Daily Notes: 03-08-2023

Developments

Ondo Finance launched USDY, a tokenized note secured by US Treasuries and bank deposits. USDY pays holders a yield, initially 5% APY. This is an addition to their Short-Term US Government Bond Fund (OUSG) which now has a total TVL > $150 Mil.

GMX launch their highly anticipated v2 product. The product offers isolated GLP-like pools for assets to segregate risk. v2 allows users to trade more alts with half the maker and take trading fees as before in v1. However, a skew-based funding rate is included in v2 trades.

The current asset for trade are:

SOL, ARB, DOGE, XRP, LTC, UNI, LINK, BTC & ETH

Arbitrum Permissionless Validation

In their current state, Arbitrum One and Nova employ permissioned validation (fraud proof contestation) to counteract denial-of-service risks in their dispute protocols.

However, Offchain Labs announced BOLD (Bounded Liquidity Delay) today. BOLD makes validation of Arbitrum chains safely permissionless.

BOLD enables:

Fixed upper bounds on confirmation times for Optimistic Rollups’ settlement

Ensures a single honest party in the world can win against any number of malicious claims

Aave Proposes Purchase CRV Tokens

A proposal is live on Aave to buy CRV tokens using $2M USDT from the Aave DAO treasury .

This acquisition would simultaneously support the DeFi ecosystem whilst benefiting GHO secondary liquidity, strengthening their position in the Curve wars. The proposal requests an exceptional "Direct-to-AIP" process due to its time-sensitive nature.

Espresso Team’s Shared Sequencer Findings

Espresso team’s findings conclude that sequencers can enable complex features like flash loans, by ensuring transactions across different rollups are sequenced together, despite not guaranteeing atomic execution.

By utilizing a specialized "Bank" contract and crypto-economic incentives, this approach offers new opportunities for interoperability in the crypto space, but with limitations such as dependency on specific contracts and additional fees.

Base Network Public Access Launch

Coinbase announced that they will launch Base for public access on the 9th of August. An official Ethereum bridge is already live, allowing token movement between Ethereum mainnet and Base. The upcoming public release will include collaborative events and the introduction of NFT functionalities such as cb.id crypto usernames on the Coinbase Wallet.

