ASXN Daily 16-05-2025

Market Updates

Macro, Regulation and Markets

The U.S. SEC is examining whether Coinbase overstated “verified user” figures before and after its 2021 IPO; Coinbase said on 15 May 2025 that it is cooperating with the probe. [source]

Galaxy Digital has begun talks with the SEC about issuing tokenized versions of its publicly traded shares, CEO Mike Novogratz told Bloomberg on 16 May 2025. [source]

FTX Recovery Trust will start a second distribution of more than $5 billion to eligible creditors on 30 May 2025 under the exchange’s Chapter 11 plan. [source]

On 16 May 2025, 27,000 BTC options (notional $2.76 billion; put-call ratio 1.03; max-pain $100,000) and 220,000 ETH options (notional $570 million; put-call ratio 1.36; max-pain $2,300) expired. [source]

Total liquidations reached $5.49M in the past hour, $21.34M over 4h, $82.83M over 12h, and $337.45M over 24h, with the 24h figure spanning 121,037 traders and split into $231.24M longs versus $106.21M shorts. The largest single liquidation was a $4.20M ETH-USDT swap on OKX. [source]

Exchanges and Listings

Binance Alpha listed Project MIRAI (MIRAI), Alaya AI (AGT) and SuiNS (NS) on 16 May 2025, while Binance Futures introduced a CVCUSDT perpetual contract. [source]

Developments

DEX infrastructure firm 0x acquired rival aggregator Flood on 15 May 2025 to expand its share of the $2.3 billion DEX-aggregator market; financial terms were not disclosed. [source]

BlackRock’s nearly $3 billion tokenized Treasury fund sBUIDL completed its first direct DeFi integration, becoming collateral on Euler via Securitize’s sToken framework on the Avalanche network. [source]

Bitcoin

Bitlayer’s BitVM bridge has enabled Peg-BTC (YBTC), a Bitcoin-backed token, to circulate on the Sui network, allowing holders to earn DeFi yield, Bitlayer and Sui said on 15 May 2025. [source]

Addentax Group Corp. (Nasdaq: ATXG) said on 16 May 2025 it is negotiating an $800 million stock-for-crypto deal to buy about 8,000 BTC and other tokens, including Official Trump. [source]

A research note found that Upbit’s parent company held 16,839 BTC, accumulated from trading- and withdrawal-fee revenue, as of 31 December 2024. [source]

ETFs

Wisconsin’s State Investment Board exited its 6,060,351-share position (about $321.5 million) in BlackRock’s iShares Bitcoin Trust (IBIT) during Q1 2025, while Abu Dhabi’s Mubadala expanded its stake to 8,726,972 shares worth $408.5 million, according to 13F filings released 15 May 2025. [source]

