ASXN Daily 14-05-2025

Market Updates

Macro, Regulation and Markets

Dubai’s Department of Finance signed an MoU with Crypto.com on 13 May 2025 to let residents pay government service fees in cryptocurrencies via the existing Dubai Pay platform. [source] [source]

U.S. consumer prices rose 0.2 % in April; headline CPI slowed to 2.3 % y/y—the lowest since February 2021—while core CPI held at 2.8 %. [source]

Thailand’s Finance Ministry said on 13 May 2025 it will issue up to 5 billion baht (≈US$150 million) of “G-Token” digital investment tokens within two months to fund this year’s borrowing plan. [source]

Wyoming’s Stable Token Commission chose Inca Digital on 14 May 2025 to provide AML monitoring for the state-backed WYST stablecoin, scheduled for a July 2025 launch and fully backed by U.S. Treasuries, cash and repos. [source]

Over the past 24h, $411.36M in crypto positions were liquidated, impacting 138,586 traders; longs comprised $183.05M while shorts made up $228.31M. The biggest single liquidation was a $12.20M ETHUSDT order on Binance. [source]

Exchanges and Listings

Robinhood agreed on 14 May 2025 to acquire Toronto-listed crypto platform WonderFi for about US$179 million in cash and stock, pending regulatory approval. [source] [source]

Galaxy Digital finalised its move to Delaware and reported a US$295 million Q1 net loss; it expects its shares to list on Nasdaq later in the week of 12–18 May 2025. [source]

Upbit opened KRW, BTC and USDT markets for Nexpace’s NXPC token on 14 May 2025; NXPC powers the Henesys L1 mainnet for Nexon’s MapleStory Universe and is bridged to Avalanche C-Chain. [source]

Binance Alpha will list Bluefin (BLUE) and sudeng (HIPPO)—both Sui-based tokens—on 15 May 2025 as part of its early-access programme. [source]

Liquid and Venture Funds

VanEck and Securitize launched the tokenised VanEck Treasury Fund (VBILL) on 14 May 2025, giving on-chain access to short-term U.S. Treasuries across Avalanche, BNB Chain, Ethereum and Solana with minimum subscriptions of US$100,000 (US$1 million on Ethereum). [source] [source]

Bitcoin

Cantor Equity Partners disclosed on 13 May 2025 that Twenty One Capital, backed by Tether, purchased 4,812 BTC for US$458.7 million at an average US$95,320 per coin as part of its merger transaction. [source] [source]

Ethereum

The Synthetix community is weighing a US$27 million token-swap acquisition of options protocol Derive to broaden its derivatives suite on Ethereum L2s; a formal proposal is expected later this month. [source] [source]

Developments

Monad-focused start-up Perpl raised US$9.25 million in a seed round led by Dragonfly to build high-frequency trading infrastructure. [source]

DeFi Development Corp bought 172,670 SOL for US$23.6 million on 12 May 2025, lifting its treasury to 595,988 SOL (≈US$102.7 million including staking rewards). [source] [source]

Circle completed the shift from bridged to native USDC on Sonic Labs on 14 May 2025 and launched CCTP V2 with hooks for automated transfers. [source]

Pine Analytics reported that private Solana DEXs such as SolFi and Obric v2 now execute 40–60 % of trades routed through aggregator Jupiter, with USDC/USDT and SOL pairs dominant. [source]

The CORES NFT mint for Zynga’s Sugartown GameFi project went live on 14 May 2025 on AbstractChain, offering phased free and paid mints and access to future in-game rewards. [source]

Social media on 14 May 2025 highlighted growing rivalry between launchpads PUMP and Bonk after both listed identical memecoins, intensifying competition for market share. [source]

Market Data

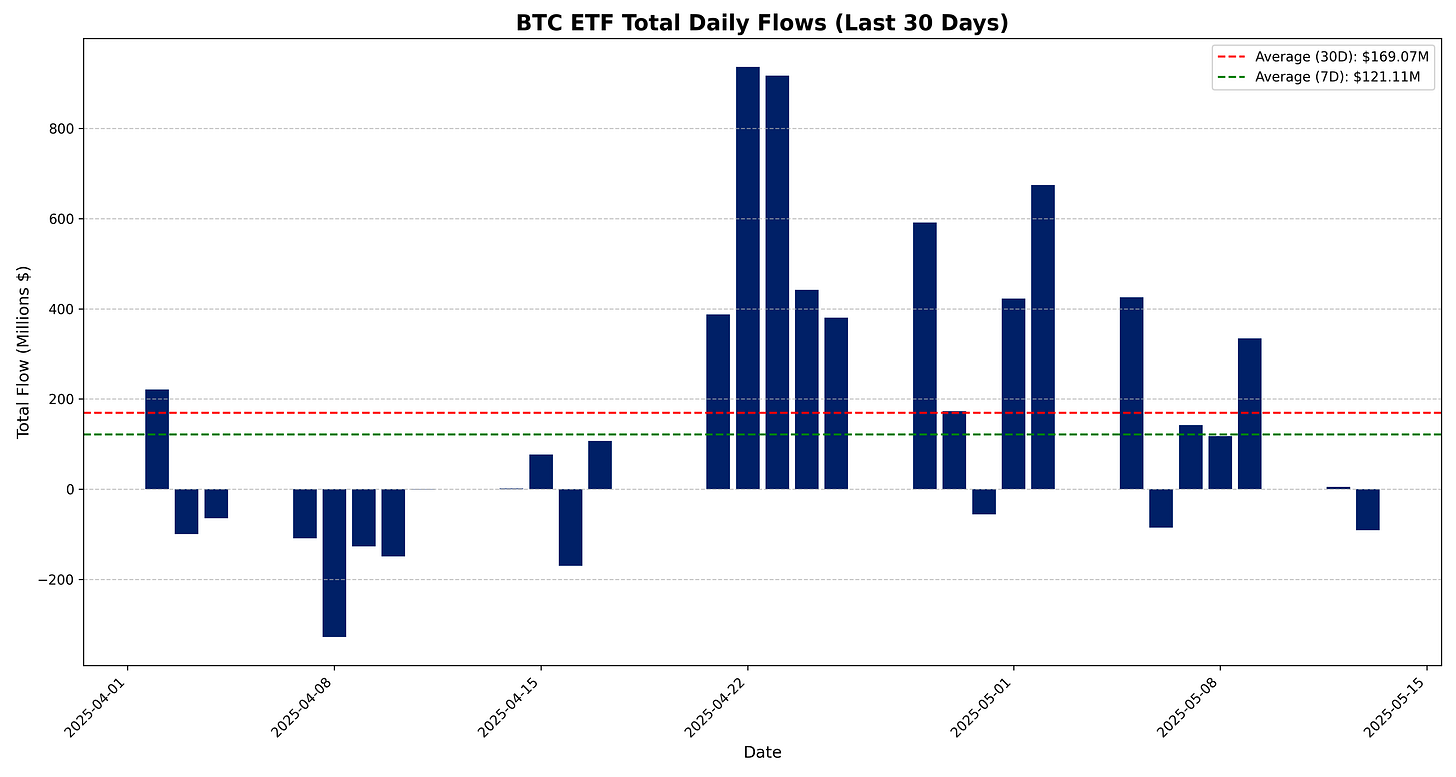

BTC ETF

BTC ETFs total net daily flow for 13 May 2025 is –$91.4M.

Breakdown:

IBIT: $0.0M

FBTC: –$91.4M

BITB: $0.0M

ARKB: $0.0M

BTCO: $0.0M

EZBC: $0.0M

BRRR: $0.0M

HODL: $0.0M

BTCW: $0.0M

GBTC: $0.0M

BTC: $0.0M

Total net daily flow: –$91.4M

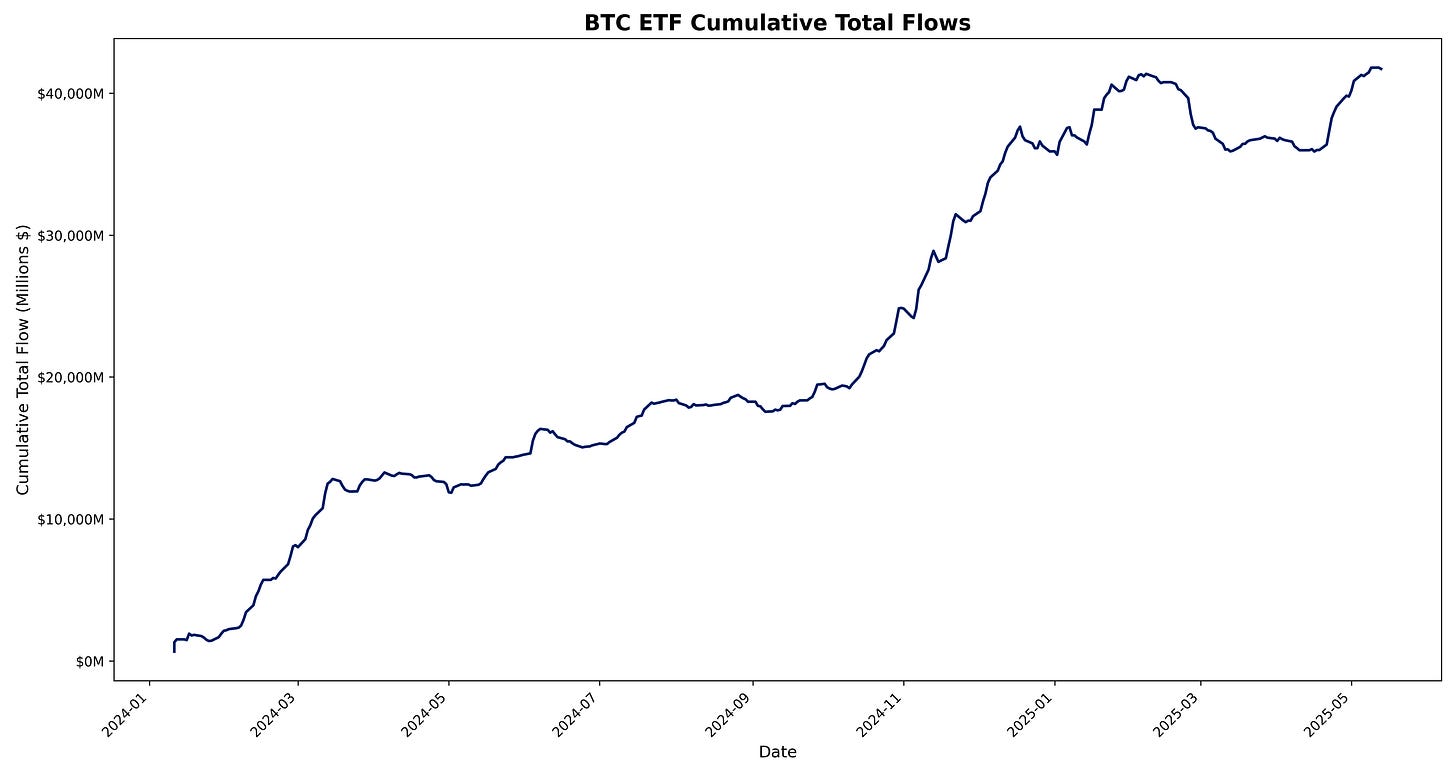

Total cumulative flows to date: $41,709.7M

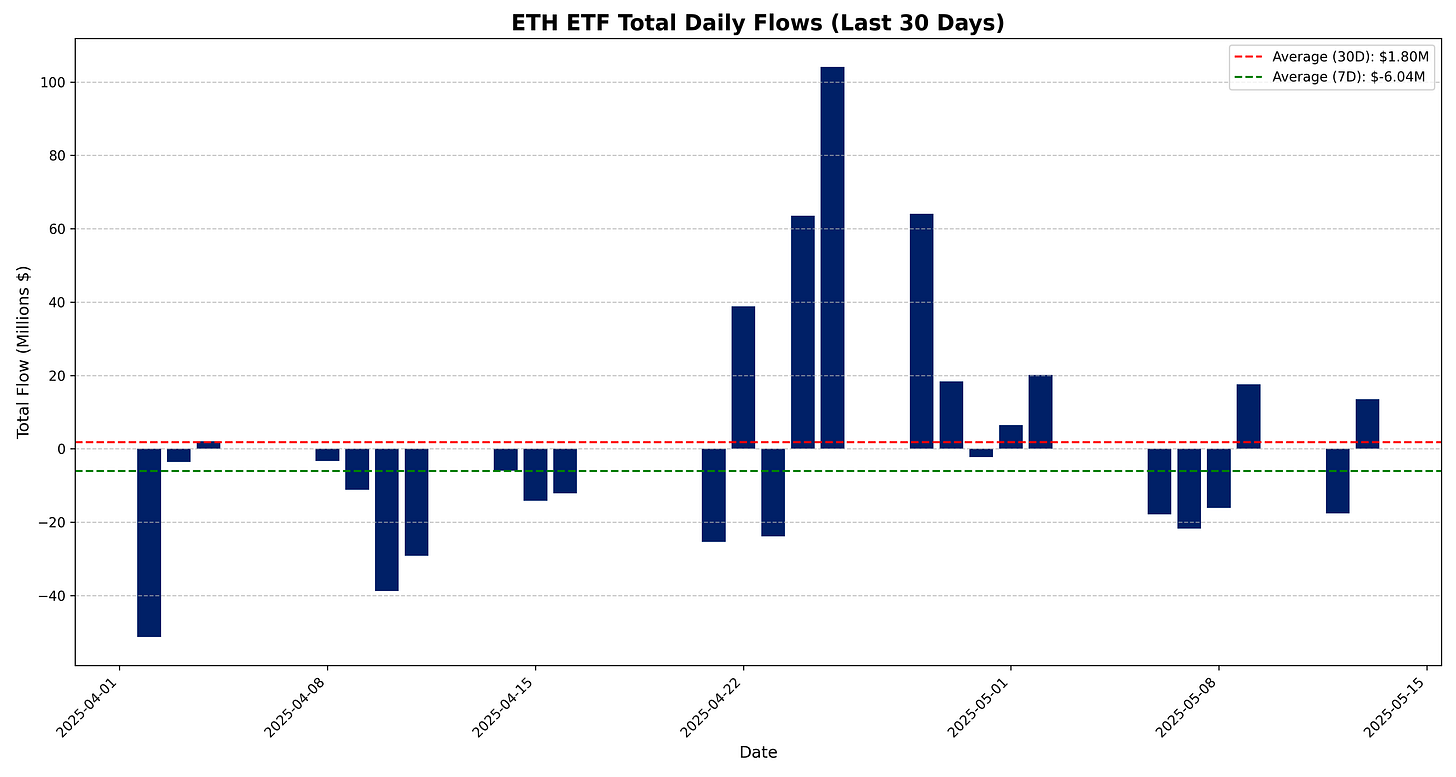

ETH ETF

ETH ETFs total net daily flow for 13 May 2025 is +$13.5M.

Breakdown:

ETHA: $0.0M

FETH: $0.0M

ETHW: $0.0M

CETH: $0.0M

ETHV: +$3.0M

QETH: $0.0M

EZET: +$3.1M

ETHE: $0.0M

ETH: +$7.4M

Total net daily flow: +$13.5M

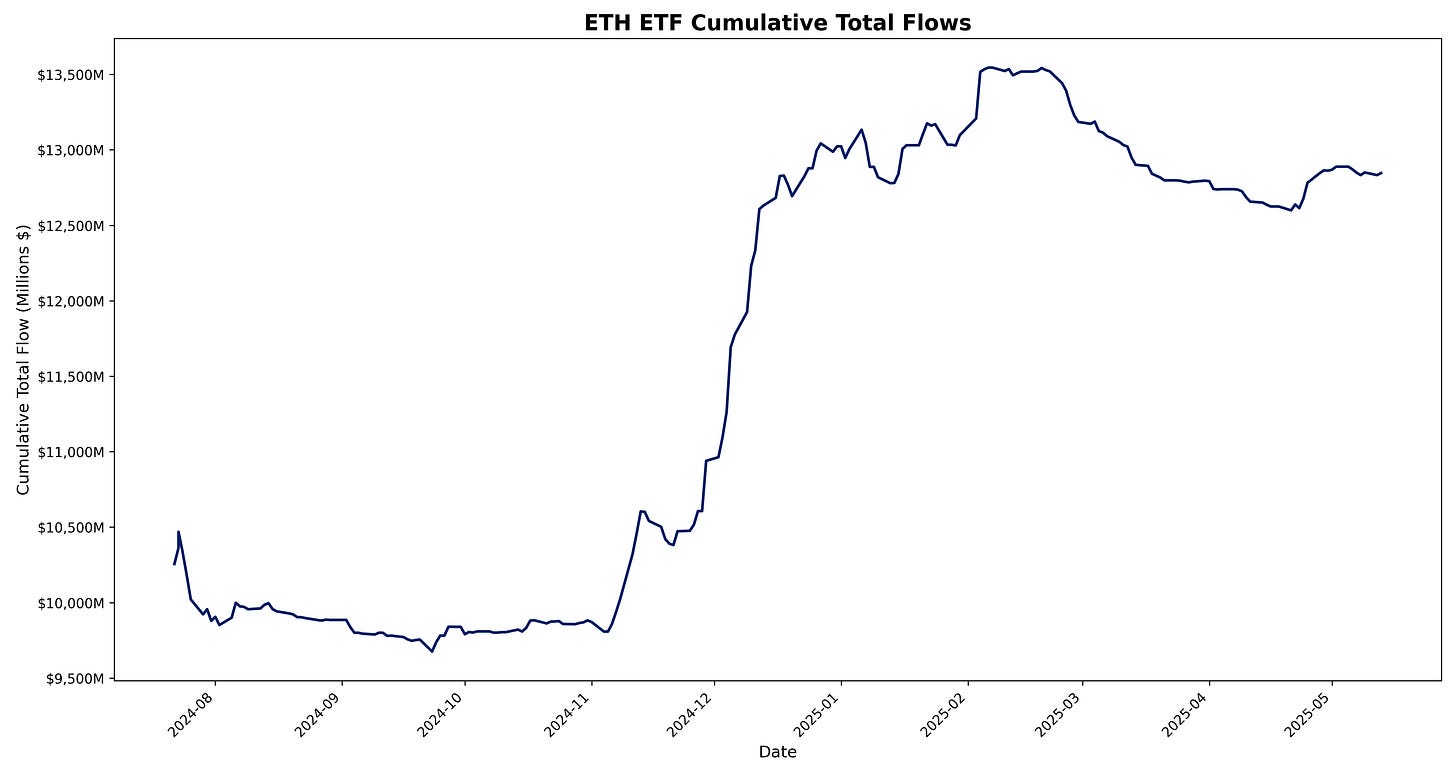

Total cumulative flows to date: $12,846.0M

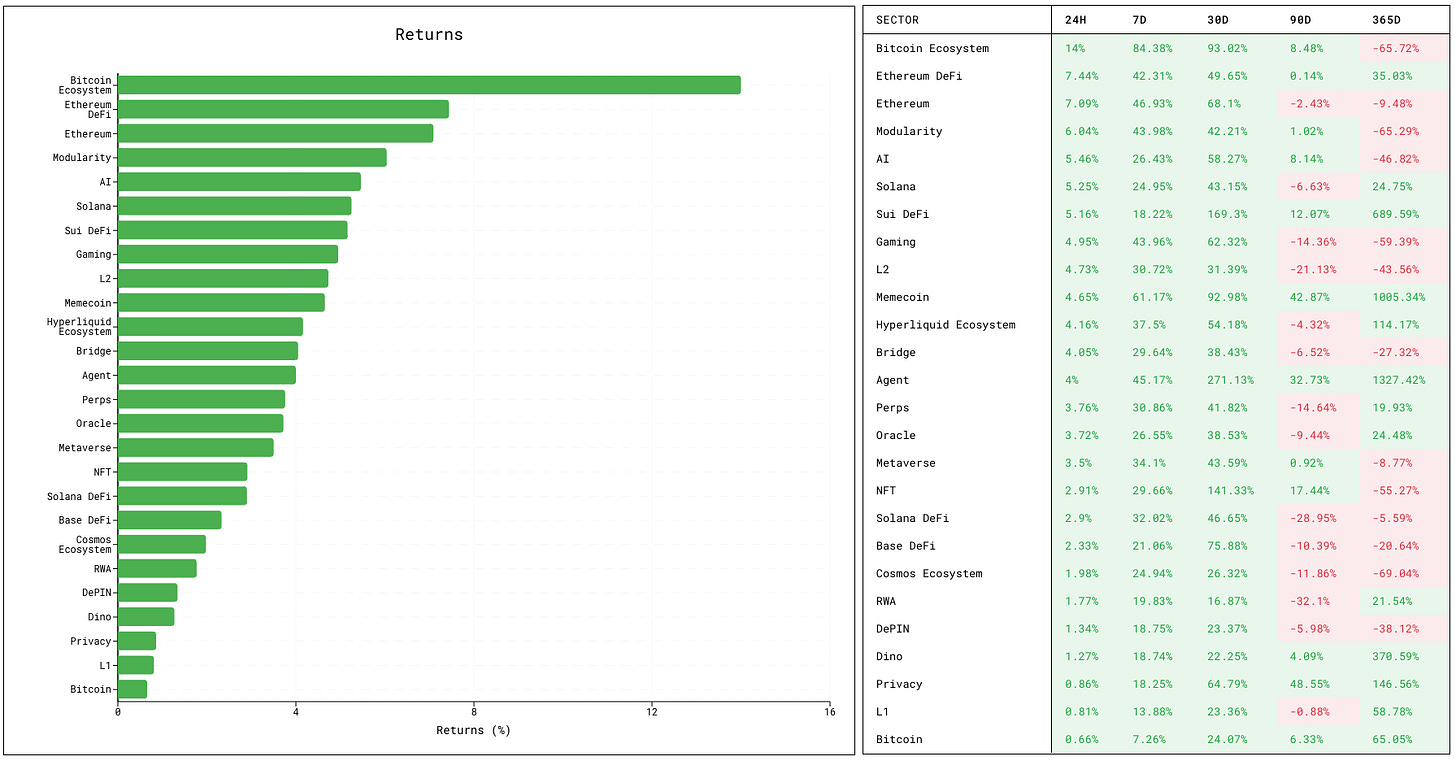

Sector Returns

Top Performing Sectors

Bitcoin Ecosystem sector is up 14.00% over the past 24 hours (ORDI up 16.19%, PUPS up 0.52%, STX up 0.12%).

Ethereum DeFi sector is up 7.44% over the past 24 hours (EIGEN up 18.46%, ENA up 17.75%, FLUID up 9.54%).

Modularity sector has risen 6.04% over the past 24 hours (DYM up 19.61%, ALT up 10.52%, TIA up 4.81%).

Worst Performing Sectors

L1 sector is down 0.81% over the past day (APT up 5.09%, AVAX up 3.79%, HYPE up 3.64%).

Privacy sector is down slightly 0.86% over the past day (XMR up 1.25%, ZEC down 2.67%).

Dino sector has fallen down 1.27% over the past day (XRP up 1.44%, BSV up 0.63%, BCH up 0.17%).

Token Returns

Top Performing Tokens

MPL is up 35.16% in the past 24 hours, among the top performers in the RWA sector.

SEND is up 25.31% in the past 24 hours, among the top performers in the Sui DeFi sector.

GRIFF is up 24.12% in the past 24 hours, among the top performers in the Agent sector.

DYM is up 19.61% in the past 24 hours, among the top performers in the Modularity sector.

EIGEN has risen 18.46% in the past 24 hours, making it a strong performer in the Ethereum DeFi sector.

Worst Performing Tokens

BONK is down 6.57% in the past 24 hours, among the worst performers in the Memecoin sector.

MNDE is down 6.12% in the past 24 hours, among the worst performers in the Solana DeFi sector.

VERTEX is down 3.97% in the past 24 hours, among the worst performers in the Perps sector.

KMNO is down 3.37% in the past 24 hours, among the worst performers in the Solana DeFi sector.

CULT has fallen 3.24% in the past 24 hours, making it among the biggest laggards in the NFT sector.

Protocol Updates

Scaling Arbitrum Everywhere

Protocol: Arbitrum

Date: 2025-05-13 13:00:35

Link: https://blog.arbitrum.io/scaling-arbitrum-everywhere/

Description: Arbitrum posted an overview of plans to extend its roll-up technology across additional networks, outlining new tooling and ecosystem partnerships to broaden adoption.

Synthetix & Derive set to unite for Mainnet Perpetual Futures

Protocol: Synthetix

Date: 2025-05-14 04:05:27

Link: https://blog.synthetix.io/synthetix-derive-set-to-unite-for-mainnet-perpetual-futures/

Description: Synthetix CC posted that Synthetix and Derive will collaborate to launch perpetual futures on mainnet, detailing how the integration will combine Synthetix liquidity with Derive’s trading interface.

Governance

Aave’s Path Forward: In-depth Analysis and Strategic Opportunities in the Lending Market

Protocol: Aave

Date: 2025-05-14 05:54:09

Description: WalleDAO posted an in-depth analysis outlining Aave’s strategic opportunities in the lending market.

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.13.25

Protocol: Aave

Date: 2025-05-13 21:54:07

Description: ChaosLabs proposed increasing supply caps on several Aave V3 assets under its Risk Steward remit.

Proposal to Deploy JTO/SOL to Deepen Liquidity & Earn Yield via GooseFX GAMMA

Protocol: Jito Network

Date: 2025-05-13 19:57:27

Description: drnick proposed deploying JTO and SOL through GooseFX’s GAMMA program to deepen liquidity and earn yield for Jito.

Dual Governance Committees

Protocol: Lido

Date: 2025-05-13 13:13:57

Link: https://research.lido.fi/t/dual-governance-committees/10050

Description: GrStepanov posted an overview of proposed committees to support Lido’s upcoming dual governance model.

Lido Dual Governance Emergency Committee

Protocol: Lido

Date: 2025-05-13 13:11:29

Link: https://research.lido.fi/t/lido-dual-governance-emergency-committee/10049

Description: GrStepanov proposed creating an Emergency Committee to handle urgent decisions within Lido’s dual governance framework.

Lido Dual Governance Tiebreaker Committee

Protocol: Lido

Date: 2025-05-13 13:09:31

Link: https://research.lido.fi/t/lido-dual-governance-tiebreaker-committee/10047

Description: GrStepanov proposed establishing a Tiebreaker Committee to resolve stalemates in Lido’s dual governance votes.

deUSD and sdeUSD Asset Assessment

Protocol: Compound

Date: 2025-05-13 21:05:30

Link: https://www.comp.xyz/t/deusd-and-sdeusd-asset-assessment/6767

Description: jbass-oz initiated an assessment of deUSD and sdeUSD to evaluate their suitability as assets on Compound.

MigratorV2 Audit

Protocol: Compound

Date: 2025-05-13 12:44:14

Link: https://www.comp.xyz/t/migratorv2-audit/6761

Description: jbass-oz requested a security audit for the MigratorV2 contract before deployment.

Compensator Audit-Readiness Assessment 202504

Protocol: Compound

Date: 2025-05-13 12:32:11

Link: https://www.comp.xyz/t/compensator-audit-readiness-assessment-202504/6760

Description: jbass-oz shared an audit-readiness assessment of the Compensator module version 202504.

Compensator Audit-Readiness Assessment

Protocol: Compound

Date: 2025-05-13 12:24:59

Link: https://www.comp.xyz/t/compensator-audit-readiness-assessment/6759

Description: jbass-oz presented an initial audit-readiness assessment for the Compensator contract.

OpenZeppelin Security Partnership - 2025 Q1 Update

Protocol: Compound

Date: 2025-05-13 12:19:50

Link: https://www.comp.xyz/t/openzeppelin-security-partnership-2025-q1-update/6758

Description: jbass-oz provided a Q1 2025 update on Compound’s security partnership with OpenZeppelin.

13 May 2025 - Roundup of Active/Upcoming Votes

Protocol: Arbitrum Foundation

Date: 2025-05-13 14:07:02

Link: https://forum.arbitrum.foundation/t/13-may-2025-roundup-of-active-upcoming-votes/29210

Description: Mateusz compiled a roundup of active and upcoming Arbitrum Foundation votes dated 13 May 2025.

Listing Proposal: List $ATH (Aethir) Perps on GMX

Protocol: GMX

Date: 2025-05-13 12:52:24

Link: https://gov.gmx.io/t/listing-proposal-list-ath-aethir-perps-on-gmx/4553

Description: cryptickatz proposed listing perpetual contracts for Aethir’s ATH token on GMX.

DIP 4: Strategic Buyback and Incentive Proposal

Protocol: Drift

Date: 2025-05-13 23:29:34

Link: https://driftgov.discourse.group/t/dip-4-strategic-buyback-and-incentive-proposal/218

Description: foundation proposed DIP 4 to fund a strategic buyback program and user incentives for Drift.

dYdX Treasury SubDAO Community Update - April 2025

Protocol: dYdX

Date: 2025-05-14 08:07:50

Link: https://dydx.forum/t/dydx-treasury-subdao-community-update-april-2025/3587

Description: kpk posted the April 2025 community update from the dYdX Treasury SubDAO.

[BIP-828] Enable Smardex Boosted SDEX/waEthLidoWETH Gauge on Balancer v3 Ethereum

Protocol: Balancer

Date: 2025-05-13 19:07:51

Description: Xeonus proposed enabling a gauge for the Smardex boosted SDEX/waEthLidoWETH pool on Balancer v3 Ethereum.

[BIP-826] Balancer Boosted Pool Rewards Rerouting Framework

Protocol: Balancer

Date: 2025-05-13 12:58:19

Link: https://forum.balancer.fi/t/bip-826-balancer-boosted-pool-rewards-rerouting-framework/6510

Description: Xeonus proposed a framework to reroute boosted pool rewards within Balancer v3.

WOOFi: Liquidity Source Integration Proposal

Protocol: CoW Protocol

Date: 2025-05-14 06:01:01

Link: https://forum.cow.fi/t/woofi-liquidity-source-integration-proposal/3007

Description: Merlin proposed integrating WOOFi as a new liquidity source for the CoW Protocol.

Cross-Chain CoWs the Simple Way: Minimal Protocol Changes Using Espresso + Across Infrastructure

Protocol: CoW Protocol

Date: 2025-05-13 16:06:37

Description: khrafts proposed minimal protocol changes using Espresso and Across to enable cross-chain CoWs.

Decentralized, Real-Time Protection for On-Chain Assets in Safe

Protocol: Safe

Date: 2025-05-14 05:53:59

Link: https://forum.safe.global/t/decentralized-real-time-protection-for-on-chain-assets-in-safe/6505

Description: zeroknowledgeGC proposed adding decentralized real-time asset protection to Safe.

Data-Driven Governance: How We Can Empower Silo with Custom Analytics

Protocol: Silo Finance

Date: 2025-05-14 07:15:18

Link: https://gov.silo.finance/t/data-driven-governance-how-we-can-empower-silo-with-custom-analytics/554

Description: ShrihaanPYOR outlined how custom analytics could enhance data-driven governance for Silo.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.