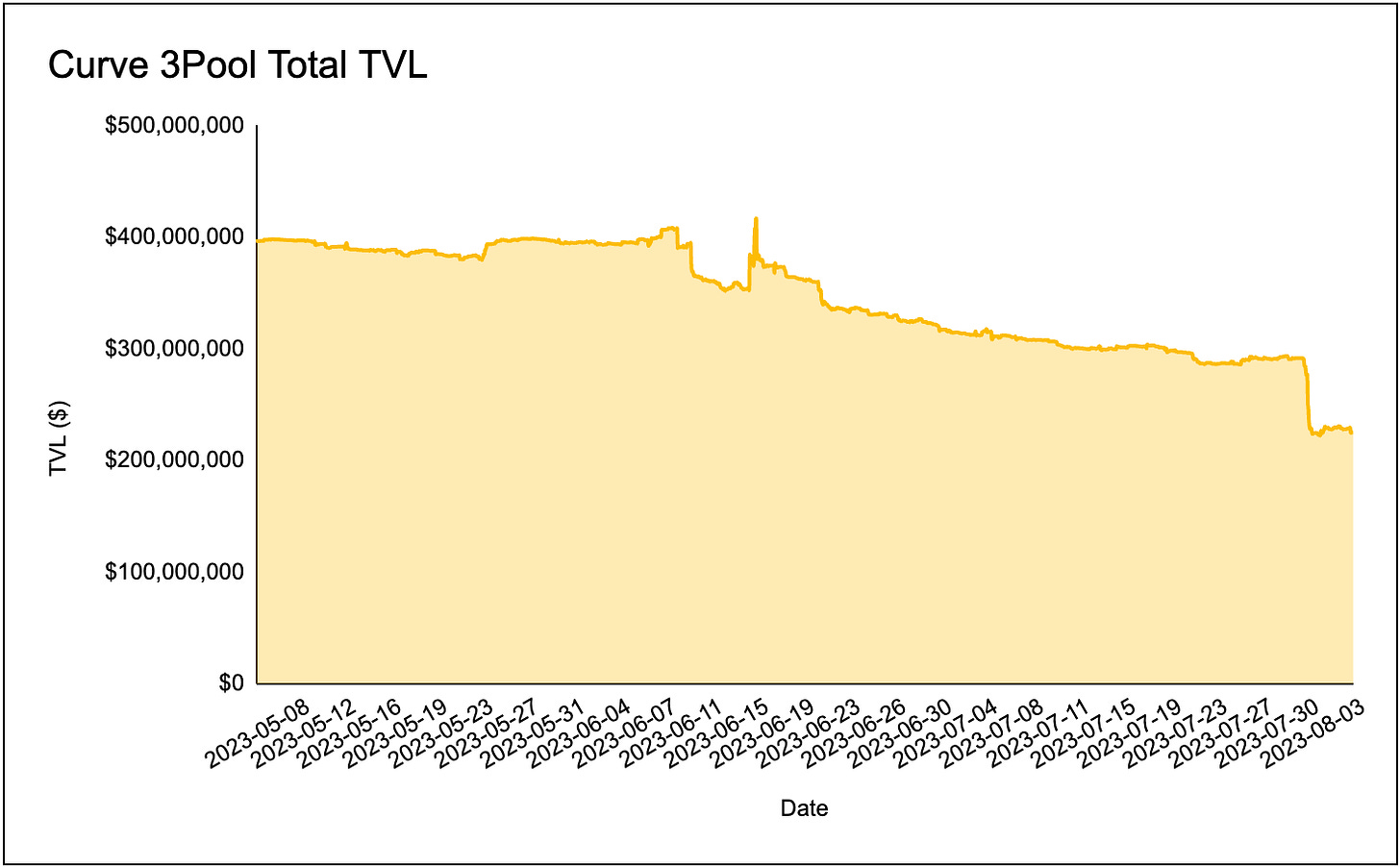

Curve Update

Curve TVL is increasing several days post exploit, and has emerged back above $2B. The 3pool however still remains low in TVL having lost almost half it’s TVL since May of this year.

The 3pool weighting have also skewed greatly toward USDT in the past couple of days, with USDT representing 61% of the pool. This could signal news / events related to Tether is soon to come out - similar to what we saw in June with the

Coinbase released their earnings for Q2, reporting a revenue of $707.9 million, surpassing the estimated $662.5 million. After hours, COIN jumped 10% higher on the news.

