Daily Notes: 06-07-2023

Developments

Binance Senior executives including General Counsel Han Ng, Chief Strategy Officer Patrick Hillmann, and SVP for Compliance Steven Christie have quit Binance.

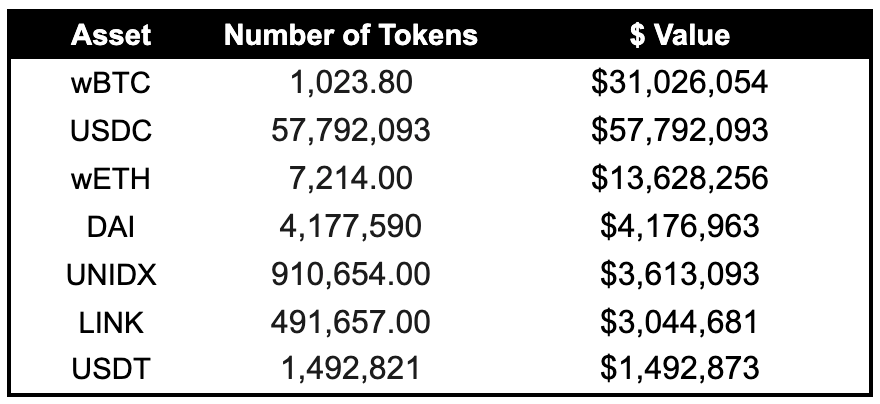

Multichain Fantom bridge is possibly drained. Assets affected are WBTC, USDC, DAI, ETH and LINK.

Whilst we don't know if this is a hack yet, these are the assets and quantities which were moved to freshly setup wallets.

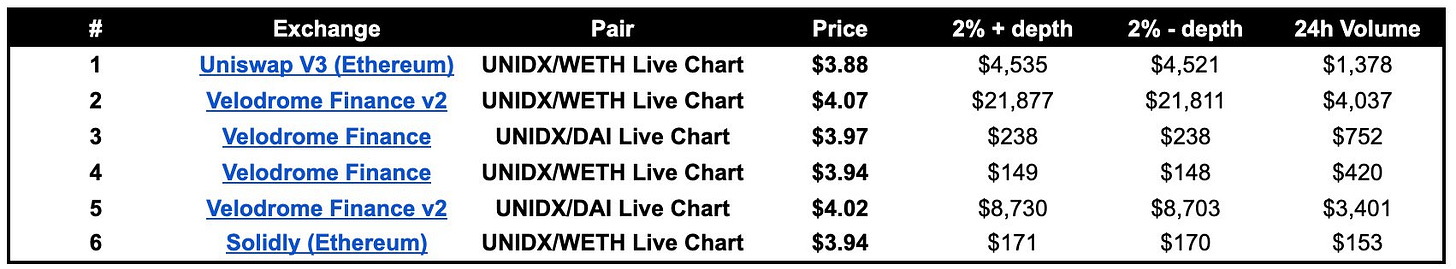

If Multichain is in fact hacked, UNIDX would essentially go to $0 if the exploiter market dumped these tokens into the existing liquidity pools. The -2% depth on UNIDX is around $20,000 & the potential exploiter has stolen $3.6M worth.

Circle, who issues USDC and EUROC, launched a wallet-as-a-service platform for developers. The platform is currently in beta testing.

wstETH has surpassed ETH as the crypto collateral with the highest DAI debt.

