Daily Notes: 06-06-2022

Developments

The SEC alleges Coinbase has never registered with the Commission as a national securities exchange, a broker-dealer, or a clearing agency, and no exemption from registration applies.

Coinbase wallet potentially qualifies as a broker-dealer.

They list SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO as securities (the first page of the tradable section on Coinbase)

Coinbase respond here.

Synapse

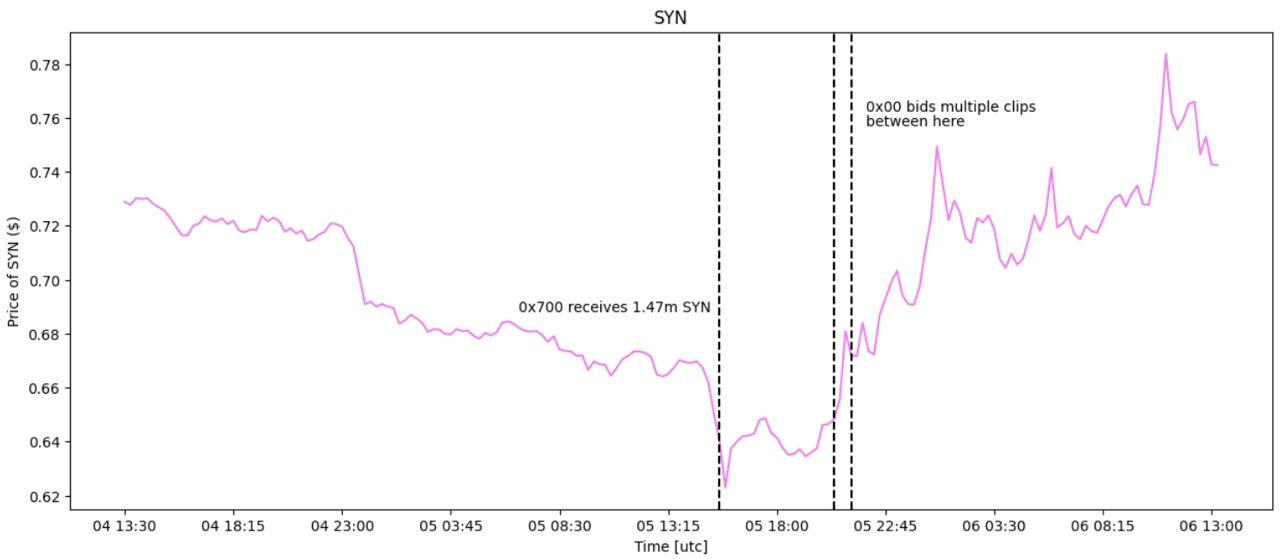

SYN has been one of the top performers over the past 24 hours, likely related to the highly anticipated upcoming launch of Synchain, an optimistic L2 cross-chain messaging chain.

SYN’s evolution to an L2 places it into the basket trade of L2’s pre EIP-4844

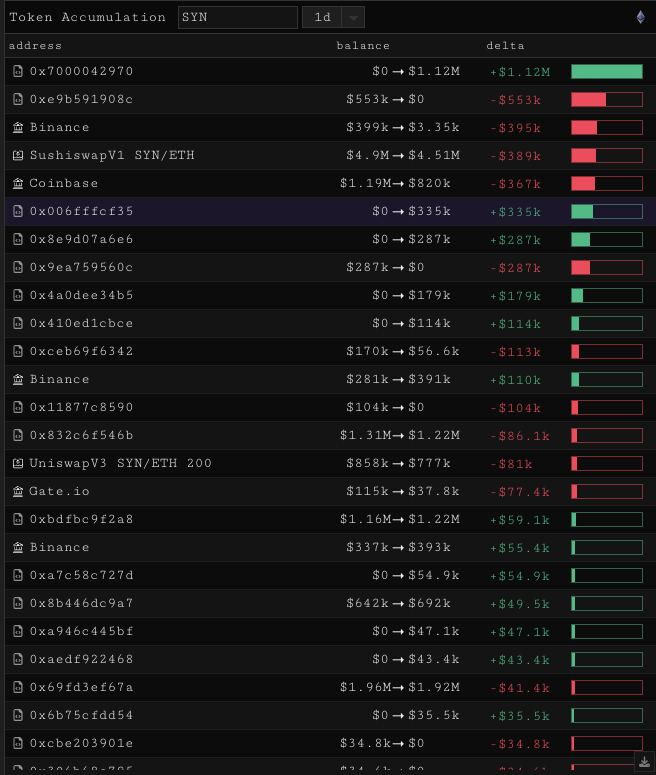

We observed a few large wallets accumulating positions on-chain that helps explain this move up.

