ASXN Daily 06-06-2025

Market Updates

Macro, Regulation and Markets

On 6 June 2025, 31,000 Bitcoin options (notional $3.18B) expired with a put/call ratio of 0.71 and max pain at $105,000; 241,000 Ether options (notional $590M) also expired, with a put/call ratio of 0.63 and max pain at $2,575. [source]

Strategy priced 11,764,700 shares of 10.00% Series A Perpetual Stride Preferred Stock at $85 on 5 June 2025, targeting net proceeds of about $979.7M for general corporate purposes, including further Bitcoin purchases. [source]

Stablecoin issuer Circle’s shares opened at $69 and closed at $83.23 on 5 June 2025—168% above the $31 offer price—raising $1.05B and valuing the company near $18B. [source]

Exchanges and Listings

Binance US began HYPE spot trading on 6 June 2025, allowing deposits via the HyperEVM network and offering HYPE/USDT and HYPE/USD pairs. [source]

Coinbase added Fartcoin (FARTCOIN) and Subsquid (SQD) to its public listing roadmap, signalling forthcoming support once liquidity and technical checks are complete. [source]

Binance will list Skate (SKATE) on Binance Alpha at 10:00 UTC on 9 June 2025 and launch a SKATEUSDT perpetual contract with up to 50x leverage on Binance Futures at 10:30 UTC. [source]

Raises

Metaplanet unveiled a ¥770.9B (~$5.4B) equity raise on 6 June 2025 via 555M moving-strike warrants, aiming to hold 100,000 BTC by end-2026 and 210,000 BTC by end-2027—about 1% of eventual supply. [source]

Bitcoin

At the Bloomberg Tech Summit on 5 June 2025, Uber CEO Dara Khosrowshahi said the firm is evaluating Bitcoin and stablecoins for future payment options but does not plan to hold crypto on its balance sheet. [source]

Solana

Maple Finance expanded to Solana on 5 June 2025 using Chainlink’s CCIP, seeding the launch with $500,000 in incentives and coordinating over $30M in liquidity. [source]

Hyperliquid

Hyperliquid replaced the testnet L1Write contract with a CoreWriter system contract and introduced the eth_usingBigBlocks JSON-RPC method, according to documentation updated on 6 June 2025. [source]

Developments

On 5 June 2025, LayerZero co-founder Bryan Pellegrino accused Hyperlane of inflating volumes with repetitive $24,000 transfers; Hyperlane said the activity came from reward chasers, while Pellegrino criticised its token-reward design. [source]

ETFs

Truth Social registered “Truth Social Bitcoin and Ethereum ETF, B.T.” as a domestic business trust in Nevada on 5 June 2025, laying groundwork for a dual-asset crypto ETF. [source]

The UK Financial Conduct Authority proposed on 6 June 2025 to lift its 2021 ban on crypto exchange-traded notes for retail investors, provided cETNs are listed on recognised exchanges and comply with promotion rules. [source]

