Daily Notes 03-10-2023

Developments

Rollbit just announced they are bringing their buyback and burn scheme fully on-chain. In the past 2 hours, rollbot.eth purchased 255,252 RLB tokens ($38k) before sending 229,727 RLB to the burn address via a Rollbit Hot Wallet.

Celsius could potentially restart under the name “NewCo” which would see the distribution of $2.3 billion of $BTC and $ETH to Celsius customers as well as NewCo Stock start before the end of 2023.

If approved, NewCo would also be seeded with up to $450 million in Crypto and plan for its future stock to be listed on the NASDAQ. Fahrenheit LLC, who will manage NewCo, has also committed to inject up to $50 million in exchange for an equity stake in the company.

A reported 95% of creditors have shown support for the plan. Notably, $4.7 billion of customer assets were lost in Celsius’ bankruptcy so the $2.3 billion to be distributed would cover slightly under 50% of user assets.

Optimism is piloting its fault proof system on the Optimism Goerli Testnet. OP’s fault proof (aka fraud proof) system will allow developers to implement or build any fraud proof system they would like.

For example, this means that zero knowledge proofs among other types could now be used on an optimistic rollup thanks to the creation of Cannon, Optimism’s Fraud-Proof Virtual Machine (FPVM). This innovation allows for further diversity within rollups promoting decentralisation across the Optimism Superchain.

Ethereum Layer 2 StarkWare delays first token unlocks to April 2024

StarkWare, who is building Starknet, has delayed the first tranche of $STRK token unlocks from November 29th 2023 to April 15th 2024.

The tokens in the first unlock belong to employees at StarkWare, core contributors of the chain and early supporters of the Starkware ecosystem.

Trending Assets

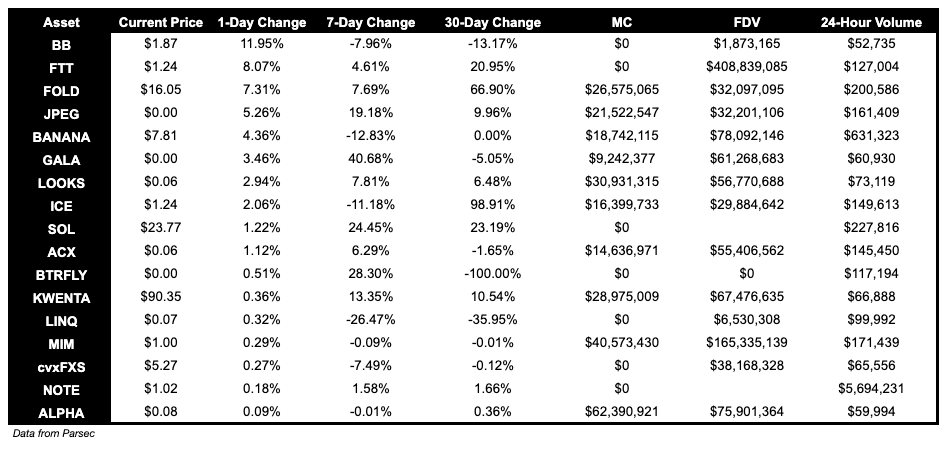

Below $100M MC by performance, on chain

BB, up 11.95%, FTT, up 8.07%, and FOLD, up 7.31% were top performers for tokens below $100M MC over the past day.

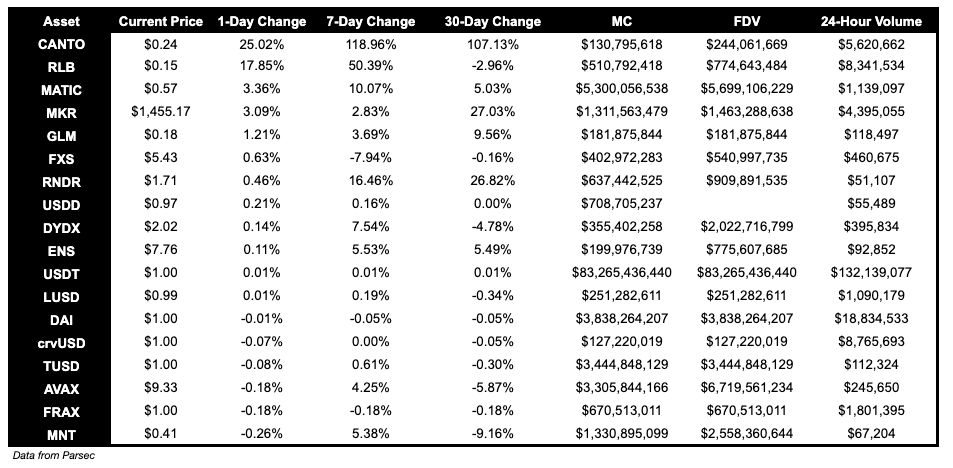

Above $100M MC by performance, on chain

Canto is up 25.02% over the past day, and notably is up 118.96% over the past week. RLB is up 17.85%, following their on-chain RLB buyback today.

Above $1B MC by performance, on chain

MATIC performed well today, is up 3.36%. MKR, up 3.09%, continues to show strength.

TVL

TVL Above $10M

Over the past day:

Helix, DEX on Injective, TVL is up 28.30%.

Range Protocol, multichain liquidity manager, TVL is up 10.15%.

Canto Lending, lending on Canto, TVL is up 7.23%.

Fees

Notably, GMX V1 fees earned are up 93.23%, following volatility over the past few days. Similarly, Uniswap V3 fees earned are up 53.81%.

Governance Proposals

[AIP-90] Deploy Alchemix on Arbitrum

Proposal to launch Alchemix on Arbitrum with a partnership with Ramses DEX.

Articles / Threads

Pirex ETH is Live on Ethereum Testnet

Redacted Cartel has launched Pirex ETH (pxETH) on Ethereum Goerli testnet, bringing them one step closer to launching Dinero, their stablecoin collateralized by ETH.

Thena is integrating Chainlink CCIP on BNB Chain and Polygon mainnets to enable cross-chain transfers of THENA’s native token, THE.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.