Daily Notes: 04-07-2023

Developments

DeFi 1.0

DeFi 1.0 coins have been top performers this past week, with names like COMP and MKR rallying 45%+ over the past week.

Hong Kong CBDC

A proposal has been put forward, urging the Hong Kong government to introduce its own stablecoin linked to the Hong Kong dollar. This stablecoin aims to compete with existing cryptocurrencies like USDT and USDC.

According to the proposal, the issuance of a government-backed stablecoin would have several benefits, including reducing transaction costs, enhancing payment systems, supporting the process of de-dollarization, and strengthening Hong Kong's fintech capabilities.

The paper presenting this idea is co-authored by prominent figures such as Wang Yang, the Vice Chancellor of the Hong Kong University of Science and Technology and Chief Scientific Advisor of the Hong Kong web3 Association, angel investor Cai Wensheng, BlockCity founder Lei Zhibin, and Ph.D. student Wen Yizhou.

crvUSD

crvUSD continues to grow at a rapid rate, closing in on $60 M in total supply. Notably, CVX is up 5.30% and CRV is up 3.10% over the past day.

OUSG Closes in On $200 Mil

OUSG, which are on-chain T-bills developed by Ondo Finance are closing in on $200 Mil in total supply.

These are the top individual holders:

0x1a8c53147e7b61c015159723408762fc60a34d17 - Institution with links to Amber

0xa661484f4b298a2ba1061379342e15366edfeb58

0xc09bd180ba12b837d4a0ca163025fb5f8f86d711 - Linked to analytico.eth

0x5ed4ebaf21f83959f81b7e7545e25d313c84081f

0xc9442e6eecd5389d73322e965cd3fa488aaeee20 - Linked to 1kx

STORJ

Storj, a decentralised storage solution token rallied 40% today, largely driven by large volumes through the Korean exchange Upbit.

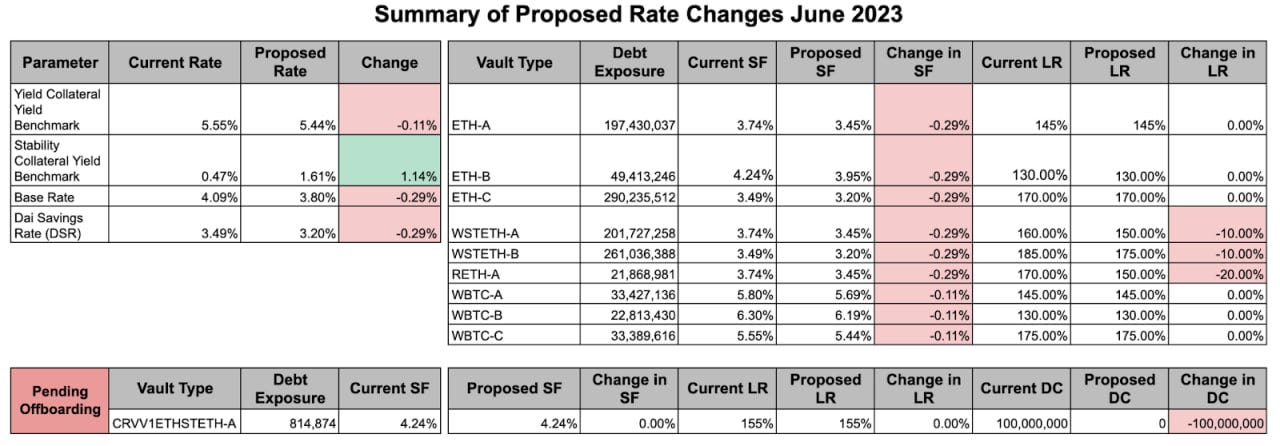

MakerDAO Proposal to Change Stability Scope Parameters

Maker is set to propose a reduction of the DSR from 3.49% to 3.19% in its upcoming executive vote.

Other changes include reducing Yield Collateral Yield benchmark from 5.55% to 5.44% and increasing the Stability Collateral Yield Benchmark from 0.47% to 1.60%

Trending Assets

Above $100M MC by performance

MKR, up 5.86%, CVX, up 5.30%, and CRV, up 3.10%, outperformed over the past day. Notably, CVX is up 14.55% and CRV is up 17.77% over the past week.

Above $1B MC by performance

AAVE, up 7.90%, is a top performer over the past day. It’s up 21.75% over the past week.