Market Data

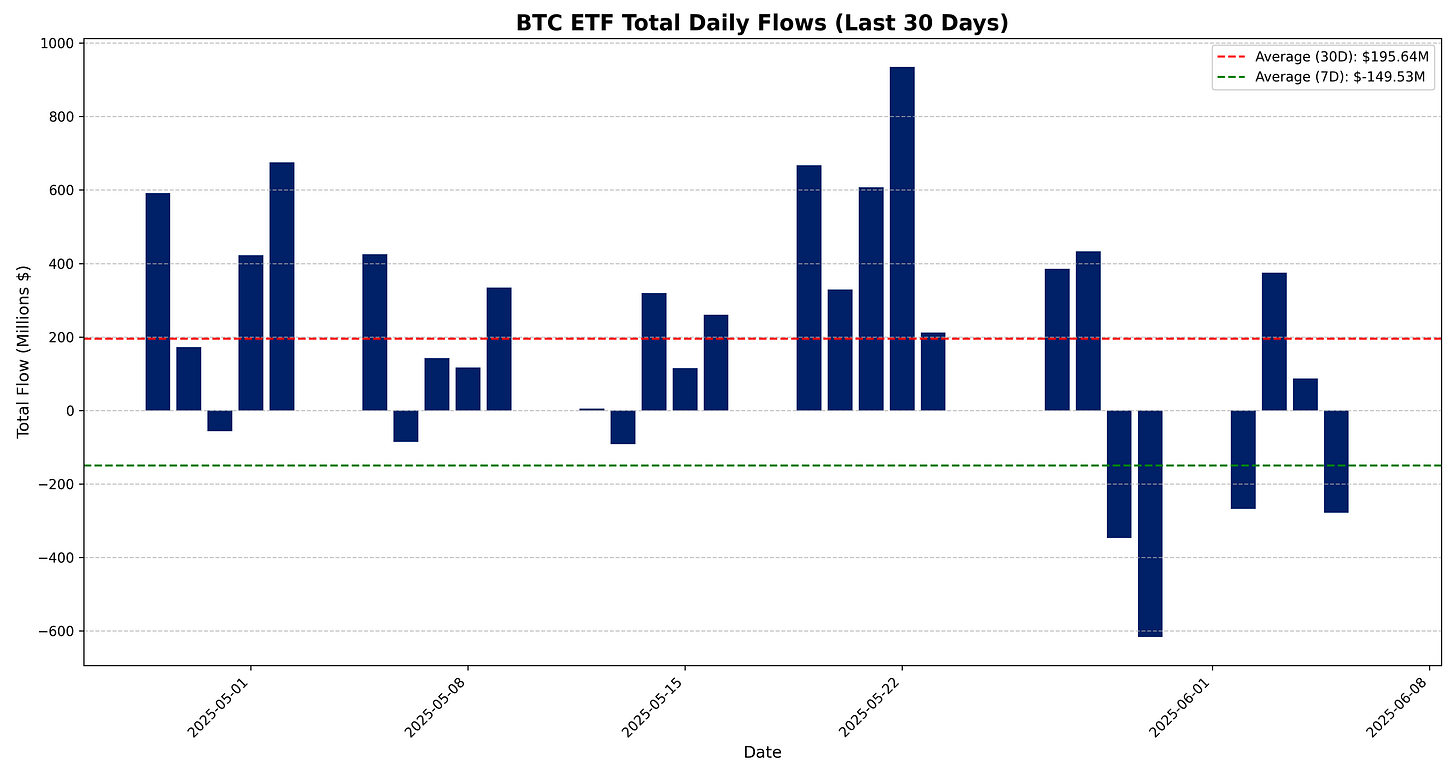

BTC ETF

BTC ETFs total net daily flow for 05 Jun 2025 is –$278.40M.

Breakdown:

IBIT: $0.00M

FBTC: –$80.20M

BITB: –$36.70M

ARKB: –$102.00M

BTCO: –$12.20M

EZBC: $0.00M

BRRR: $0.00M

HODL: –$6.50M

BTCW: $0.00M

GBTC: –$24.10M

BTC: –$16.70M

Total net daily flow: –$278.40M

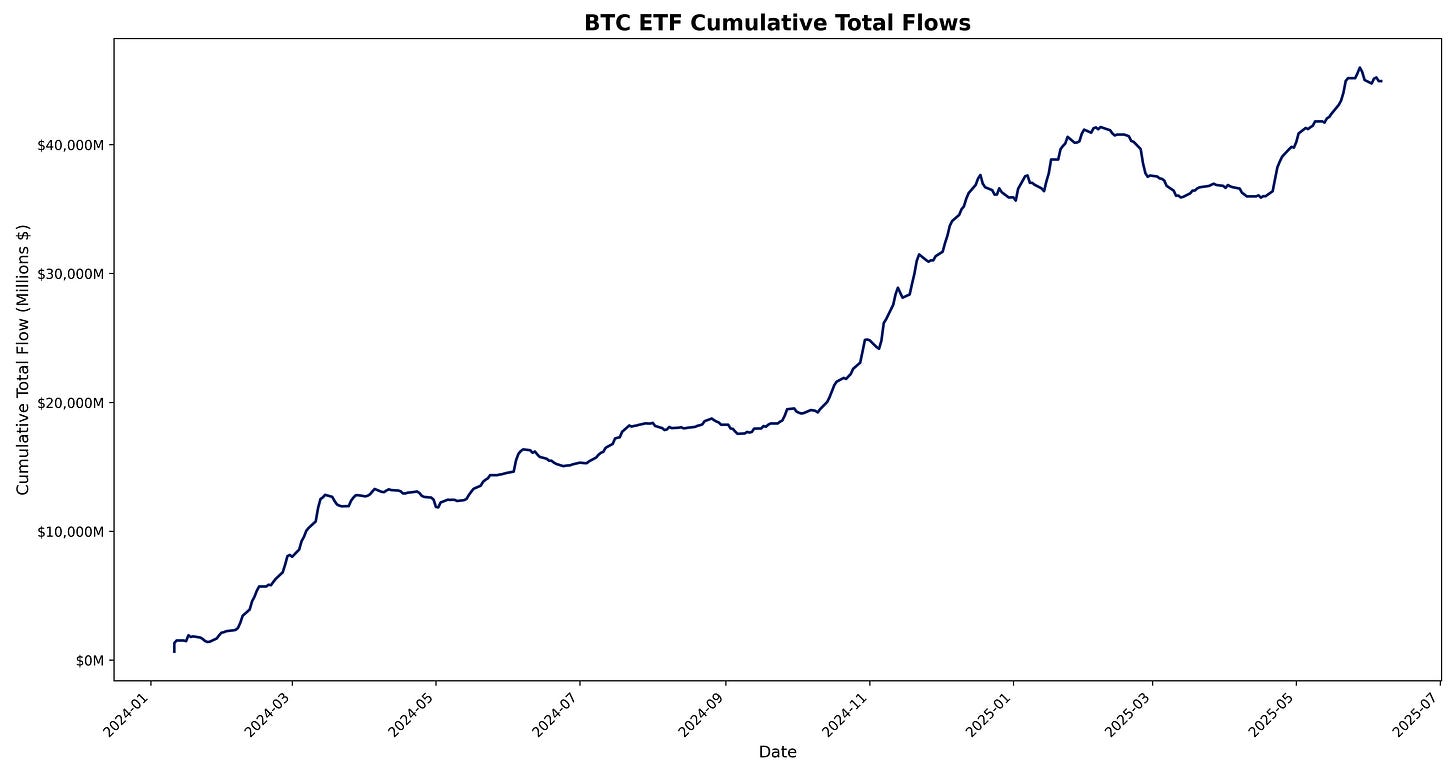

Total cumulative flows to date: $44,925.90M

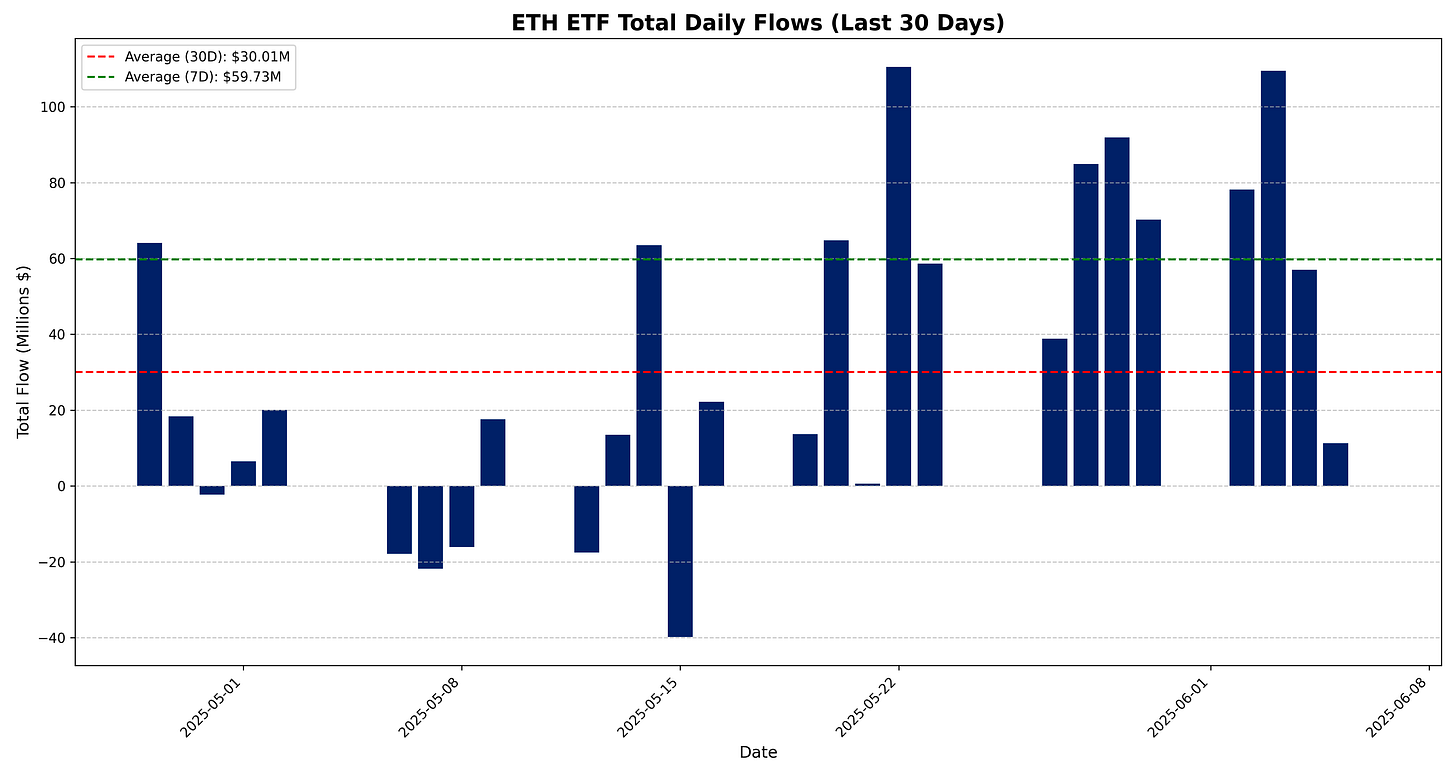

ETH ETF

ETH ETFs total net daily flow for 05 Jun 2025 is +$11.30M.

Breakdown:

ETHA: +$34.70M

FETH: –$23.40M

ETHW: $0.00M

CETH: $0.00M

ETHV: $0.00M

QETH: $0.00M

EZET: $0.00M

ETHE: $0.00M

ETH: $0.00M

Total net daily flow: +$11.30M

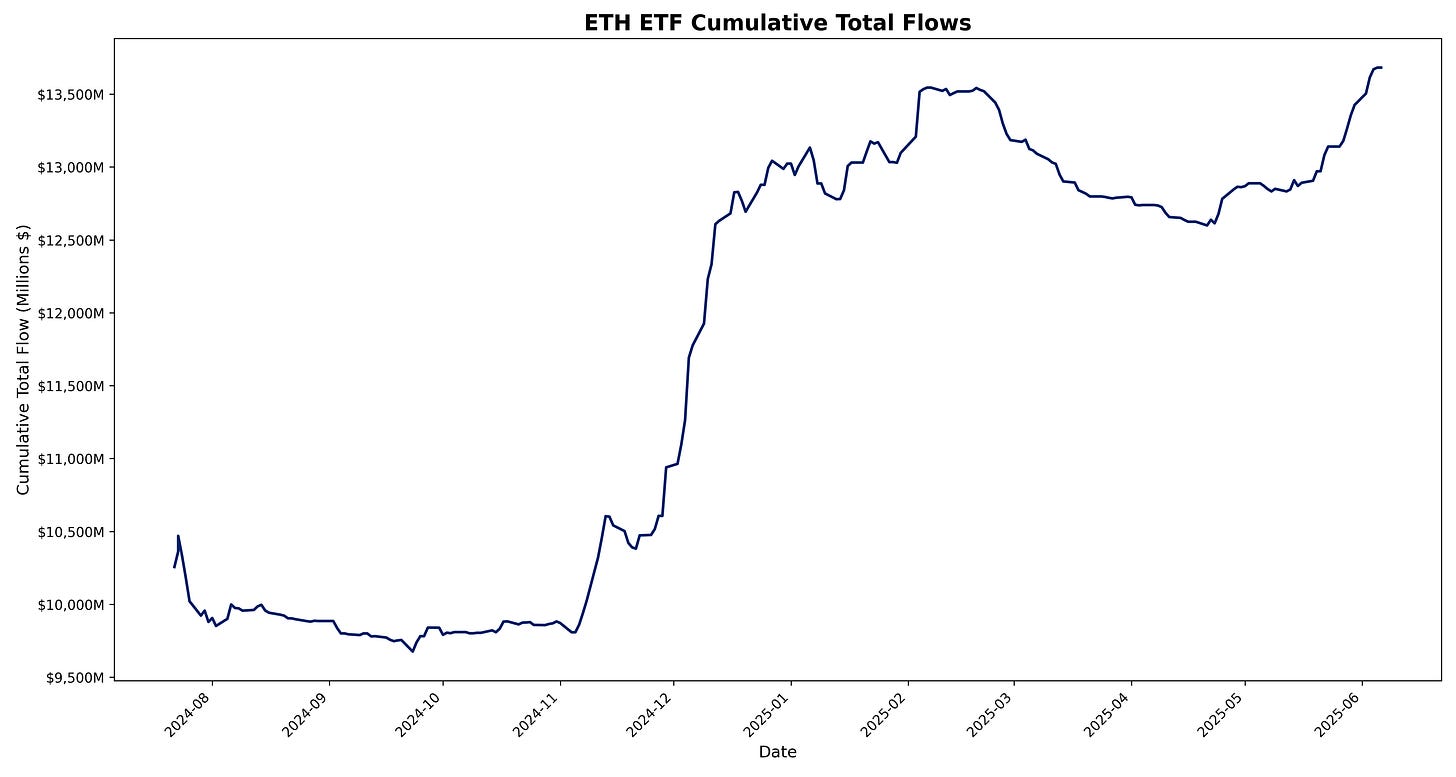

Total cumulative flows to date: $13,681.90M

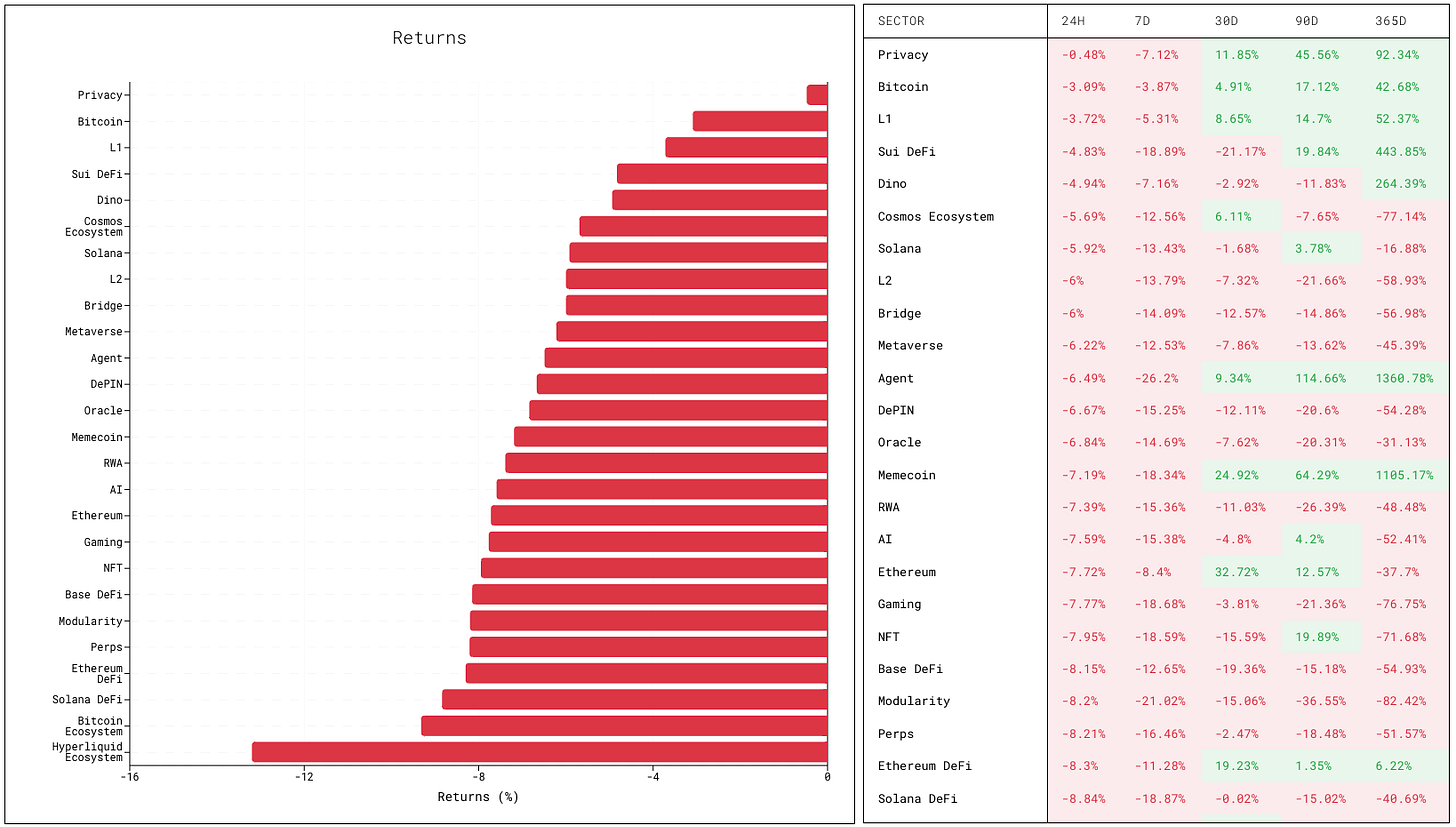

Sector Returns

Worst Performing Sectors

Hyperliquid Ecosystem sector is down -13.20% over the past 24 hours (HFUN -21.14%, PURR -11.01%).

Bitcoin Ecosystem sector is down -9.32% over the past day (ORDI -9.41%, PUPS -8.86%, STX 0.26%).

Solana DeFi sector has fallen -8.84% over the past 24 hours (SAVE -19.27%, JUP -12.09%).

Token Returns

Top Performing Tokens

FART (Memecoin) is up 9.54% in the past 24 hours.

VERTEX (Perps) is up 6.04% in the past 24 hours.

TRX (L1) is up 2.67% in the past 24 hours.

ARB (L2) is up 2.18% in the past 24 hours.

BONK (Memecoin) has risen 0.56% in the past 24 hours.

Worst Performing Tokens

HFUN (Hyperliquid Ecosystem) is down 21.14% in the past 24 hours.

SAVE (Solana DeFi) is down 19.27% in the past 24 hours.

RPL (Ethereum DeFi) is down 16.09% in the past 24 hours.

GEAR (Ethereum DeFi) is down 15.03% in the past 24 hours.

LDO (Ethereum DeFi) has fallen 14.59% in the past 24 hours.

Protocol Updates

Aligning Around MORPHO — The Only Asset For Morpho

Protocol: Morpho

Date: 2025-06-06 1:45:30

Link: https://x.com/PaulFrambot/status/1930971485142761909

Description: Paul Frambot posted that the Morpho community should concentrate on a single asset, MORPHO, phasing out alternative token forms to streamline incentives and governance.

Governance

[ARFC] GHO CEX Earn Incentive Program

Protocol: Aave

Date: 2025-06-05 18:58:13

Link: https://governance.aave.com/t/arfc-gho-cex-earn-incentive-program/22284

Description: sid_areta proposed an incentive program to boost GHO deposits on centralized-exchange Earn products under the ARFC framework.

Geo-Distributed Jito Stake Delegation Process

Protocol: Jito Network

Date: 2025-06-05 22:35:58

Link: https://forum.jito.network/t/geo-distributed-jito-stake-delegation-process/782

Description: Otto outlined a process for delegating Jito stake across geographically distributed validators to strengthen network resilience.

Introducing: SyrupUSDC on Kamino

Protocol: Kamino Finance

Date: 2025-06-05 14:07:30

Link: https://gov.kamino.finance/t/introducing-syrupusdc-on-kamino/762

Description: toothfairy introduced SyrupUSDC and detailed parameters for adding the yield-bearing USDC token to Kamino.

Investor Staking Notice

Protocol: Initia

Date: 2025-06-06 05:39:47

Link: https://forum.initia.xyz/t/investor-staking-notice/273

Description: Initia_Foundation notified investors about upcoming staking options and provided key dates and requirements.

Echelon VIP score contract change proposal

Protocol: Initia

Date: 2025-06-06 04:39:08

Link: https://forum.initia.xyz/t/echelon-vip-score-contract-change-proposal/272

Description: laws proposed amending the Echelon VIP score contract to update scoring criteria and enhance fairness.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.