Daily Notes: 07-06-2023

Developments

Binance US Assets Freeze & Delistings

The SEC submitted a motion to freeze Binance US assets held (including customer assets) yesterday after suing them. Users on Binance, desperate to get assets of the platform bidded crypto asset like BTC and ETH in order to transfer these off the exchange (as crypto rails are faster than fiat rails). BTC and ETH were trading at as much as 8% premiums on Binance US because of this.

Later in the day, Binance US released a statement detailing how they will be removing over 40 pairs from trading at 16:00 on June 8th, 2023.

The pairs that will be delisted:

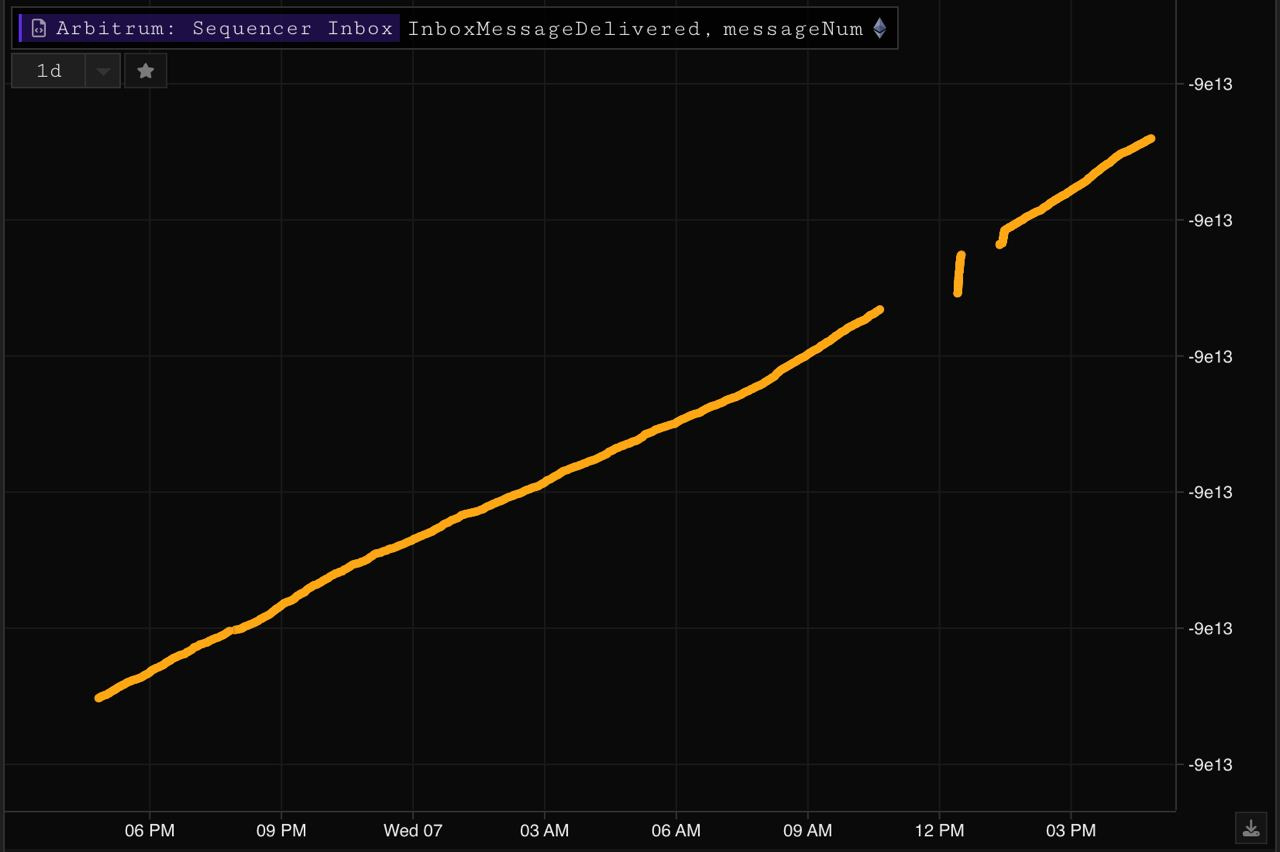

Arbitrum Sequencer

Arbitrum stopped processing transactions for an hour today after it’s sequencer ran out of gas to submit messages. A sequencer collects L2 transactions, orders them and then sends them into one batched transaction to Ethereum mainnet.

