Daily Notes: 01-08-2023

Developments

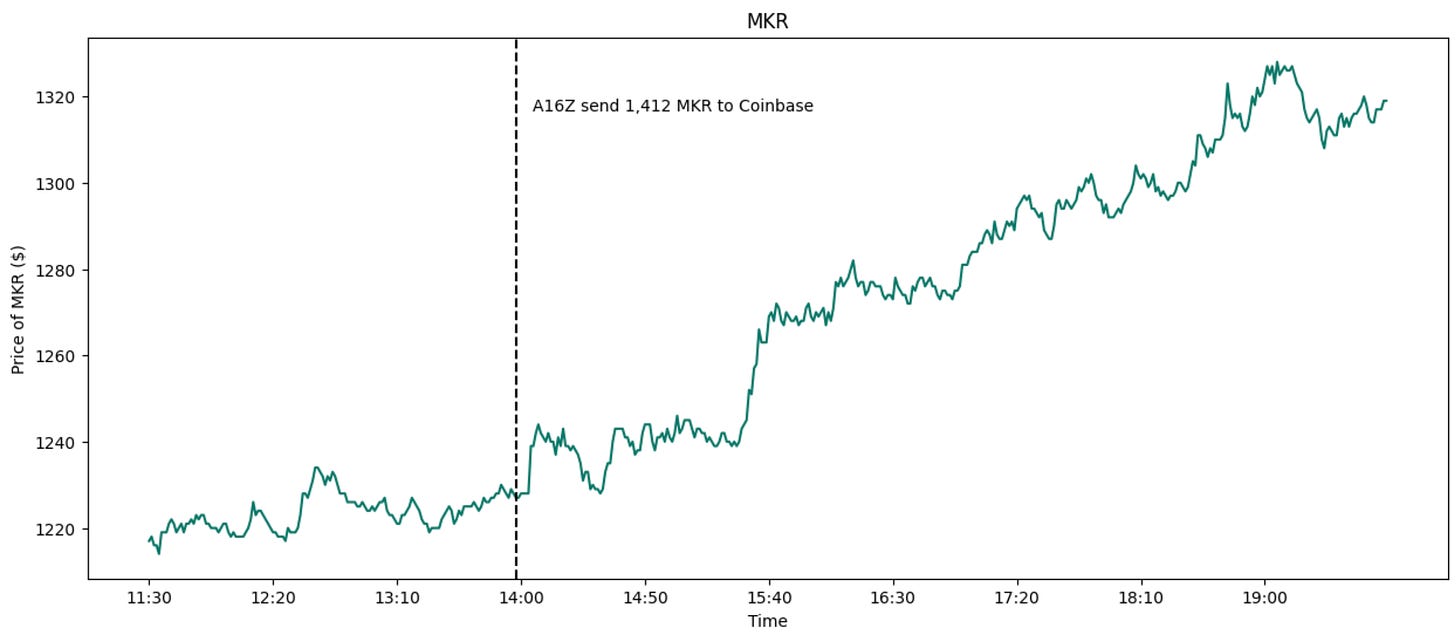

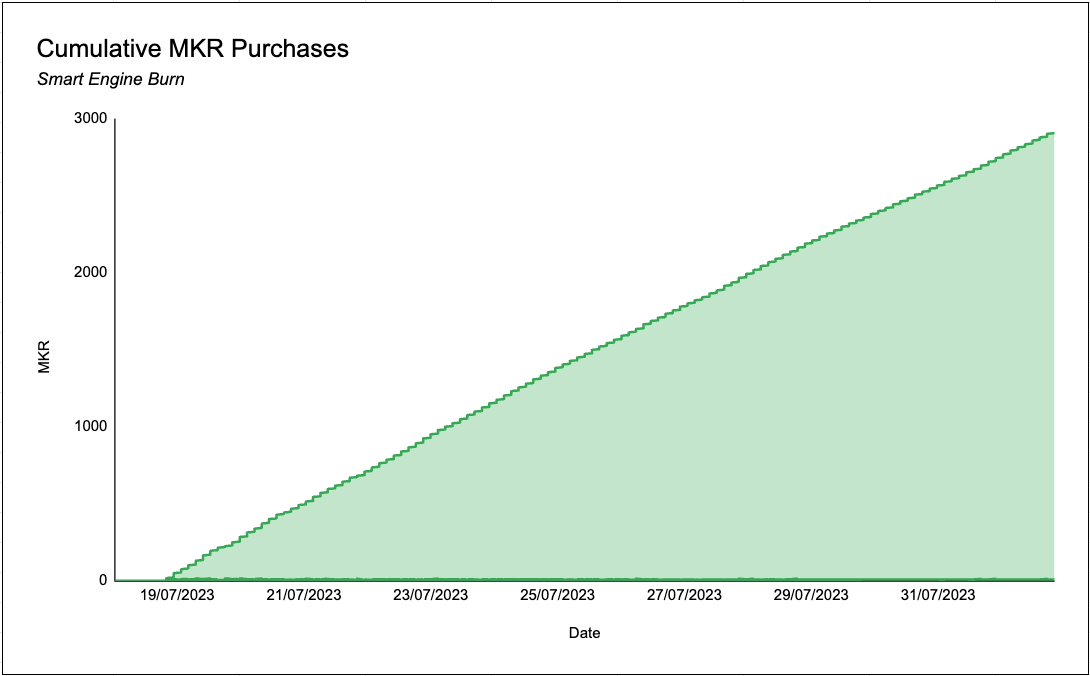

A16Z Maker Position

A16Z sent another 1,412 clip of MKR to Coinbase today. They now have 4,234 MKR left to sell, which judging by historical action would be 2-3 days left of selling. Despite the sales, MKR still rallied throughout the day. Part of this sell pressure from Paradigm & A16Z is being absorbed by the smart engine burn which has now accumulated and LP’d 2900 MKR.

Curve Founder OTC’d CRV tokens

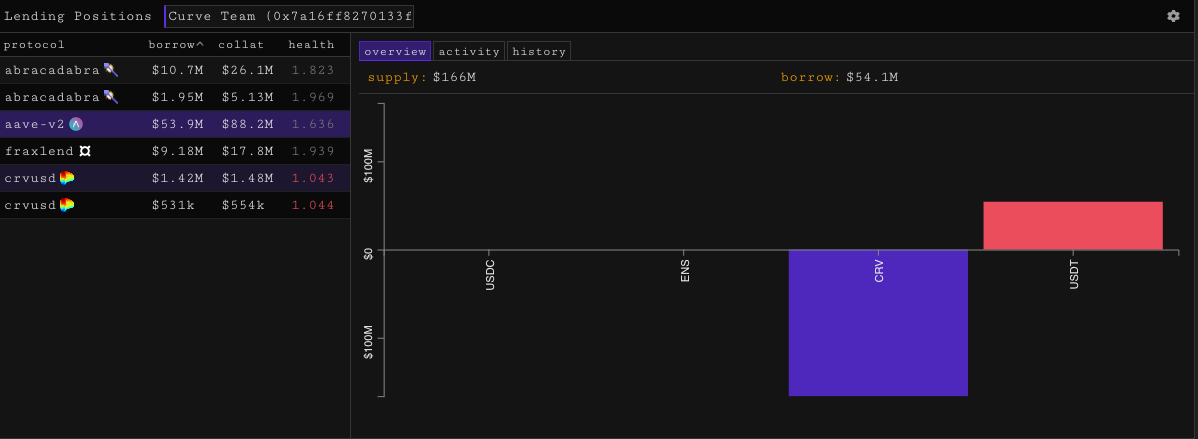

Curve Founder Michael Egorov has sold CRV tokens 5M CRV to Justin Sun, 4.25M CRV to DCF GOD, 3.75M CRV to Machi Big Brother 2.5M CRV to DWF Labs and 2.5M CRV to Cream Finance.

Egorov has sold a total of 39.25M CRV via OTC and has received 15.8M USDT. After paying down his loans, Egorov has managed to reduce his liquidation price to approximately $0.36 on Abracadabra and Aave, and $0.29 on Fraxlend.

Sei and CyberConnect join Binance Launchpool

Sei, an L1 built using Cosmos SDK, and CyberConnect, a social network protocol, have joined Binance’s Launchpool. Users can stake BNB, TUSD and FDUSD to farm SEI and CYBER.

