ASXN Daily 21-05-2025

Market Updates

Developments

Succinct introduces SP1 Hypercube, a next-generation zkVM built for real-time Ethereum proving (<12s), reaching 93% of blocks in that window with a 10.3s mean. [source]

Performance gains come from a new multilinear-polynomial proof stack (Jagged PCS plus LogUp GKR) replacing STARKs, yielding up to 5x speedups on compute-heavy tasks and cutting GPU demand by roughly half versus SP1 Turbo.

A reference cluster needs ~160 RTX4090 GPUs and costs $300-400K; with cheaper hardware the entry point could fall to ~$100K, broadening access and supporting Ethereum scaling, rollups and interoperability.

Code is open source; Hypercube is in audit now, with a production-ready prover and cluster implementation planned for release once the audit finishes in the coming months.

Yesterday, 20-05-2025, Succinct published an article on the Succinct Prover Network, an Ethereum-settled marketplace that pairs proof requesters with a distributed pool of provers, and detailed the upcoming native PROVE token used for payments, staking and governance. [source]

Architecture separates an off-chain auctioneer (real-time reverse auctions, RPC interface) from on-chain settlement contracts that post periodic ZK proofs and manage user funds, enabling fast interaction alongside verifiable state.

PROVE starts with 1B supply; provers stake it to join auctions and can be slashed for missed deadlines, while delegates may stake to provers and share fees; the mechanism aims to encourage competitive pricing and may later shift to broader proof contests.

Stage 2.5 of the testnet, offering end-to-end deployment and prover onboarding, is scheduled for release a few weeks after 19 May 2025, with governance empowered to adjust auctions and emissions thereafter.

John Adler proposes adding a native rollup to Celestia with zero state-machine changes by introducing a Core-Untouched Soft Fork (CUSF) and an external sidecar that enforces rollup withdrawal validity, inspired by Bitcoin’s SegWit. [source]

Mechanism: deposits flow into an openly published “anyone-can-spend” account; the sidecar either fully re-executes the rollup or verifies ZK proofs, while Celestia only handles data ordering.

Benefits and trade-offs: keeps complex verifier code out of core, enables trust-minimized bridging and protocol verticalization, but shifts computational cost to nodes running the sidecar; >1/3 Tendermint voting power must adopt it to preserve safety, with >2/3 needed for resumed liveness.

Next steps include community feedback on proof-posting formats and validator willingness to operate the sidecar before any soft-fork activation.

On 20 May 2025, Initia introduced a proposal to upgrade the mainnet to v1.1.0 at block 3,180,000 on 28 May 2025, moving the network from bootstrap parameters to a more durable governance and economic structure. [source]

Technical changes: whitelist required for emergency-proposal submitters; governance authority to adjust rollup withdrawal and finalization periods; staking emission release_rate cut 0.05 → 0.0125 (12.5M INIT/yr); hashed-address check added to IBC Hooks.

Impacts: lowers risk of hostile rapid proposals, standardizes user withdrawal experience, realigns staking returns toward 30% APR and encourages liquidity deployment across L2 rollups.

Next steps: separate proposals will set the initial whitelist and rollup timing values; token holders are voting with options YES, NO, NO WITH VETO or ABSTAIN.

Macro, Regulation and Markets

Societe Generale’s crypto arm SG Forge plans to issue a US dollar stablecoin on Ethereum for institutional clients, the first such product from a major bank on a public blockchain; the group already issues the euro-denominated EUR CoinVertible token. [source]

Over the past 24H, crypto exchanges saw $244.68M in liquidations across 88,410 traders, with $110.40M from longs and $134.27M from shorts. BTC and ETH led with $69.89M and $69.57M respectively, and the largest single liquidation was a $1.97M BTCUSDT order on Bybit. [source]

Exchanges and Listings

South Korean exchange Upbit will open Mantra (OM) trading pairs with KRW, BTC and USDT on 21 May 2025 and add USDT pairs for ACS, GO, OBSR, QTCON and RLY. [source]

Binance’s off-exchange settlement venue Alpha 2.0 recorded $2B in trading volume on 20 May 2025, 223% higher than the same day a week earlier and its seventh consecutive daily record. [source]