Currently all L2’s rely on single, centralised sequencers (OP / ARB) and this presents very obvious concerns surrounding censorship resistance, decentralisation and liveliness. Today, we saw this in action when the Arbitrum batch submitter contract ran out of gas and was unable to send transactions.

We can see here how the batch submitter contract burned through 4.6 ETH in just 15 blocks from reverting transactions. A key step toward decentralisation and a truly censorship resistant system will be decentralising the sequencer for these large L2’s.

h/t not_trademarc for making the above chart

Ethereum Staking / LSD-Fi

We continue to see net inflows into the Ethereum staking contract. Binance were a large part of this staking inflow, sending a combined 41,600 ETH into the contract in two transactions.

unshETH

unshETH have integrated Swell (swETH) and ankr (ankrETH) to the unshETH index and ecosystem. As a result, unshETH had the highest ever swap volume in the vdAMM, with more than $2M in arbitrage volumes

Raft

Raft offers decentralized borrowing and a stETH-backed stablecoin called R. Raft saw its TVL soar from $1.17M TVL to $23.6M TVL over the last 4 days.

Stader Labs

Stader is a non-custodial smart contract-based liquid staking platform. Stader’s ETHx has launched on Mainnet after a 3-phase roadmap.

BNB Liquidations

Venus protocol has a $236 million BNB liquidation at at price of $218, from the BNB bridge hacker who deposited stolen BNB for stables before bridging off-chain. This has come to light again as the BNB token has fallen with the recent market downturn and the idiosyncratic Binance FUD, putting this liquidation only 15% away.

This liquidation will be handled solely by BNB Chain as per the following Venus improvement proposal:

Proposal to manage debt positions on Venus that resulted from the Sept. 2022 BNB Bridge incident.

BNB chain proposes to upgrade the vToken contracts on USDT, USDC, ETH and BTC to swap BUSD debt on behalf of the exploiter’s account into other more sustainably liquid assets.

Needless to say, a liquidation of this size would be very detrimental to the price of BNB, although somewhat alleviated since BNB chain will execute it personally and likely over a longer period of time.

