Daily Notes 04-10-2023

Developments

The SEC’s motion to appeal to turnover the Ripple ruling, which found $XRP to not be a security, has been rejected. However, the SEC will still have the opportunity to appeal again after a trial on April 23rd 2024 that will attend to remaining issues in the matter.

31% of stake on the Solana network now runs through the Jito Labs validator client, which has only been live for 1 year and 2 months. The other 69% is staked through the original validator client launched by Solana Labs.

Blackrock Spot BTC ETF Predicted Approval Acceptance Date

Steven Schoenfield, an ex-blackrock Director, has estimated that the SEC will approve a spot BTC ETF within 3 to 6 months. Previously, Schoenfield estimated that the ETF would be approved in 9-12 months but due to the SEC losing in the Grayscale lawsuit, the abnormal preemptive delaying of BTC ETF applications recently and the SEC now asking for comments on the ETF, he has revised his estimate accordingly.

An OTC scammer has scammed $1 million of the $HyPC token. After selling on both the Ethereum and BNB networks, causing the price to crash by 60% at its lowest point, the scammer received a total $609,145.47 of $ETH and $BNB.

Trending Assets

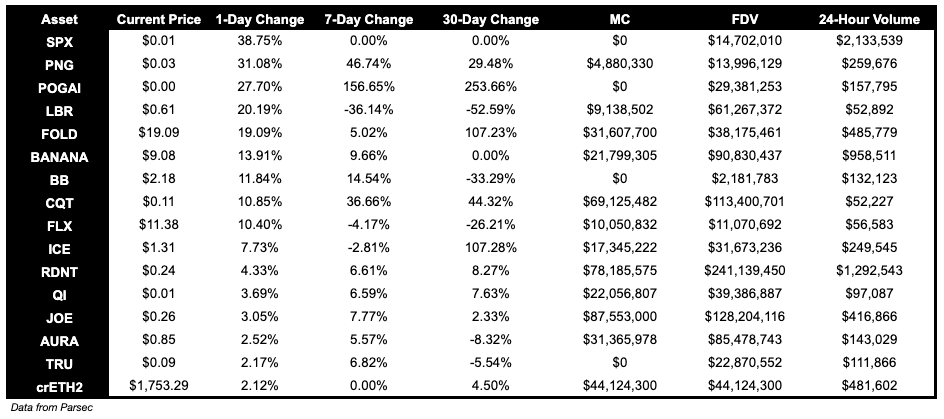

Below $100M MC by performance, on chain

SPX, up 38.75%, performed well today. LBR, up 20.19%, and BANANA, up 13.91%, similarly performed well.

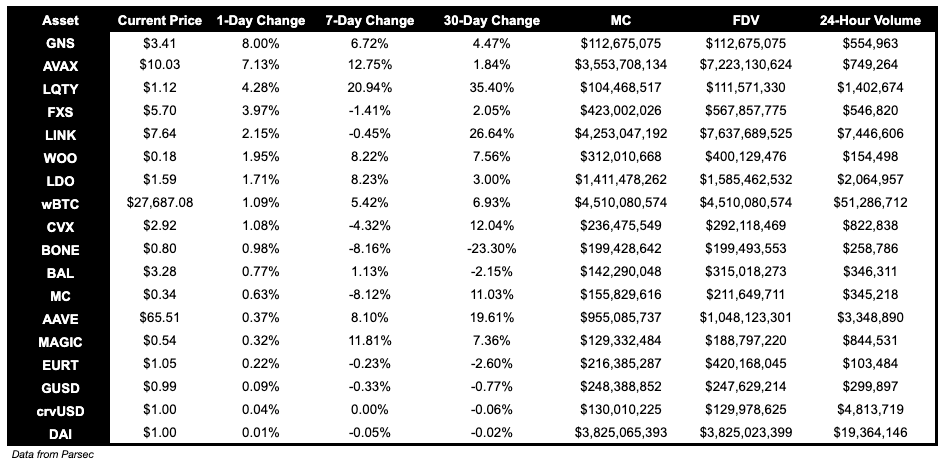

Above $100M MC by performance, on chain

GNS, up 8%, LQTY, up 4.28%, and FXS, up 3.97%, performed well over the past day.