Bitcoin

Asset manager Strive has filed to purchase claims to about 75,000 BTC, valued at roughly $8B, from the Mt. Gox bankruptcy to build a corporate Bitcoin reserve; the deal, arranged with 117 Castell Advisory Group, requires shareholder approval under filings dated 20 May 2025. [source]

Ethereum

Ethereum co-founder Jeffrey Wilcke moved 105,736 ETH (about $262M) to Kraken at 22:10 UTC+8 on 20 May 2025, his first exchange deposit in six months; 30 minutes later Kraken routed the same amount to eight newly created addresses, leaving 268 ETH in Wilcke’s wallet. [source]

Nasdaq-listed BTCS bought 3,450 ETH for $8.42M at an average $2,441, increasing its holdings to around 12,500 ETH, up 38% since 31 March; the company previously arranged up to $57.8M in convertible notes with ATW Partners to finance further purchases. [source]

ETFs

Blackstone’s Alternative Multi-Strategy Fund disclosed owning 23,094 shares of the iShares Bitcoin Trust (IBIT) as of 31 March 2025, marking its first reported Bitcoin-related position. [source]

The US SEC on 20 May 2025 postponed decisions on the 21Shares Core XRP Trust, Grayscale XRP Trust, Grayscale Dogecoin Trust and Bitwise Ethereum ETF staking amendment, requesting further public comment. [source]

Market Data

BTC ETF

BTC ETFs total net daily flow for 20 May 2025 is +$329.2M.

Breakdown:

IBIT: +$287.5M

FBTC: +$23.3M

BITB: +$5.8M

ARKB: +$6.4M

BTCO: $0.0M

EZBC: $0.0M

BRRR: $0.0M

HODL: $0.0M

BTCW: $0.0M

GBTC: $0.0M

BTC: +$6.2M

Total net daily flow: +$329.2M

Total cumulative flows to date: $43,400.9M

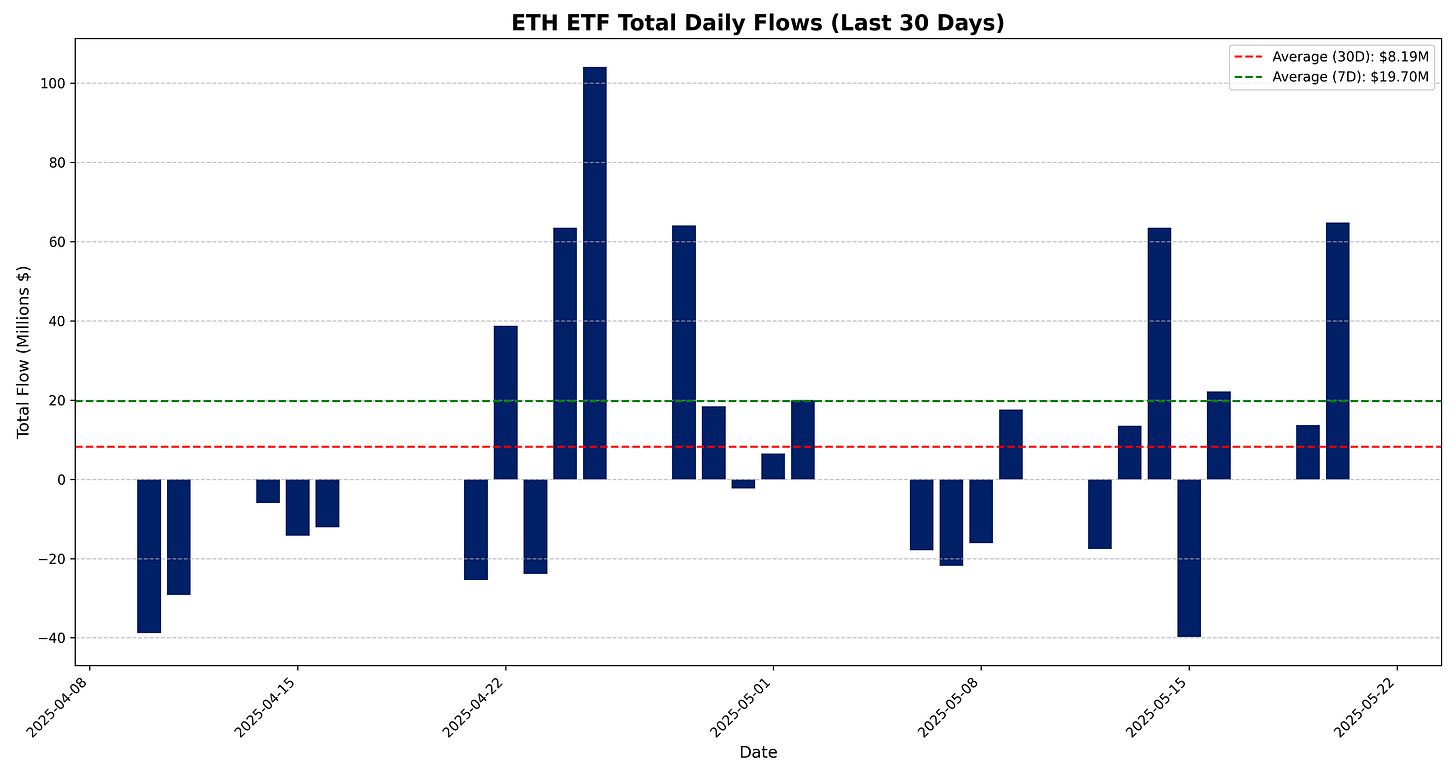

ETH ETF

ETH ETFs total net daily flow for 20 May 2025 is +$64.8M.

Breakdown:

ETHA: +$45.0M

FETH: +$19.8M

ETHW: $0.0M

CETH: $0.0M

ETHV: $0.0M

QETH: $0.0M

EZET: $0.0M

ETHE: $0.0M

ETH: $0.0M

Total net daily flow: +$64.8M

Total cumulative flows to date: $12,970.4M

Sector Returns

Top Performing Sectors

Privacy sector is up 1.57% over the past 24 hours (XMR up 1.91%, ZEC down 1.68%).

Ethereum DeFi sector has risen 0.99% over the past day (AAVE up 9.55%, EIGEN down 5.79%, RPL down 4.21%).

Cosmos Ecosystem sector is up 0.94% over the past 24 hours (OSMO up 1.06%, STRD up 0.11%).

Worst Performing Sectors

Bitcoin Ecosystem sector is down 5.52% over the past 24 hours (PUPS down 11.64%, ORDI down 4.69%, STX down 3.69%).

Hyperliquid Ecosystem sector is down 4.26% over the past day (HFUN down 7.11%, PURR down 2.65%).

Solana DeFi sector has fallen 3.14% in the past 24 hours (RAY down 6.28%, JUP down 3.46%, KMNO up 2.92%).

Token Returns

Top Performing Tokens

AAVE (Ethereum DeFi) is up 9.55% in the past 24 hours.

RONIN (Gaming) is up 7.56% in the past 24 hours.

GFI (RWA) is up 3.42% in the past 24 hours.

BONK (Memecoin) is up 3.10% in the past 24 hours.

KMNO (Solana DeFi) has risen 2.92% in the past 24 hours.

Worst Performing Tokens

PUPS (Bitcoin Ecosystem) is down 11.64% in the past 24 hours.

WLD (AI) is down 10.56% in the past 24 hours.

PYTH (Oracle) is down 10.46% in the past 24 hours.

FART (Memecoin) is down 9.12% in the past 24 hours.

ARB (L2) has fallen 9.03% in the past 24 hours.

Protocol Updates

Sei Development Foundation Appoints Jamie Finn as Strategic Advisor

Protocol: Sei

Date: 2025-05-20 15:33:06

Link: https://blog.sei.io/sei-development-foundation-appoints-jamie-finn-as-strategic-advisor/

Description: Sei posted about appointing fintech entrepreneur and Securitize co-founder Jamie Finn as a strategic advisor. Finn will work on partnerships and use cases to boost institutional adoption of the Sei network.

SP1 Hypercube: Proving Ethereum in Real-Time

Protocol: Succinct

Date: 2025-05-20 15:11:32

Link: https://blog.succinct.xyz/sp1-hypercube/

Description: John Guibas posted about SP1 Hypercube, a zero-knowledge virtual machine that can generate proofs for Ethereum blocks in under 12 seconds. Internal tests showed it handled 93% of 10,000 mainnet blocks in real time using a 200-GPU cluster.