0x700 received 1.47 million SYN tokens worth ~$1mil from a FalconX wallet, suggesting institutional accumulation.

0x006 started executing on-chain transactions last night at 8:30 pm UTC, swapping USDC and LDO tokens to SYN in 4 clips ranging from 56,000 SYN to 157,000 SYN in size.

Long Liquidations

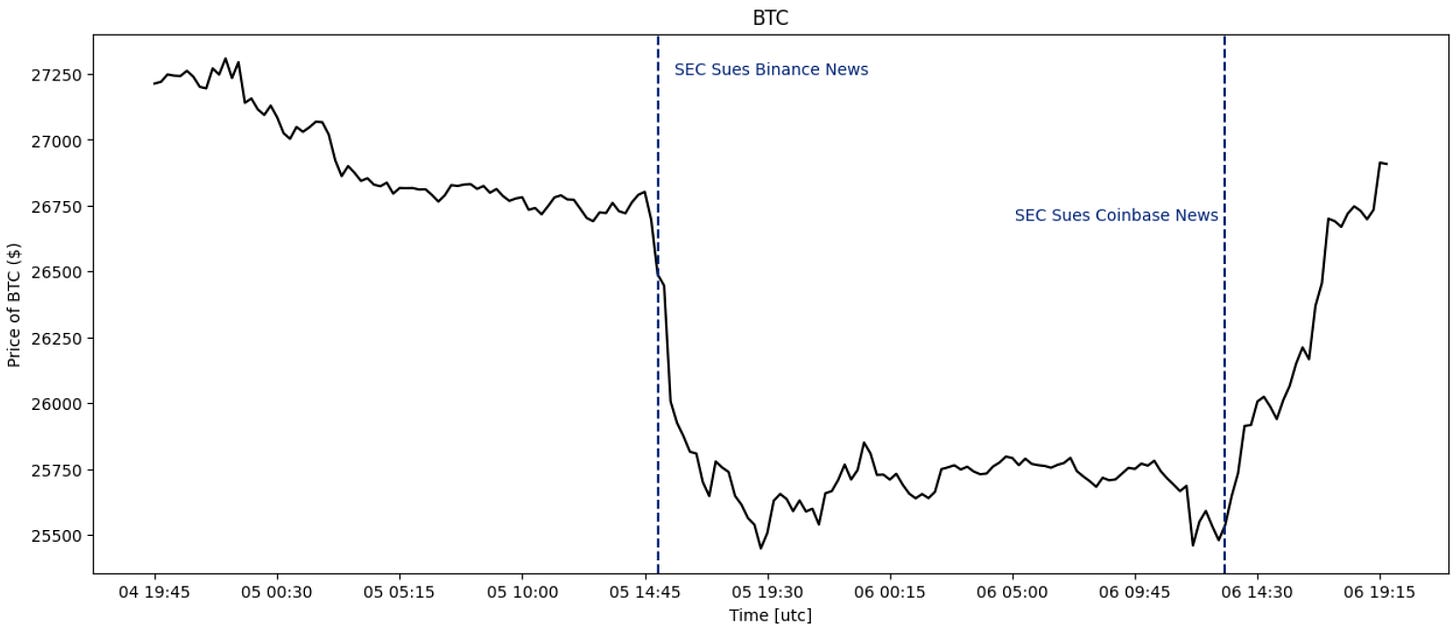

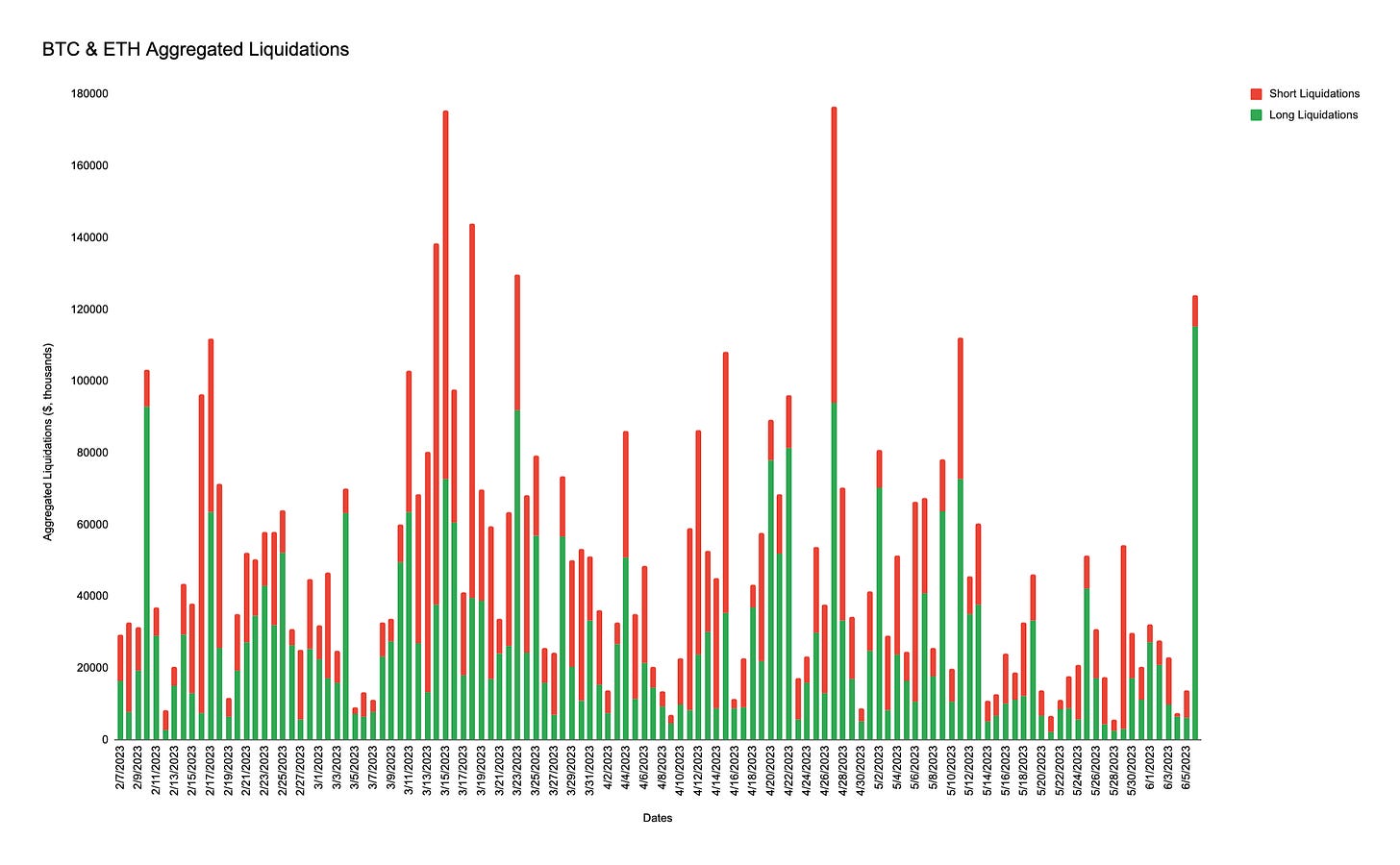

Post SEC v. Binance news announcement yesterday, BTC & ETH both saw the largest aggregated long liquidations to date, since November 2022 (post-FTX collapse).

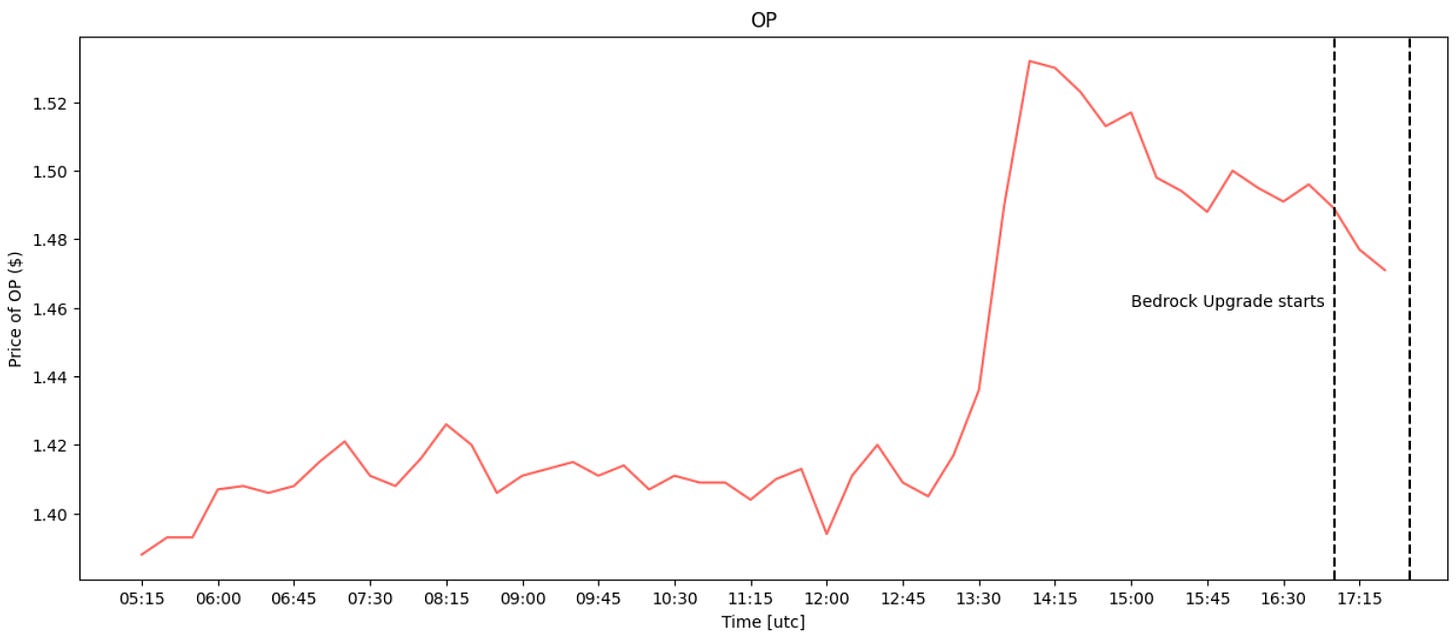

OP bedrock

As mentioned in yesterday’s issue, Optimism is undergoing it’s long anticipated ‘Bedrock’ upgrade.

In order to complete this upgrade, the chain went down at 17:00 UTC and is expected to be down for between 2-4 hours.

You can follow the progress here.

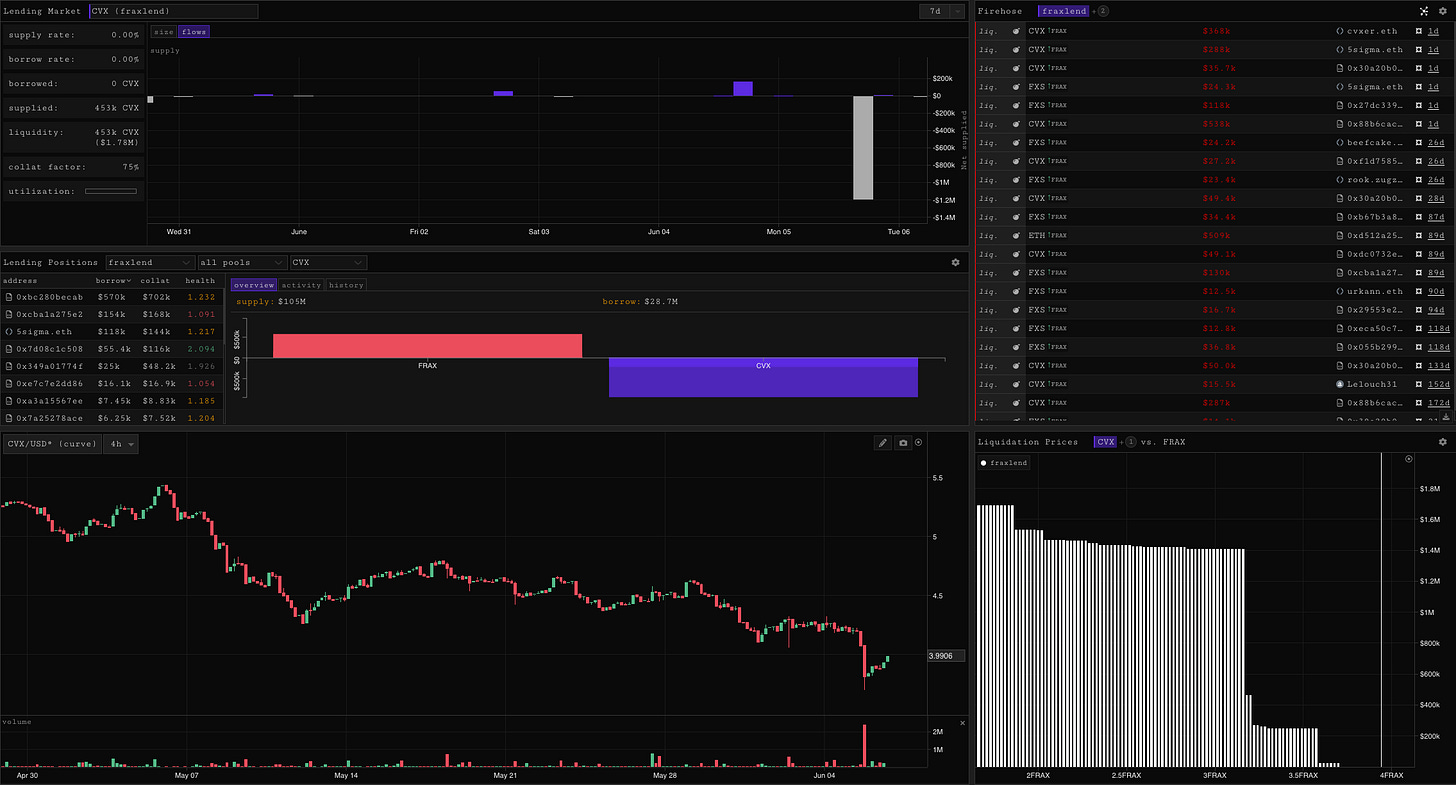

CVX Liquidations

There were 4 large-ish CVX liquidations on Fraxlend yesterday

cvxer.eth, 5sigma.eth and 0x88 got hit for a total liquidation of $1mil, leading to CVX in the pool dropping by 30%

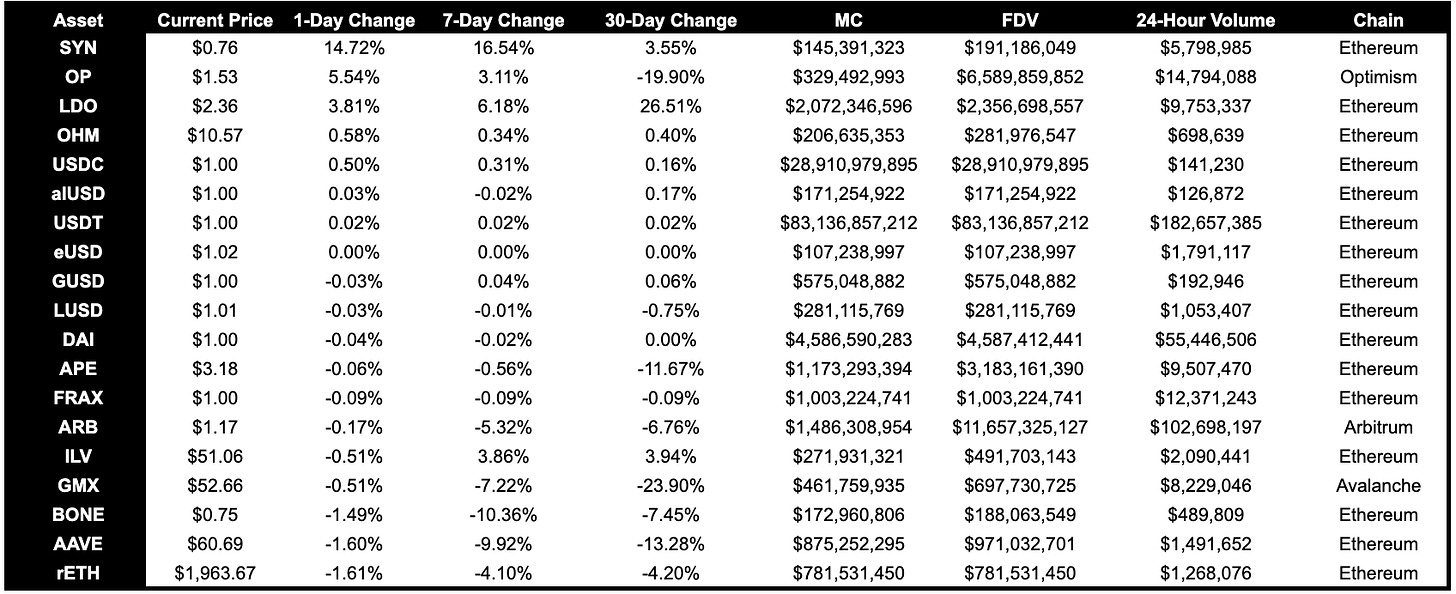

Trending Assets

Above $100M MC by performance

As mentioned before, SYN has been one of the top performers over the past 24 hours, likely due to the upcoming launch of Synchain.

Additionally seeing outperformance in OP, likely due to the Bedrock upgrade that went live earlier today.

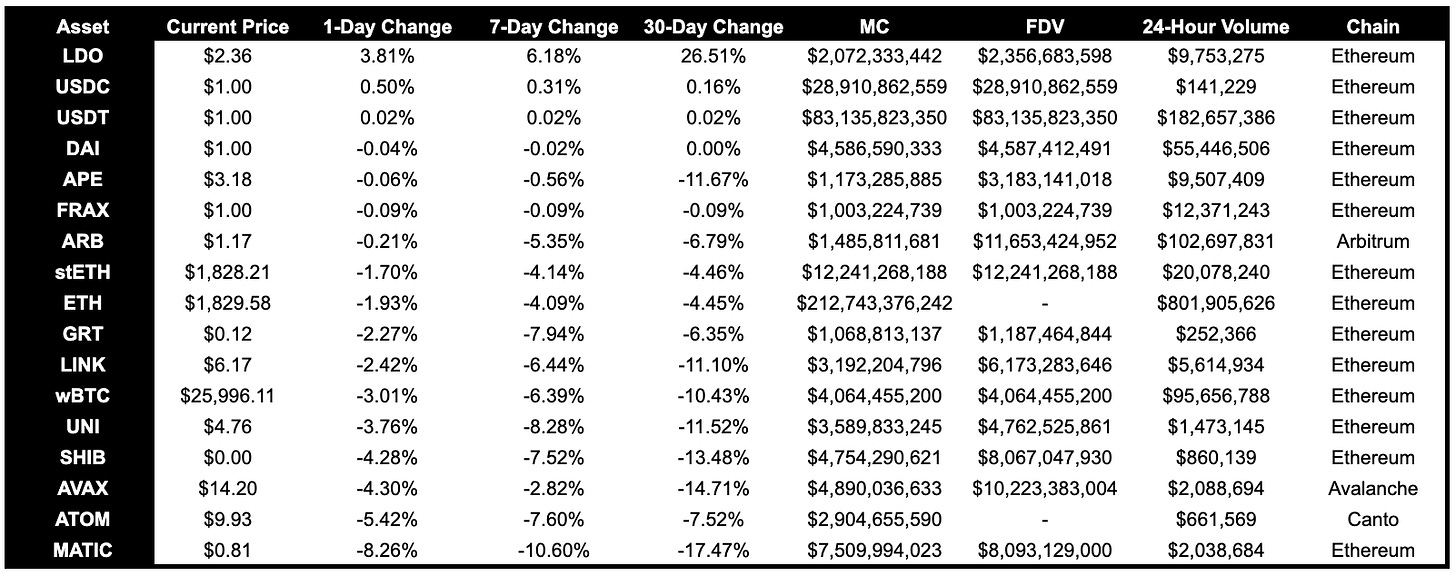

Above $1B MC by performance

Another top performer today was LDO, being one of the few coins on Binance that did not make a daily low during the Binance SEC news yesterday.

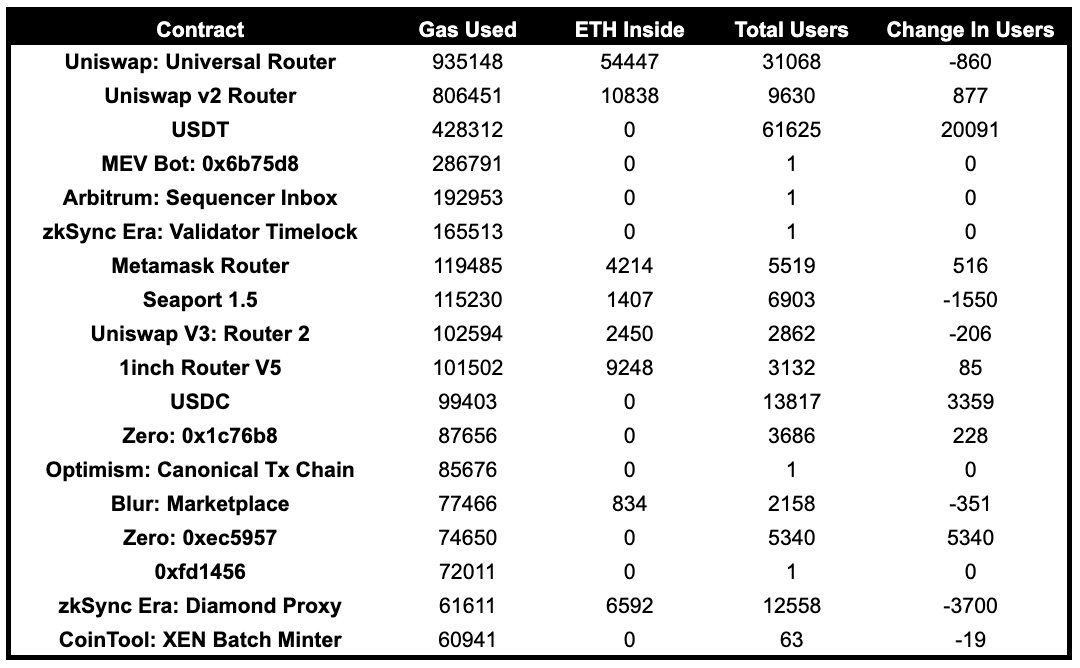

Trending Contracts

0x6b75d8af000000e20b7a7ddf000ba900b4009a80 is an MEV bot which spent $287k on gas today

Coingecko Trending Assets

Pepe

Sui

Ethereum

Bitcoin

Ovr - AR Metaverse coin

Edu-coin

Arbitrum

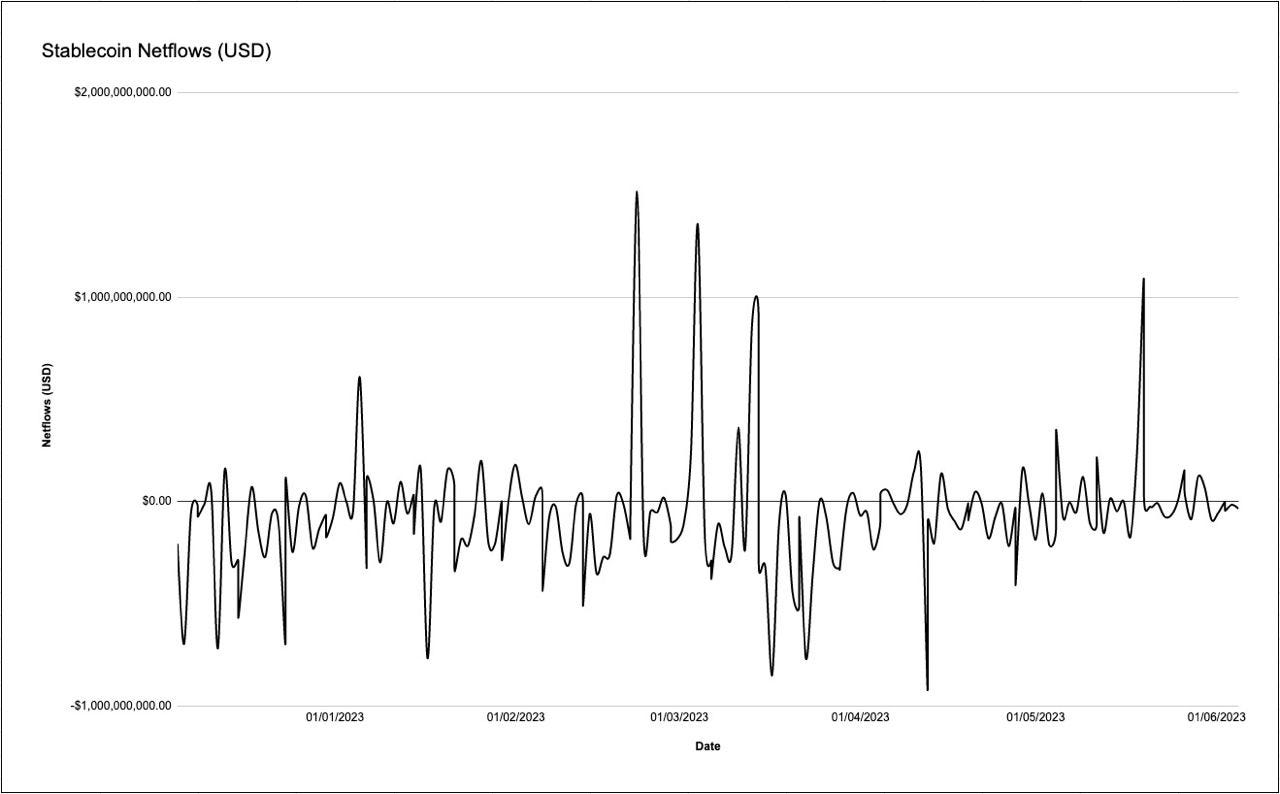

Stablecoin Netflows

Still seeing slightly negative net outflows of stablecoins from the ecosystem with today coming in at a $39 million outflow. With the regulatory environment we find it hard to see how an US company could meaningfully allocate to the sector and sense that even funds will be apprehensive to deploy with specific assets being alleged securities.

Governance Proposals

AAVE: ARFC - GHO Mainnet Launch

Proposal to launch GHO, with two initial facilitators: the Aave V3 Ethereum Facilitator and the FlashMinter Facilitator.

A Facilitator can generate or burn GHO tokens.

Proposal for Hop to claim their ARB airdrop and delegate to multisigs managed by Hop’s ambassadors, to give DAO flexibility in the tokens future potential use.

STFX: SIP-005: Liquidity Reduction

Proposal for a 25% reduction to both Ethereum and Arbitrum STFX/ETH Uniswap pools.

Articles

Kwenta releases their roadmap for Q3 and Q4 2023:

Q3 2023: TWAP perps testnet, v2 staking, SDK, referral program and smart margin upgrades

Q4 2023: DAO 2.0, SNX v3 migration and programmable delegated trading

Chronos v2 to include:

A new NFT marketplace (for maNFTs, veCHR and chrNFTs) and changes to maNFTs

Concentrated liquidity

Revised emissions (**35% reduction** in CHR max supply from 275M to 180M.)

Open Liquidity Program (OLP) Launch

Starting June 13, 2023, **60,000 INJ** can be earned by users during each epoch for using Injective

Level & Trader Joe: Teaming Up for Liquidity

Level Finance will use Trader Joe as the LVL Token's main DEX on Arbitrum.

To bootstrap liquidity on Trader Joe, Level has migrated the DAO-owned portion of the LVL/USDT LP from BNB Chain to Arbitrum.

Introducing The Sushi DEX Aggregator

Sushi launches their DEX aggregator

Synthetix, What Comes Next, Part One

Kain teases upgrades to Synthetix that will "not only ensure that the protocol can scale as demand grows, but that will drive user demand in the first place"

New Protocols

Torus

Description: Omnichain Curve Finance Omnipools. Torus pioneers the ETH Omnipool on Ethereum Mainnet. Root Genesis Labs, powered by LayerZero.

Twitter: https://twitter.com/Torus_xyz

Website: n/a

Flowmatic

Description: Derivatives, options and perps trading terminal.

Twitter: https://twitter.com/FlowmaticXYZ

Website: n/a

Lockbox

Description: An innovative smart contract based self-custody solution for permissioned and scalable crypto treasury management

Twitter: https://twitter.com/getLockbox

Website: https://getlockbox.xyz/