Daily Notes 07-03-2024

Developments

Pantera Eyes $250 Million in Discounted Solana Tokens from FTX Estate

Pantera is looking to raise funds to buy $250 million in discounted locked Solana tokens from the FTX estate. Investors who participate will be able to purchase at $59.95 per SOL but may have to lock their tokens for up to 4 years. They will also pay Pantera a 0.75% management fee and a 10% performance fee.

SEC Solicits Comments on Franklin Templeton Ethereum ETF Proposal

The SEC published a notice to solicit comments on a proposed rule change filing by the Cboe BZX exchange to list and trade shares of the Franklin Templeton Ethereum ETF under BZX Rule 14.11(e)(4).

Ark Invest Sells Over $100 Million of Coinbase Shares

Ark Invest has sold over $100 million of Coinbase shares (COIN) so far this week.

Tesla and SpaceX Holdings Revealed by Arkham Intelligence

Arkham Intelligence claims Tesla and SpaceX to be holding $778 million and $560 million respectively after identifying the two entities.

Bitcoin's Premium Surges in South Korean Exchanges

Yesterday, Bitcoin was trading at a 10.32% premium on South Korean exchanges of which foreign investors are forbidden from trading on. The premium suggests a high local demand for Bitcoin.

Kamino Finance to Distribute KMNO Token

Kamino Finance will take a points snapshot on March 31st and distribute the KMNO token in April. 7% of the KMNO supply (700 million KMNO) will be initially distributed to the community.

Brave Integrates SegWit Bitcoin Wallets

Brave integrated SegWit Bitcoin wallets into its wallet for desktop users. Brave will also be allowing users to store BRC-20 tokens and Ordinals in the Brave Wallet later this year.

Injective’s inEVM Goes Live on Mainnet

Injective’s inEVM went live on mainnet. “inEVM enables Ethereum developers to build dApps that leverage blazing fast speeds & near zero fees while achieving composability across WASM and EVM”. inEVM is the “first-ever EVM capable of achieving true composability across cosmos and solana”. inEVM will use Celestia as its Data Availability layer and Pyth as its oracle provider.

Backpack Exchange's First Snapshot Scheduled

Backpack Exchange to take its first snapshot on March 18th.

Zama Raises $73 Million in Series A Funding Round

Zama raised $73 million in a series A funding round led by Multicoin capital and Protocol lab. Zama is a cryptography firm building fully homomorphic encryption, (which enables the processing of data without decrypting) solutions for blockchain and AI.

SafePal Launches Visa Card with USDC

SafePal launched a Visa card with USDC as the default deposit currency after strategically investing in Fiat24, a Swiss bank.

Jupiter DAO Launches Genesis Vote

Jupiter launched its genesis DAO vote - “Which animal is the cutest?” - to get DAO members familiar with the platform.

BlockFi Reaches Tentative Settlement with FTX and Alameda

BlockFi customers may receive a full value recovery as BlockFi reached a tentative settlement in which they will receive a $185.2 million customer claim from FTX and $689.3 million claim against Alameda Research.

Rarible API Now Integrated with Celo

Rarible’s API integrates into Celo.

GMX Launches Python SDK GMX launched a Python Software Development Kit (SDK).

Trending Assets

Below $100M MC by performance, on chain

Doginme continues to do well, has risen by 79.21%. ORBIT is up by 52.84%, and AST (Airswap) is up by 25.28%.

Above $100M MC by performance, on chain

ONDO is up 16.72%, MANTA is up 17.95%.

Above $1B MC by performance, on chain

RBN is top performer for assets above $1B MC, up 17.75%. FET is up 15.67% and INJ is up 13.86%.

Trading Volumes

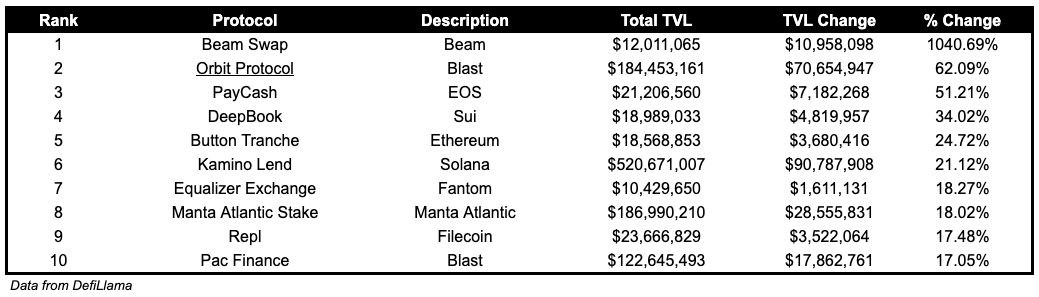

TVL

TVL Above $10M

Over the past day:

Beam Swap, a DEX on Beam (gaming chain), TVL grew by 1040%.

Orbit Protocol, a money market on Blast, TVL grew by 62%.

DeepBook, CLOB on Sui, TVL grew by 34.02%.

Fees

Ethereum fees earned are down by 15.29%, Optimism fees earned are down by 47.2%, and BSC fees earned are up by 47.39%.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.