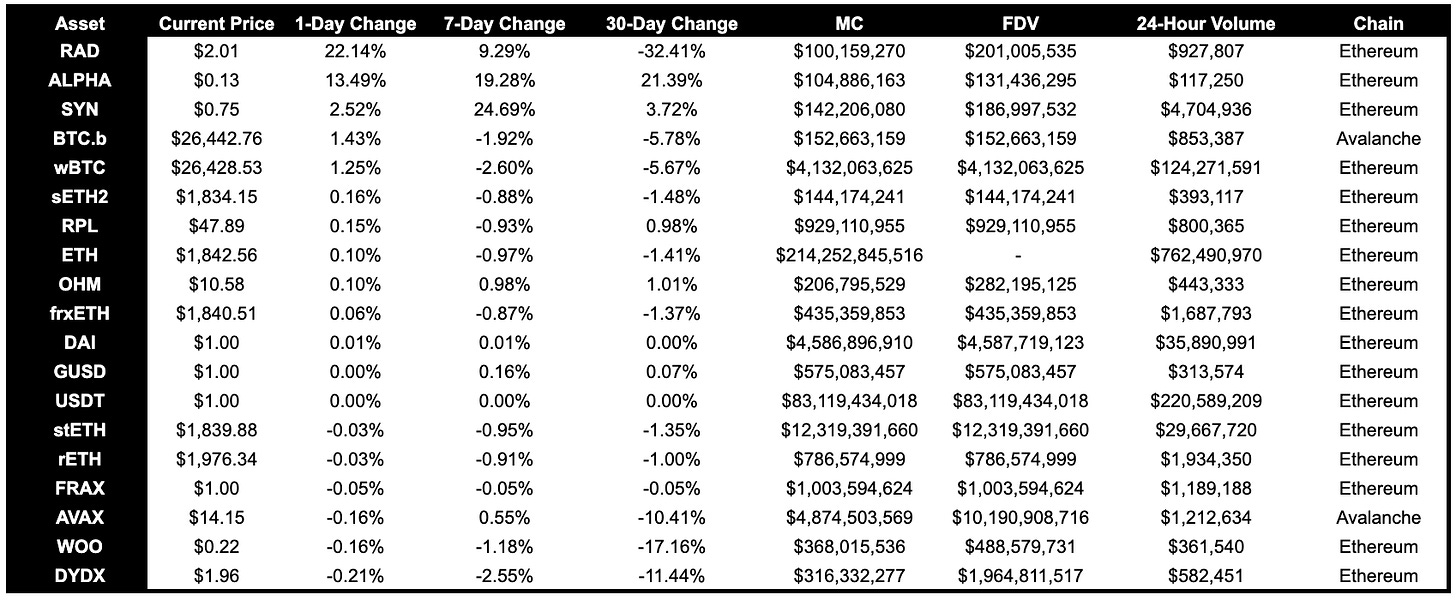

Trending Assets

Above $100M MC by performance

SYN continues to be a strong performer with a large wallet entering on-chain with multiple 29 ETH clips before depositing his SYN into the SYN/wETH pool on Sushiswap. This whale makes up ~9% of the TVL in that pool.

Above $1B MC by performance

Trending Contracts

No significant changes since yesterday, aside from two big NFT mint events: GOOFIES and ARGUS GENESIS.

Coingecko Trending Assets

Pepe

Sui

Bitcoin

Binancecoin [BNB]

Edu-coin

Velodrome [VELO] - related to Aerodrome / Base launch & good

Arbitrum

Stablecoin Netflows

Seeing a large amount of stablecoin outflows ($324M) over the last day or so.

Governance Proposals

Aave: ARFC - Add ARB to Arbitrum Aave v3

Part of the next steps after the temperature check, which showed that the community was interested in adding $ARB to Arbitrum Aave v3.

Proposed risk parameters can be seen in detail in the snapshot. A simple summary:

Will be part of isolation mode, will be borrowable, collateral enabled.

20M supply cap, 16.5M borrow cap

LTV 50%, LT 60%

Stable borrowing disabled.

Aave: TEMP CHECK - Aave V3 Deployment on Base

Temperature Check to see if the community is interested in deploying Aave v3 on Base mainnet.

1inch: 1IP-30 - 1inch Hardware Wallet production completion

Proposal regarding the completion of the 1inch Hardware Wallet product development, both software and hardware.

Has been coordinated with 1inch core team and is seeking funding of $2M to complete the product trade version of the 1inch hardware wallet.

Articles

The 1inch DAO Discontinues Swap Surplus Collection

A swap surplus forms as a result of a unique market occurrence known as "positive slippage": i.e. when the rate of the token swap changes in the user's favor.

1inch DAO has voted to stop collecting swap surplus', which will lead to less gas required and spent per swap.

Mummy’s Expansion Into Arbitrum

Mummy Finance will expand into Arbitrum and offer initially offer margin trading, swaps, liquidity provision, staking and vesting. In the future they will implement a trade to earn campaign.

Aori utilizes a seat-based governance model member-owned structure

Seat holders do not pay fees

Seat holders decide and collect fees (40-60% of fees charged to non-seat holders trading through the seat holders seat)

Umami DAO Treasury Update May 2023

In the month of May, there was a Net Treasury loss of $643,054 or 11.47%.

Gross yield earned on the treasury was: $35,354 at time of writing, which is a 8.5% APR return for the whole treasury.

Umami’s Operational Expenses was $136,800 in May.

New Protocols

Lifted Stake

Description: A new model of "DeFi economic engine" on Layer 2. Decentralized Staking and Options Trading Platform on Arbitrum.

Twitter: https://twitter.com/LiftedStake

Website: n/a

Temporal Finance

Description: A Novel Primitive for DeFi: Market-Determined Yield Curves

Twitter: https://twitter.com/TemporalFinance

Website: https://temporal.exchange/

AAA Lending

Description: NFT lending aggregator

Twitter: https://twitter.com/AAA_lending

Website: https://www.aaa.is/

Chord Fi

Description: Leverage Trading and Leverage Farming Platform.

Twitter: https://twitter.com/chord_fi

Website: n/a

Aerodrome Fi

Description: The central trading and liquidity marketplace on Base. Built in partnership with Velodrome.

Twitter: https://twitter.com/aerodromefi

Website: