Daily Notes 05-09-2023

Developments

In March of this year, the Synapse Protocol DAO voted in favour of accepting $40 million of “actively managed” stablecoin Bridge liquidity that was to be “locked for twelve months” from Nima Capital, a family office. In exchange, Nima Capital received a 10 million $SYN (Synapse protocols token currently used for governance) token grant to “align a long-term capital partner with the DAO” as well as 33% of bridge and swap fees for a 12 month period (until ~march of 2024).

Yesterday, Nima Capital violated the conditions of the agreement by removing the $40 million of stablecoin liquidity. They also sold 9/10million $SYN tokens on-chain yesterday in 2 transactions of 4.5 million tokens each within 1 minute for $2.347 million taking 7 figures worth of slippage. The other 1 million tokens were transferred to Coinbase 141 days ago and it is highly probable that they were sold too.

It is unclear if conditions of the uses of the grant were set in a legally binding contract of any sort.

So far the Synapse team has stated that they are in touch with Nima and will update once there is more info.

Frax Finance Make Headway In RWA

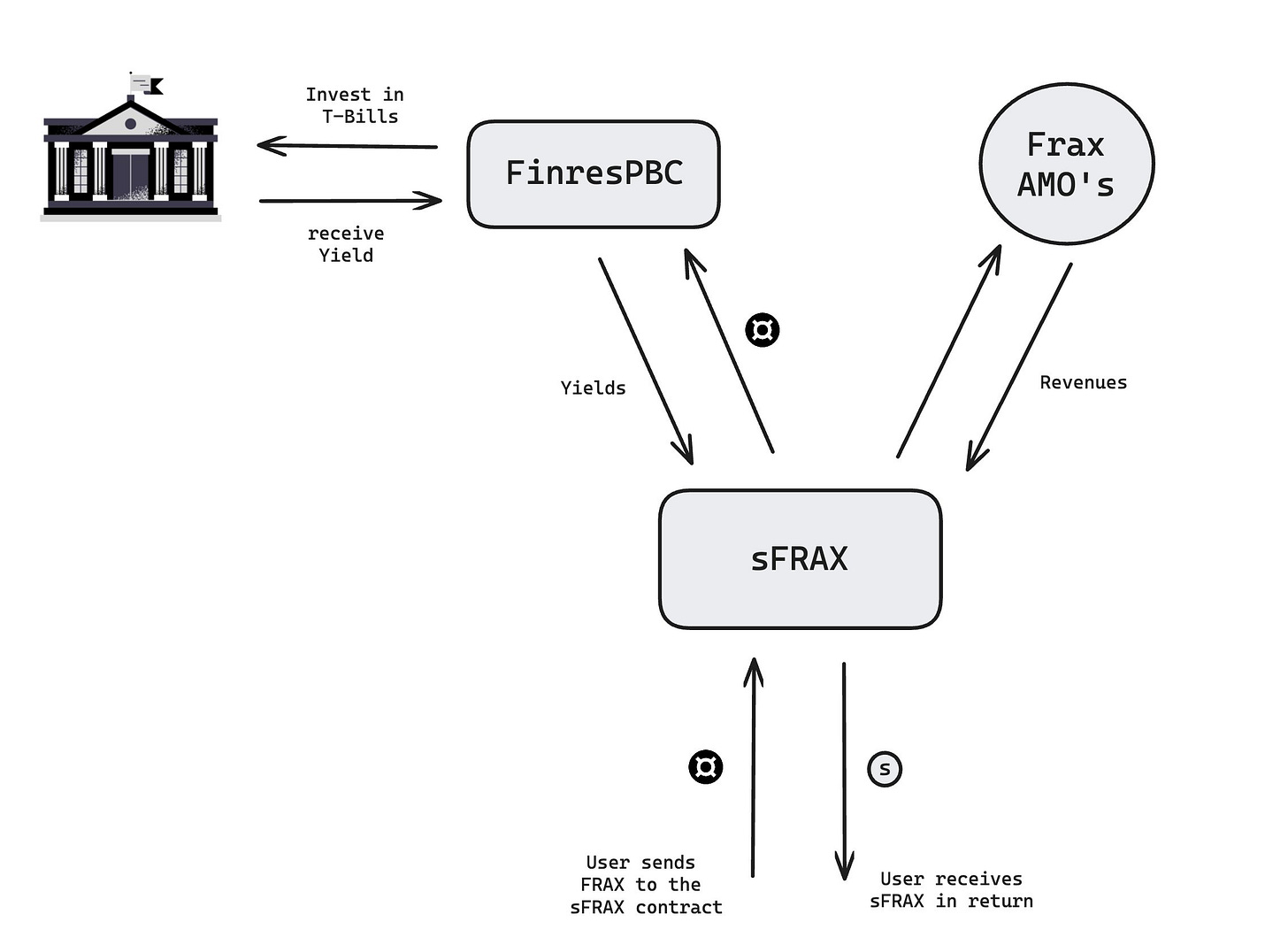

A member of Frax’s Core Team has proposed the introduction of staked Frax (sFRAX). Much like the DAI savings rate, it allows users to deposit Frax (pegged to $1) and earn interest in the form of $FRAX stablecoins providing a low-duration savings option for users.

The interest rate will be variable and may come from multiple sources. One source of yield mentioned will be from an allocation of the Frax protocols revenues derived from Frax’s Algorithmic Market operations controllers (eg. a frax-owned autonomous contract) and real world asset strategies.

The APR will “softly target” the Federal reserve’s Interest on Reserve Balances (IORB), which is currently 5.4%, at all times. If unable to, Frax will always prioritise keeping $FRAX at 100% collateral ratio and then would direct any excess revenue towards sFrax.

All in all the introduction of sFRAXs aims to allow builders to build on top of sFRAX and thus promote the growth of an enhanced stablecoin ecosystem and attract greater liquidity while increasing the FRAX supply .

Native USDC Goes Live On Optimism & Base

USDC has officially launched on Optimism and Base. Both Optimism and base will be working with their ecosystems to facilitate the migration of the “bridged” forms of USDC (that were not issued by Circle) - USDC.e and USDbC respectively - to the now native USDC.

Note that Coinbase supports the depositing of both USDbC and USDC.

So far, the law firm Sullivan & Cromwell, who is handling FTX’s bankruptcy, has made $110 million in fees.

Another law firm, Kirkland & Ellis, who is handling the procceedings of three other bankrupt crypto firms, has made $101 million in fees.

Additionally, the two firms also changed $500,000 and $2.5 million in expenses respectively bringing the combined total to $211 million (fees) + $3 million in “expenses”.

This money being spent comes out of a pool that could have otherwise been used to give back to users that lost money and are "extortionary and ridiculous" as commentated by Daniel Frishberg.

Trending Assets

Top 300 Performers

CFG up 12.56% today as the RWA theme continues to stay in the spotlight, recently having surpassed $3billion total RWA TVL in DeFi.

Top 300 Losers

Synapse down 10.22% today after Nima Capital sell 9 million SYN tokens in the Sushi/ETH liquidity pool.

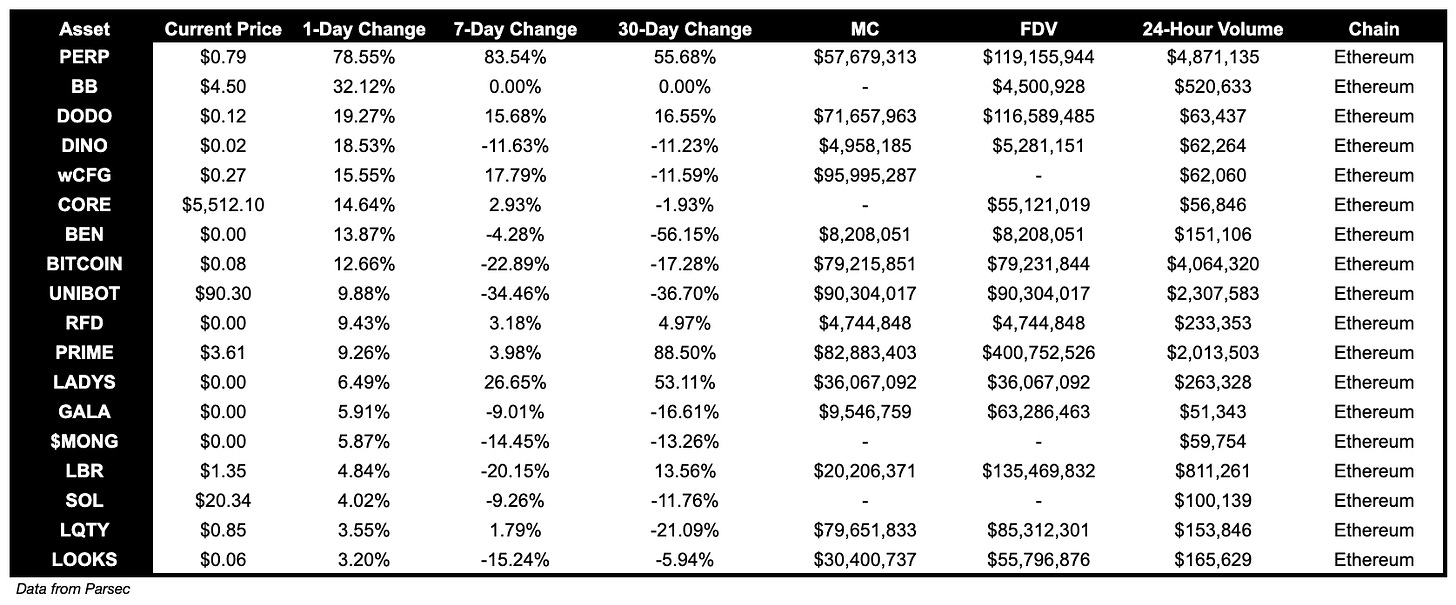

Below $100M MC by performance, on chain

PERP, up 78.55%, and BB, up 32.12%, performed well over the past day.

Above $100M MC by performance, on chain

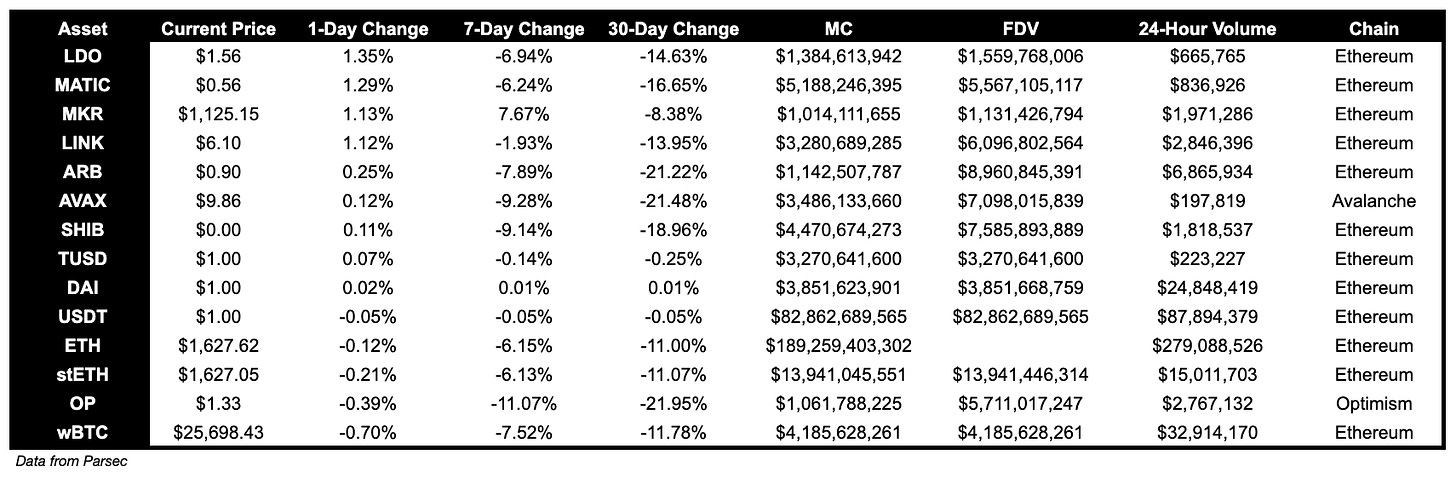

BLUR, up 5.28%, JASMY, up 5.10%, and SNX, up 3.79%, outperformed over the past day.

Above $1B MC by performance, on chain

LDO was the top performer over the past day for coins above $1B MC, and is up 1.35%, followed by MATIC, up 1.29%, and MKR, up 1.13%.

