ASXN Daily 09-05-2025

You can also read our daily newsletter on Twitter: https://x.com/asxn_r/status/1920793801175568414

Market Updates

Macro, Regulation and Markets

The U.S. Senate on 8 May 2025 failed to advance the GENIUS Act, a bipartisan stable-coin framework, after several Democrats withdrew support over new anti-money-laundering and national-security language. Republican sponsors forced the vote but fell short of the 60-vote threshold, leaving the bill stalled. [source]

SEC Commissioner Hester Peirce said on 8 May 2025 that the agency is weighing an exemption order that would let firms issue, trade and settle securities on distributed-ledger systems under tailored conditions. The proposal would open a path for trading platforms to list tokenised shares. [source]

President Donald Trump announced a comprehensive U.S.–UK trade pact on 8 May 2025 that cuts tariffs on agricultural, chemical, energy and industrial goods, allows up to 100,000 UK-made vehicles into the U.S. each year at a 10 % tariff and removes steel-and-aluminium duties. Digital-trade issues remain under negotiation. [source]

The SEC and Ripple have agreed to settle the XRP securities case for US $50 million and asked a New York judge to approve the deal, ending the long-running dispute without Ripple admitting liability. [source]

Exchanges and Listings

Coinbase has agreed to buy crypto-options exchange Deribit for about US $2.9 billion in cash and stock, gaining its Dubai futures licence and expanding into derivatives. Founders John and Marius Jansen will depart, and the firms say the tie-up will lower spreads, deepen order books and broaden the product range once regulators sign off. [source]

South Korea’s Upbit has opened KRW, BTC and USDT markets for PENGU, the token linked to the Pudgy Penguins NFT brand. [source]

Coinbase reported Q1 2025 revenue of US $2.03 billion versus a US $2.2 billion consensus, with trading volume down 10 % to US $393 billion. Transaction revenue came in at US $1.26 billion, adjusted EBITDA at US $930 million and net income at US $66 million, while derivatives volume reached US $804 billion and assets under custody rose by US $25 billion. [source]

Liquid and Venture Funds

Jump Crypto has taken a strategic equity stake in tokenisation platform Securitize to expand institutional access to on-chain assets; financial terms were not disclosed. [source]

Ethereum

The Arbitrum DAO has voted to allocate 35 million ARB to tokenised U.S. Treasury funds managed by Franklin Templeton, Spiko and WisdomTree, moving part of its treasury into yield-bearing government bonds. [source]

Unichain overtook Ethereum as the top network for Uniswap v4 by transaction count on 8 May 2025, according to Dune data. [source]