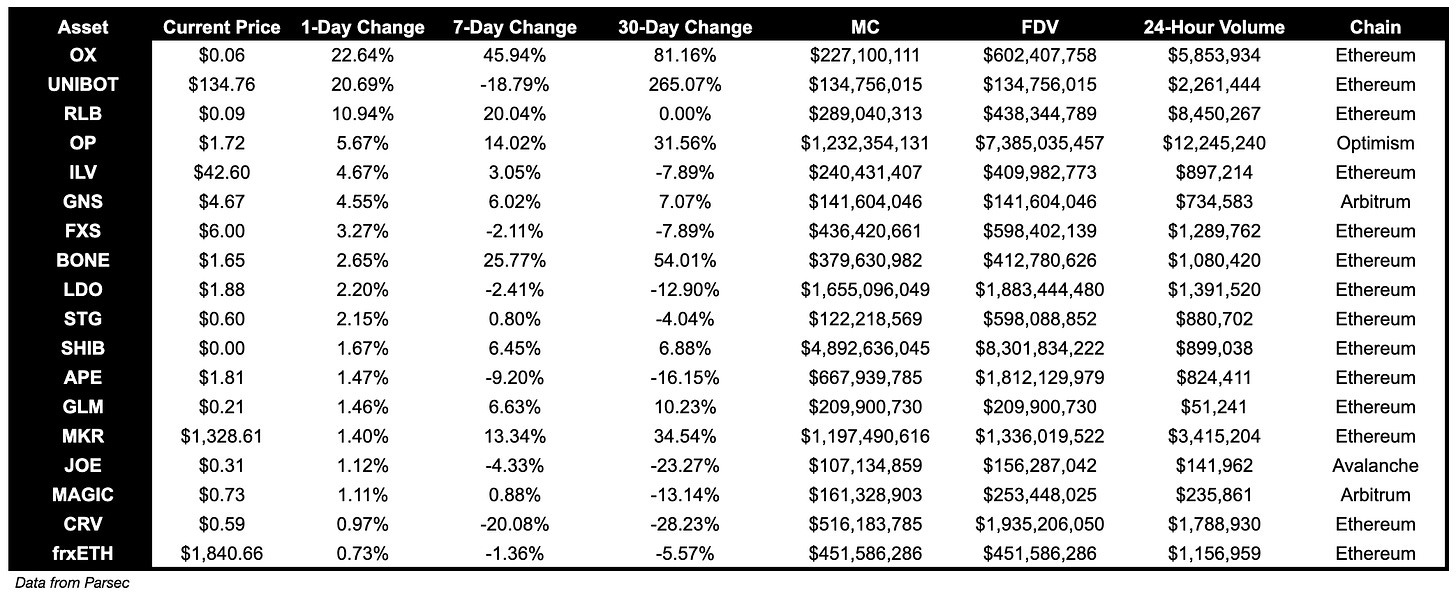

Trending Assets

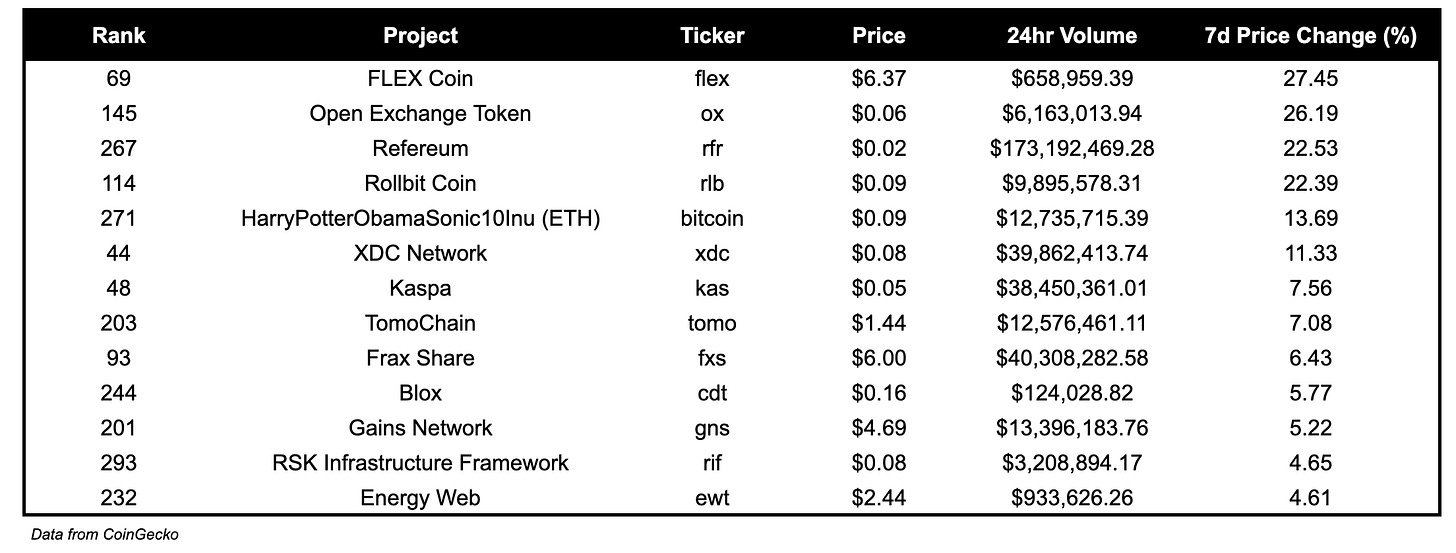

Top 300 performers

OX, RLB & BITCOIN were top performers today, all gaining > 13%.

