ASXN Daily 15-05-2025

Market Updates

Macro, Regulation and Markets

Data published by the U.S. Bureau of Labor Statistics on 15 May 2025 show the Producer Price Index fell 0.5 % in April and rose 2.4 % year-on-year, the sharpest monthly drop since April 2020. [source]

On 15 May 2025 Nebraska’s legislature passed a bill in its final reading that imposes zoning and noise limits on crypto-mining facilities. [source]

JPMorgan settled its first tokenised U.S. Treasury transaction on a public chain on 14 May 2025, buying tokenized treasury bonds on the Ondo public ledger and triggering crosschain payments via Chainlink’s CCIP from a private-blockchain account. [source]

About US$3.1 billion in Deribit Bitcoin and Ethereum options expire on 16 May 2025; BTC contracts total US$2.66 billion with max pain at US$100,000, while ETH contracts total US$525 million with max pain at US$2,200. [source]

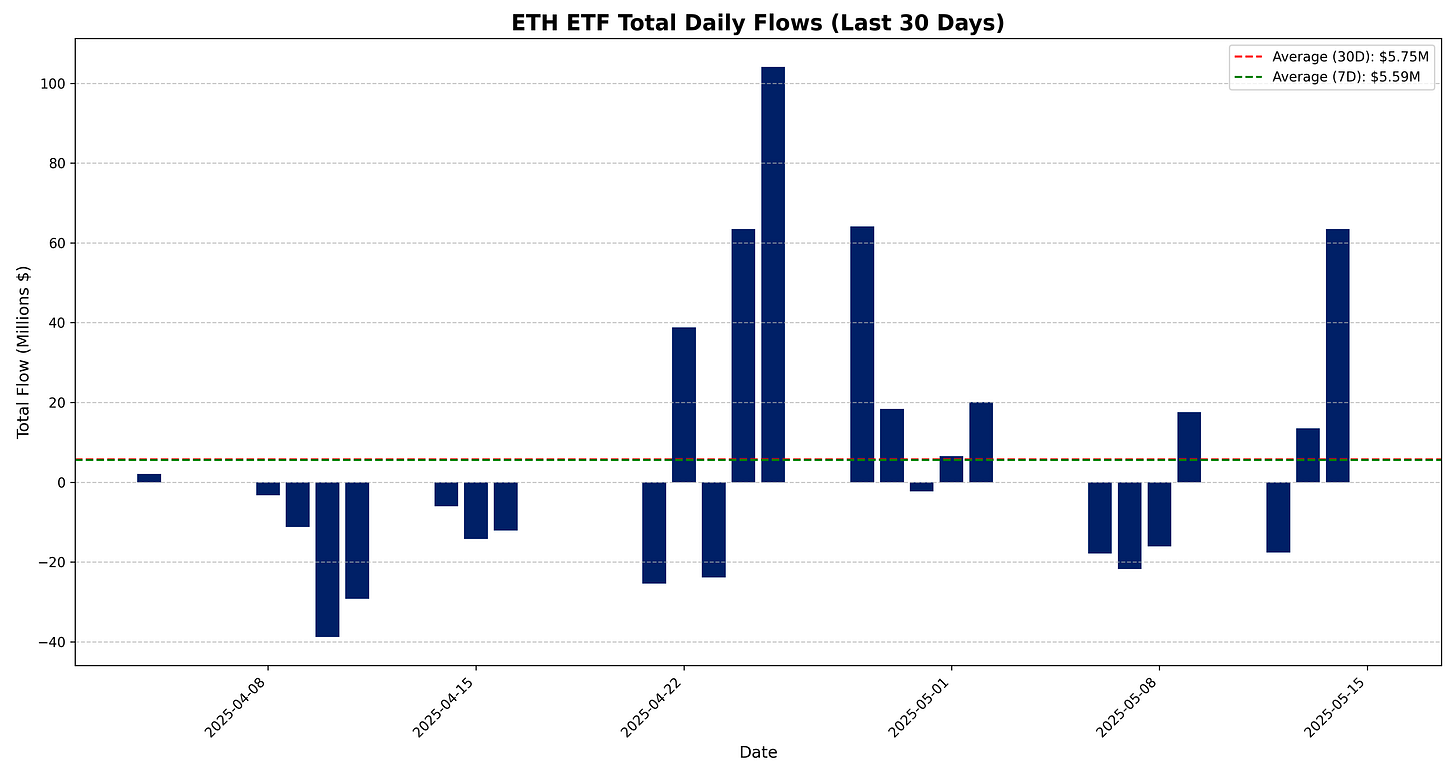

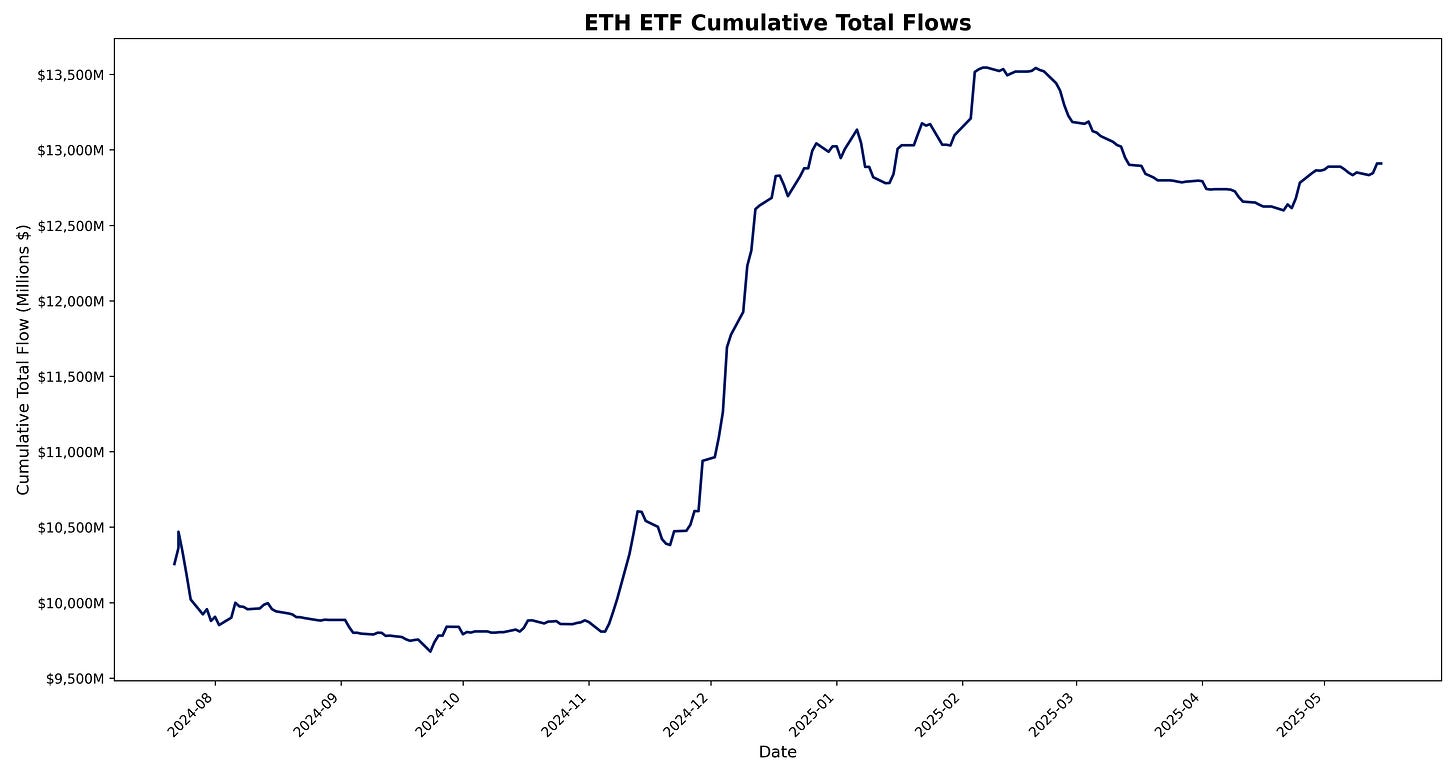

$63.5M USD in ETF Flows for ETH ETFs yesterday, coming from ETHA (+$57.6M) and FETH (+$5.9M). Cumulative flows now sit at $12,909.5M (including the initial seed of $10,255M).