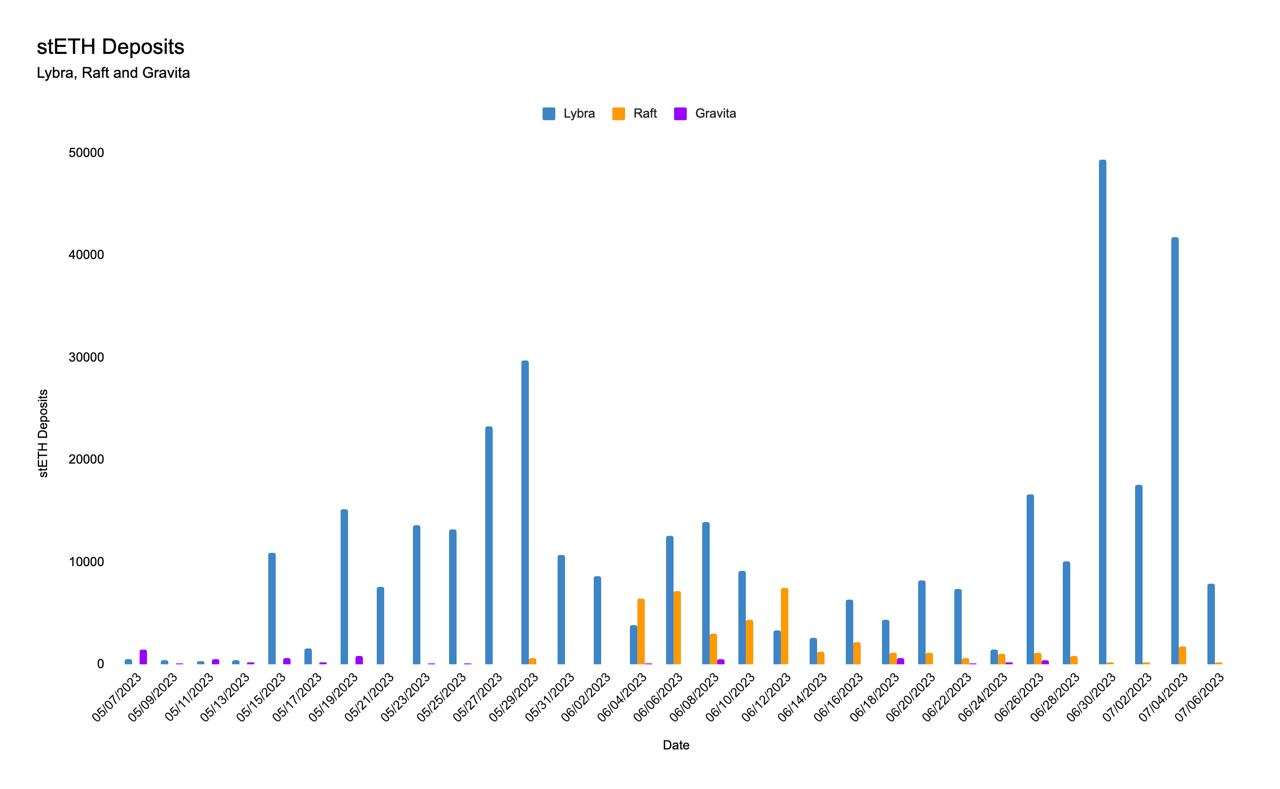

We have started to see Lybra Finance dominate the LST stablecoin space, by taking the lions share of stETH deposits.

Hidden Hand V2, which introduces features such as range bribes, limit bribes, a yield harvester, new markets, UX upgrades, and more, has gone live.

Sami teased that Hidden Hand V2 is the final launch before Dinero, Redacted’s stablecoin backed by blockspace.

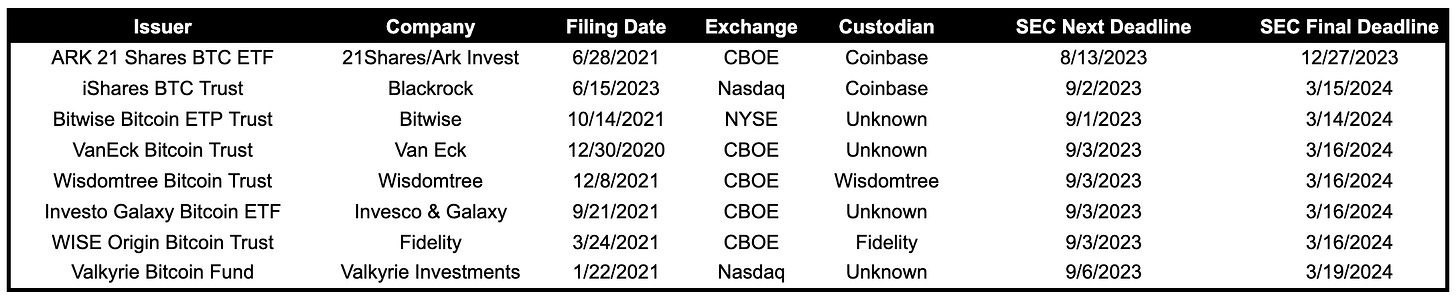

ETF Launches

ARK 21 Shares BTC ETF, filed on 28/6/2021, is set to receive a response from the SEC on 13/08/2023.