Trending Contracts

Nothing particularly notable in terms of trending contracts.

Stablecoin Netflows

Stablecoin Chain Flows

Polygon, Ethereum and BSC have seen notable stablecoin net inflows into their ecosystem, with Polygon receiving the most with $5.381M. Avalanche has stablecoin outflows of -$1.253M over the past day.

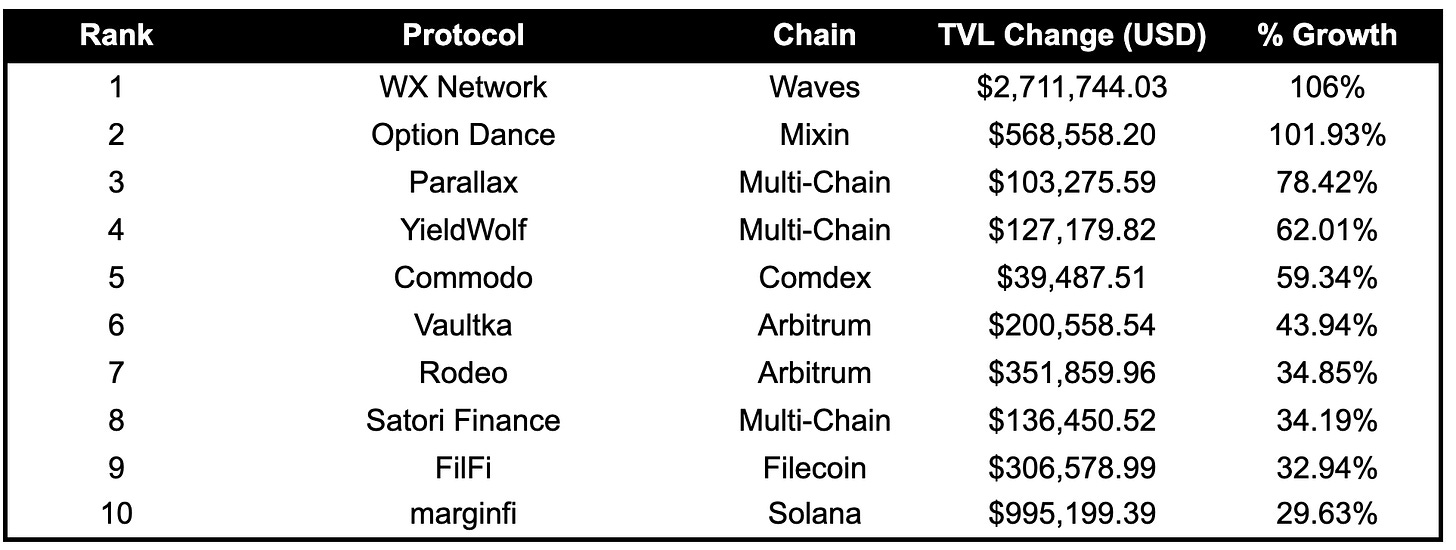

TVL

TVL Top Gainers

Nothing of note in TVL changes today.

Governance Proposals

MIP18 - List cbETH as collateral to AaveV3-ETH Optimizer

Proposal to list cbETH as collateral asset on the AaveV3-ETH Optimizer.

Stader DAO Treasury Diversification & Active Management

Proposal to diversify assets in the following manner:

USDC 36%

BTC 20%

ETH 12%

DAI/ LUSD 8%

USDT 8%

Ondo Finance US Treasuries 8%

Fiat for Working Capital 8%

Proposal to:

Distribute a total of 1M $MORPHO;

Focus rewards distribution on markets where peer-to-peer matching is activated;

Emphasize the distribution of rewards on the supply side in WETH markets, as opposed to the borrow side.

Articles / Threads

On June 12th, the STFX DAO passed SIP-005: Liquidity Reduction to reduce 25% of liquidity from both Ethereum and Arbitrum STFX/ETH Uniswap pools.

After SIP-005, SIP-006: Proposed STFX Token Burn was proposed to either burn STFX or deliver it back to treasury. DAO passed to burn.

Yesterday, first STFX burn event took place. $10.3M was burned (1.03% of total STFX supply and 3.4$ of circulating STFX supply).

yETH: LSD Lobbying season is now open

Yearn announces that they are launching the the bootstrapping phase to launch yETH.

The bootstrapping phase will consist of three stages:

Whitelisting for LSD protocols

Deposit and Incentives

Voting