In the last 24h 161,065 traders were liquidated for $359.59M, with longs accounting for $291.39M and shorts $68.20M; the largest single liquidation was a $2.64M ETHUSDT position on Binance. Liquidations over shorter windows were $227.84M in 12h, $50.55M in 4h, and $9.26M in 1h. [source]

Exchanges and Listings

Coinbase said bribed overseas support agents copied personal data for under 1 % of active users; the exchange rejected a US$20 million ransom and is offering the same amount as a bounty for information on the attackers. [source]

CEO Brian Armstrong told Bloomberg on 14 May 2025 that Coinbase is evaluating further acquisitions after its US$2.9 billion Deribit deal, with a focus on international expansion; no decision has been made on buying Circle. [source]

Binance will list Nexpace (NXPC) at 07:30 UTC on 15 May 2025, offering pairs in USDT, USDC, BNB, FDUSD and TRY, and tagging the token as Seed; a HODLer airdrop is live. [source]

Ethereum

The Ethereum Foundation on 14 May 2025 launched the “Trillion Dollar Security” initiative to fund wallet, UX and smart-contract improvements aimed at institutional-grade safety. [source]

More than 11,000 EIP-7702 smart-wallet authorisations have been recorded within a week of the Pectra upgrade, indicating rapid adoption of the new account model. [source]

Developments

Backpack Exchange and Wallet now support the Sui network, enabling trading, lending, bridging and yield on SUI, with promotional rewards exceeding US$200,000. [source]

Tether unveiled QVAC, a peer-to-peer AI platform that runs on local devices and lets autonomous agents execute BTC and USDT transactions via its WDK toolkit. [source]

Squads introduced a stablecoin treasury account service for businesses, offering multi-sig controls and on-chain auditability. [source]

Kaito Foundation said its market-making deal with Web3Port ran from 17 to 27 February 2025 and that it has not sold KAITO tokens since the token-generation event; Binance listed the token on 20 February 2025. [source]

Believe, an app that lets Twitter users mint tokens, had the third most memecoin volume of any launchpad, behind pumpdotfun and Meteora yesterday. Its associated token LAUNCHCOIN reached a market cap of 357M yesterday. Tokens list on a bonding curve with an anti-snipe fee, creators collect 50 % of trading fees, and projects that reach a US$100K market cap “graduate” to a Meteora DEX pool for deeper liquidity. [source]