Market Data

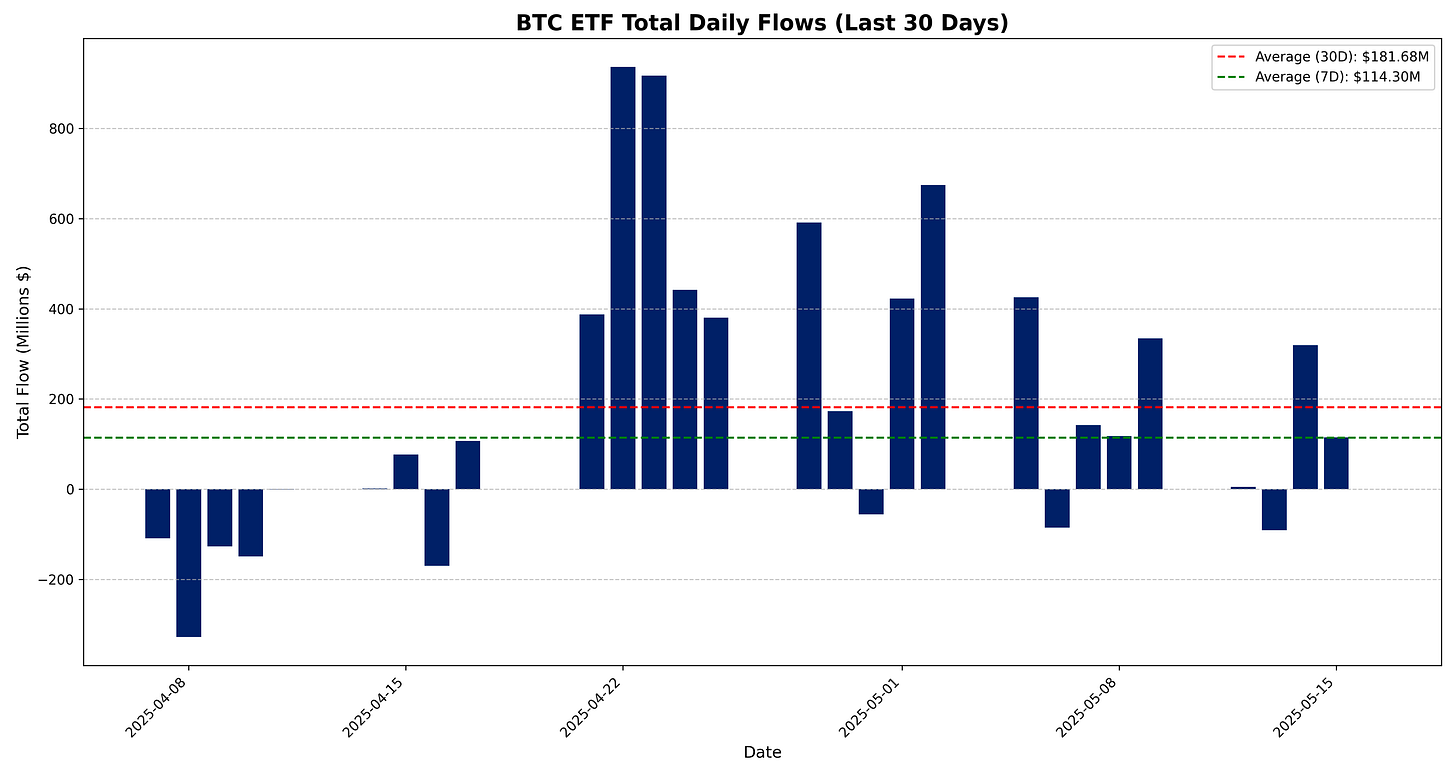

BTC ETF

BTC ETFs total net daily flow for 15 May 2025 is +$114.9M.

Breakdown:

IBIT: +$409.7M

FBTC: –$123.7M

BITB: $0.0M

ARKB: –$132.0M

BTCO: $0.0M

EZBC: $0.0M

BRRR: $0.0M

HODL: $0.0M

BTCW: $0.0M

GBTC: –$39.1M

BTC: $0.0M

Total net daily flow: +$114.9M

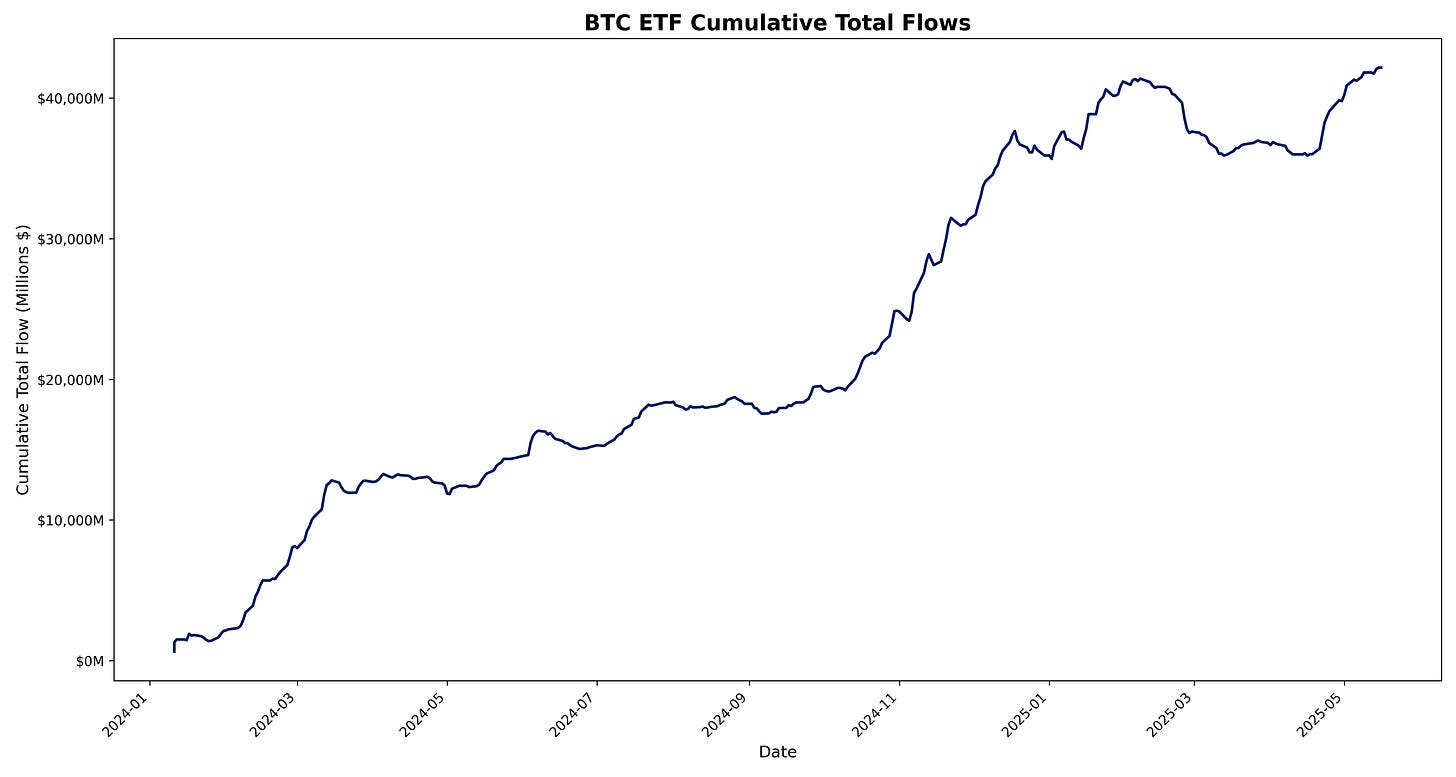

Total cumulative flows to date: $42,144.1M

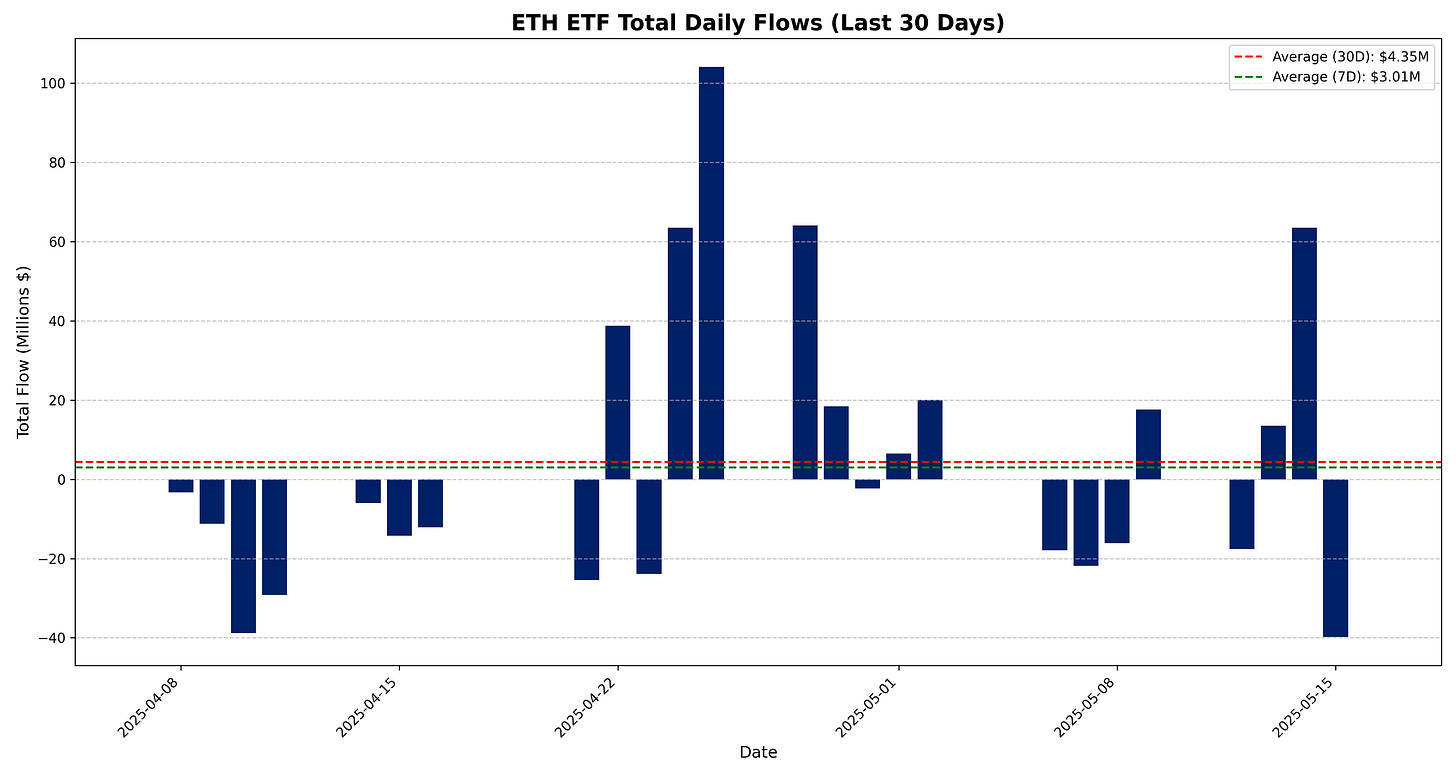

ETH ETF

ETH ETFs total net daily flow for 15 May 2025 is –$39.8M.

Breakdown:

ETHA: +$8.4M

FETH: –$31.6M

ETHW: $0.0M

CETH: $0.0M

ETHV: $0.0M

QETH: $0.0M

EZET: $0.0M

ETHE: –$16.6M

ETH: $0.0M

Total net daily flow: –$39.8M

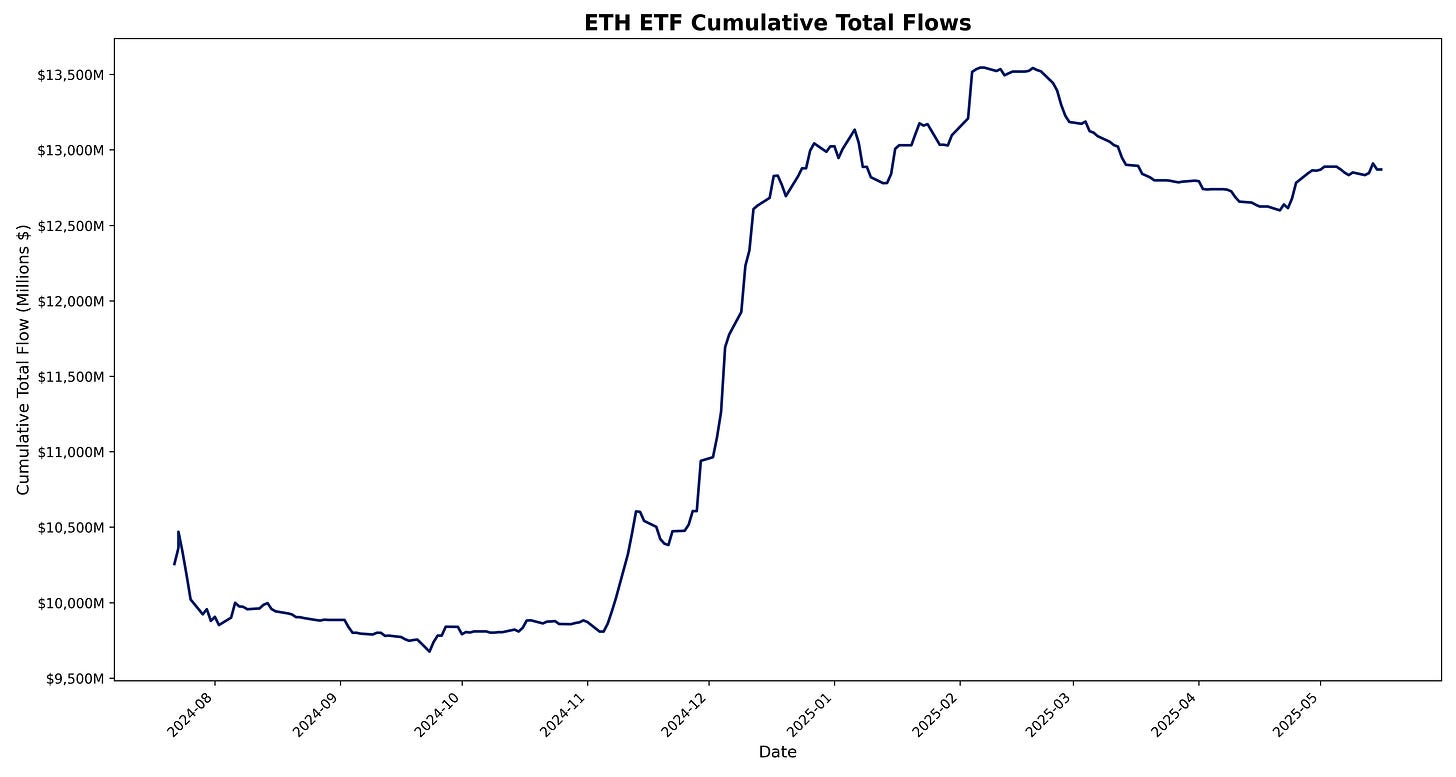

Total cumulative flows to date: $12,869.7M

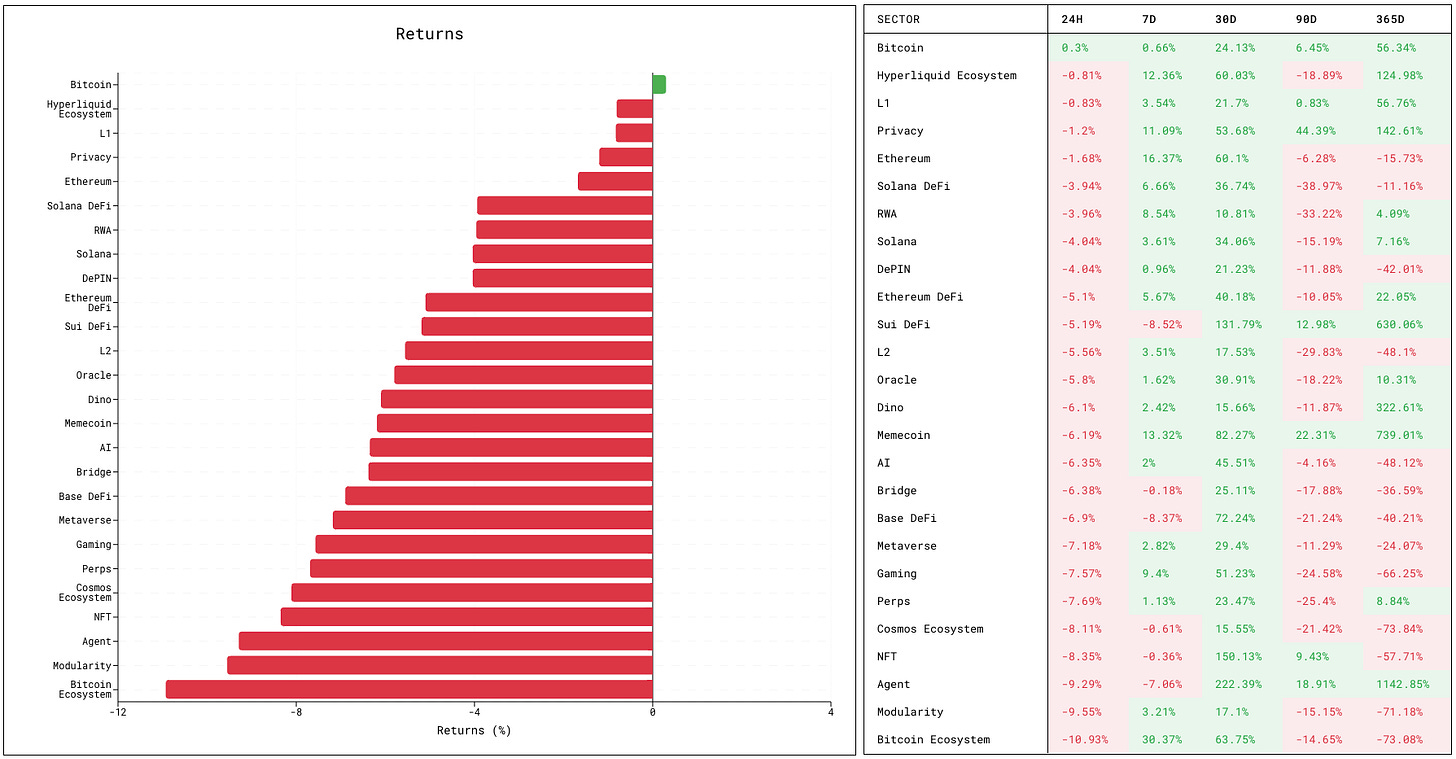

Sector Returns

Top Performing Sectors

Hyperliquid Ecosystem sector is up marginally, just 0.81% (PURR down 2.89%, HFUN up 2.71%).

L1 sector has risen slightly, only 0.83% on the day, with HYPE up 3.48%, AVAX down 5.82%, SUI down 1.48%.

Worst Performing Sectors

Bitcoin Ecosystem sector is down 10.93%, having the steepest pullback (ORDI down 11.85%, PUPS down 5.39%, STX up 5.99%).

Modularity sector is down 9.55% (TIA down 9.66%, ALT down 9.10%, DYM down 8.34%).

Agent sector has fallen 9.29% in the last 24 hours (GRIFF down 15.21%, AIXBT down 11.47%, VIRTUAL down 8.45%).

Token Returns

Top Performing Tokens

MNDE is up 48.58% in the past 24 hours, among the top performers in the Solana DeFi sector.

MPL is up 45.61% in the past 24 hours, among the top performers in the RWA sector.

STX is up 5.99% in the past 24 hours, among the top performers in the Bitcoin Ecosystem sector.

HYPE is up 3.48% in the past 24 hours, among the top performers in the L1 sector.

HFUN has risen 2.71% in the past 24 hours, among the top performers in the Hyperliquid Ecosystem sector.

Worst Performing Tokens

PRCL is down 17.09% in the past 24 hours, among the worst performers in the RWA sector.

ARB is down 16.82% in the past 24 hours, among the worst performers in the L2 sector.