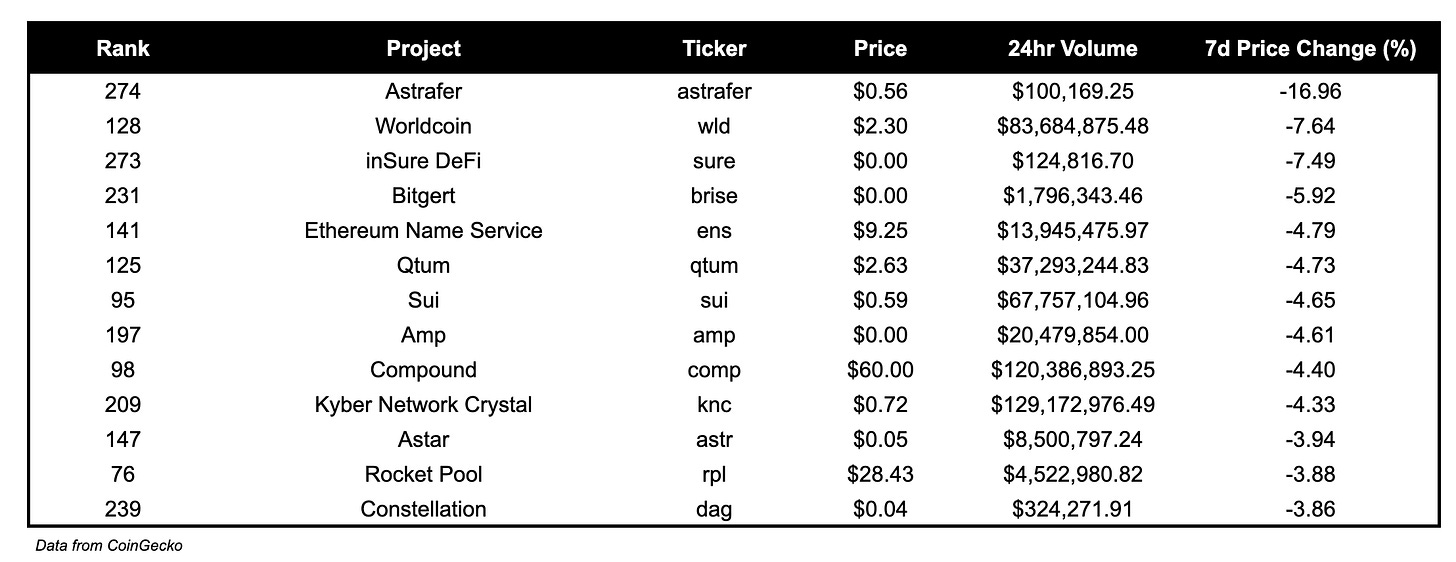

Top 300 Losers

Worldcoin lost ~8% on the day after news it would be banned in Kenya, one of the countries that had the most sign ups.