TVL

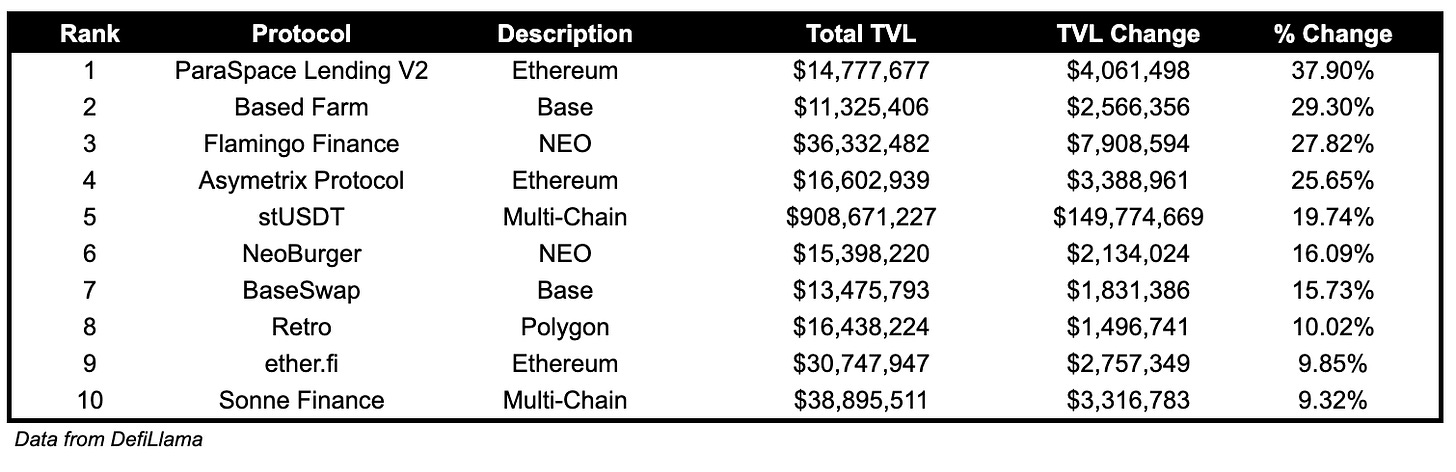

TVL Above $10M

Over the past day:

ParaSpace Lending V2, lending on Ethereum, TVL grew by 37.90%.

Asymetrix Protocol, yield on Ethereum, TVL grew by 27.82%.

stUSDT, multichain RWA, TVL grew by 19.74%.

Fees

Notably, Opensea Seaport fees earned are up 1512.28% and Aave V3 fees are up 1469.51%. Additionally, Convex Finance fees are up 101.20% over the past day as well.

Governance Proposals

Stargate Foundation 12-month Budget Proposal

Proposal for a 12-month budget (September 2023 - August 2024) based on an estimation of costs required by the Foundation. Total proposed is $1.8M.

[ARFC] Treasury Management - Replace AGD's DAI Allowance with GHO Allowance

Proposal to replace Aave Grants DAO's (AGD) DAI allowance with a GHO allowance. The AGD has $377,938.79 unclaimed DAI remaining.

MIP-27: Clarification of $BIT to $MNT migration policy and service

Proposal to pause the current on-chain migration smart contract and authorize the implementation a new migration smart contract or migration service that can restrict the automatic migratability of FTX Group’s $BIT tokens, pending the resolution of related issues.

MIP-26: [EC Proposal] Treasury Assets in Support of Applications

A proposal to deploy a portion of Mantle’s Treasury, which is currently valued at $3.3 billion ($2.6 billion consisting of MNT tokens), to support liquidity on applications deployed to the Mantle Network has been posted on the chains governance forum.

The cap for liquidity is set at a combined allowance of 60M USDx, 30k ETH, and 120M MNT for applications.

Seed Liquidity for RWA-yield Backed Stablecoins shall see a combined allowance of 60M USDx.

Liquidity Support for third party bridges will also see up to a combined allowance of 10M USDx, and 5k ETH

It is of note that the above allocations may overlap.

The effort will aim to provide a better experience for Mantle users by supplying a foundational layer of liquidity for the dapps to function and hopefully increase the appeal of the Mantle ecosystem as a whole.

[1IP-41] Stake $1M DAI to earn yield from DAI Saving Rate

Proposal to swap 1 million USDC to DAI through the PSM and then depositing the DAI into the DSR and minting sDAI directly.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.