WLD is down 16.45% in the past 24 hours, among the worst performers in the AI sector.

GRIFF is down 15.21% in the past 24 hours, among the worst performers in the Agent sector.

WIF has fallen 13.41% in the past 24 hours, among the worst performers in the Memecoin sector.

Protocol Updates

Announcing pxSOL—a high-yield LST for Solana

Protocol: Mirror

Date: 2025-05-15 15:40:25

Description: Dinero posted about pxSOL, a new high-yield liquid staking token for Solana that lets users earn validator rewards while retaining on-chain liquidity.

Synthetix sUSD Peg Update

Protocol: Synthetix

Date: 2025-05-15 13:29:58

Link: https://blog.synthetix.io/synthetix-susd-peg-update/

Description: Synthetix CC posted an update on sUSD’s dollar peg, detailing recent price deviations, added liquidity incentives, and upcoming measures to maintain stability.

Governance

Lido Whale Withdrawal Analysis: $19B DeFi Redeployment Patterns

Protocol: Aave

Date: 2025-05-16 02:17:13

Link: https://governance.aave.com/t/lido-whale-withdrawal-analysis-19b-defi-redeployment-patterns/22081

Description: WalleDAO posted an analysis of a large Lido staker’s $19 billion withdrawals and subsequent redeployment across DeFi protocols.

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.15.25

Protocol: Aave

Date: 2025-05-15 18:31:23

Description: ChaosLabs proposed increasing supply caps for several assets on Aave V3 under its Risk Steward mandate.

[ARFC] Onboard eUSDe August expiry PT tokens on Aave V3 Core Instance

Protocol: Aave

Date: 2025-05-15 13:59:02

Description: ACI proposed adding eUSDe August-expiry principal tokens to the Aave V3 Core market.

[Gauntlet] - COMP Rewards Recommendations (Part - 1)

Protocol: Compound

Date: 2025-05-15 22:12:48

Link: https://www.comp.xyz/t/gauntlet-comp-rewards-recommendations-part-1/6773

Description: Gauntlet presented its first set of recommendations for adjusting COMP rewards distribution.

Optimism Town Hall Season 4: Growing the Superchain Through Collaborative Governance

Protocol: Optimism

Date: 2025-05-15 16:33:12

Description: gene announced the Season 4 Optimism Town Hall focused on expanding the Superchain through collaborative governance.

[BIP-XXX] Enable Aave Boosted USDN/aGHO Gauge on Balancer v3 Ethereum

Protocol: Balancer

Date: 2025-05-16 11:56:34

Link: https://forum.balancer.fi/t/bip-xxx-enable-aave-boosted-usdn-agho-gauge-on-balancer-v3-ethereum/6527

Description: TokenLogic proposed enabling a liquidity gauge for the Aave Boosted USDN/aGHO pool on Balancer v3 Ethereum.

[BIP-XXX] Sunset BAL emissions and Fee Processing on the Balancer v2 Fraxtal Deployment

Protocol: Balancer

Date: 2025-05-16 06:57:59

Description: Xeonus proposed ending BAL emissions and fee processing on the Balancer v2 Fraxtal deployment.

[BIP-XXX] Transfer and automation of vlAURA management

Protocol: Balancer

Date: 2025-05-16 06:56:30

Link: https://forum.balancer.fi/t/bip-xxx-transfer-and-automation-of-vlaura-management/6525

Description: Xeonus proposed transferring and automating the management of the vlAURA position.

[BIP-XXX] Enable Aave Boosted USDf/aGHO Gauge on Balancer v3 Ethereum

Protocol: Balancer

Date: 2025-05-15 21:23:29

Link: https://forum.balancer.fi/t/bip-xxx-enable-aave-boosted-usdf-agho-gauge-on-balancer-v3-ethereum/6520

Description: TokenLogic proposed adding a gauge for the Aave Boosted USDf/aGHO pool on Balancer v3 Ethereum.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.