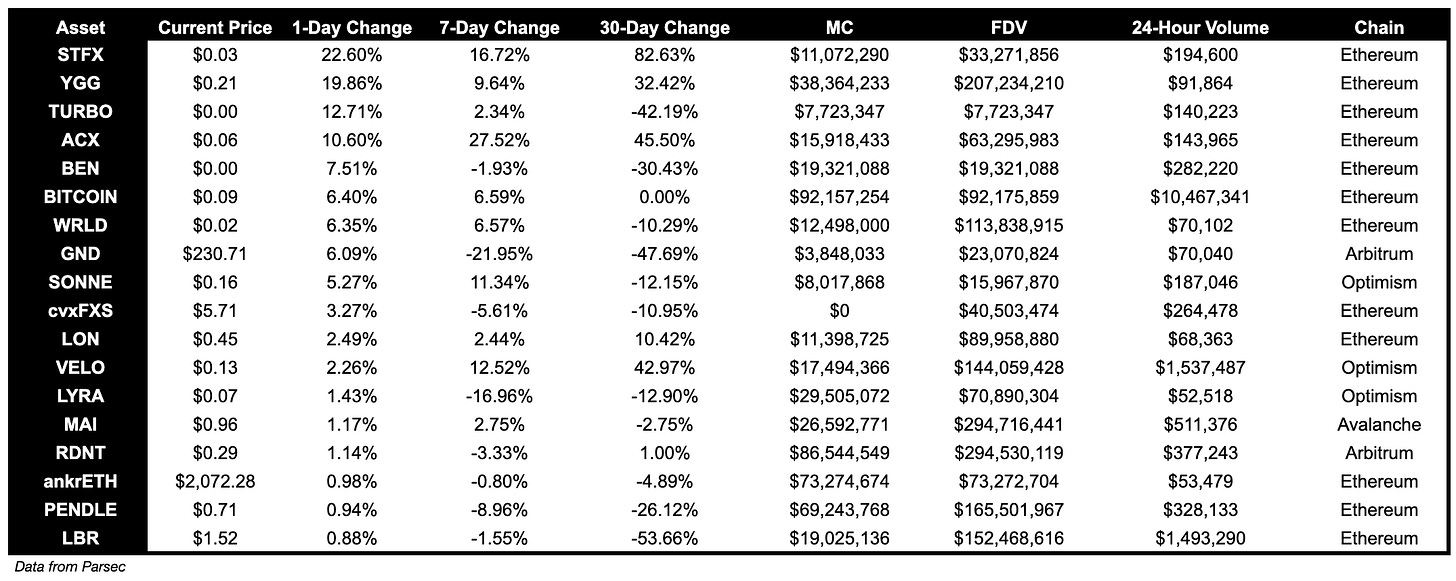

Below $100M MC by performance, on chain

STFX, up 22.60%, is the top performer over the past day, followed by YGG, up 19.86%. Notably, STFX recently announced a copy-trading Telegram bot implementation.

Above $100M MC by performance, on chain

OX, up 22.64%, UNIBOT, up 20.69%, and RLB, up 10.94% are the top performers over the past day.

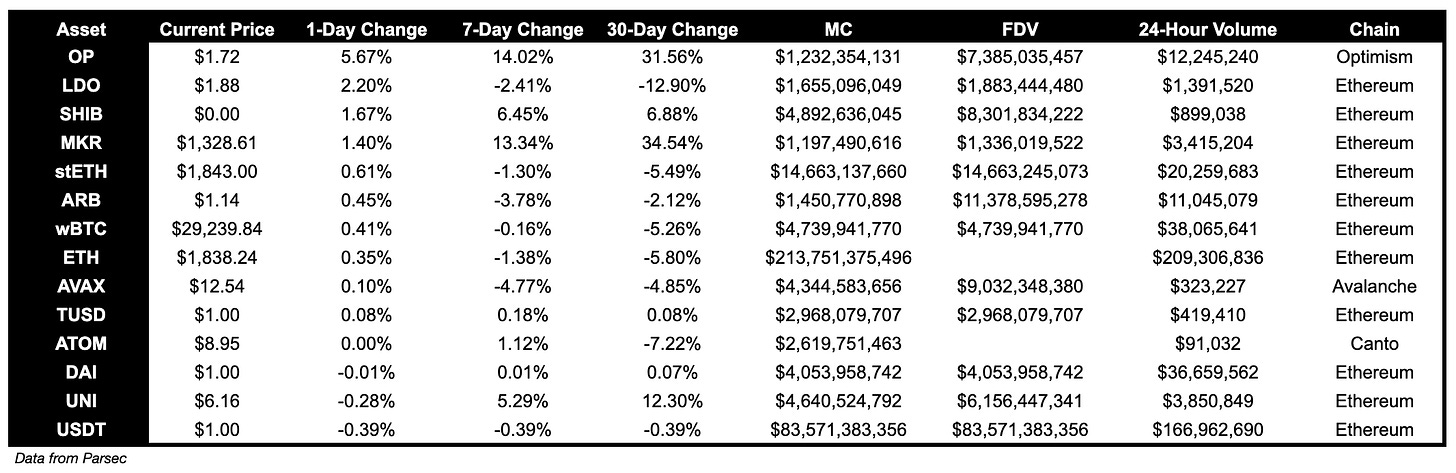

Above $1B MC by Performance, on chain

OP, up 5.67%, is the top performer for assets above $1B MC on chain.

