mint ibBTC.

The proposal offers three options to allocate these funds:

Seed Initial eBTC Liquidity

Sell the funds to bootstrap yield for eBTC

Place the funds at discretion of community council to invest and earn yield.

JPEG'D: PIP-58 - Increase base LTV, Update liquidation threshold and improve Boosts mechanics

Raise base LTV of select collections

Allow JPEG LTV boost to reach max LTV without the cig boost

Introduce a Max Liquidation Threshold to cap LTV when the cig boost and the LTV boost are combined

Add a buffer for liquidation of 11% beyond the Base LTV up to the Max Liquidation Threshold rather than 1% like currently

Make boosts perpetual and add a 7 day processing delay

Articles

Abracadabra Money: Introducing MagicLVL, Your Key to Optimal Returns on BNB Chain!

magicLVL is an autocompounder developed on top of Level Finance

The autocompounder generates yield from distributed fees and $LVL incentives from the Level's staking mechanism.

Partnership Announcement: Halborn

Plutus partners with Halborn, a security firm, which will offer Plutus security advisory over the next three months.

Silo Protocol: Vulnerability Disclosure 2023–06–06

Silo received a whitehat report which showed that in markets with $0 in deposits for any of the assets, it was possible to manipulate utilization rate to points above 100%, increasing interest rates to extremely high levels.

Loopring + Taiko: Ready Layer 3

Loopring Layer 3 will be implemented on top of Taiko, an Ethereum type-1 zkEVM.

Loopring Smart Wallet will integrate Taiko's new A3 testnet. Users can complete tasks and earn NFT rewards.

New Protocols

Fstar Fi

Description: Fstar is a decentralized derivatives trading platform focused on omnichain. Construct on decentralized stable currency Frax Finance and Stargate Finance.

Twitter: https://twitter.com/Fstar_Fi

Website: https://fstar.fi/

Stradle

Description: First of a kind crypto options aggregator

Twitter: https://twitter.com/stradlexyz

Website: https://www.stradle.xyz/arbitrage-deals

Ouija Exchange

Description: Novel AMM DEX bringing unparalleled capital efficiency to the omnichain future!

Twitter: https://twitter.com/ouija_exchange

Website: n/a

Cog Finance

Description: n.a

Twitter: https://twitter.com/CogFinance

Website: https://www.cog.finance/

Parallel Money

Description: Providing an overcollateralized, decentralized & multichain EURO stablecoin

Twitter: https://twitter.com/ParallelMoney

Website: https://www.mimo.capital/

Radiate Protocol

Description: Earn boosted yield on Radiant with no lockups!

Twitter: https://twitter.com/RadiateProtocol

Website: https://www.radiateprotocol.com/