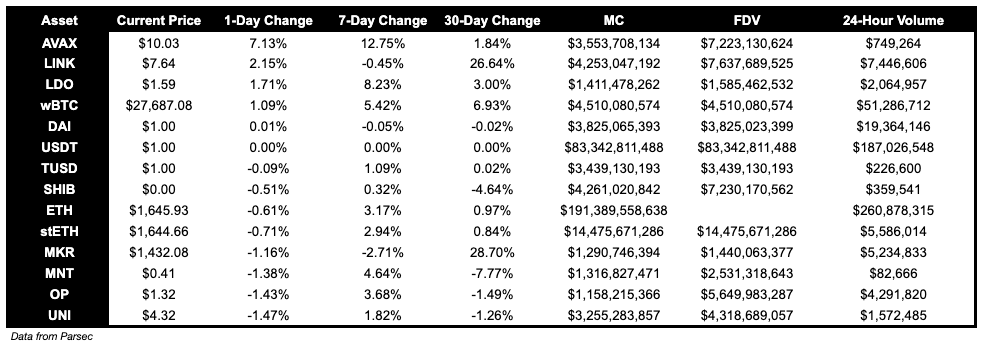

Above $1B MC by performance, on chain

AVAX, up 7.13%, performed well, following the popularity of Star Arena - an Avalanche SocialFi platform.

TVL

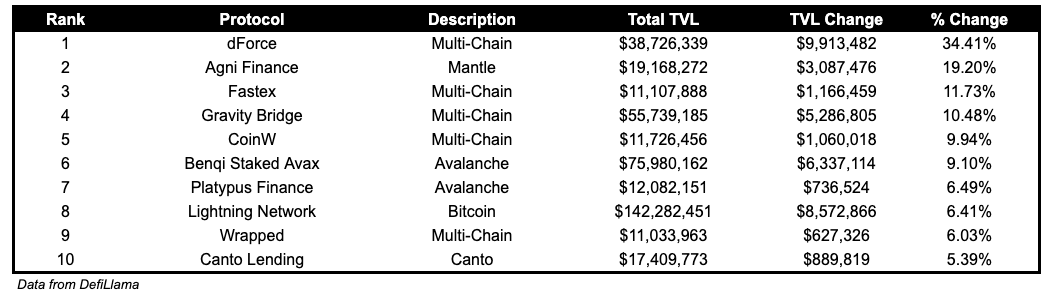

TVL Above $10M

Over the past day:

dForce, multichain lending, TVL grew by 34.41%.

Agni Finance, DEX on Mantle, TVL grew by 19.20%.

Gravity Bridge, bridge, TVL grew by 10.48%.

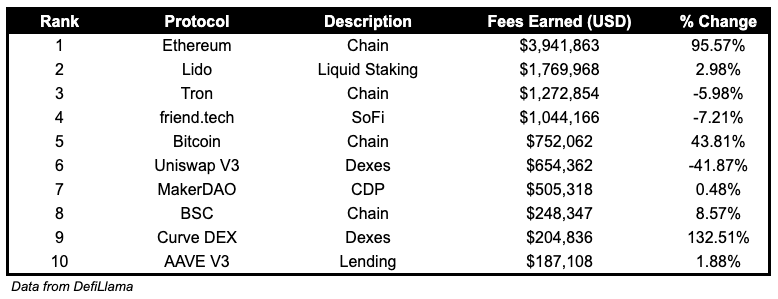

Fees

Notably, Ethereum fees earned are up 95.57% over the past day. Additionally, Curve fees earned are up 132.57% over the past day.

Articles / Threads

Y2K has launched their new UI.

Perennial has launched Perennial V2, where they’ve integrated Pyth On-demand Oracle system, have added support for complex order types and have redesigned their market structures. Additionally, Perennial V2 will be oracle agnostic, which will allow the launch of markets for NFTs, RWAs, and other long-tail assets.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.