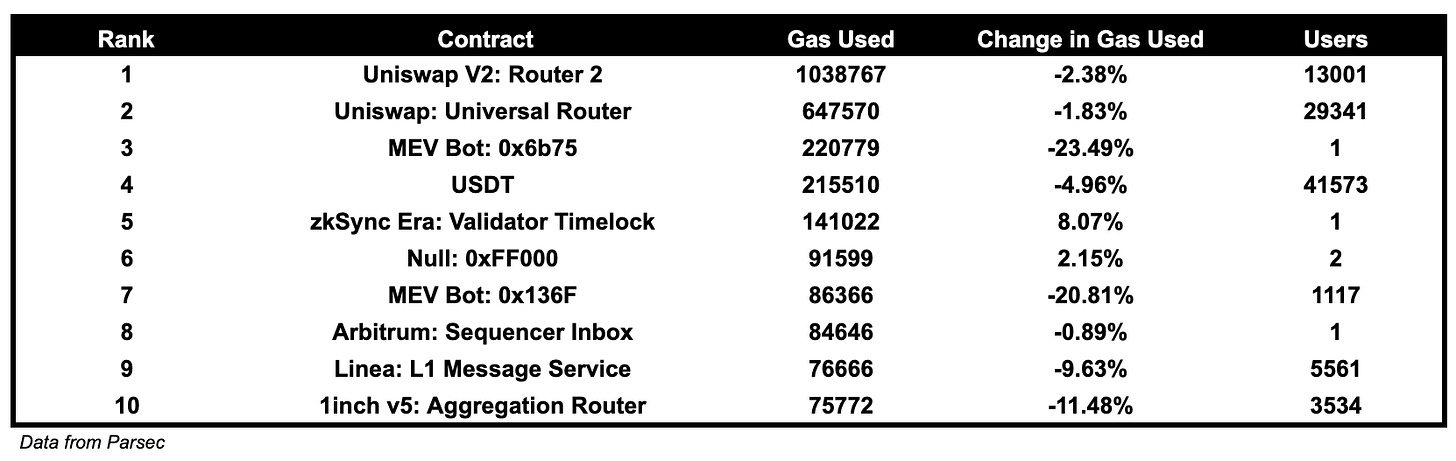

Trending Contracts

Nothing particularly notable in terms of trending contracts.

