Daily Notes 04-08-2023

Developments

Tether BTC Accumulation

Tether now ranks as the 11th largest holder of Bitcoin globally, with approximately $1.6 billion worth of the digital asset. In Q1 of this year, the stablecoin issuer disclosed its Bitcoin holdings, announcing plans to invest up to 15% of its profits regularly into Bitcoin. This move is part of its strategy to shift reserves from U.S. government debt to cryptocurrencies.

On-chain analysis shows this wallet matches up with Tether’s quarterly reported BTC holdings:

bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4

The stablecoin issuer now holds 55,020 BTC.

$10 Billion Cumulative ETH Burned

Since EIP-1559, a cumulative $10billion in ETH has been burned.

3Pool Weightings

USDT at 60% weighting in the 3pool, notably on much lower token inflows as 3pool liquidity continues to dwindle.

Frax Finance Move to Onboard T-Bills

To execute its FRAX v3 RWA asset strategy, Frax Protocol has posted a proposal with a potential mechanism to hold cash deposits and other low-risk cash-equivalent assets (including reverse repo contracts and treasury bills) using the FRAX stablecoin collateral. In order to onboard these assets Frax needs an offchain RWA manager. They have proposed to use FinresPBC.

FinresPBC facilitates the Frax Protocol's access to safe traditional financial assets on the blockchain without aiming for profits or charging fees, benefiting the public. Future plans include expanding traditional infrastructure and meeting Federal Reserve Master Account requirements.

Curve Exploiter Returns Funds

In three transaction batches, the Curve Finance exploiter refunded a total of 4,820 alETH and 2,258 ETH to the protocol, which amounts to approximately $12.7 million in returned funds.