According to a lawyer representing the bankrupt firm, Voyager Digital Holdings Inc. potentially faced a hack of user data as it reopened its crypto platform to allow customers to retrieve their funds during a court-supervised liquidation process.

FTX has confirmed plans to restart the exchange in a plan filing.

Microstrategy acquire 467 Bitcoin

In July, Microstrategy acquired an additional 467 BTC for $14.4M and now holds 152,800 BTC.

Aerodrome announced that they will launch following the public launch of Base, Coinbase’s L2, and will release news of their tokenomics this week.

Leetswap Exploit / Sushi Launches on Base

LeetSwap, DEX on Base and Canto, was exploited for 340 ETH, worth approximately $628K.

Sushi has launched their DEX on Base with pools live for ETH/axlUSDC and BALD/ETH.

dYdX Shifting from LP Rewards to Market Maker Rebates Gains Early Support

dYdX proposal to increase market maker rebate from 0.5bps to 0.85bps, and reduce the per-epoch LP rewards by 50% from 1,150,685 DYDX/epoch to 575,342.50 DYDX/epoch has gained a lot of early support.

Trending Assets

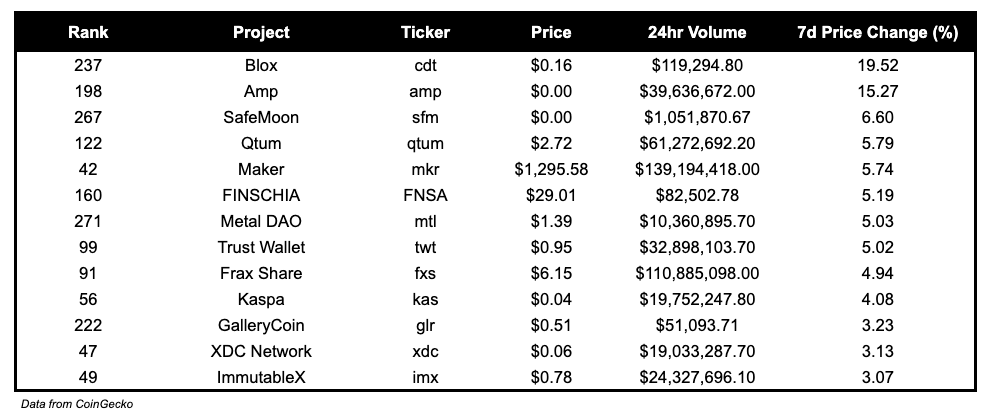

Top 300 performers

Top 300 Losers

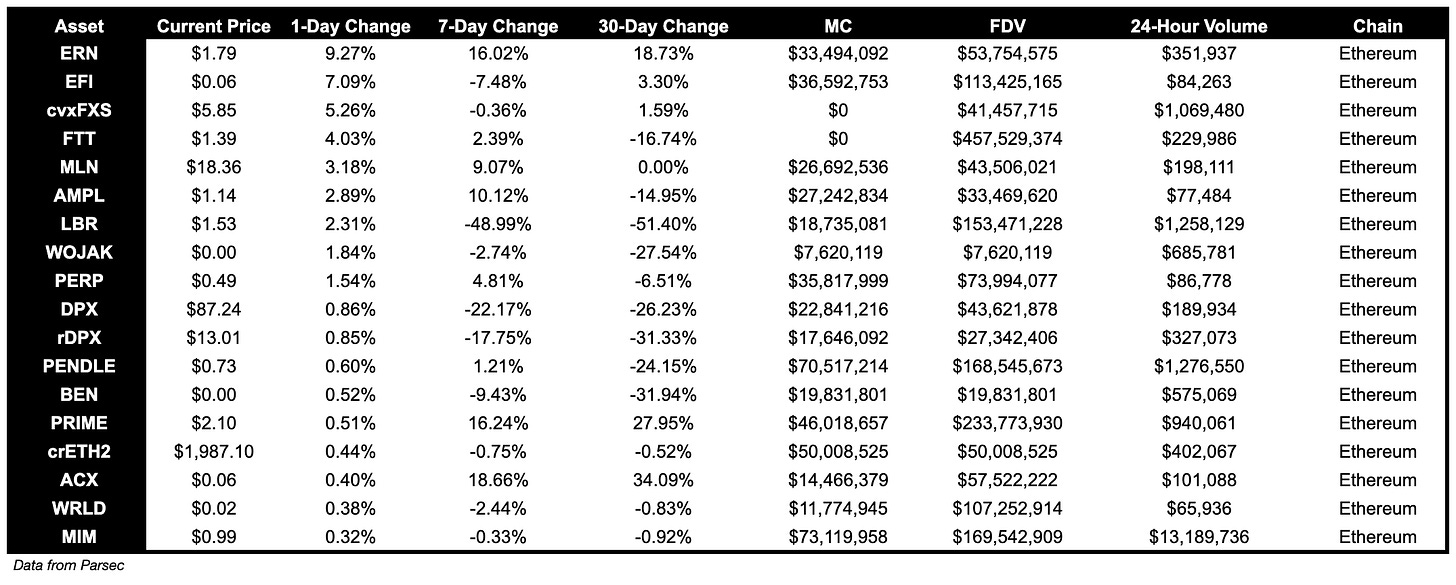

Below $100M MC by performance, on chain

Notable coins under $100M MC that have performed well are FTT, up 4.03%, LBR, up 2.31% and PERP, up 1.54%.

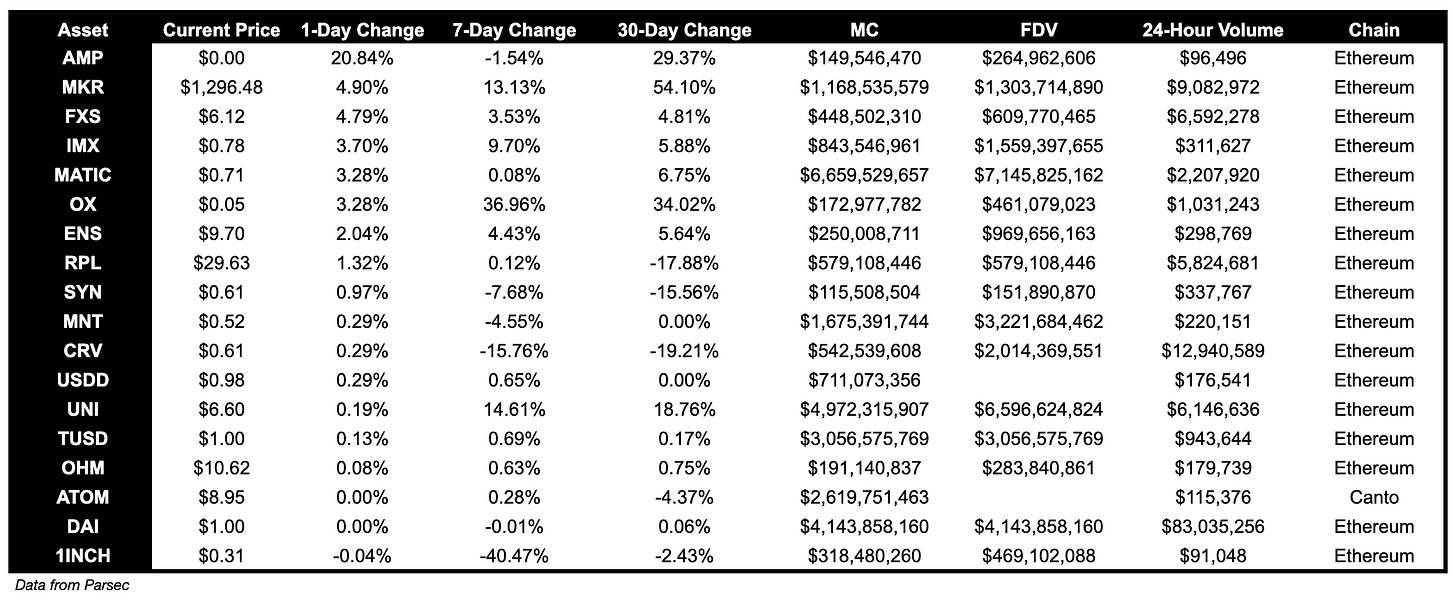

Above $100M MC by performance, on chain

AMP, up 20.84%, is the top performing coin above $100M MC over the past day, followed by MKR, up 4.90% and FXS, up 4.79%.