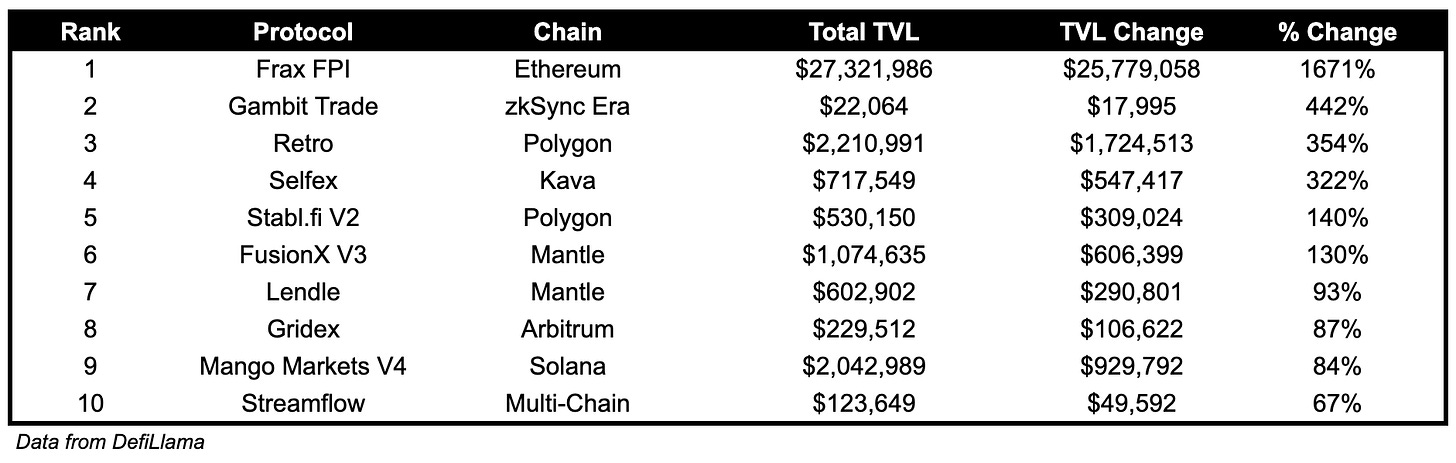

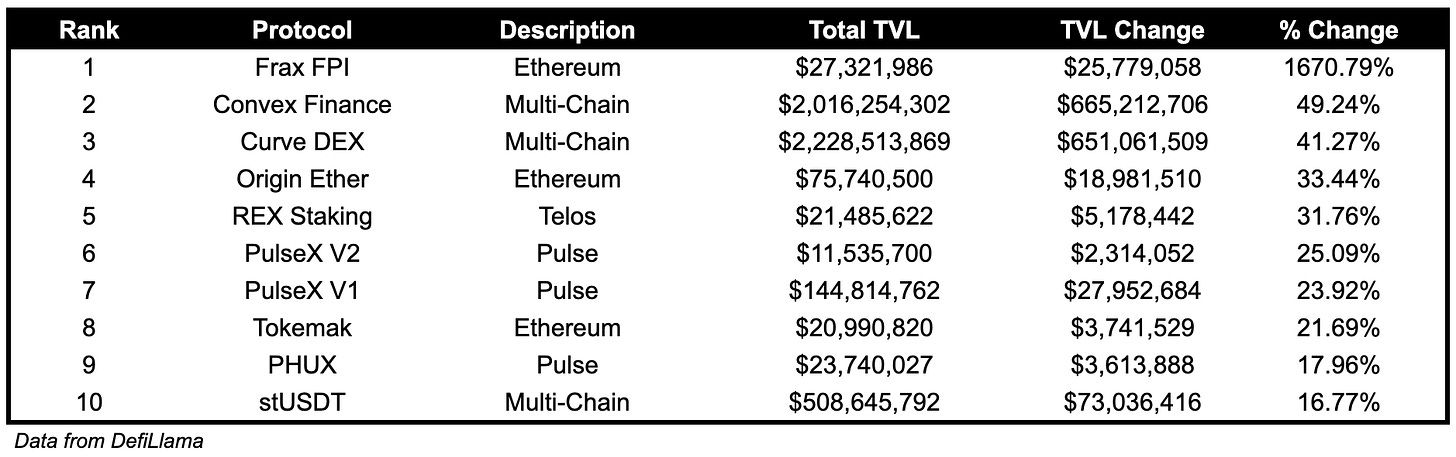

TVL

All

Over the past day:

Frax FPI, multichain stablecoin, TVL increased 1671%.

Gambit Trade, perpetual DEX on zkSync, TVL increased by 442%.

FusionX, DEX on Mantle, TVL grew by 130%.

TVL Above $10M

Over the past day:

Convex Finance, meta-governance for Curve, TVL increased 49.24%.

Curve, multichain stableswap, TVL increased by 41.27%%.

FusionX, DEX on Mantle, TVL grew by 130%.