Market Data

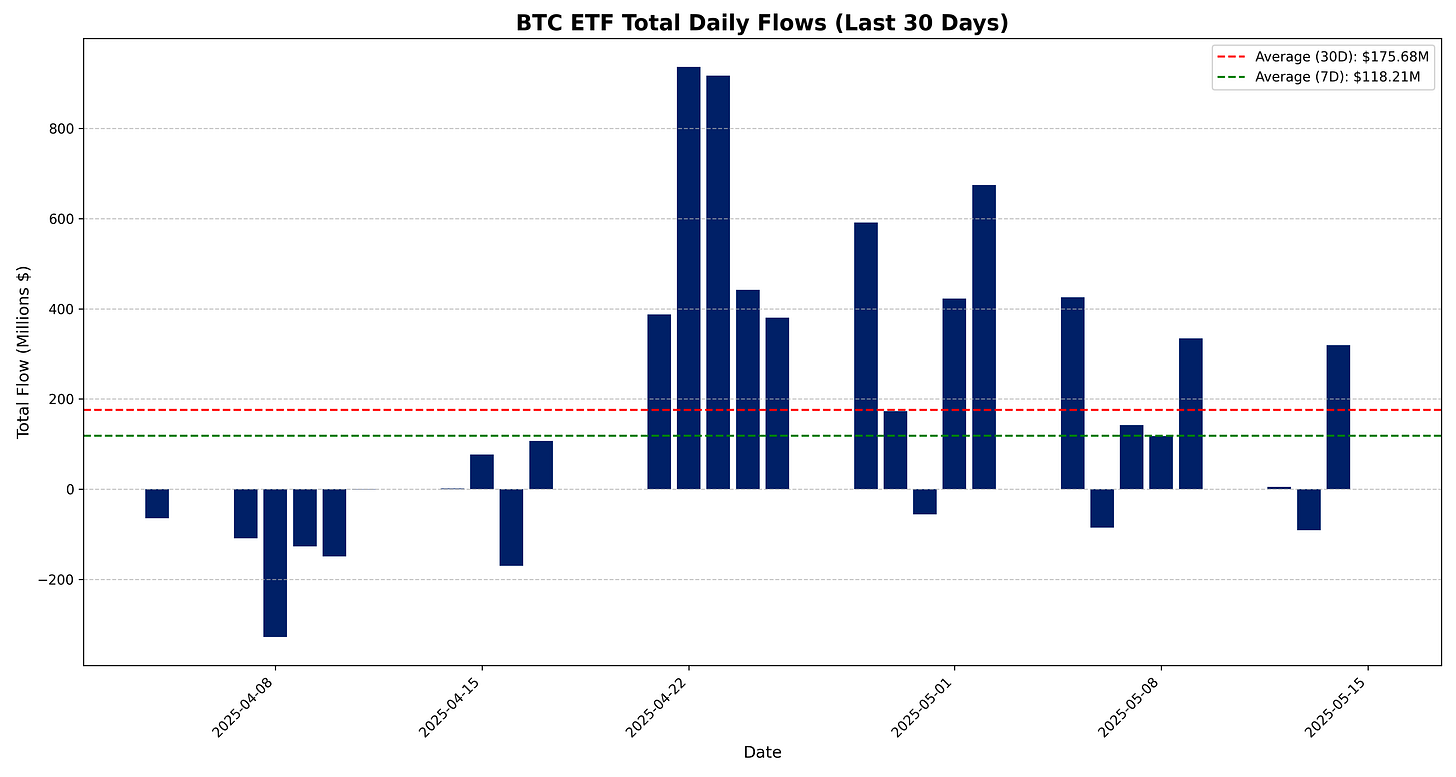

BTC ETF

BTC ETFs total net daily flow for 14 May 2025 is +$319.5M.

Breakdown:

IBIT: +$232.9M

FBTC: +$36.1M

BITB: +$2.8M

ARKB: +$5.2M

BTCO: $0.0M

EZBC: $0.0M

BRRR: $0.0M

HODL: +$7.3M

BTCW: $0.0M

GBTC: $0.0M

BTC: +$35.2M

Total net daily flow: +$319.5M

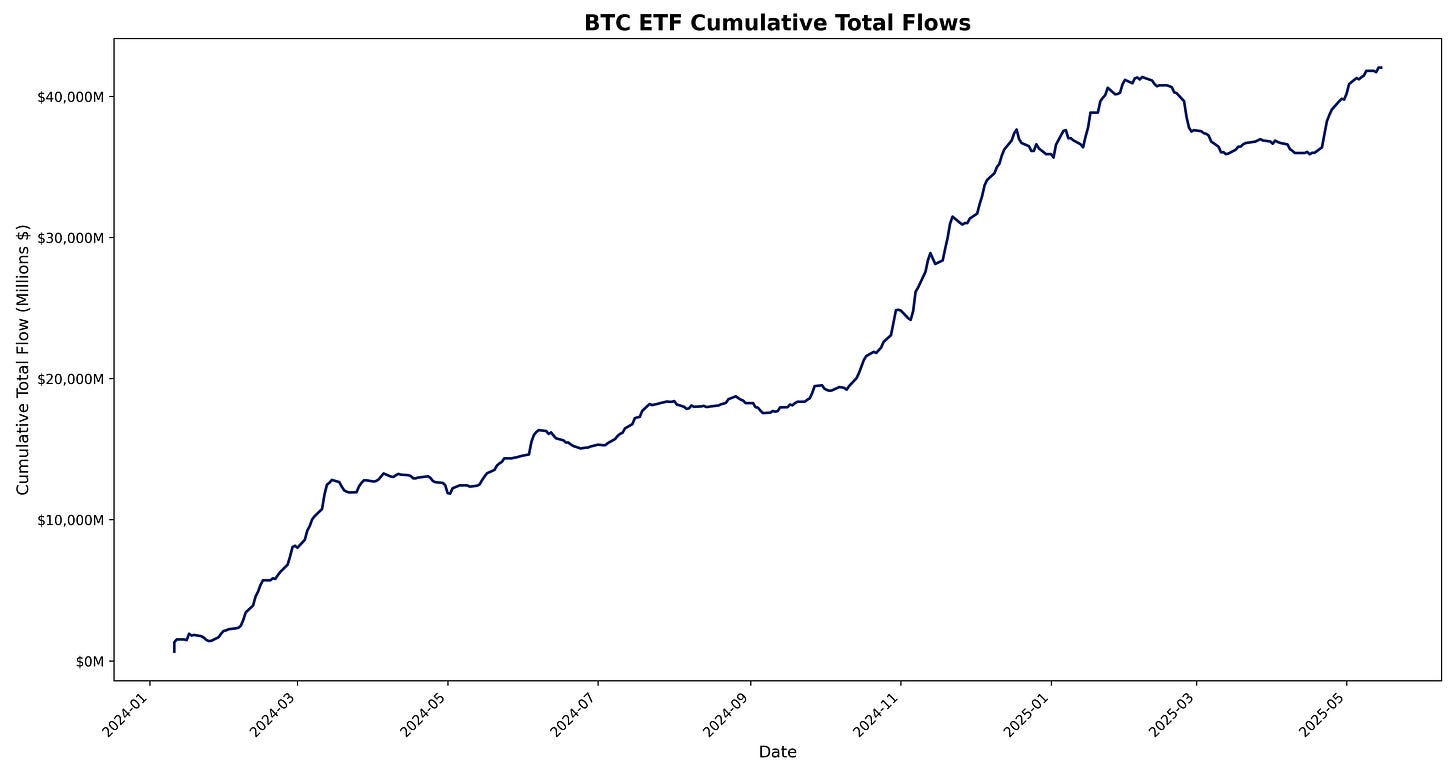

Total cumulative flows to date: $42,029.2M

ETH ETF

ETH ETFs total net daily flow for 14 May 2025 is +$63.5M.

Breakdown:

ETHA: +$57.6M

FETH: +$5.9M

ETHW: $0.0M

CETH: $0.0M

ETHV: $0.0M

QETH: $0.0M

EZET: $0.0M

ETHE: $0.0M

ETH: $0.0M

Total net daily flow: +$63.5M

Total cumulative flows to date: $12,909.5M

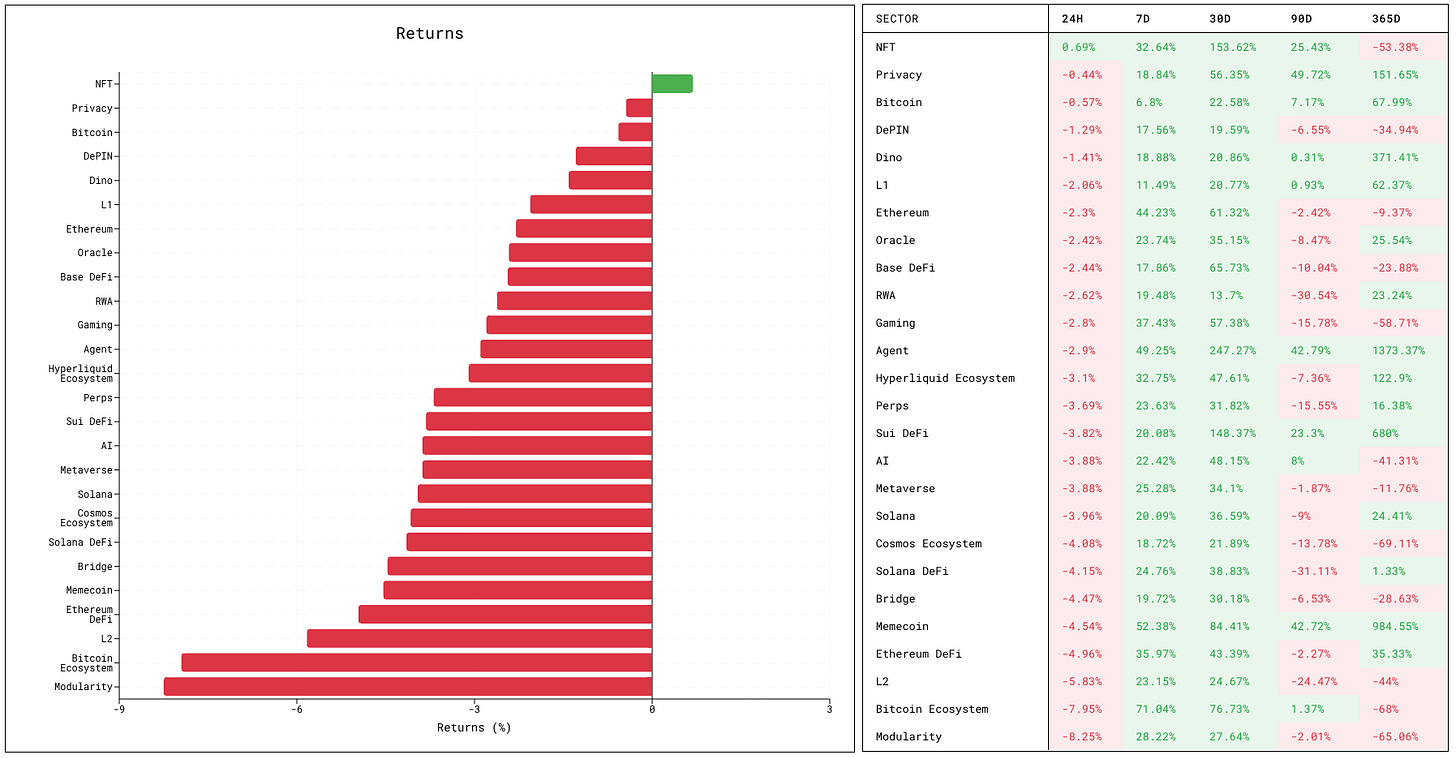

Sector Returns

Top Performing Sectors

NFT sector is up 0.69% over the past 24 hours, supported by token moves (BLUR down 5.85%, TNSR down 5.71%, PENGU up 3.14%).

Privacy sector is up relative to peers, only 0.44% over the past 24 hours (ZEC down 2.52%, XMR down 0.21%).

Worst Performing Sectors

Modularity sector is down 8.25% over the past 24 hours, reflecting broad weakness (DYM down 14.05%, TIA down 7.94%, ALT down 7.33%).

Bitcoin Ecosystem sector is down 7.95% in the past 24 hours (PUPS down 15.48%, STX up 7.87%, ORDI down 6.90%).

L2 sector has fallen 5.83% over the past 24 hours with mixed performance (BLAST up 13.60%, ARB down 13.24%, OP down 8.38%).

Token Returns

Top Performing Tokens

MPL is up 144.20% in the past 24 hours, making it among the top performers in the RWA sector.

BLAST is up 13.60% in the past 24 hours, making it among the top performers in the L2 sector.

GRASS has risen 12.41% in the past 24 hours, making it among the top performers in the AI sector.

WLD is up 12.25% in the past 24 hours, making it among the top performers in the AI sector.

BONK is up 11.29% in the past 24 hours, making it among the top performers in the Memecoin sector.

Worst Performing Tokens

PUPS is down 15.48% in the past 24 hours, making it among the worst performers in the Bitcoin Ecosystem sector.

DYM is down 14.05% in the past 24 hours, making it among the worst performers in the Modularity sector.

ARB has fallen 13.24% in the past 24 hours, making it among the worst performers in the L2 sector.

SEND is down 11.98% in the past 24 hours, making it among the worst performers in the Sui DeFi sector.

KMNO is down 10.40% in the past 24 hours, making it among the worst performers in the Solana DeFi sector.

Protocol Updates

Erigon and Nethermind Join Arbitrum

Protocol: Arbitrum

Date: 2025-05-14 14:00:22

Link: https://blog.arbitrum.io/erigon-and-nethermind-join-arbitrum/

Description: Arbitrum posted that Ethereum clients Erigon and Nethermind have integrated with its network, expanding node software options for builders and validators.

Lido Protocol’s wstETH Now Available on Swellchain

Protocol: Lido

Date: 2025-05-14 12:48:18

Link: https://blog.lido.fi/wsteth-now-available-on-swellchain/

Description: Lido posted that its wrapped staked Ether (wstETH) is now supported on Swellchain, giving stakers additional liquidity and DeFi access.

SNXweave Weekly Recap 181

Protocol: Synthetix

Date: 2025-05-14 17:52:23

Link: https://blog.synthetix.io/snxweave-weekly-recap-181/

Description: SNXweave posted its Weekly Recap 181 covering recent governance proposals, protocol metrics, and ecosystem updates across Synthetix.