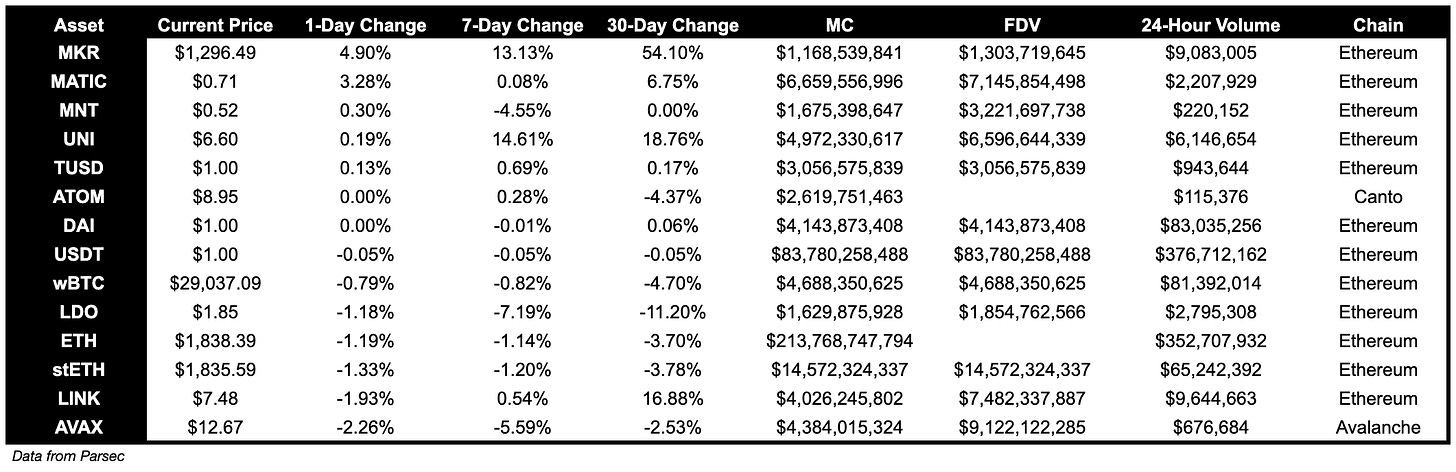

Above $1B MC by performance, on chain

MATIC, up 3.28%, is the second best performing coin above $1B MC, after MKR.

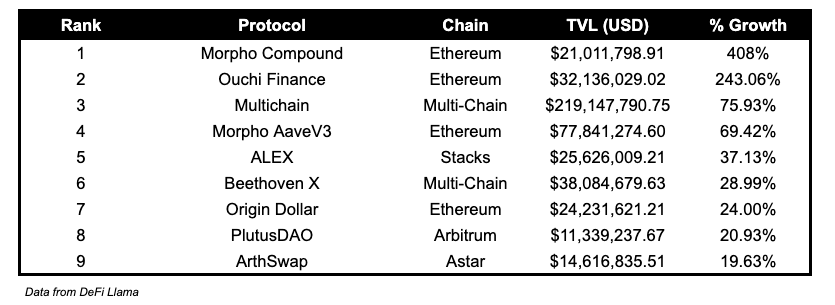

TVL

Above 10M TVL

Morpho Compound, optimizer for Compound on Ethereum, TVL grew by 408% today.

Morpho Aave V3, optimizer for Aave on Ethereum, TVL grew by 69.42%.

ALEX, DEX on Stacks, TVL grew by 37.13%.