Manifold Finance, mevETH and Cream ETH

Cream ETH multisig, where all the underlying ETH for crETH2 is held, moved 320ETH to a new multsig created 14 days ago.

Manifold Finance announced that this is the first official deposit for mevETH. mevETH is an MEV-optimized, natively multichain LST.

The new multisig is largely Manifold Finance controlled, with some Cream team members still as signers.

Cumulative Returns During Trading Hours

Over the past 2 weeks, highest returns have been seen during Asia trading hours, followed by European trading hours, and lastly during American trading hours.

Trending Assets

Above $100M MC by on-chain performance

FXS and ENS outperformed over the past day. FXS is up 7.16% and ENS is up 5.22% over the past 24 hours.

Over the past 7 days, FXS is up 21.8%, BIT is up 19.59% and YFI is up 11.40%.

Above $1B MC by on-chain performance

Tokens above $1B MC continue to underperform.

Stablecoin Netflows

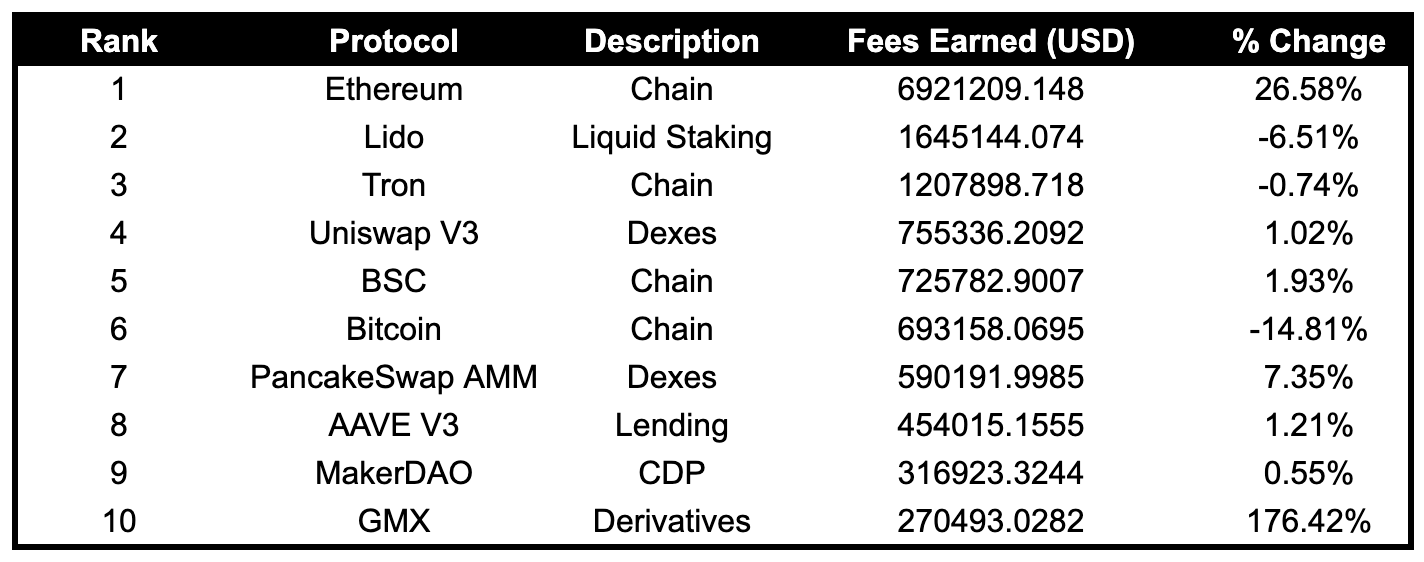

Fees

Ethereum has earned $6.9M in fees over the last day, which is 26.58% compared to yesterday. Notably, GMX fees are up 176.42%, at 270.5K earned.

Governance Proposals

[TEMP CHECK] Aave V3 Deployment on Linea Testnet

Temperature check to deploy Aave V3 on Linea Testnet and move to Mainnet right after all pre-conditions and dependencies are met on Linea Mainnet.

Aura Finance proposal to deploy on Optimism.