Upshift, Launches on Injective

Protocol: Injective

Date: 2025-05-14 14:54:00

Link: https://blog.injective.com/the-largest-institutional-yield-platform-upshift-launches-on-injective/

Description: Injective posted that Upshift, described as the largest institutional yield platform, has launched on the network, offering new investment products for traders and institutions.

Governance

[ARFC-Addendum]: Supply and Borrow Cap Risk Oracle Constraint Specification

Protocol: Aave

Date: 2025-05-15 12:38:46

Description: ChaosLabs posted an addendum specifying oracle-based constraints for supply and borrow cap risk parameters on Aave V3.

Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 05.14.25

Protocol: Aave

Date: 2025-05-14 21:23:58

Description: ChaosLabs proposed raising supply and borrow caps on several Aave V3 assets based on updated utilisation metrics.

Kamino: Season 3 Distribution

Protocol: Kamino Finance

Date: 2025-05-14 14:24:25

Link: https://gov.kamino.finance/t/kamino-season-3-distribution/557

Description: Owayne_Maphumulo posted details of the Season 3 KMNO token distribution plan for Kamino participants.

[DIP v1.6] Delegate Incentive Program Results (April 2025)

Protocol: Arbitrum Foundation

Date: 2025-05-14 23:00:38

Link: https://forum.arbitrum.foundation/t/dip-v1-6-delegate-incentive-program-results-april-2025/29218

Description: olimpio posted the April 2025 results of Arbitrum’s Delegate Incentive Program, detailing participation metrics and incentive allocations.

[Non-Constitutional] Invest in Builders & Ignite ARB Demand with q/acc

Protocol: Arbitrum Foundation

Date: 2025-05-14 15:36:33

Description: Griff proposed a non-constitutional initiative to invest in builders and stimulate ARB demand via the q/acc mechanism.

Optimism Fractal Season 6: Expanding Democratic Coordination Across the Superchain

Protocol: Optimism

Date: 2025-05-15 12:37:35

Description: Optimystics proposed running Optimism Fractal Season 6 to broaden democratic coordination across the Superchain.

Superscan Metrics Overview: Retro Funding Season 7

Protocol: Optimism

Date: 2025-05-15 11:42:11

Link: https://gov.optimism.io/t/superscan-metrics-overview-retro-funding-season-7/9923

Description: 0x_rebeca posted an overview of Superscan metrics intended to inform evaluation of Retro Funding Season 7 submissions.

Proposal : Introduction of a New Penalty Mechanism for Sandwich Attackers

Protocol: Marinade Finance

Date: 2025-05-14 13:06:55

Description: SouthCloud0703 proposed adding a penalty mechanism to deter sandwich attacks within the Marinade ecosystem.

SPP2 - Transition & Implementation Plan

Protocol: ENS

Date: 2025-05-15 02:50:02

Link: https://discuss.ens.domains/t/spp2-transition-implementation-plan/20796

Description: daostrat.eth posted a plan outlining steps to implement the SPP2 transition within ENS governance.

ENS Subname Solution Contract Generator/Deployer

Protocol: ENS

Date: 2025-05-14 13:16:30

Link: https://discuss.ens.domains/t/ens-subname-solution-contract-generator-deployer/20792

Description: clowes.eth introduced a tool for generating and deploying ENS subname solution contracts.

Frontier Markets: Risk-isolated looping vaults

Protocol: Euler Finance

Date: 2025-05-15 07:32:59

Link: https://forum.euler.finance/t/frontier-markets-risk-isolated-looping-vaults/1405

Description: Objective proposed introducing risk-isolated looping vaults targeting frontier markets on Euler.

Update on Fee Distribution & Auto-Bribing Activation on Berachain clusters

Protocol: Euler Finance

Date: 2025-05-14 14:40:46

Description: 0xMagikarp posted an update on enabling fee distribution and auto-bribing features for Euler deployments on Berachain clusters.

Disabling Protocol DAO Guardian

Protocol: Rocket Pool

Date: 2025-05-15 04:41:05

Link: https://dao.rocketpool.net/t/disabling-protocol-dao-guardian/3617

Description: langers proposed removing the Protocol DAO Guardian role from Rocket Pool’s governance framework.

Separating Retrievability from Availability: Implications for the DA Network

Protocol: Celestia

Date: 2025-05-14 19:41:04

Description: nashqueue posted an analysis on separating data retrievability from availability and its impact on Celestia’s data-availability network.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.