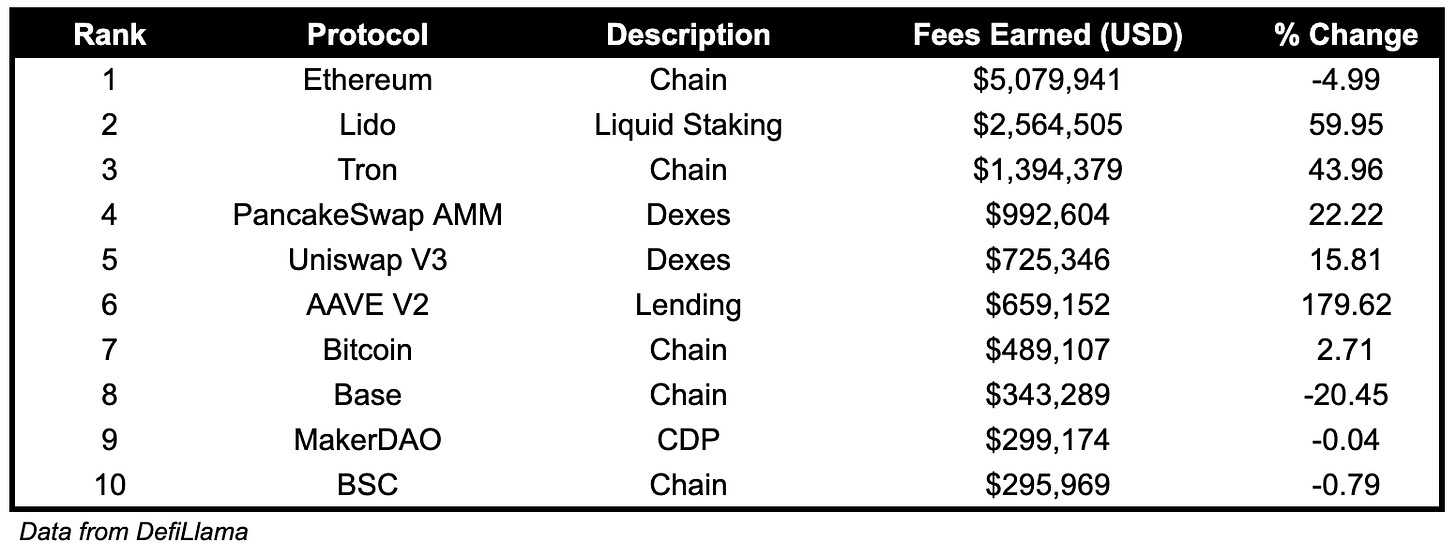

Fees

Ethereum earned the highest fees over the past day, at $5.08M, followed by Lido, at $2.56M, and Tron, at $1.4M.

Few things of note here:

Aave V2 fees earned are up 179.62%, Lido fees earned are up 59.95% and Tron fees earned are up 43.96%.

Base is the 8th highest fee earned over the past day, with $343.3K earned.

Governance Proposals

MIP-25: Mantle Economics Committee, and ETH Staking Strategies

Proposal to authorize the Mantle LSD and Lido ETH staking strategies, with a combined allowance of up to 200L ETH, and Lido ETH staking strategies up to an individual allowance of 40k ETH.

[GIP-66] CA side incentives reduction

Proposal to reduce Credit Account users liquidity mining rewards. This will reduce 0.196% of the supply on an annual basis, equal to $100K yearly.

[FIP - 275] Add a new market into Fraxlend on Ethereum (FRAX/WBTC)

Proposal to add FRAX/WBTC market into Fraxlend on Ethereum.

[FIP - 276] Add a new market into Fraxlend on Ethereum (FRAX/WETH)

Proposal to add FRAX/WETH market into Fraxlend on Ethereum.

AIP #13.5: Interest rate adjustment for the CRV cauldrons

Proposal to apply collateral-based interest to both CRV cauldrons. Given the current outstanding principal is $18M, the base interest rate would be 200%.

At this interest rate, the loan would be fully covered within 6 months. As principal is repaid, the base rate would decrease.

Articles / Threads

Tokenomics and Transparency Update

unshETH team has burned 2M USH from team allocation in response to vdUSH farm exploit. Additionally, team members have extended vesting period to 2 year linear vest for remaining tokens.

Conic has raised $1m from Curve founder Michael Egorov. The $1M of additional funding is held in the Conic treasury and was raised at a valuation of $17M. The sold tokens are subject to an 8 month linear vesting schedule.

Clearpool Expands To Polygon zkEVM

Clearpool is expanding Polygon zkEVM.

End-of-V1 & Looking Ahead to nftperp V2

nftperp is sunsetting V1, where they generated 281.9K ETH in trading volume ($530M) across 2,576 of wallets. V1 was paused due accrued bad debt by the protocol.

V2 will move away from vAMM and use a hybrid Fusion AMM and decentralized limit order book system.