Daily Notes 07-11-2023

Developments

Ondo Finance has partnered with Mantle to launch USDY on the Mantle network. USDY is a yield bearing stablecoin overcollateralized by short-term US Treasuries and “high-quality bank demand deposits' that currently yields 5.1% APY. The TVL of USDY is currently $35 million. It is unknown how much of the current TVL is contributed by the Mantle DAO Treasury.

The EigenLayer voting contest to add new LSTs to the protocol is nearly over, with 17.5 hours left to vote. The current standings are as follows:

All projects that receive over 15k ETH in votes will be added to EigenLayer in order of the votes received, in ‘the next few months’.

Sushi’s founder, Jared Gray, has published a proposal to redefine the tokenomics for the protocol’s token, SUSHI. The revamps would scale fees from Sushi pools, routing fees via Sushi’s aggregation router, and more. Additionally, it would attempt to align SUSHI tokenomics to ensure longer term incentives for LPs, provide a stable token supply for xSushi holders.

Kraken Considering Building an L2

Kraken is considering blockchain-technology firms to help them launch their own Layer 2 chain. These firms include Polygon, Matter Labs, and Nil foundation and others that are not publicly disclosed.

GMX To Deploy ARB LP Incentives

GMX will start to deploy the 12 million ARB (~$13 million) received via the Arbitrum STIP program tomorrow on the 8th of November. A portion of the ARB will be used to incentivise liquidity providers and trading weekly over a 12 week period. Week 1 will see 200,000 ARB allocated to GM liquidity incentives. Additionally, 2 million ARB will be used to support Arbitrum protocols building on and integrating with GMX.

An Enjin token multisig withdrew 169.3 million ENJ (~$52 million) from Binance. The wallet now holds 201.7 million ENJ which is equal to 20% of the tokens supply and valued at $64 million.

Co-founder of BitMEX, Samuel Reed, has pleaded guilty to Bank Secrecy Act Violations and has agreed to pay a $10 million fine. His co-founders, Arthur Hayes and Benjamin Delo pleaded guilty to the same crime earlier in February of 2022.

USDC will be natively available on Moonbeam. Users will be able to pay for gas and transact with USDC without needing to hold DOT via establishing a Polkadot Asset Hub account. This has been done in order to attract mainstream users to Polkadot and grow the ecosystem.

Aave V3 has gone live on Gnosis chain.

Shrapnel, a first person Avalanche blockchain based shooter that recently raised $20 million and another $10.5 million in 2021, has launched their token SHRAP on the Avalanche chain. It will be available for trading on HTX and Kucoin tomorrow when deposit volum meets the demand of market trading on HTX and "10:00 UTC" on Kucoin.

Shrapnel's early access beta is scheduled for December on the Epic games store for players who own an Extraction pack.

Trending Assets

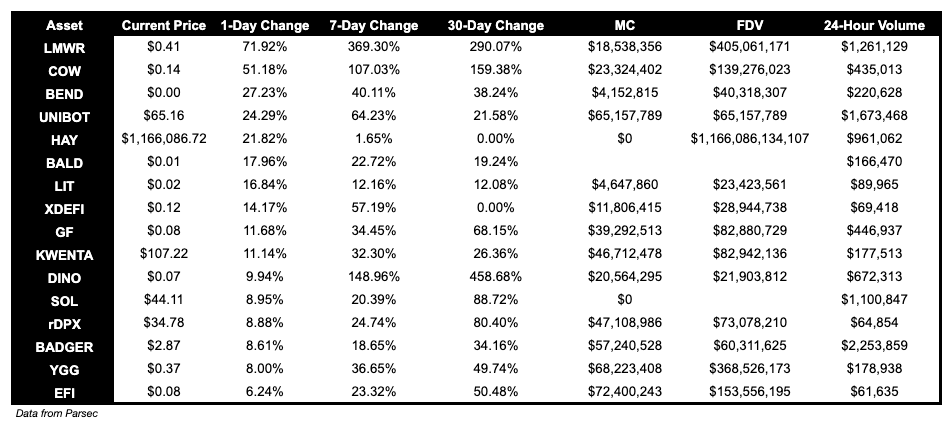

Below $100M MC by performance, on chain

LMWR is up 71.92%. COW is up 51.18% following the core team’s proposal to add fees to test which fee models would be best suited for long-term adoption.

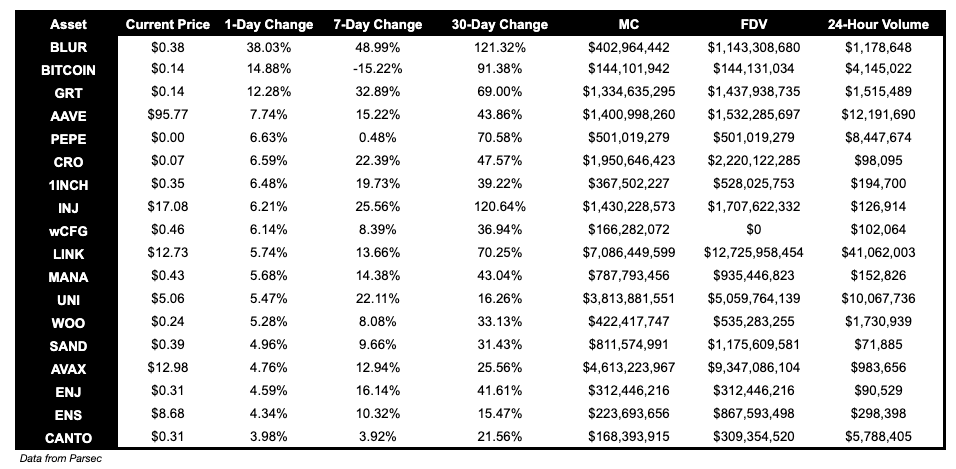

Above $100M MC by performance, on chain

BLUR, up 38.03%, BITCOIN up 14.88% and GRT up 12.28% performed well today.

