ASXN Daily 05-06-2025

Market Updates

Macro, Regulation and Markets

Treasure Global will deploy a phased $100M digital-asset treasury strategy, allocating to Bitcoin, Ethereum and regulated stablecoins to support the Q3 2025 launch of its AI-driven consumer-intelligence platform. [source]

Circle priced its upsized IPO at $31 per share on 4 June 2025, raising almost $1.1B and valuing the company at about $6.9B ($8.1B fully diluted). [source]

The European Central Bank cut its deposit facility rate by 25bp to 2% on 4 June 2025 and lowered the main refinancing and marginal lending rates to 2.15% and 2.4%, marking a seventh straight reduction. [source]

Exchanges and Listings

Coinbase opened deposits for Ethena (ENA) and will start phased trading of the ENA-USD pair on or after 9 AM PT on 5 June 2025, subject to liquidity and jurisdictional restrictions. [source]

Coinbase opened deposits for Lagrange (LA) and expects phased trading of the LA-USD pair later on 5 June 2025 under its Experimental label. [source]

Binance will introduce LAUSDT perpetual contracts with up to 50x leverage on 5 June 2025, following LA’s listing on Binance Alpha. [source]

Upbit will list a KRW pair for Ravencoin (RVN) and add Lagrange (LA) to its BTC and USDT markets on 5 June 2025. [source]

Raises

Hardware-wallet maker OneKey closed a Series B round led by YZi Labs, valuing the company at $150M; proceeds will fund new devices, on-chain threat detection and expansion in the US, Europe and emerging markets. [source]

3Jane announced their $5.2M seed round led by Paradigm, to build a credit-based money market on Ethereum. [source]

Ethereum

On 4 June 2025, 306,438 ETH (over $800M) were queued for validator activation—the highest level in more than a year—while 347,919 ETH were already in the entry queue, implying a six-day wait. [source]

The Ethereum Foundation has formalized its Treasury Policy, linking fiat-reserve sizing to two variables, Annual Opex (A) fixed at 15% of the treasury and a Years-of-Opex Buffer (B) of 2.5; the A×B product sets the fiat buffer and dictates the cadence of ETH sales, with quarterly re-evaluation by the Board. Crypto management adopts conservative, liquid DeFi strategies: core ETH is solo-staked or lent on major protocols, the foundation may borrow stable-coins for yield, and carefully vetted farms or tokenized RWA positions can migrate into the fiat sleeve over time. Fiat reserves are segmented into immediate-liquidity cash, liability-matched instruments, and tokenized RWAs, backed by quarterly Board reporting and a public annual report to enhance oversight. EF plans to taper annual opex to 5% over the next five years and notes 2025-26 as pivotal for ecosystem support, committing to adjust A and B as conditions evolve. [source]

ETFs

JPMorgan will accept holdings of BlackRock’s iShares Bitcoin Trust as collateral for loans to trading and wealth-management clients and may add other spot Bitcoin ETFs; such ETF positions will also count toward clients’ liquid-asset calculations. [source]

Market Data

BTC ETF

BTC ETFs total net daily flow for 04 Jun 2025 is +$87.0M.

Breakdown:

IBIT: +$284.0M

FBTC: –$197.0M

BITB: $0.0M

ARKB: $0.0M

BTCO: $0.0M

EZBC: $0.0M

BRRR: $0.0M

HODL: $0.0M

BTCW: $0.0M

GBTC: $0.0M

BTC: $0.0M

Total net daily flow: +$87.0M

Total cumulative flows to date: $45,204.3M

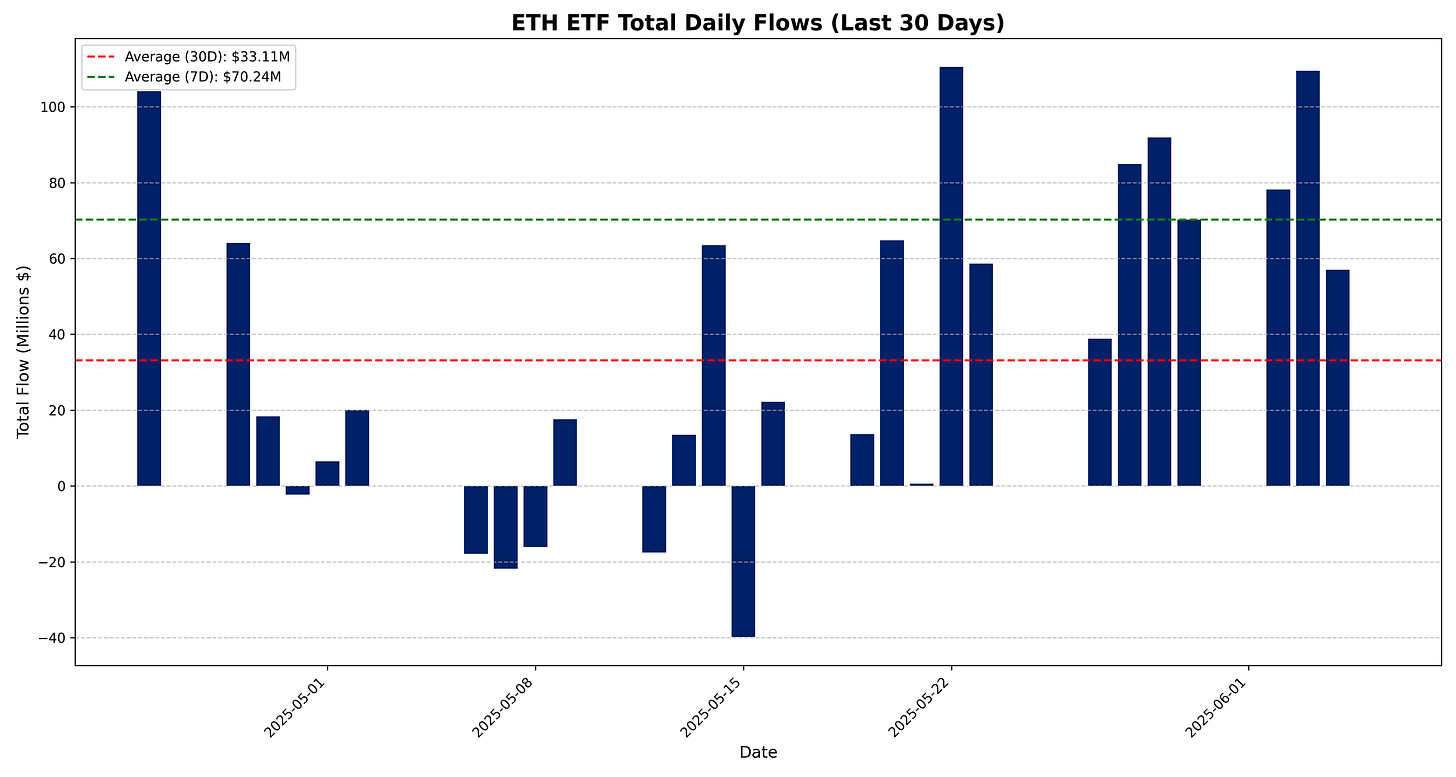

ETH ETF

ETH ETFs total net daily flow for 04 Jun 2025 is +$57.0M.

Breakdown:

ETHA: +$73.2M

FETH: –$23.6M

ETHW: $0.0M

CETH: $0.0M

ETHV: $0.0M

QETH: $0.0M

EZET: $0.0M

ETHE: $0.0M

ETH: +$7.4M

Total net daily flow: +$57.0M

Total cumulative flows to date: $13,670.6M

Sector Returns

Top Performing Sectors

L1 sector is up -0.04% over the past 24 hours (MOVE -5.28%, BERA -4.73%, AVAX -4.28%).

Base DeFi sector is up -0.32% over the past day (WELL -4.37%, AERO -0.32%).

Perps sector has risen -1.55% in the past 24 hours (DRIFT -3.49%, AEVO -0.87%, VERTEX -0.29%).

Worst Performing Sectors

Privacy sector is down -8.75% over the past 24 hours (XMR -8.90%, ZEC -7.72%).

Hyperliquid Ecosystem sector is down -7.68% over the past day (HFUN -13.09%, PURR -6.00%).

Agent sector has fallen -7.58% over the past 24 hours (VIRTUAL -8.05%, GRIFF -7.43%, AIXBT -4.24%).

Token Returns

Top Performing Tokens

SAVE (Solana DeFi) is up +19.55% in the past 24 hours.

GRASS (AI) is up +11.18% in the past 24 hours.

RPL (Ethereum DeFi) is up +10.18% in the past 24 hours.

WLD (AI) is up +6.59% in the past 24 hours.

LDO (Ethereum DeFi) has risen +4.96% in the past 24 hours.

Worst Performing Tokens

BLAST (L2) is down -14.33% in the past 24 hours.

GEAR (Ethereum DeFi) is down -13.21% in the past 24 hours.

HFUN (Hyperliquid Ecosystem) is down -13.09% in the past 24 hours.

SEND (Sui DeFi) is down -10.51% in the past 24 hours.

WIF (Memecoin) has fallen -9.03% in the past 24 hours.

Governance

Chaos Labs Risk Stewards - Adjust USDT Interest Rate Curve on Aave V3 - 06.05.25

Protocol: Aave

Date: 2025-06-05 09:46:57

Description: ChaosLabs proposed adjusting the USDT interest-rate curve on Aave V3 to better align with current market conditions.

[Gauntlet] - ezETH, tETH, and rsETH Risk Recommendations

Protocol: Compound

Date: 2025-06-04 20:15:24

Link: https://www.comp.xyz/t/gauntlet-ezeth-teth-and-rseth-risk-recommendations/6842

Description: Gauntlet provided risk-parameter recommendations for the ezETH, tETH and rsETH markets on Compound.

Deprecation of USDM vaults

Protocol: Morpho

Date: 2025-06-05 08:08:54

Link: https://forum.morpho.org/t/deprecation-of-usdm-vaults/1810

Description: Steakhouse proposed deprecating the USDM vaults on Morpho and outlined migration steps for depositors.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.