Developments

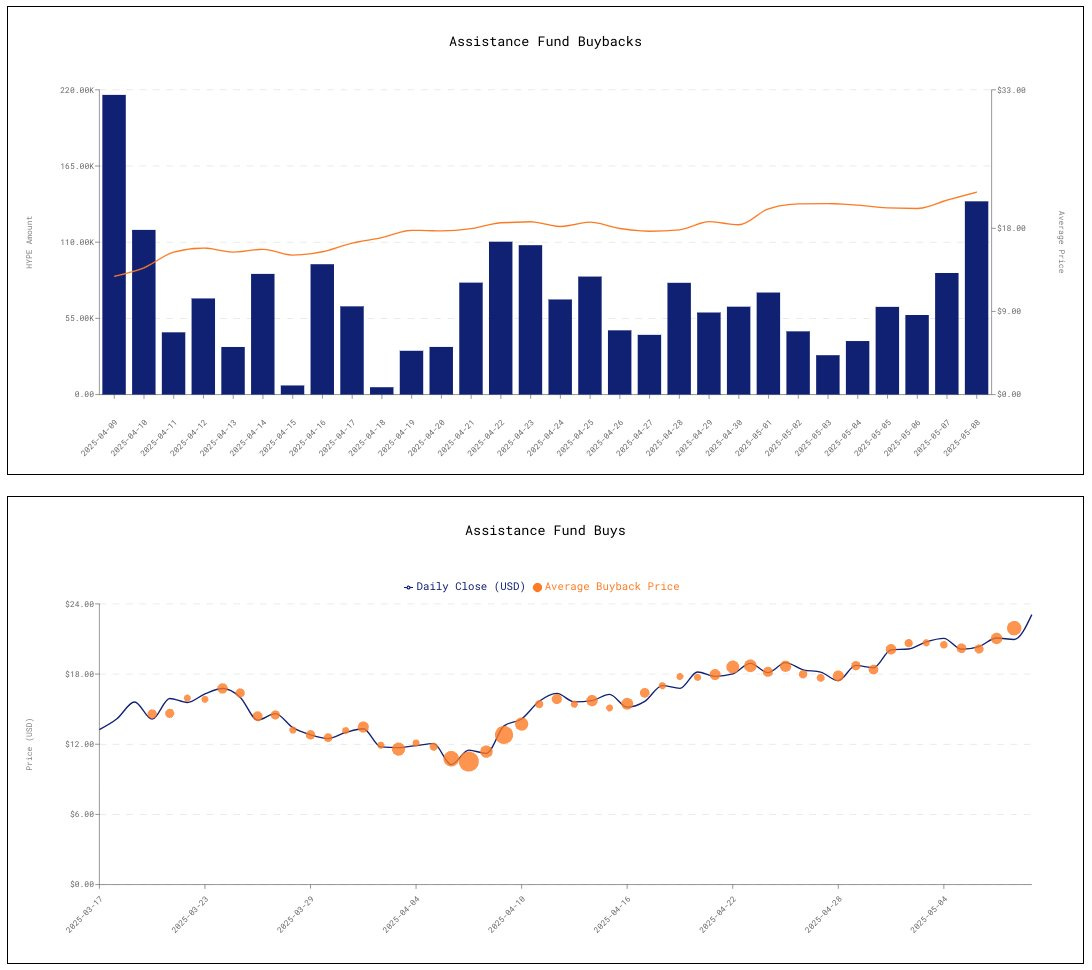

A total of 139.5K HYPE ($3.06M USD) was bought back by the Hyperliquid AF yesterday at an average price of $21.93 USD. Approximately 534K HYPE (0.16% of current circulating supply) has been bought back over the past week. [source]

Meta Platforms is in early talks with crypto firms about using stablecoins such as USDC for low-value cross-border payouts on Instagram and has hired former Plaid executive Ginger Baker as VP of Product to lead the effort. [source]

Payments company Stripe unveiled checkout and payout tools on 8 May 2025 that let merchants accept and send stablecoins across multiple blockchains, calling the new product suite a “gale-force tailwind” for its crypto strategy. [source]

World Liberty Financial’s Trump-linked USD1 stable-coin has expanded its circulating supply from roughly US $130 million to more than US $2 billion since late April 2025. [source]

Superstate has launched “Opening Bell,” a programme to bring SEC-registered equities on-chain, starting with Solana-issued shares, in an effort to bridge traditional securities and DeFi infrastructure. [source]