Introducing the Succinct Network Architecture and the $PROVE Token

Protocol: Succinct

Date: 2025-05-19 17:49:18

Link: https://blog.succinct.xyz/introducing-the-succinct-network-architecture-and-the-prove-token/

Description: Kshitij Kulkarni posted about the architecture of the Succinct Prover Network and its PROVE token. The article explains that PROVE pays provers, incentivises competitive pricing, and secures the network through staking and governance.

Governance

[TEMP CHECK] Adopt The SEAL Safe Harbor Agreement

Protocol: Aave

Date: 2025-05-21 06:23:43

Link: https://governance.aave.com/t/temp-check-adopt-the-seal-safe-harbor-agreement/22139

Description: samczsun proposed a temperature check for Aave to adopt the SEAL Safe Harbor Agreement, seeking initial feedback.

[ARFC ADDENDUM] Modify E-Modes for PT Token Collateral

Protocol: Aave

Date: 2025-05-20 17:36:41

Link: https://governance.aave.com/t/arfc-addendum-modify-e-modes-for-pt-token-collateral/22128

Description: CryptoScam proposed an addendum to adjust E-Mode parameters for PT token collateral on Aave V3.

LlamaRisk Insights: aUSDC/aUSDT as USDe Backing Assets

Protocol: Aave

Date: 2025-05-20 17:31:43

Link: https://governance.aave.com/t/llamarisk-insights-ausdc-ausdt-as-usde-backing-assets/22127

Description: LlamaRisk posted an analysis of using aUSDC and aUSDT as backing assets for USDe, detailing risk and supply implications.

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.20.25

Protocol: Aave

Date: 2025-05-20 15:02:22

Description: ChaosLabs proposed increasing supply caps for several Aave V3 assets based on updated utilisation metrics.

Rationalizing Liquidity Observation Lab & Rewards Share Committee: Growth Committee

Protocol: Lido

Date: 2025-05-21 09:25:35

Description: lidoecosystem-ops proposed merging the Liquidity Observation Lab and Rewards Share Committee into a unified Growth Committee.

Lido v3 Whitepaper RFC

Protocol: Lido

Date: 2025-05-20 15:18:34

Link: https://research.lido.fi/t/lido-v3-whitepaper-rfc/10124

Description: UniteTheClans posted a request for comments on the draft Lido v3 whitepaper, inviting community feedback.

Kamino to Onboard ACRED Tokenized Fund, in Collaboration with Steakhouse Financial

Protocol: Kamino Finance

Date: 2025-05-20 18:37:18

Description: toothfairy proposed onboarding the ACRED tokenised fund to Kamino in collaboration with Steakhouse Financial.

Stop ACX Emissions on ACX LP

Protocol: Across

Date: 2025-05-20 19:49:52

Link: https://forum.across.to/t/stop-acx-emissions-on-acx-lp/2062

Description: Kevin_UMA proposed stopping ACX emissions on the ACX liquidity pool to mitigate token inflation.

Stop ACX Emissions on wstETH/ACX LP Balancer Pool

Protocol: Across

Date: 2025-05-20 19:45:43

Link: https://forum.across.to/t/stop-acx-emissions-on-wsteth-acx-lp-balancer-pool/2061

Description: Kevin_UMA proposed halting ACX emissions on the wstETH/ACX Balancer pool to reduce incentive spend.

[BIP-XXX] USP/aUSDC Gauge proposal

Protocol: Balancer

Date: 2025-05-21 09:13:09

Link: https://forum.balancer.fi/t/bip-xxx-usp-ausdc-gauge-proposal/6538

Description: Biaf proposed a gauge for the USP/aUSDC pool under BIP-XXX to receive protocol incentives.

Temperature check: a native rollup with zero state machine changes

Protocol: Celestia

Date: 2025-05-21 02:12:49

Link: https://forum.celestia.org//t/temperature-check-a-native-rollup-with-zero-state-machine-changes/1998

Description: musalbas initiated a temperature check on creating a native rollup that requires no state-machine changes.

Initia Chain Upgrade Proposal #1: Taking Off the Training Wheels

Protocol: Initia

Date: 2025-05-20 06:43:14

Link: https://forum.initia.xyz//t/initia-chain-upgrade-proposal-1-taking-off-the-training-wheels/166

Description: manan proposed Initia Chain Upgrade #1 to remove training wheels and enable mainnet functionality.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.