Above $1B MC by performance, on chain

CRO is up 7.52%.

Trading Volumes

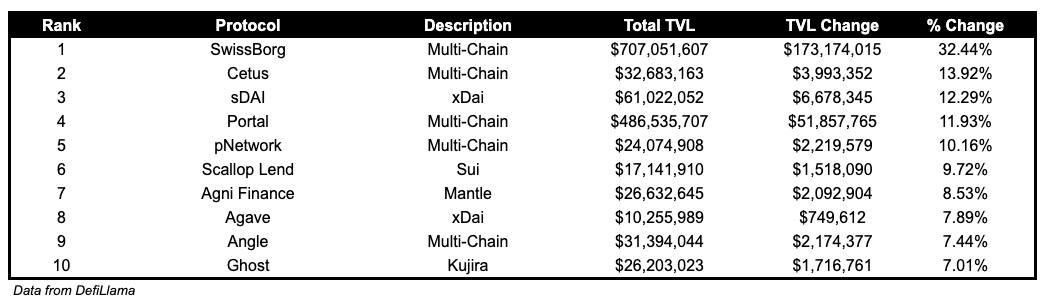

TVL

TVL Above $10M

Over the past day:

SwissBorg, CeFi, TVL grew by 32.44%.

Cetus, DEX on Sui and Aptos, TVL grew by 13.92%.

sDAI, yield-bearing stablecoin on xDai, TVL grew by 12.29%.

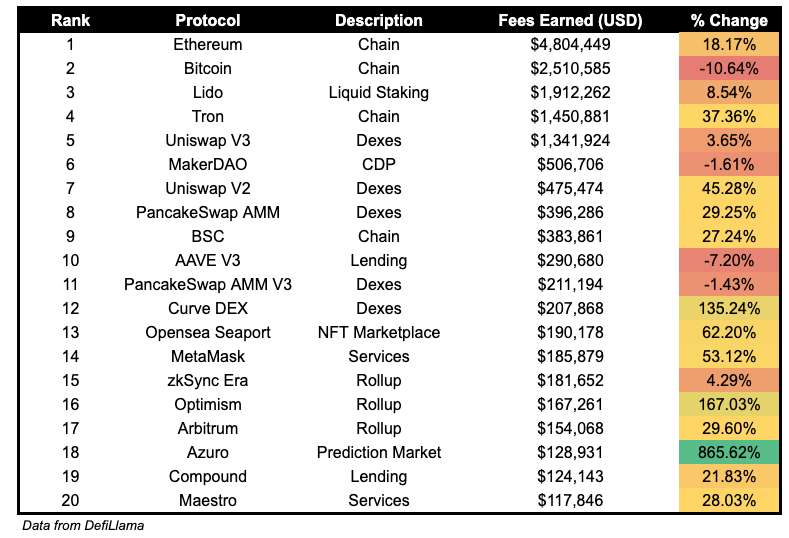

Fees

Azuro fees earned grew by 865.62% yesterday.

Governance Proposals

Aave proposal to upgrade the Aave Swap Contract to include Limit Orders and TWAP swap functionality.

Proposal to Backfund Successful STIP Proposals

Arbitrum proposal to backfund 26 STIP Round 1 proposals that were approved but not funded due to budget issues, allocating 21.4M additional ARB. Projects which would potentially receive the highest portion of the backfund allocation are: Gains (4.5M ARB), Synapse (2M ARB), Wormhole (1.8M ARB) and Stargate (2M ARB).

Should the Lido DAO accept ownership of wstETH Bridge Components on zkSync Era?

Lido proposal for Lido DAO to accept the ownership of the wstETH bridging on zkSync Era.

Articles / Threads

Take Profit & Stop Loss Orders – Live on Vertex

Vertex has launched Take Profit and Stop Loss orders on their trading platform.

Introducing the Canyon Hardfork

Canyon will activate on Optimism, Base, and other Superchain testnets on November 14th at 17:00 UTC.

The hardfork includes support for the Shanghai and Capella Ethereum hardforks and some minor bug fixes.

The EIP-1559 basefee denominator will increase from 50 to 250, reducing how quickly the basefee rises when blocks are over the gas target.

Unclosed channels will now be handled differently, allowing the op-node to read the first channel ready instead of requiring channels to time out.

A new field will be added to deposit transaction receipts to fix a bug in consensus encoding.

The create2Deployer bytecode will be set on all OP networks, enabling access to a commonly used contract.

Node operators will need to upgrade their nodes, and governance updates will announce when mainnets can upgrade.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.