ETFs

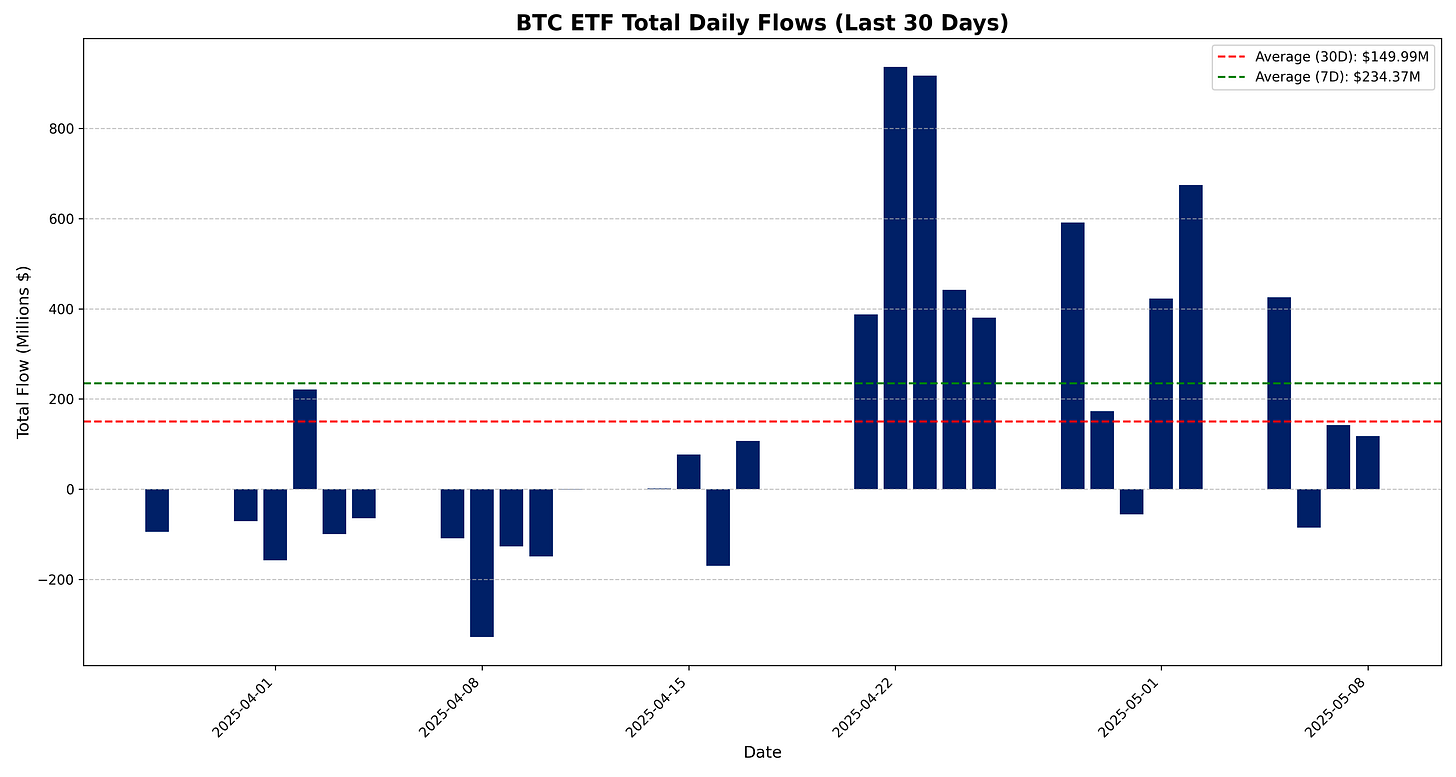

U.S. spot Bitcoin ETFs saw a net inflow of US $117 million on 8 May 2025, while spot Ethereum ETFs recorded a third straight day of outflows totaling US $16.1 million. [source]

Market Data

BTC ETF

BTC ETFs total net daily flow for 2025-05-08 is $117.4M.

Breakdown:

IBIT: +$69.0 M

FBTC: +$35.3 M

BITB: $0.0 M

ARKB: +$13.1 M

BTCO: $0.0 M

EZBC: $0.0 M

BRRR: $0.0 M

HODL: $0.0 M

BTCW: $0.0 M

GBTC: $0.0 M

BTC: $0.0 M

Total net daily flow: +$117.4 M

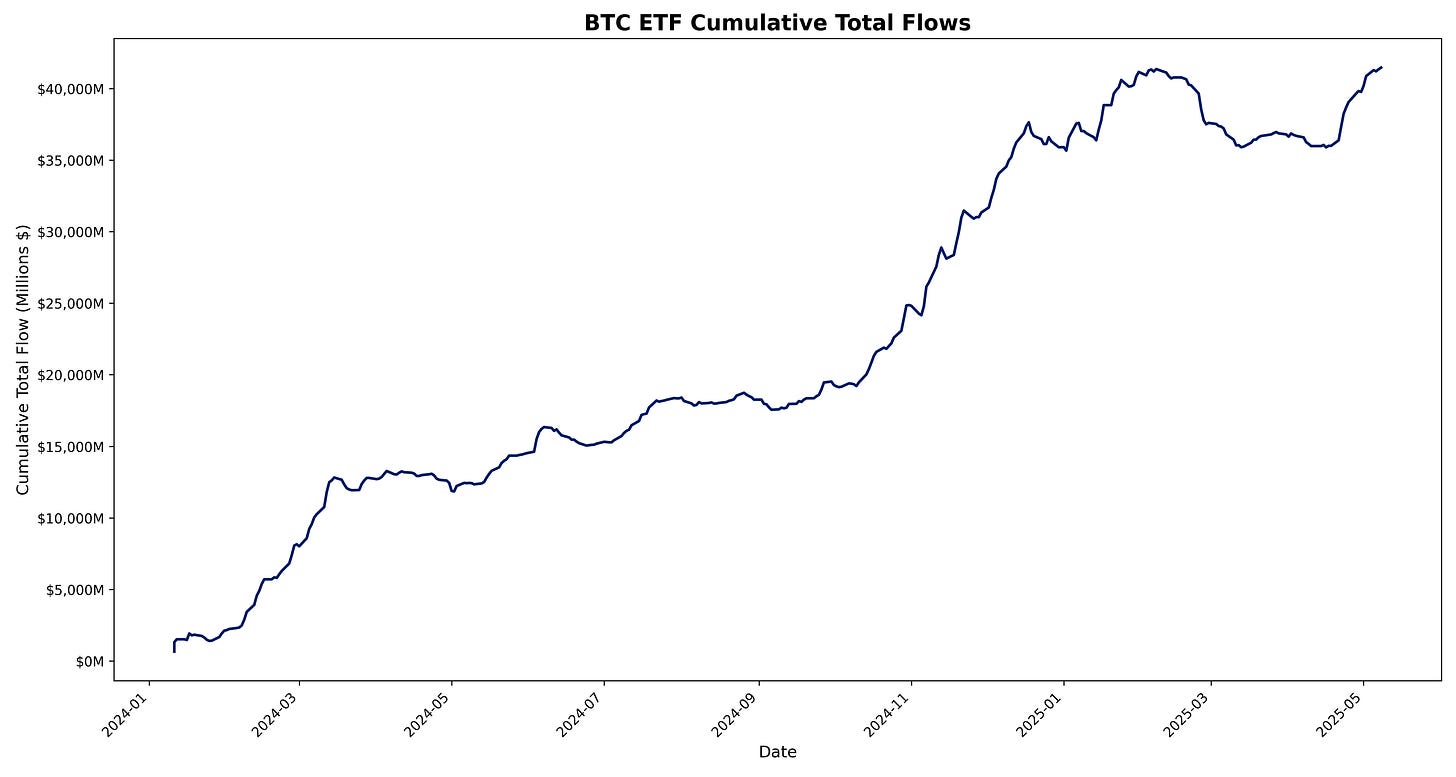

Total cumulative flows to date: $41,461.4M

Sector Returns

Top Performing Sectors

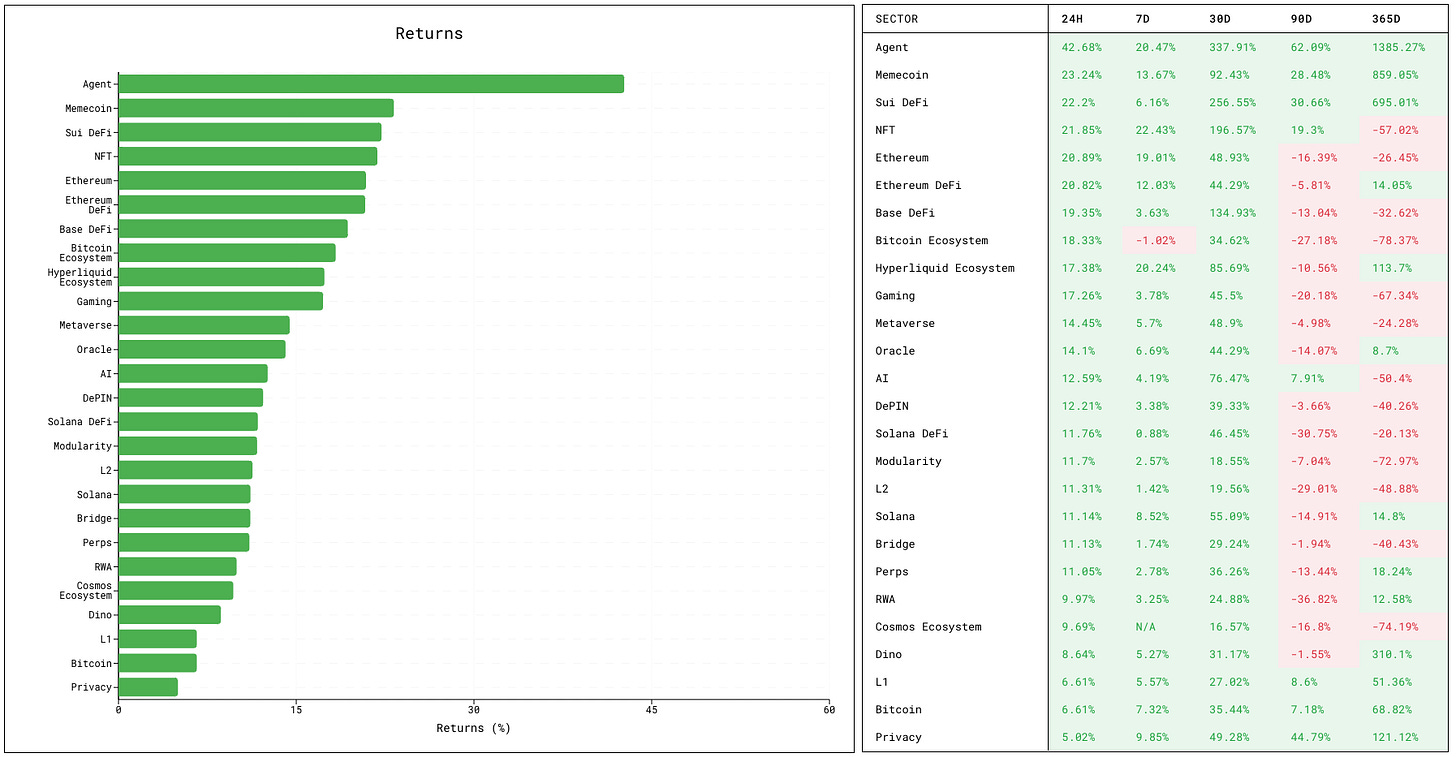

Agent sector leads the market (VIRTUAL up 47.44%, GRIFF up 25.25%, AIXBT up 14.17%), up 42.68% over the past 24 hours.

Memecoin sector has gained 23.24% over the past day (BITCOIN up 41.53%, SHIB up 36.98%, PEPE up 32.95%).

Sui DeFi sector is up 22.20% in the last 24 hours (DEEP up 22.99%, BLUE up 21.68%, CETUS up 20.91%).

Worst Performing Sectors

Privacy sector has increased by only 5.02% (XMR up 5.14%, ZEC up 4.06%) over the past 24 hours.

L1 sector is up 6.61% in the last 24 hours (BERA up 22.74%, NEAR up 20.07%, SUI up 20.02%).

Bitcoin sector is up 6.61% over the past 24 hours (BTC up 6.61%).

Token Returns

Top Performing Tokens

CULT has gained 47.55% over the past 24 hours in the NFT sector.

VIRTUAL’s price has risen 47.44% over the last 24 hours in the Agent sector.

EIGEN advanced 43.45% over the past day in the Ethereum DeFi sector.

BITCOIN token is up 41.53% over the past 24 hours in the Memecoin sector.

SHIB has gained 36.98% in the last 24 hours in the Memecoin sector.

Worst Performing Tokens

WLD price has decreased 24.51% over the past 24 hours in the AI sector.

STX has fallen 20.69% over the past day in the Bitcoin Ecosystem sector.

VERTEX is down 4.75% in the last 24 hours in the Perps sector.

MPL has dropped 4.28% over the past 24 hours in the RWA sector.

BLAST is down 1.95% in the last 24 hours in the L2 sector.

Protocol Updates

Curve Best Yields & Key Metrics | Week 19, 2025

Protocol: Curve

Date: 2025-05-08 13:47:23

Link: https://news.curve.fi/curve-best-yields-key-metrics-week-19-2025/

Description: Saint Rat posted weekly yield and ecosystem metrics for Week 19, noting a 38.6 % top yield on the crvUSD/SQUID Llamalend market, Curve TVL up 4.4 % to $2.123 B, and crvUSD supply at a new all-time high.