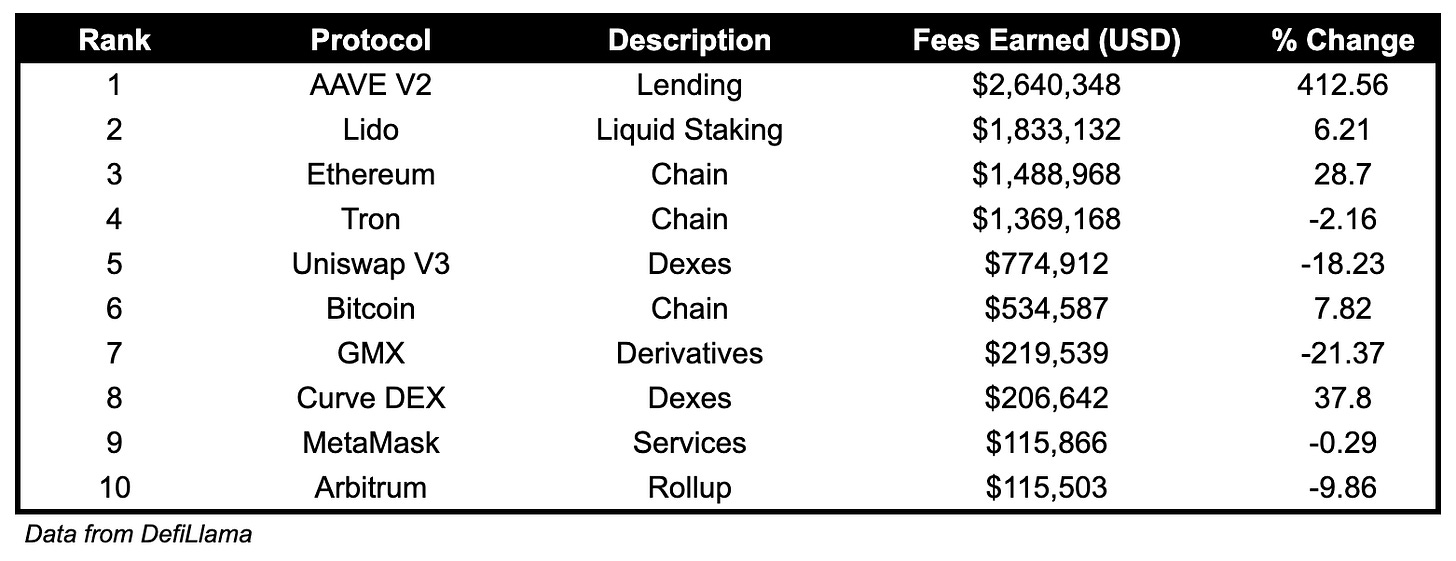

Fees

Aave V2 has earned the highest fees over the past day, at $2.64M. This is 412.6% higher compared to the previous day.

Additionally, Arbitrum is the 10th highest fee earner over the past day, at $115.5K earned.

Governance Proposals

#AIP: 13.6 - Adjustment in Interest

Proposal to apply collateral-based interest to both CRV cauldrons. Given the current outstanding principal is $12.5M, the base interest rate would be 150%.

Lido - April Slashing Incident: Key Limit Follow-up

In April 2023, a slashing occurred involving validators operated by the RockLogic GmbH. Proposal is to see if RockLogic GmbH can resume increasing their validator count.

[AIP-41] Replenish the Aura Ecosystem Fund

Proposal to replenish the Aura Ecosystem Fund (AEF) with a grant of 600K AURA.

Articles / Threads

Trader Joe has launched on-chain limit orders. Users can set automated buy or sell orders that execute with no fees or price impact. The on-chain limit orders will allow:

No reliance on external oracles

Your trades have perfect execution

Swaps with no additional fees or price impact

Complete decentralization ‘on-chain’ execution

Vertex partners with Toa Capital Partners

Vertex has partnered with Toa Capital to provide deeper liquidity on the exchange. Toa will act as a market maker on Vertex.

Protectorate development team has been working on deploying PRTC vesting contracts (which should launch this week), development of V1 and launch of flagship product NFT Capsule and oPRTC (claiming & exercising).

Perennial has launched a dedicated interface for Maker’s and LPs. LPs can pick between simplified Earn page or advanced Make page.

$WLD is live on Synthetix Perps

Synthetix is launching $WLD perpetual futures for leverage trading.