Trending Assets

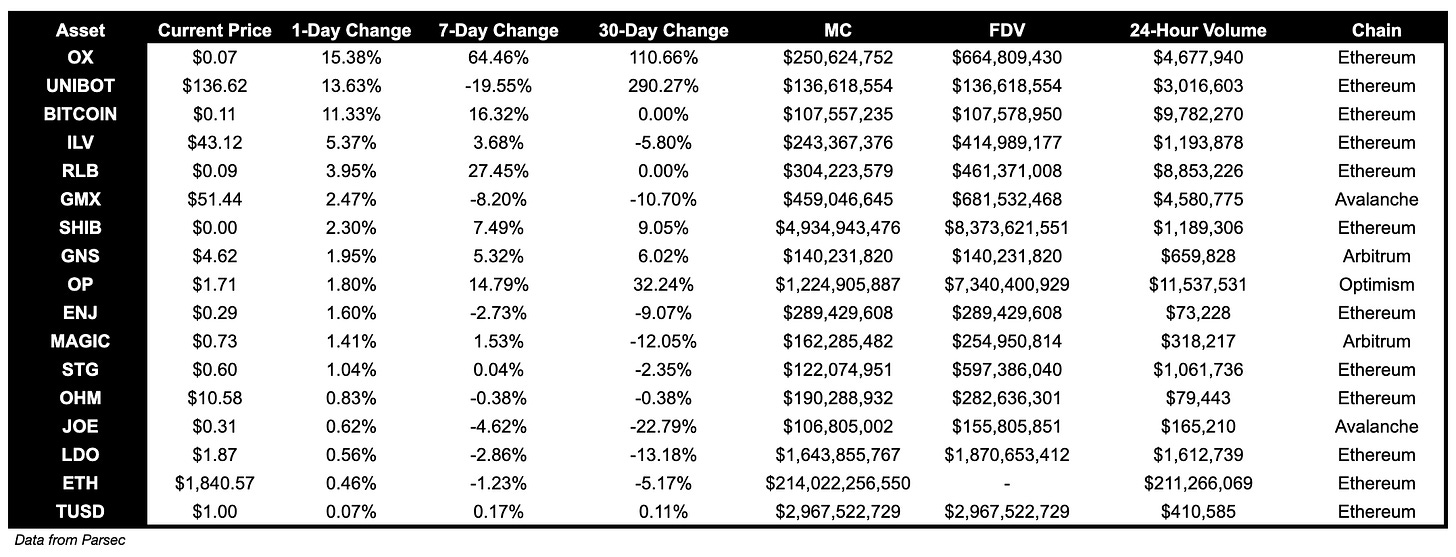

Top 300 Performers

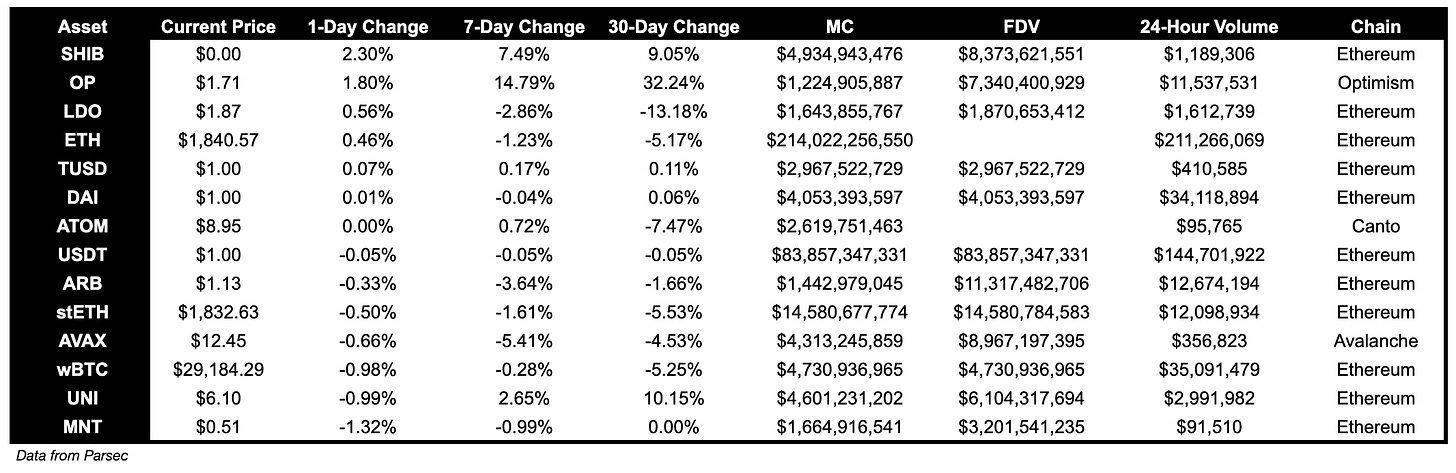

Top 300 Losers

Below $100M MC by performance, on chain

Top performer over the past day for coins below $100M MC is STFX, which is up 30.41%.

Above $100M MC by performance, on chain

OX, up 15.38%, UNIBOT, up 13.63%, and BITCOIN, up 11.33%, are the top performers over the past day for coins above $100M MC.

Above $1B MC by performance, on chain

SHIB, up 2.30%, is the top performer for coins above $1B MC.

TVL

TVL Above $10M

Over the past day:

Bancor V2.1, DEX on Ethereum, TVL grew by 19.97%.

Bancor V3, DEX on Ethereum, TVL grew by 17.59%.

Sushi Swap V3, multichain DEX, TVL grew by 14.54%.

Fees

Ethereum earned the highest fees today, at $5.92M, followed by Lido, $1.82M and Tron, $1.26M,

Articles / Threads

Trader Joe is now live on Ethereum Mainnet

Trader Joe has launched their concentrated liquidity AMM ‘Liquidity Book’ on Ethereum Mainnet.

Through their integration with Socket, Kwenta will now offer users use their interface to bridge to Optimism from Ethereum Mainnet, Polygon, Arbitrum & BSC rewards as OP tokens.

Aerodrome: Launch & Tokenomics

Aerodrome has announced their official tokenomics ahead of their launch on Base.

Allocation:

veAERO

Airdrop for veVELO Lockers: 200M (40%)

Ecosystem Pairs and Public Goods: 105M (21%)

Aerodrome Team: 70M (14%)

Protocol Grants: 50M (10%)

AERO Pools Votepower: 25M (5%)

AERO

Voter Incentives: 40M (8%)

Genesis Liquidity Pool: 10M (2%)

Vertex Protocol now supports stop-market orders, and will soon support all stop orders.