Blockchain Bandits: How Public DA Creates New MEV Attack Vectors

Protocol: Sei

Date: 2025-05-08 20:07:17

Link: https://blog.sei.io/blockchain-bandits-how-public-da-creates-new-mev-attack-vectors-2/

Description: Sei posted an analysis showing how Autobahn’s public data-availability layer and concurrent block production enable new MEV tactics such as transaction theft and inter-block front-running, and it reviews mitigations including commit-reveal schemes, threshold crypto, and VDF timelocks.

Governance

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.08.25

Protocol: Aave

Date: 2025-05-08 15:45:31

Description: ChaosLabs proposed raising supply caps on several assets in Aave V3 under its Risk Steward mandate to align with updated risk parameters.

Standing Delegate Call May 13 - Thread

Protocol: ZKSync

Date: 2025-05-09 08:03:22

Link: https://forum.zknation.io/t/standing-delegate-call-may-13-thread/672

Description: Theshelb opened a thread for the 13 May standing delegate call, inviting zkSync delegates to post agenda items and questions.

LIP-28 Dual Governance

Protocol: Lido

Date: 2025-05-08 18:53:20

Link: https://research.lido.fi/t/lip-28-dual-governance/10032

Description: Leuts proposed LIP-28, introducing a dual governance framework that separates staker and node-operator voting power within Lido.

Ethena’s April 2025 Governance Update

Protocol: Ethena Foundation

Date: 2025-05-08 13:34:27

Link: https://gov.ethenafoundation.com/t/ethena-s-april-2025-governance-update/567

Description: Muntangled posted Ethena’s April 2025 governance update, summarising treasury movements, protocol changes and forthcoming proposals.

STEP Report - April 2025

Protocol: Arbitrum Foundation

Date: 2025-05-08 21:32:32

Link: https://forum.arbitrum.foundation/t/step-report-april-2025/29192

Description: Steakhouse released the April 2025 STEP report, detailing grant allocations and ecosystem development metrics for Arbitrum.

25th GRC Call - Recording & Transcript

Protocol: Arbitrum Foundation

Date: 2025-05-08 16:25:32

Link: https://forum.arbitrum.foundation/t/25th-grc-call-recording-transcript/29190

Description: Sinkas shared the recording and transcript of the 25th Governance Risk & Compliance call, providing a reference for community members.

Analysis of Vote Buying Services

Protocol: Arbitrum Foundation

Date: 2025-05-08 16:16:34

Link: https://forum.arbitrum.foundation/t/analysis-of-vote-buying-services/29189

Description: DefiLlama_Research posted an analysis of vote-buying services impacting DAO governance and outlined potential mitigation strategies.

Balancer Maxis: Monthly Update for April 2025

Protocol: Balancer

Date: 2025-05-09 09:52:01

Link: https://forum.balancer.fi/t/balancer-maxis-monthly-update-for-april-2025/6507

Description: Xeonus delivered Balancer Maxis’ April 2025 update covering treasury status, liquidity incentives and recent governance activity.

Voting Report (Avsa.eth)

Protocol: ENS

Date: 2025-05-08 17:30:42

Link: https://discuss.ens.domains/t/voting-report-avsa-eth/20752

Description: AvsA issued a voting report summarising their recent ENS votes and the rationale behind each decision.

pDAO 2025/04/10 - 2025/05/08 Treasury Report

Protocol: Rocket Pool

Date: 2025-05-09 04:00:52

Link: https://dao.rocketpool.net/t/pdao-2025-04-10-2025-05-08-treasury-report/3613

Description: Vacalaranja presented the pDAO treasury report for 10 Apr–8 May 2025 detailing revenues, expenditures and current balances.

GMC Bounty Updates - May 2025

Protocol: Rocket Pool

Date: 2025-05-08 20:03:14

Link: https://dao.rocketpool.net/t/gmc-bounty-updates-may-2025/3612

Description: ShfRyn updated the community on GMC bounty progress and reward distributions for May 2025.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.